09Dec2025

Latest News & Report / Vietnam Briefing

Comments: No Comments.

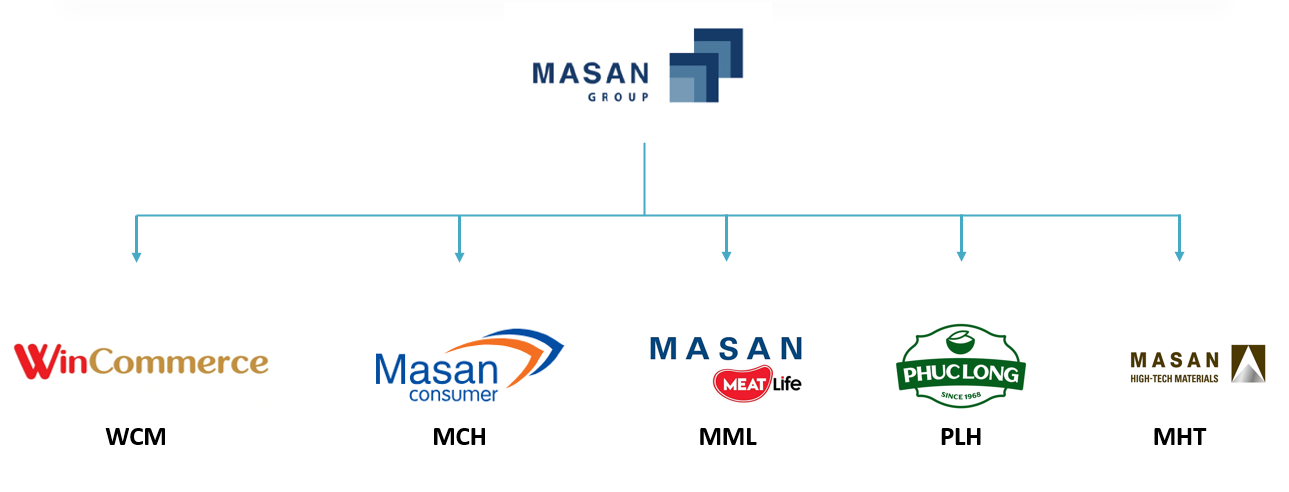

Masan Group had a diversified consumer-retail ecosystem that integrates food, beverages, modern retail, branded meat, and high-tech materials. In this article, Masan Group’s key business sectors and the performance of its major subsidiaries are investigated. Each subsidiary’s strategic role, financial contribution, and competitive position will help illustrate how Masan advances its long-term Point-of-Life strategy.

Introduction of Masan Group

Masan Group was founded in the mid-1990s by its founder Nguyen Dang Quang and publicly listed on HOSE since 2009. It has grown into one of Vietnam’s largest private conglomerates. Throughout years of operation, the group has evolved from a traditional food business into a diversified platform stretching across fast-moving consumer goods (FMCG), retail, branded meat, beverage & café, and even high-tech materials[1].

Masan’s journey over nearly 30 years reflects a continuous transformation driven by its mission to meet large, unmet consumer needs in Vietnam. Starting in the 1990s, Masan built its FMCG leadership through Masan Consumer Holdings (MCH). In 2011, Masan entered branded meat and livestock feed, laying the foundation for Masan MEATLife (MML). A major strategic shift came in 2019 with the acquisition of WinCommerce (WCM), enabling Masan to reshape Vietnam’s modern retail landscape. Masan expanded into lifestyle and F&B by acquiring Phuc Long Heritage (PLH) in 2021–2022. In this ecosystem, Masan provides customers with telecommunications through the 2021 acquisition of Mobicast (Wintel) and financial services through close partnership with Techcombank. Together, these moves formed an integrated Point-of-Life ecosystem combining FMCG, fresh food, retail, F&B, telecom, and financial services to serve the daily needs of over 100 million Vietnamese consumers[2].

Besides, in 2014, Masan High-Tech Materials (formerly Masan Resources) began commercial operations with the launch of the Nui Phao polymetallic mine, marking the start of its journey as Vietnam’s leading producer of tungsten and high-tech industrial materials[3].

Masan’s Group Subsidiaries

Source: B&Company’s synthesis from Masan’s websites

In 2024, Masan Group reported their net revenue reached 83,178 billion VND, a 6.3% increase compared to 2023. 2024 also marked a turning point where formerly loss-making businesses like WinCommerce and Masan MEATLife turned profitable[4]. The year’s gross profit reached 24,656 billion VND, a 11.5% increase compared to 2023. Gross profit margin increase from 28.3% in 2023 to 29.6% in 2024, showing the enhanced efficiency and cost management[5].

WinCommerce (WCM)

WinCommerce is Masan’s retail arm, operating the largest modern retail network in Vietnam under formats such as WinMart supermarket chain and the WinMart+ minimart chain. This gives Masan a distribution and retail endpoint for many of its consumer and meat products, enabling vertical integration from production to point-of-sale.

A Winmart+ Store in Bac Giang

Source: Bac Giang Province Portal

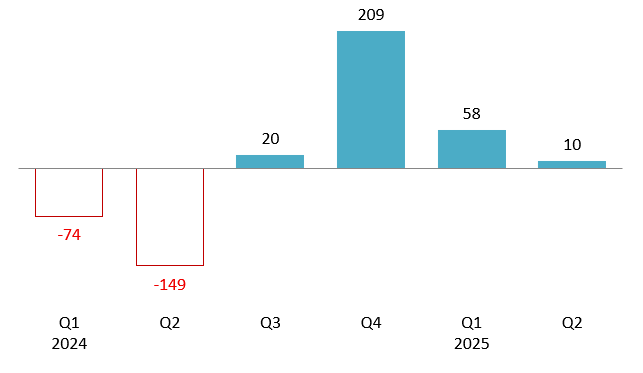

Ever since its establishment, WinCommerce grew in revenue but bore loss continuously. By 2024, the company reported a post-tax profit of VND 6 billion, compared with a net loss of about VND 599 billion in 2023, marking the first year of profitability since becoming part of Masan Group[6]. Into 2025, the momentum continued: by mid-year, WinCommerce had logged its fourth consecutive profitable quarter.

WinCommerce profit after tax from Q1-2024 to Q2-2025

Unit: Billion VND

Source: CafeF

As of mid-2025, the chain expanded to over 4,000 points of sale nationwide, driven by a major push into rural areas with roughly 75% of new stores being WinMart+ outlets in non-urban provinces. This combination of network expansion and improving store economics underscores WinCommerce’s growing role as a stable and scalable retail engine within Masan’s ecosystem[7].

Masan Consumer Holdings (MCH)

Masan Consumer is the legacy pillar of Masan, responsible for producing and marketing a broad portfolio of fast-moving consumer goods, including staples like sauces, condiments, instant noodles, beverages, and convenience food. Its brands, including Chin-Su, Nam Ngu, Omachi and Wake-Up 247 are among the most recognizable in Vietnamese households.

Masan Consumer’s products

Source: Masan Consumer

Distribution is a key Masan Consumer’s strength. Its products have both deep penetration in traditional retail channels and wide presence in modern retail networks and supermarkets. Masan Consumer’s products reach 98% of Vietnamese households, and the company is estimated to lead nearly 80% of all essential FMCG categories nationwide. Masan Consumer brands also make presence in global market, have entered 26 countries and appeared in top retail chains such as Cotsco (the US, South Korea) and Woolsworths (Australia)[8].

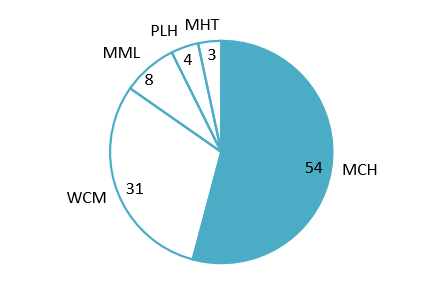

On performance, Masan Consumer has shown remarkable resilience and profitability, even through economic cycles, cost pressures, and market disruptions[9]. Despite rising input and logistics costs in recent years, MCH managed to maintain stable profitability, riding on strong brand recognition and consistently high demand for staple goods. Among Masan Group’s subsidiaries, Masan Consumer contributes more than half of the annual gross profit in 2024.

Masan Group gross profit distribution by subsidiaries (2024)

100% = 24,656 Billion VND

Source: Masan Group 2024 report

Looking ahead, Masan Consumer continues to invest in premiumization by upgrading products and expanding into higher-margin segments such as ready-to-eat meals, healthier snacks, and household care while maintaining its strong core categories. Internationally, Masan Consumer will accelerate its Go Global strategy, targeting over 20% growth in major markets such as the U.S., Korea, Japan, and the EU, particularly in seasonings, convenience foods, and instant coffee[10].

Masan MEATlife (MML)

Masan MEATLife (MML) operates a “feed-farm-food” (3F) integrated model: from upstream livestock and feed to downstream chilled meat processing and retail distribution to deliver branded, traceable meat such as pork via MeatDeli and related product lines. This vertical integration aims to modernize Vietnam’s animal-protein supply chain, ensure food safety and quality, and meet rising consumer demand for branded meat.

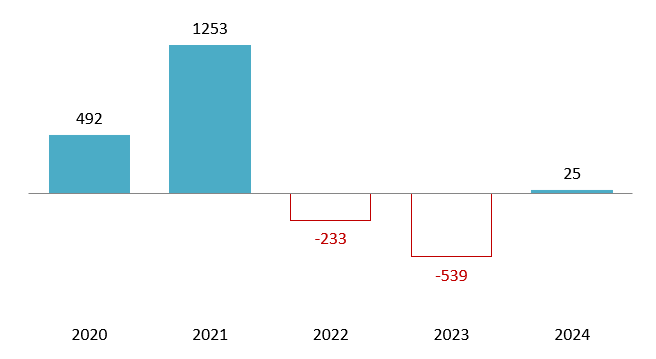

Originally in 2015, Masan MEATLife built its business around animal feed and launched the first chilled, branded meat in Vietnam (MeatDeli) in late 2018. In 2019, the company positioned itself from a B2B agricultural product business model to a consumer goods business model providing branded products through retail[11]. In 2021, Masan MEATLife transferred the feed business to De Heus Vietnam, so that the company could focus solely on branded meat products while still keeping close partnership with De Heus Vietnam to ensure the tracebility of the 3F model[12]. At that time, the feed unit had contributed up to 80% revenue, but the meat business was still nascent, resulting in a sharp drop in consolidated revenue after the divestment, and losses in 2022 and 2023[13].

In 2024, thanks to rising sales of chilled and processed meat under MeatDeli (and related brands) and higher average selling prices of chicken and pork in the general market, the company reported positive profitability.

Masan MEATlife Profit after tax 2020-2024

Unit: Billion VND

Source: Nguoi dua tin

Looking forward, Masan MEATlife will continue investing in processed meat, aiming for this segment to contribute largely to total sales as consumers increasingly shift from fresh to packaged protein. Deep integration with WinCommerce retail network is another advantage of the company, as they set up Meat Corner inside WinCommerce stores, targeting an increase in WinCommerce processed-meat share from 16.6% in 2024 to 20% in 2025, with a long-term target of 40%.

Phuc Long Heritage (PLH)

Phuc Long Heritage represents Masan’s presence in the beverage and coffee/tea retail segment. Acquired in 2022, Phuc Long allows Masan to tap into the growing Vietnamese café culture and beverage consumption trends, thus extending the “Point of Life” ecosystem beyond food and retail, into lifestyle and consumption experiences.

Before joining Masan, Phúc Long was a mid-sized Vietnamese tea & coffee chain with limited scale and regional presence. After Masan’s acquisition during 2021-2022, Phúc Long experienced a significant acceleration in expansion and financial performance. Phúc Long rapidly expanded its retail footprint from 72 stores in January 2022 to 860 points of sale by September 2022, spanning multiple formats including flagship stores, mini stores, and kiosks integrated within WIN and WinMart+[14]. Phuc Long’s financial performance grows substantially in both revenue and profit, especially the growth in net profit margin from 2% in 2019 to 7.6% in 2024[15].

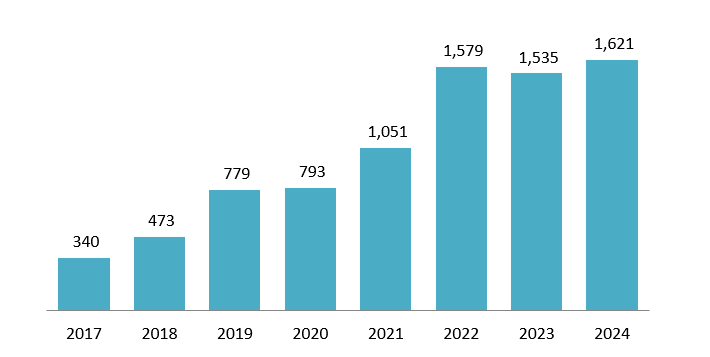

Phuc Long Heritage’s Revenue from 2017 to 2024

Unit: Billion VND

Source: Znews

In the future, Phuc Long will take advantage of WIN Membership, allowing personalized offers based on consumer purchasing patterns. It also implements targeted seasonal campaigns to capture peak consumption periods. To enhance competitiveness, Phuc Long will introduce refreshed store designs and new store formats that emphasize experiential value and better differentiation, appealing to both loyal and new customers.

Masan High-Tech Material (MHT)

Masan High‑Tech Materials (MHT) represents Masan’s legacy in mining and industrial materials, particularly tungsten and other high-tech materials used in battery production and industrial applications. Historically, this segment diversified Masan’s business beyond consumer goods.

Masan High‑Tech Materials acquired the majority stake in the German tungsten recycler H.C. Starck (HCS), aiming to expand its tungsten value chain into high-tech materials and advanced industrial applications. However, in December 2024, Masan fully divested HCS, selling the entire stake to Mitsubishi Materials Corporation. The transaction substantially reduced MHT’s debt burden and freed capital for reinvestment into core consumer-retail operations. This exit marked a strategic shift: instead of continuing capital-intensive expansion in global materials technology, Masan prioritized strengthening its consumer-retail ecosystem[16].

In 2024, MHT achieved revenue of 14,336 billion VND, an increase of 2% year-on-year despite operational challenges such as disruption of blasting services at Nui Phao Mining Company and Yagi Typhoon. Looking ahead, MHT has adopted a “Back to Basics” strategy, which prioritizes operational excellence, cost discipline, and resource optimization in its core mining and refining business[17]. Given supply-chain disruptions and rising demand for critical minerals worldwide (for electronics, renewable energy, and industrial applications), MHT plans to leverage its low-cost production capability to meet global demand, positioning itself as a competitive exporter[18].

Conclusion

Masan Group is entering a phase of stronger integration and healthier profitability across its subsidiaries, especially WinCommerce and Masan MEATlife turn profitable after years of losses. Masan Consumer continues to anchor the ecosystem with stable growth and market-leading brands, while Phuc Long enhances lifestyle coverage within the ecosystem. The Masan High-Tech Materals after divesting HCS, is refocusing on core mining and refining operations. Together, these developments reinforce Masan’s long-term strategy of building a unified, consumer-centric ecosystem designed to meet Vietnam’s evolving daily needs.

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

[1] Masan Group, Our Business (https://www.masangroup.com/our-business.html)

[2] Masan Group Annual Report 2024 (https://cafef1.mediacdn.vn/download/250425/msn-bao-cao-thuong-nien-nam-2024-0.pdf)

[3] Masan Group Annual Report 2023 (https://static2.vietstock.vn/data/HOSE/2023/BCTN/VN/MSN_Baocaothuongnien_2023.pdf)

[4] Masan Group, Masan Group Releases Accounts For Q4 And FY2024 (https://masangroup.com/news/masan-news/Masan-Group-releases-accounts-for-Q4-and-FY2024.html)

[5] Masan Group Annual Report 2024 (https://cafef1.mediacdn.vn/download/250425/msn-bao-cao-thuong-nien-nam-2024-0.pdf)

[6] Vietnam Businesspeople, WinMart accumulated a loss of nearly 4,000 billion VND (https://doanhnhanvn.vn/winmart-lo-luy-ke-gan-4000-ty-dong.html)

[7] Masan Group, WinMart/WinMart+ chain records Fourth Consecutive Profitable Quarter (https://www.masangroup.com/vi/news/masan-news/WinMart-WinMart-Records-Fourth-Consecutive-Profitable-Quarter.html)

[8] VnEconomy, Masan Consumer’s core brands lead nearly 80% of the FMCG industry portfolio (https://vneconomy.vn/cac-thuong-hieu-chu-luc-cua-masan-consumer-dan-dau-gan-80-danh-muc-nganh-hang-fmcg.htm)

[9] VnEconomy, Masan Consumer maintains sustainable profits amid global fluctuations (https://vneconomy.vn/masan-consumer-duy-tri-loi-nhuan-ben-vung-giua-bien-dong-toan-cau.htm)

[10] Masan Group, Masan Profit of 4Q2024 increased nearly 14-fold YoY (https://masangroup.com/vi/news/press-releases/Masan-Profit-of-4Q2024-increased-nearly-14-fold-YoY.html)

[11] Masan Group Annual Report 2023 (https://static2.vietstock.vn/data/HOSE/2023/BCTN/VN/MSN_Baocaothuongnien_2023.pdf)

[12] Masan MEATlie Annual Report 2022 (https://masanmeatlife.com.vn/upload/iblock/c52/c520fc475f4a84c4c16b2288055382d1.pdf)

[13] CafeF, Separating the feed segment, which contributes 80% of Masan MEATLife’s revenue, and at the same time mobilizing more than 7,000 billion VND in capital, what ambitions does billionaire Quang have for the processed meat segment? (https://cafef.vn/tach-mang-cam-dong-gop-80-doanh-thu-cua-masan-meatlife-dong-thoi-huy-dong-von-hon-7000-ty-dong-ty-phu-quang-dang-co-tham-vong-gi-voi-mang-thit-che-bien-2021091300233063.chn)

[14] Vietnam.vn, Decoding the “phenomenon” Phuc Long (https://www.vietnam.vn/en/giai-ma-hien-tuong-phuc-long)

[15] Economy & Consumption, Phuc Long under Masan: Revenue and profit growth “huge” (https://kinhtetieudung.vn/phuc-long-duoi-thoi-masan-doanh-thu-loi-nhuan-tang-truong-khung-a19534.html)

[16] Lao Dong, Masan divests capital from HCS, focuses on retail consumption segment (https://laodong.vn/ldt/thi-truong/masan-thoai-von-tai-hcs-don-luc-cho-mang-tieu-dung-ban-le-1441142.ldo)

[17] https://masanhightechmaterials.com/wp-content/uploads/2025/04/TCBC_-AGM-2025.pdf

[18] https://en.baothainguyen.vn/202504/masan-high-tech-materials-advances-back-to-basics-strategy-to-drive-profitable-growth-and-long-term-value-for-shareholders-0af2053/