01Apr2025

Highlight content / Industry Reviews / Latest News & Report

Comments: No Comments.

Vietnam’s semiconductor industry is on a growth trajectory, supported by government initiatives and rich in mineral resources. While still in the early stages of development, the industry is gradually establishing itself as a key player in the region.

Overview of the semiconductor industry in Vietnam

The semiconductor market is projected to reach a revenue of around 21 billion USD in 2025, marking an 18% increase from 2024 and an impressive 49% growth over the past five years, The market is expected to continue expanding at a CAGR of 10% from 2025 to 2029, ultimately reaching a total value of 31 billion USD by 2029[1].

Semiconductor revenue in Vietnam from 2020 to 2050 by product type

Unit: Billion USD

Source: Statista

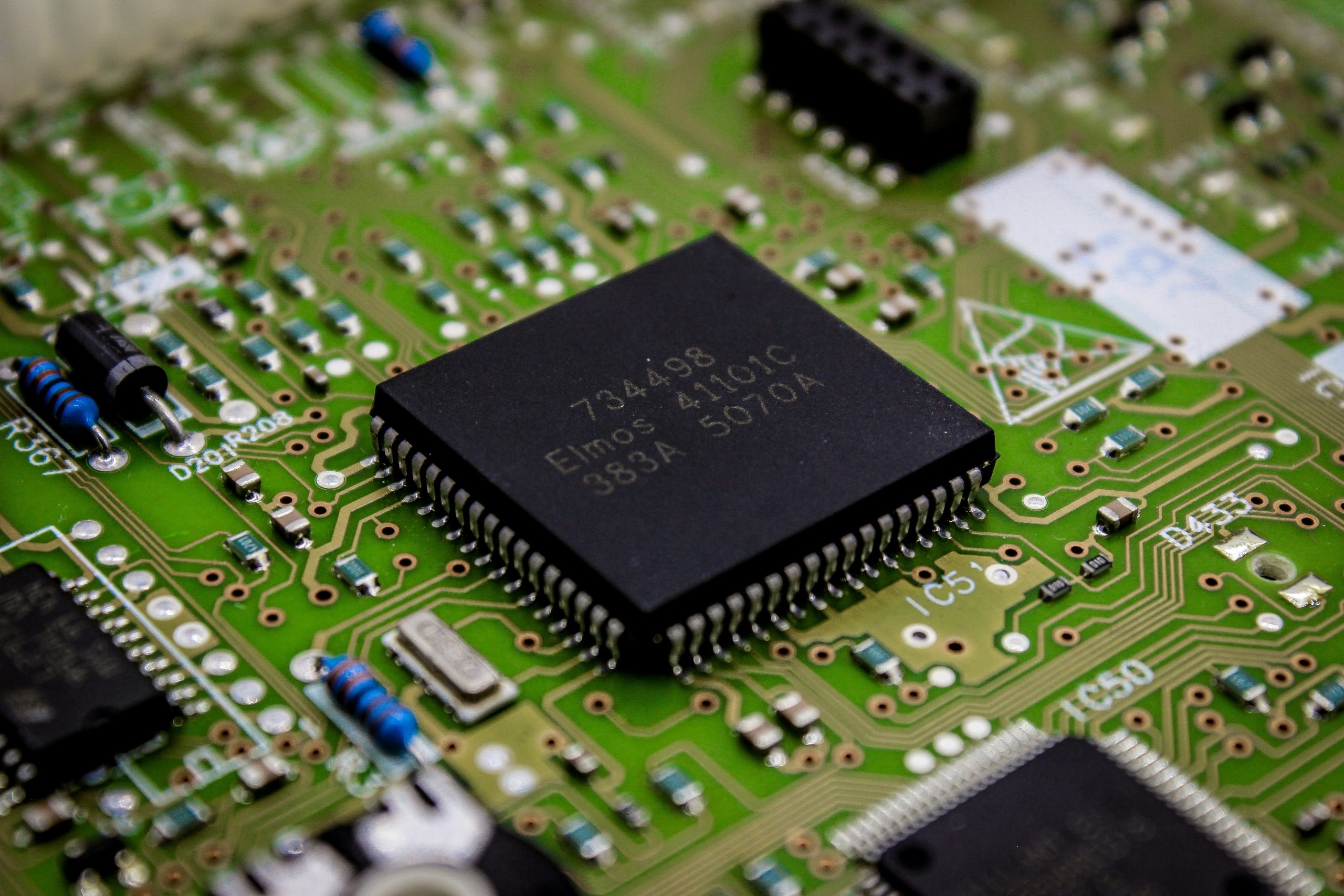

From 2020 to 2024, integrated circuits (ICs) continued to dominate the market and show an increase in trend when accounting for 81% of revenue in 2020 to 85% of the total market by the end of 2024. While ICs are widely applied across various industries, including electronics appliances, automotive, healthcare, and more, other semiconductor components such as optoelectronics, discrete semiconductors, and sensors & actuators remain limited in use. As a result, market revenue for these components stayed consistently low, making up only 15% of the total market in 2024, with little fluctuation over the period.

In addition, 2024 has also recorded an all-time high in FDI disbursement, reaching approximately 25 billion USD, an overall 9% increase year-over-year[2]. This positions Vietnam as a high-value market for investment, not only for the economy as a whole but particularly for the semiconductor industry.

Main player in the industry

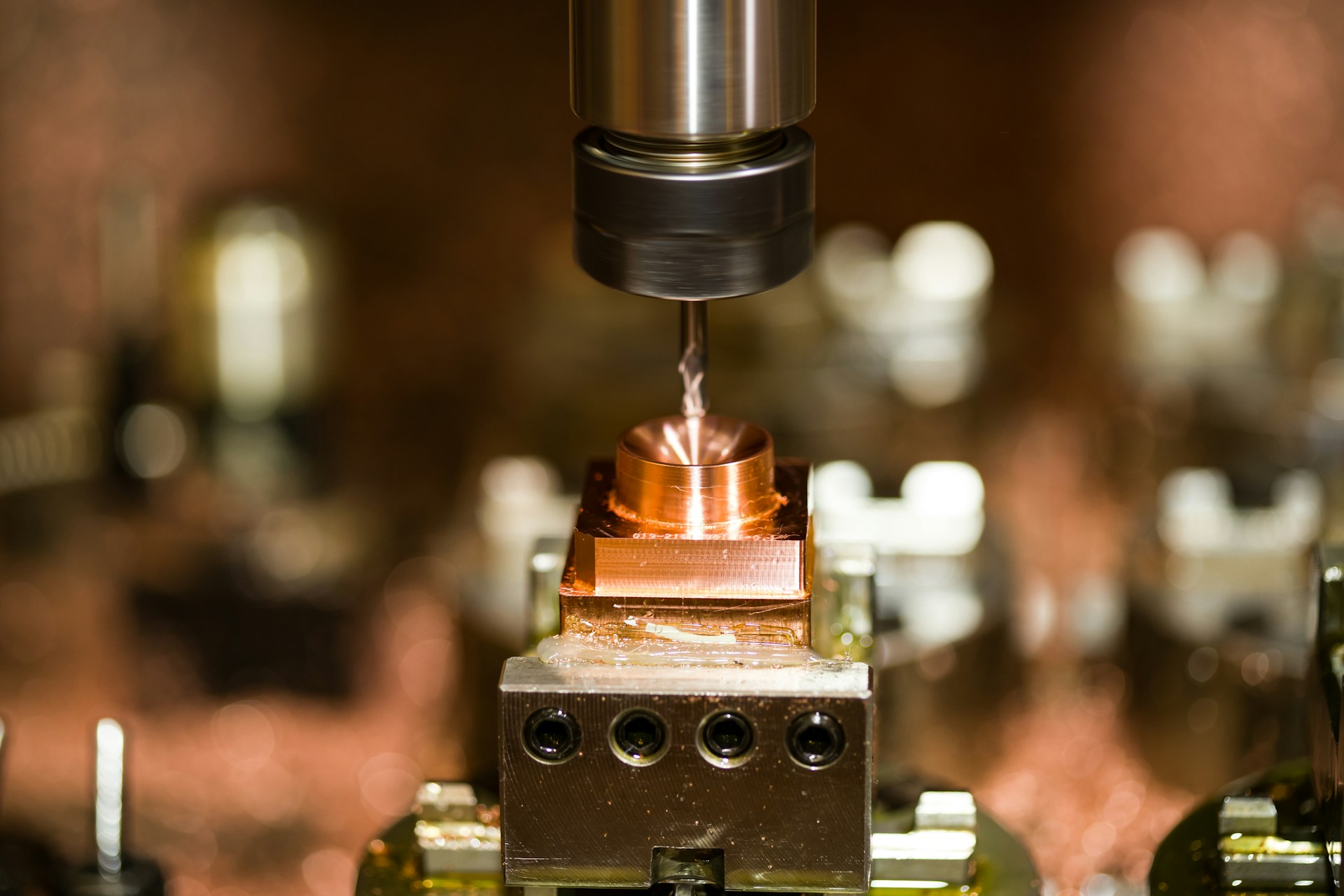

The semiconductor industry is divided into three main stages: design and research, manufacturing, and assembly–testing–packaging[3]. Overall, Vietnam’s semiconductor market is largely driven by international companies, primarily operating in the design and research stages. In contrast, the manufacturing and assembly–testing–packaging segments have only a limited number of players. Vietnam’s domestic participation in the industry remains minimal, with local companies mainly involved in design and research, while lacking the capability to engage in manufacturing and assembly processes.

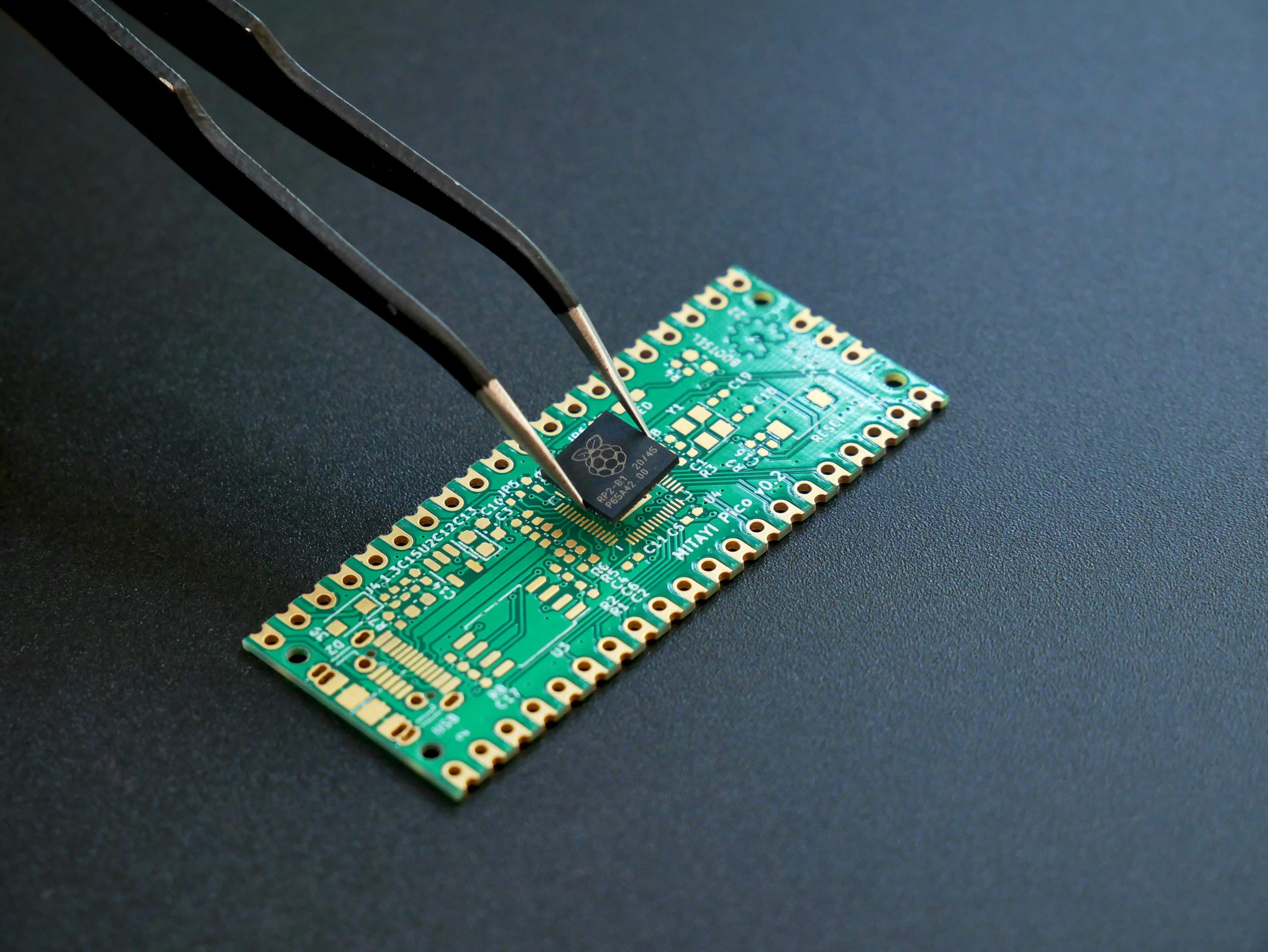

In terms of design and research, numerous companies are operating in this sector, primarily located in major cities such as Hanoi and Ho Chi Minh City. While most of these companies are foreign-owned, coming from countries like Japan, Germany, China, South Korea and the US, Vietnam also has a domestic representative—FPT Semiconductor. The company operating in this stage focuses on developing chipsets, and electronic devices.

Conversely, the manufacturing segment is currently dominated by companies from countries with strong semiconductor industries, such as Samsung and Hana Micron from South Korea, and Micro Commercial Components from China. These manufacturing facilities are primarily located in major industrial zones, producing key semiconductor products such as printed circuit boards, integrated circuits, and semiconductor components.

Assembly – testing – packaging stages share the same trends with representatives from the US such as Amkor and Intel. The primary products are electronics components, chipsets and other internal technology products.

Some companies operating in the semiconductor industry in Vietnam

| Operation stage | Company name | Country of origin | Main products | Location |

| Design/research | Renesas | Japan | System on Chip (SoC) products, microcontrollers, communications, etc. | Ho Chi Minh |

| FPT Semiconductor | Vietnam | Chipsets for power management, smart applications, healthcare, etc. | Ha Noi | |

| Qualcomm | The US | Chipsets for electronics devices, automobiles, home appliances, robotics, etc. | Ha Noi, Ho Chi Minh | |

| Manufacturing | Samsung Electro-Mechanics | Korea | High-density Interconnect (HDI), printed circuit boards, touch sensor modules, etc. | Thai Nguyen |

| Hana Micron | Korea | Integrated circuits for mobile phones and other smart devices | Bac Ninh, Bac Giang | |

| Assembly – testing – packaging | Amkor Technology | The US | Semiconductor for System in Package (SiP) | Bac Ninh |

| Intel Product Vietnam | The US | Chips and other technology products from Intel | Ho Chi Minh |

Source: B&Company’s Synthesis

Investment moves in the Semiconductor Industry

Investment in Vietnam’s semiconductor industry is primarily driven by private enterprises and large foreign corporations, with capital reaching millions of dollars. However, by the end of 2021, coupled with the economic downturn, the market began to slow down. Intel was the first to announce that it would not pursue new investments after having invested over 1 billion USD by the end of 2021[4]. Samsung quickly followed up a year after, showing no further investment activity after allocating around 900 million USD to expand its production[5].

However, Vietnam’s economy quickly recovered, coupled with government initiatives to further develop the semiconductor industry. Starting in 2024, the market has regained momentum, attracting a series of investments from major global companies.

Some major semiconductor investment projects in Vietnam from 2025 to 2030

| Operation stage | Company name | Country of origin | Project name | Completion Year | Investment value

(million USD) |

Location |

| Design/ research | Victory Giant Technology | China | Factory construction | 2026 | 206 | Bac Ninh |

| Manufacturing | Hana Micro Vina | Korea | Capital Invesment | End of 2025 | 400 | Bac Giang |

| Signetics | Korea | Factory construction for flip-chip, MCM, BGA, and FBGA production | October 2025 | 100 | Vinh Phuc | |

| Besi | Netherlands | Factory construction for electronics components | March 2025 | 5 | Ho Chi Minh | |

| Viettel | Vietnam | Semiconductor manufacturing plant | 2030 | Unknown | Unknown | |

| Assembly – testing – packaging | Amkor Technology | The US | Factory expansion from 420 ton/year to 1,600 ton/year | October 2025 | 1,000 | Bac Ninh |

Source: B&Company Synthesis

Moreover, on February 19, 2025, Japan and Vietnam held a meeting focused on fostering cooperation in the semiconductor industry. With Vietnam’s young and abundant workforce, Japan is exploring opportunities for labor collaboration alongside potential investments, particularly in the semiconductor sector[6]. Additionally, Japan has outlined plans to expand its own semiconductor industry to over 10 billion USD in 2025 and 333 billion USD by 2030. This broader industry growth could open up further investment opportunities for Vietnam through strengthened collaboration[7].

Government Initiatives to Develop the Semiconductor Industry

The government has introduced various support policies to facilitate semiconductor businesses, aiming to position Vietnam as a key global hub in the industry.

Vietnam policies to further promote the Semiconductor Industry

| Decision | Issued date | Policy name | Terms on promoting the semiconductor industry |

| Decision No. 38/2020/QĐ-TTg | 2020

Effective: 2021 |

Approving The List of High Technologies Prioritized for Development Investment and the List of Hi-tech Products Encouraged for Development | The semiconductor industry and its related products are listed as the prioritized group for investment and development |

| Decree No. 182/2024/NĐ-CP | 2024 | Investment support fund for Semiconductor and Artificial Intelligence (AI) companies | Provide support funding for semiconductor and artificial intelligence (AI) companies when they invest in specified categories[8].

· Human Resource Development: Up to 50% of training cost for Vietnamese employees · Research & Development (R&D): Up to 30% for R&D expenses, · Investment in Fixed Assets: Up to 10% of total cost for equipment and infrastructure · High-Tech Product Manufacturing: Up to 3% of the value-added production costs · Social Infrastructure: Up to 25% of total expenses when constructing social facilities[9] |

| Decision No. 1018/QĐ-TTg | 2024 | Development roadmap for the Semiconductor industry with a long-term vision toward 2050 | By 2050, Vietnam is set to achieve the following:

· Over 100,000 engineers, at least 300 design/research enterprises. A minimum of 3 manufacturing factories and 30 assembly factories. · Vietnam’s Semiconductor market revenue reaching 100 billion USD annually |

Source: Vietnam Government Portal

Opportunities and Challenges for Investors

Alongside strong government support, Vietnam also holds significant opportunities for semiconductor industry growth. As of 2024, the country is estimated to have 22 million tons of “rare earth” minerals, accounting for over 18% of the global supply—the second largest in the world after China[10]. Additionally, starting in the 2025 academic year, several Vietnamese universities, including Hanoi National University of Education, University of Technology, and University of Science, will introduce new programs in semiconductor technology to strengthen the talent pipeline[11].

On the other hand, challenges still remain for investors in Vietnam, as complex administrative regulations and procedures can often be time-consuming[12]. Additionally, logistics costs remain high. Vietnam currently loses 16% of its GDP to logistics costs, compared to other countries in the region, like 11% in Japan, 8% in Singapore, or 13% in Malaysia etc[13]. This can be a burden for companies since they have to pay more to access cutting-edge technology, which will delay adoption and ultimately weaken the global competitiveness of Vietnamese tech enterprises.

[1] Statista (2024). Revenue of Semiconductor Industry in Vietnam <Access>

[2] VietnamPlus (2025). Vietnam Achieves Record FDI Disbursement in 2024 <Access>

[3] Vietnam Supporting Industry Portal (2024). Overview of Semiconductor Industry <Access>

[4] VnExpress (2023). Intel is Not Committing to Invest in Vietnam <Access>

[5] Government News (2022). Samsung Increases Their Investment by 920 million USD <Access>

[6] Ministry of Planning and Investment (2025). Vietnam – Japan Semiconductor Cooperation Meeting <Access>

[7] The Voice of Vietnam (2025). Potential for Vietnam – Japan Cooperation in Semiconductor Industry <Access>

[8] The level of support funding will vary depending on each company’s expenditure, with stricter conditions required to qualify for higher levels of funding

[9] Social Infrastructure includes: Social housing for workers to rent, schools, daycare centers, medical facilities, cultural establishments, and sports facilities

[10] U.S. Geological Survey (2025). Rare Earths Statistics and Information <Access>

[11] VnExpress (2025). Various Universities Now Offer Semiconductor Training Programs <Access>

[12] Tinnhanhchungkhoan (2024). Vietnam’s Investment Procedures are too Time-consuming <Access>

[13] Government News (2024). Lowering Logistics Costs in Vietnam to Increase Competitive Advantages <Access>

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |