2025年4月23日

最新ニュースとレポート / ベトナムブリーフィング

コメント: コメントはまだありません.

ベトナムは、安定した政治環境、力強い経済成長、戦略的な貿易協定、そして競争力のある労働力により、外国投資家にとって最も魅力的な投資先として急速に台頭しています。ホーチミン市やハノイといった主要都市は活気ある経済の中心地へと変貌を遂げており、東南アジア全域に事業を拡大する企業にとって明確なメリットを提供しています。

近年のベトナムの経済状況

2024年には、ベトナムのGDPは2023年と比較して約7%増加し、4,760億米ドルに達すると予測されています。2014年から2024年の10年間で、ベトナム経済は大幅な経済成長を遂げ、年平均成長率(CAGR)9%を達成しました。サービス部門は引き続きGDPの42%を占め、引き続き大きな割合を占めています。次いで工業部門と農業部門がそれぞれ約38%と12%を占めています。経済構造は徐々に変化しており、サービス部門と工業部門の成長への投資が増加する一方で、農業のシェアは大幅に減少しています。

2014年から2024年までのベトナムのGDP(部門別)

出典:ベトナム統計総局

さらに、ベトナムは半導体、エネルギー、建設といった主要産業への投資と拡大に徐々に重点を移しつつあります。これらのセクターは、数十億ドル規模の大規模プロジェクトによって支えられています。

– 南北高速鉄道:ハノイとホーチミン市を、最高時速350kmで走行可能な高速鉄道で結びます。推定建設費は約670億米ドルで、2030年までに着工、2035年の完成を目指しています。[1].

– 原子力発電所:ベトナムは、増大するエネルギー需要に対応し、温室効果ガスの排出を削減するため、2031年までに初の原子力発電所を建設する計画です。政府は、ロシアの国営原子力企業ロスアトムと原子力エネルギー分野における協力を強化する協定を締結しました。[2].

– 半導体製造:ベトナムは半導体産業に投資しており、Viettelの1億ドル規模のチップ工場が2025年に稼働予定となっている。[3]政府は、2030年12月31日までに稼働する半導体製造工場の総プロジェクト投資費用30%をカバーする最大4億ドルの資金パッケージを含む、この分野を支援する政策を導入した。[4].

ベトナムの労働力市場

ベトナムは依然として「黄金の人口構造」段階にある[5]2024年には15歳以上の労働力人口が5,300万人に達し、2019年からの過去5年間、総人口の67%の安定したレベルを維持しています。失業率は年間を通じて約2%と低く、労働力の配分は主に農村部と郊外部で61%を占め、残りの39%は都市部の労働者で構成されています。[6].

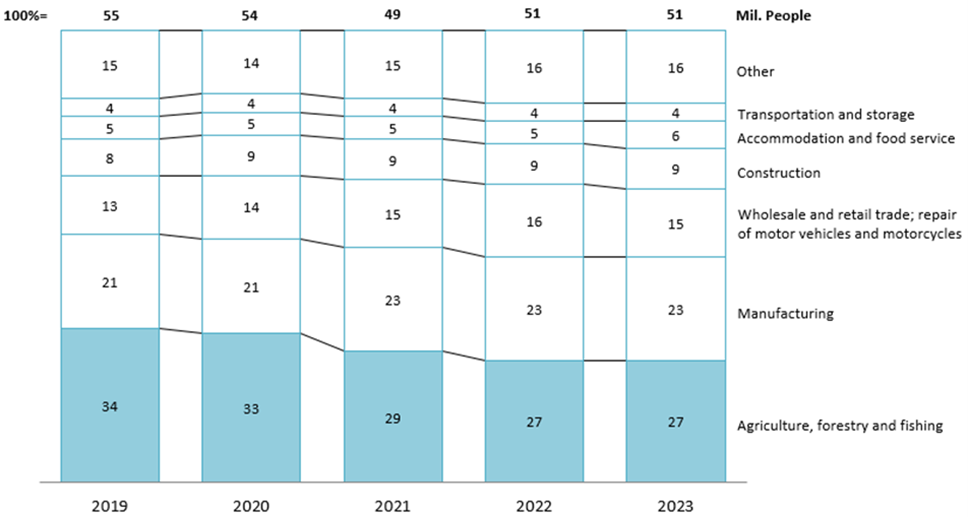

2023年末までに、農林水産業部門は引き続きベトナムの雇用構造を支配し、総雇用数の27%を占めた。これに続いて加工・製造業が23%、小売・自動車修理が15%、建設が9%となった。[7].

2019年から2023年までのベトナムの経済活動別就業者数

出典:ベトナム統計総局

さらに、2024年にはベトナムの高技能労働者の割合は比較的低く、労働力のわずか28%だけが正式な訓練や認定を受けている。[8]一方、労働力の62%は正式な研修を受けておらず、認定資格も取得していません。これは、2023年と比較して1%の微増、2019年から5%の増加という、わずかな改善を示しています。[9]特に、半導体やテクノロジーなどの分野では、有資格者の供給が拡大しており、労働力が大幅に改善した。[10]熟練労働者の増加により、ベトナムの平均月給は315米ドル近くまで上昇し、2023年から81TP3兆ドル増加した。[11]これは、賃金が競争力がある一方で、コスト効率の良い労働ソリューションを求める企業を引き付け続けていることを示しています。

ベトナムのFDI投資状況

過去10年間(2014年から2024年)にわたり、ベトナムへのFDIは新規登録投資件数とプロジェクト数の両方で顕著な拡大を遂げ、年平均成長率(CAGR)は約6%(約6兆1千億トン)に達しました。2024年末までに、登録済みFDIの累計総額は約5,030億米ドルに達し、4万2,000件以上のプロジェクトが進行中と予測されています。2024年の新規登録FDIは約380億米ドルと推定され、2023年と比較して4%(約4兆1千億トン)減少します。しかし、この数字は2020年の景気後退後、徐々に回復していくことを示しています。[12].

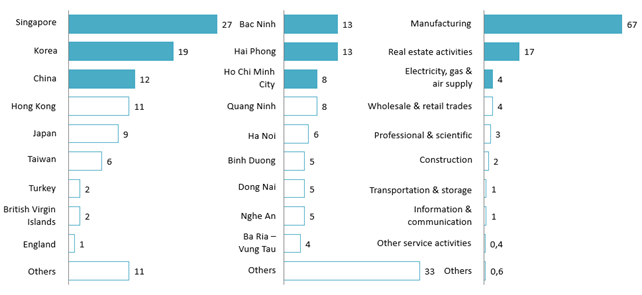

セクター別の資本配分では、製造・加工業が依然としてトップを占め、総投資額は約260億米ドルに達し、登録投資総額の671兆3千億米ドルを占めています。不動産業がこれに続き、60億米ドルで171兆3千億米ドルを占めています。続いてエネルギー、卸売・小売業などが、それぞれ41兆3千億米ドルを占めています。[13].

2024年ベトナム新規FDI投資国・省・分野別登録件数

単位:100% = 382億ドル

出典:計画投資省

シンガポールはベトナムへの投資額において引き続きトップの座を維持しており、新規登録FDIは100億米ドルに達し、27%を占めています。韓国と中国はそれぞれ約70億米ドルと50億米ドルで2位と3位に続いています。日本はベトナムへの投資国の中で5位にランクインしており、投資額は約40億米ドルです。バクニン省、ハイフォン市、ホーチミン市は投資額が最も多い上位3つの都市・省であり、その他の省・都市への投資額もほぼ均等に分散しています。

近年ベトナムで注目すべきFDIプロジェクトがいくつかある

| 業種 | 資金提供元 | 案件名 | 国 | 投資額

(百万USD) |

投資年 | 地域 |

| エネルギー | 国際協力銀行、民間企業 | ベトナムにおける再生可能・低炭素エネルギープロジェクトへの投資 | 日 | 20,000 | 2025 | 該当なし |

| 製造 | ハナマイクロヴィナ | 半導体製品製造への投資拡大 | 韓国 | 400 | 2025 | バクザン |

| 製造 | ビクトリージャイアントテクノロジー | 半導体工場の建設 | 中国 | 206 | 2025 | バクニン省 |

| 製造 | LGディスプレイ | 電子製品の生産への投資を増やす | 韓国 | 1,000 | 2024 | ハイフォン市 |

| 製造 | ライトオンテクノロジー | 電子部品製造工場の建設 | 台湾 | 690 | 2025 | クアンニン |

資料: B&Company

さらに、ベトナム政府は、特に半導体やエネルギーなど最近注目を集めている分野において、さまざまな投資インセンティブを提供しています。

ベトナムの一部の分野における投資支援政策

| ポリシー | 業種 | 投資支援 | |

| 182/2024/NĐ-CP | 半導体およびハイテク | 2024 | 様々な分野で支援資金を提供[14]

· 人材育成: 最大50% · 研究開発: 30%まで · 固定資産への投資: 最大10% · 製品製造: 最大3% 社会基盤: 最大25% |

| 政令第58/2025/NĐ-CP号 | エネルギー | 2025 | 風力エネルギー

• 建設期間中の海域使用料:最大3年間免除+その後9〜12年間は50%減額 • 総発電量の20%以内での余剰電力売電が認められる • 融資返済期間中に最低70〜80%の発電契約を保証 風力エネルギー • 上記の優遇に加え、風力発電特有の融資条件(最大15年の契約確保)あり

屋上太陽光発電 • 出力100kW未満の家庭、個人は事業者登録不要 • 総発電量の20%以内での余剰電力売電が認められる |

出典:Vietnam Government Portal

外国人投資家への実践的アドバイス

ベトナムのような新興市場への進出や投資には多くの利点があるものの、投資家はいくつかの課題にも留意する必要があります。ベトナムは、省庁数の削減を含む行政手続きの合理化を目指し、大規模な官僚制度改革を進めています。これらの改革は効率性の向上を目的としていますが、プロジェクト承認のペースに一時的に影響を及ぼす可能性があります。[15]さらに、政府は2025年末までにビジネス関連の行政手続きをオンラインプラットフォームに移行する予定だが、実施における地域格差が依然として課題となる可能性がある。[16]文化的なニュアンスや言語の壁は依然として重要です。効果的なコミュニケーションには、地域によって異なる間接的な表現や非言語的な合図を理解することが不可欠です。こうした文化的なダイナミクスや行政上の変遷に適応することは、ベトナムのビジネス環境を効果的に乗り切る上で不可欠です。

まとめ

ベトナムは、多くの投資家にとって、事業拡大や地域の長期的な成長への投資先として魅力的な選択肢です。ベトナム経済は緩やかに成長していますが、世界的な貿易摩擦は経済とベトナム市場の両方に一定の影響を与えています。投資上のメリットに加え、投資家が留意すべき課題もいくつか存在します。しかし、これらの課題を乗り越えることができれば、ベトナムは東南アジア地域で市場拡大を目指す企業にとって、依然として理想的な投資先であり続けるでしょう。

[1] ベトナムプラス(2024年)。南北高速鉄道の建設費用は673億4000万米ドルと推定される。

[2] ラオドンニュース(2025年)。ロシアはベトナムの原子力開発を支援し続ける

[3] Nguoiquansat(2024年)。ベトナムは国内に半導体製造工場を建設する計画だ。

[4] Linkedin (2025). ベトナムの半導体政策:機会と戦略的課題

[5] 黄金の人口構造は、労働年齢人口(15~64歳)と扶養人口(15歳未満および64歳以上)の割合が最も高いことが特徴です。

[6] 計画投資省ポータル(2025年)。2024年のベトナムの労働・雇用状況

[7] ベトナム統計総局(2024年)。2023年の経済活動種別就業者数

[8] 15歳以上の就労中または失業中の者で、国家教育制度内の職業訓練または技術訓練プログラムを学び卒業し、初等(職業)、中等、短大、大学(学士)、修士、博士、または理学博士のいずれかの学位または証明書を取得した者。

[9] ベトナム統計総局(2025年)。ベトナムの雇用報告書

[10] ベトナム概要(2024年)。2024年上半期のベトナム労働市場レポート

[11] アジアの源泉(2024年)。ベトナムの労働市場2024年以降

[12] ベトナム統計総局(2024年)。ベトナムで認可された外国直接投資プロジェクト

[13] 計画投資省(2025年)。2024年のベトナムへの外国直接投資の状況

[14] 支援資金のレベルは各企業の支出に応じて異なり、より高いレベルの資金を受け取るにはより厳しい条件が求められる。

[15] VnExpress(2025年)。ベトナム、大規模再編計画の下、63の地方自治体を6つの市と28の省に統合へ

[16] ベトナム法務フォーラム(2025年)。2025年末までにすべてのビジネス関連行政手続きをオンラインで実施

*ご注意: 本記事の情報を引用される場合は、著作権の尊重のために、出典と記事のリンクを明記していただきますようお願いいたします。

| B&Company株式会社

2008年に設立され、ベトナムにおける日系初の本格的な市場調査サービス企業として、業界レポート、業界インタビュー、消費者調査、ビジネスマッチングなど幅広いサービスを提供してきました。また最近では90万社を超える在ベトナム企業のデータベースを整備し、企業のパートナー探索や市場分析に活用しています。 お気軽にお問い合わせください info@b-company.jp + (84) 28 3910 3913 |