02Jan2026

Latest News & Report

Comments: No Comments.

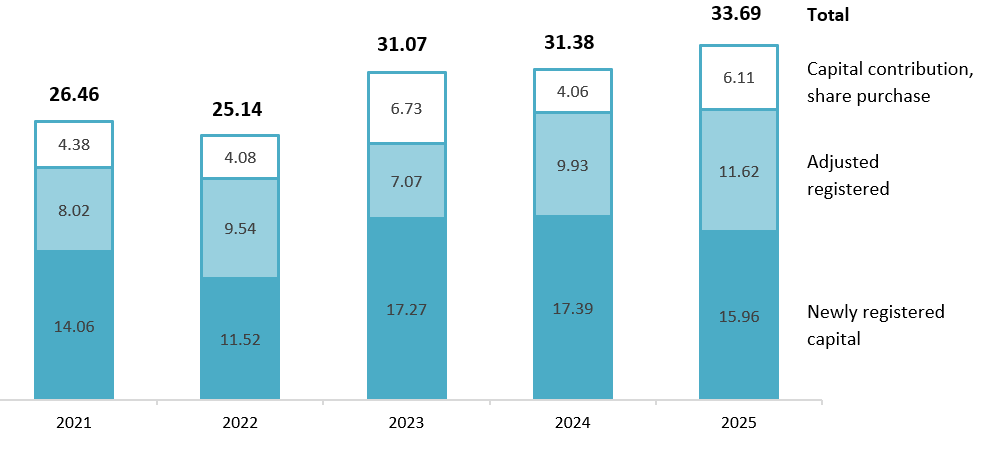

As of the end of the first 11 months of 2025, Vietnam continued to attract strong foreign direct investment (FDI), maintaining steady growth momentum. According to official data from the National Statistics Office (Ministry of Finance), total registered FDI in the first 11 months exceeded USD 33.69 billion, up 7.4% year-on-year. Notably, disbursed FDI was estimated at USD 23.6 billion, marking the highest level of realized investment in the past five years and indicating that investor confidence in Vietnam’s investment environment remains very strong.

FDI Flows into Vietnam: Key Highlights

During the period 2015 – 2024, Vietnam maintained a leading position in attracting FDI in ASEAN. The country frequently ranked among the region’s top three largest FDI recipients, after Singapore and Indonesia. This performance shows Vietnam’s stable attractiveness amid shifting global investment trends[1]. In the first 11 months of 2025, the National Statistics Office recorded total registered FDI into Vietnam, including newly registered capital, adjusted registered capital, and foreign investors’ capital contributions and share purchases, at USD 33.69 billion. This figure increased by 7.4 % compared with the same period last year[2].

FDI Registered in Vietnam in the First 11 Months, 2021–2025

Unit: Billion USD

Source: National Statistics Office (Ministry of Finance)

Out of the USD 33.69 billion in registered FDI, newly registered capital included 3,695 newly licensed projects with total registered capital of USD 15.96 billion. This represents a 21.7% increase year on year in the number of projects, but an 8.2% decrease in newly registered capital. Among sectors, manufacturing and processing attracted the largest amount of newly licensed FDI, with registered capital of USD 9.17 billion, accounting for 57.5% of total newly registered capital. Real estate activities followed with USD 3.14 billion, making up 19.7%. The remaining sectors recorded USD 3.65 billion, accounting for 22.8%[3].

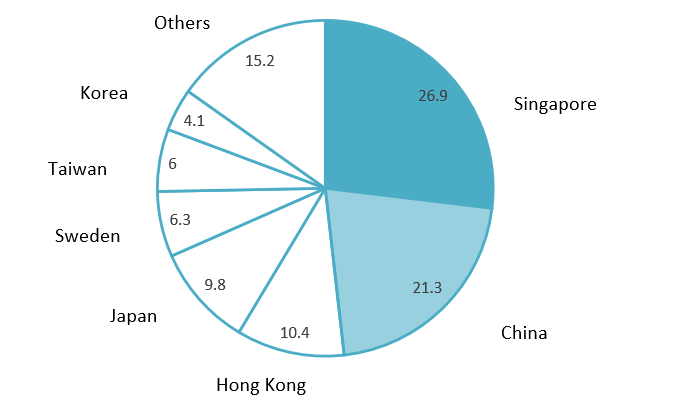

Composition of newly registered FDI capital in Vietnam by country in the first 11 months of 2025

100% = USD 15.96 Billion

Source: National Statistics Office (Ministry of Finance)

Newly registered FDI is mainly concentrated in a few major source markets. Singapore leads with 26.9%, followed by China with 21.3%. Hong Kong accounts for 10.4% and Japan 9.8%, which are also significant, while the remaining countries make up smaller shares. This suggests that new registered inflows are strongly oriented toward regional financial and manufacturing hubs. It also indicates that Vietnam continues to attract Asian investors and related supply chains.

Notably, the National Statistics Office stated that the most important indicator of FDI is actual disbursed capital. In the first 11 months of 2025, disbursed FDI in Vietnam was estimated at USD 23.6 billion, up 8.9% compared with the same period last year. This is a very high level of realized FDI and the highest in the 2021 to 2025 period. By sector, manufacturing and processing accounted for 82.9% of total disbursed FDI, real estate activities accounted for 7.1%, and the production and distribution of electricity, gas, hot water, steam, and air conditioning accounted for 3.2%.

FDI is shifting from new projects to expansion, creating broad spillover effects across multiple industries

– Investors are expanding existing projects rather than launching large new ones: In the first 11 months of 2025, Vietnam recorded a strong rise in adjusted capital, showing that many foreign investors already operating in Vietnam are increasing capacity and adding more investment. At the same time, newly registered capital fell by 8.2%, while the number of newly licensed projects rose by 21.7%. This suggests continued strong investor interest, with more small and mid-sized projects that can still create wide spillover effects[4].

– Industrial real estate benefits from the production expansion wave: As FDI continues to concentrate in manufacturing and real estate, demand rises for industrial parks, ready-built factories, and warehousing logistics. The market has also seen more industrial park-related projects moving forward to capture this FDI trend, including Hoa Tam Industrial Park Phase 1 of nearly 492 ha in Dak Lak, and the Yen Binh concentrated IT park of over 197.6 ha in Thai Nguyen[5].

– Supporting industries and local firms gain from deeper supply chain needs: When FDI shifts from new entry to scaling up production, foreign firms tend to look more actively for local suppliers for components, parts, packaging, precision mechanical processing, and technical services. Stronger linkages between FDI firms and Vietnamese companies can raise localization and also push local suppliers to upgrade quality standards, management systems, and technology capability to meet global supply chain requirements. Vietnam’s Ministry of Industry and Trade, via partners such as JETRO and KOTRA, has been running promotion programs and regularly connecting with potential FDI firms, supported by a network of nearly 60 Vietnamese trade offices abroad[6].

Key foreign companies leading FDI inflows into Vietnam

Vietnam has actively attracted FDI to expand production capacity, boost exports, and deepen its participation in global value chains. Over the past decades, many multinational corporations have become leading investors and have continuously expanded their presence in Vietnam, especially in technology and manufacturing.

Some key foreign companies are leading FDI inflows into Vietnam

| No | Name | Year of FDI investment in Vietnam | Country Origin | Short description | URL

|

| 1 | Samsung Electronics | 1995 | Korea | – Strong investments in the manufacturing of electronic devices, electronic components, and high technology, including semiconductors and chips.

– Invested USD 23.2 billion in Vietnam over 30 years as of November 2025. – Mobile phones produced in Vietnam account for more than 50% of the company’s global output. |

https://www.samsung.com/vn/ |

| 2 | LG Electronics | 1996 | Korea | – Invests in the production of electronic components and camera modules for smartphones, as well as displays for mobile devices and TVs, and home appliances.

– Total investment in Vietnam is about USD 9 billion as of 2024, with an additional USD 3 billion planned over the next five years. – LG is also focusing on high tech fields such as artificial intelligence, robotics, materials and components, standardization technologies, next generation computing, and cloud data. |

https://www.lg.com/vn/ |

| 3 | Intel Products Vietnam | 2006 | The USA | – Invests in semiconductor chip and component assembly and testing.

– Total investment in Vietnam is about USD 1.5 billion as of 2024. – Intel Vietnam is also the largest assembly and test site among Intel’s four global assembly and test facilities. |

https://www.intel.vn/ |

| 4 | Foxconn Technology Group | 2007 | Taiwan | – Invests in high tech areas such as AI servers, printed circuit boards, electric vehicle components, and the manufacturing of telecommunications equipment.

– Total investment in Vietnam is about USD 2.2 billion as of 2024. |

https://www.foxconn.com/vi-vn |

| 5 | Heineken Vietnam | 1991 | Netherlands | – Invests in the production of beer and beverages.

– Heineken’s investment in Vietnam reached USD 1 billion in 2022, and it plans to invest an additional USD 500 million over the next 10 years. |

https://www.heineken.com/vn/vi/home/ |

B&Company’s synthesis

FDI inflows into Vietnam are driven mainly by large-scale technology and manufacturing groups, particularly in electronics, semiconductors, components, and high-tech equipment. Investors from South Korea, the United States, Taiwan, and the Netherlands entered Vietnam relatively early (1991 to 2007) and have continuously expanded their investments, with cumulative capital reaching tens of billions of US dollars. This reflects Vietnam’s increasingly important role in global supply chains, not only in assembly but also in component manufacturing, testing, and higher-value-added activities. At the same time, the fact that many companies continue to announce additional investment plans in the coming years indicates strong long term confidence in Vietnam’s investment environment and growth outlook.

Implications for foreign investors

For foreign investors considering FDI in Vietnam, a suitable approach is to follow a phased approach: starting with a moderate scale to facilitate decision-making and risk control, but designing for capacity expansion when market conditions are favorable. When choosing a location, prioritize areas with a complete manufacturing ecosystem, such as industrial clusters, convenient logistics connections, and an existing supplier network, rather than focusing solely on low rental rates. Simultaneously, proactively prepare land allocation plans early, consider pre-built factories to shorten implementation time, and negotiate expansion clauses from the outset to avoid being caught off guard when scaling up later.

Alongside factory development, investors should seriously invest in a domestic supplier development strategy, including selecting potential suppliers, standardizing quality requirements, and maintaining regular evaluation processes to meet supply chain standards. Participating in supply-demand matching programs and supporting industry promotion also helps to access suitable partners faster and reduce information search costs. In addition, opportunities can be considered in industries and services benefiting from the wave of production expansion, such as warehousing, logistics, technical services, maintenance, processing, and packaging. In the long term, the project should be oriented towards a gradual upgrade in technology and added value in Vietnam; especially for new investors, following established industry clusters with established regional business networks and supply chains will help reduce startup risks and increase opportunities for partner connections.

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

[1] ASEANstats Data Portal. Flows of Inward Foreign Direct Investment (FDI) to ASEAN Countries (in million US$) <Access>

[2] Nhandan.vn. FDI Attraction into Vietnam Continues to Rise Strongly <Access>

[3] Nhandan.vn. FDI Attraction into Vietnam Continues to Rise Strongly <Access>

[4] VnEconomy. FDI 2025: Disbursed Capital Hits a 5 Year Record, Foreign Funds Continue to Flow Strongly into Manufacturing <Access>

[5] Tin Nhanh Chung Khoan. Industrial Real Estate Keeps Pace with the FDI Wave <Access>

[6] Ministry of Industry and Trade of Vietnam. Investment Promotion in Supporting Industries <Access>