26Mar2025

Latest News & Report / Vietnam Briefing

Comments: No Comments.

Vietnam has rapidly emerged as a global hub for computer and electronic manufacturing. Fueled by a combination of government incentives and increasing foreign direct investment (FDI), the country has positioned itself as a key player in the global supply chain.

Overview of Vietnam Computer & Electronic Manufacturing

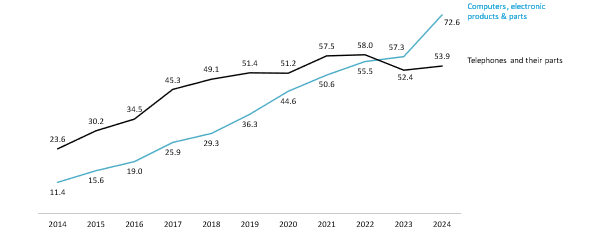

Vietnam’s manufacturing sector has made remarkable strides and achieved significant accomplishments, with high-tech industries driving growth. In 2024, the electronics sub-sector accounted for about 18% of the entire industrial sector, primarily focusing on the production of electronic products, computers, and optical devices[1]. Notably, computer and electronics manufacturing has emerged as a key driver of economic expansion. From 2011 to 2024, exports in this sector grew at an annual rate of nearly 25%, surpassing telephones and parts as Vietnam’s top export category since 2022[2]. By 2024, it contributed almost 20% of the country’s total export value, solidifying its role in Vietnam’s global trade.

Export value of computers and electronics and telephones and parts from 2014 to 2024

(Unit: billion USD)

Source: GSO, B&Company synthesis

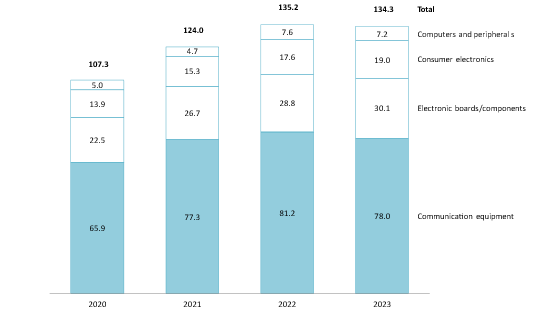

According to B&Company Vietnam’s Enterprise Database, Vietnam’s electronics industry had around 2,800 companies in 2023, generating $134 billion in net revenue. The sector is categorized into four key industries based on Decision No. 27/2018/QD-TTg[3]:

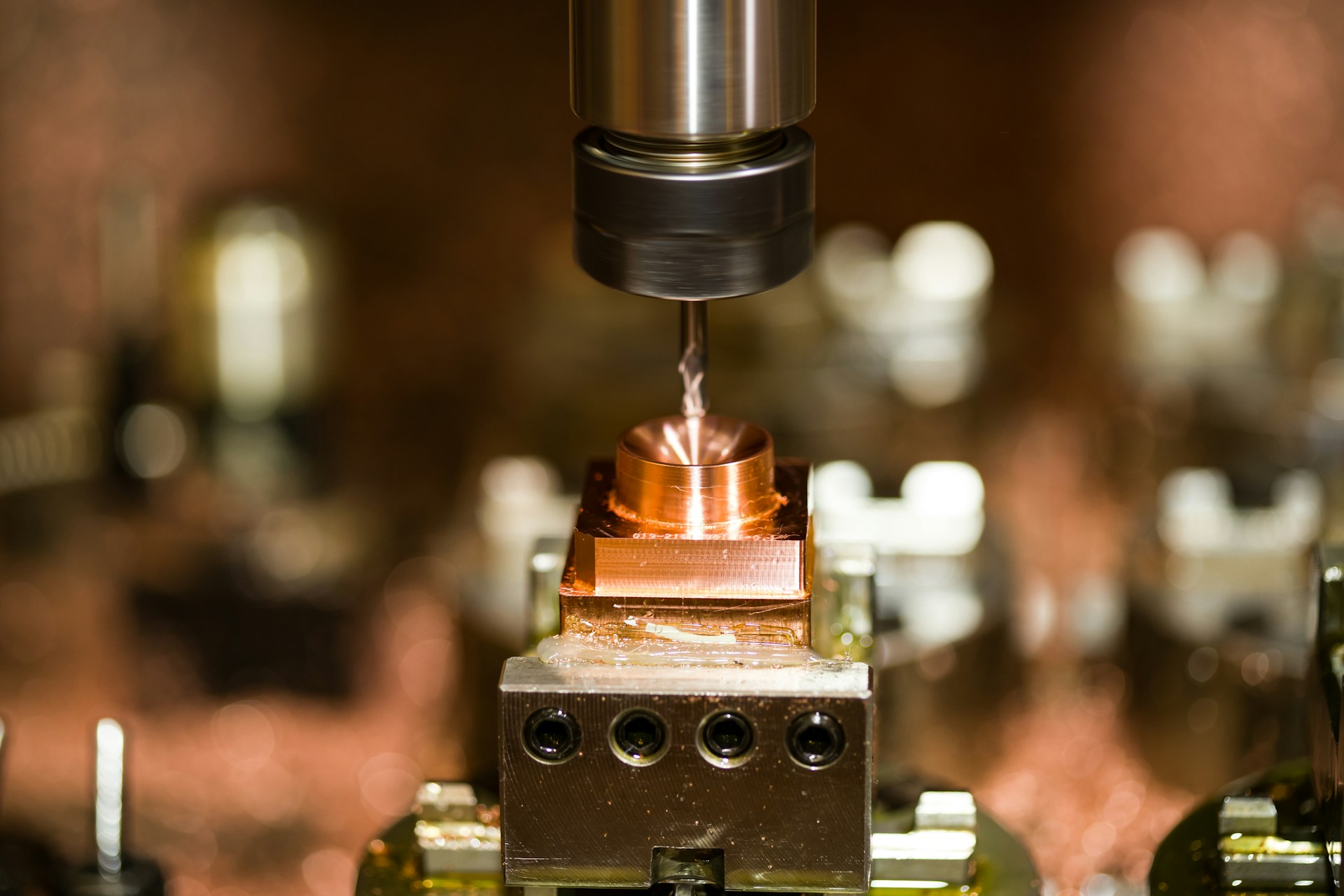

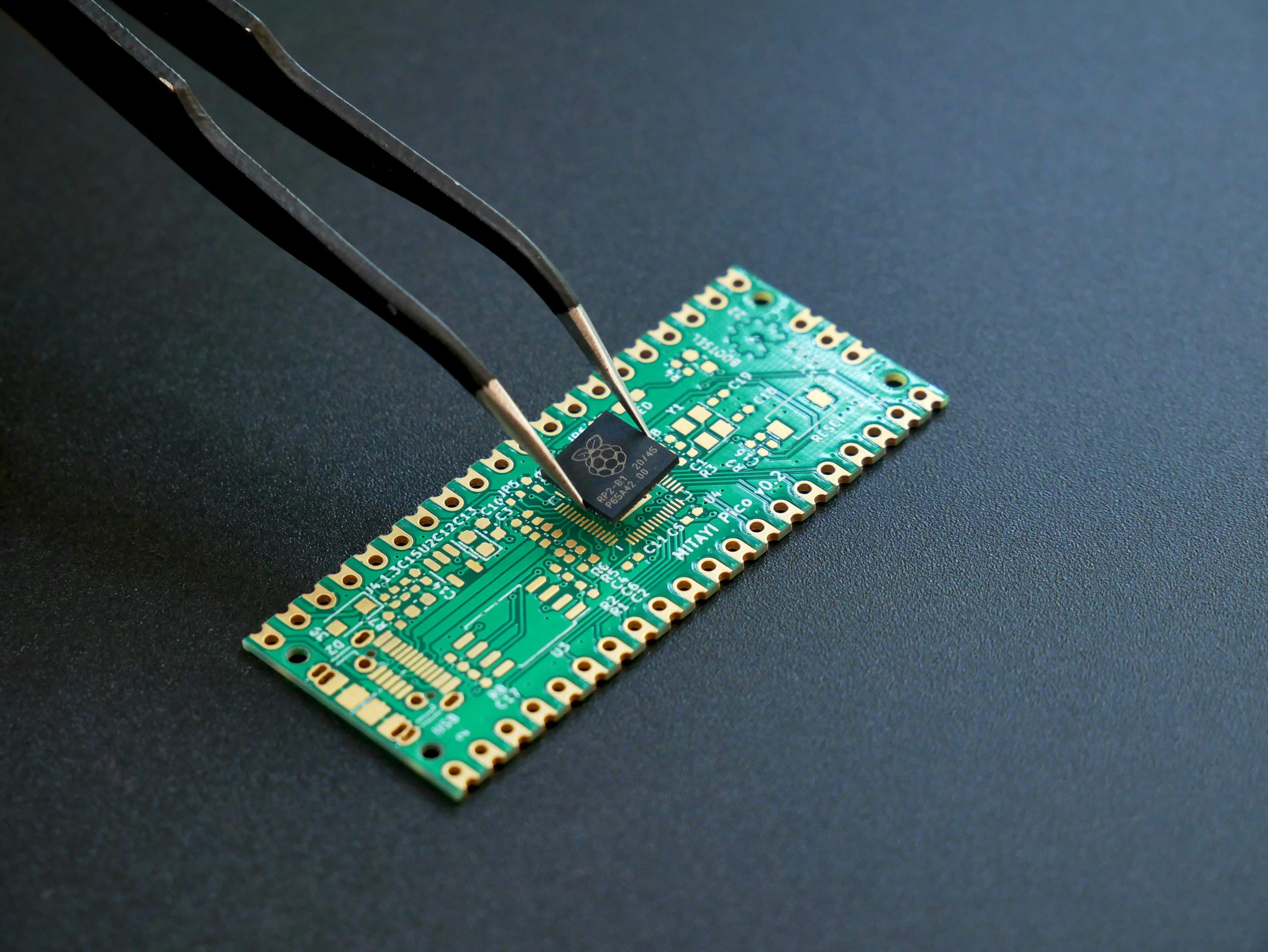

(1) Manufacturing of electronic components and boards (VSIC code 2610) covers the production of electronic components and semiconductors, including microchips and circuit boards, which serve as the foundation for various electronic devices with notable names such as Intel and Funing Precision Component (Foxconn). The industry posted a total net revenue of 30 billion USD in 2023 with a CAGR of 10% since 2020.

(2) Manufacture of computers and peripheral equipment (VSIC code 2620) pertains to the manufacturing of computers and peripheral equipment such as laptops, desktops, and storage devices, supporting both consumer and business. In 2023, the industry recorded a net revenue of 7.2 billion USD.

(3) Manufacturing of communication equipment (VSIC code 2630) focuses on communication equipment production, including mobile phones, networking devices, and radio transmission systems. The industry had the highest net revenue in 2023 with 78 billion USD with well-known brands like Samsung and LG.

(4) Manufacturing of consumer electronics (VSIC code 2640) encompasses consumer electronics manufacturing, covering products like televisions, audio devices, and home entertainment systems. Despite economic challenges in 2023, the industry recorded the highest growth rate in net revenue in the sub-sector at 8% to 19 billion USD.

Net revenue of computer and electronics manufacturing sub-sector, 2020 to 2023

Unit: Billion USD

Source: B&Company Vietnam’s Enterprise Database

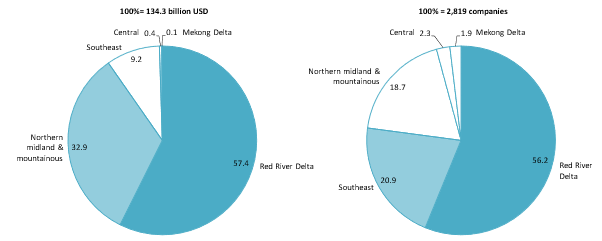

The manufacturing of computers and electronics is heavily concentrated in the Northern regions, with the Red River Delta accounting for nearly 60% of the sub-sector’s total net revenue and number of companies in 2023. On a provincial scale, Bac Ninh generated a third of the total net revenue at 42 billion USD, followed by Thai Nguyen (25 billion USD – 19%) and Hai Phong (16 billion USD – 12%).

Net revenue and company number of Vietnam computers and electronics manufacturing industry by region in 2023

Unit: %

Source: B&Company Vietnam’s Enterprise Database

Due to strong incentives from the government and the industry’s innate technological barrier, the sector is predominantly occupied by well-known international players. South Korea’s giant Samsung dominated the industry in 2023 with multiple branches leading the top revenue companies. Vietnam’s factories also accounted for over 50% of Samsung’s smartphone output, highlighting the importance of Vietnam in the global supply chain[4].

Table 1: Top 10 companies in Vietnam’s manufacturing of computers and electronics industry by net revenue in 2023

| No. | Company Name | VSIC Code | City/Province | Country of investment |

| 1 | Samsung Electronics Vietnam Thai Nguyen Co., Ltd. | 26300 | Thai Nguyen | Singapore |

| 2 | Samsung Display Vietnam Co., Ltd. | 26300 | Bac Ninh | South Korea |

| 3 | Samsung Electronics Vietnam Co., Ltd. | 26300 | Bac Ninh | South Korea |

| 4 | LG Display Vietnam Haiphong Co., Ltd. | 26300 | Hai Phong | South Korea |

| 5 | Samsung Electronics HCMC CE Complex Co., Ltd. | 26400 | HCMC | Singapore |

| 6 | LG Innotek Vietnam Haiphong Co., Ltd. | 26300 | Hai Phong | South Korea |

| 7 | Compal (Vietnam) Co., Ltd. | 26100 | Vinh Phuc | China |

| 8 | LG Electronics Vietnam Hai Phong Co., Ltd. | 26400 | Hai Phong | South Korea |

| 9 | Luxshare – ICT (Vietnam) Limited | 26300 | Bac Giang | China |

| 10 | Intel Products Vietnam Co., Ltd. | 26100 | HCMC | Netherlands |

Source: B&Company’s Enterprise Database

Foreign investment trends in Vietnam

Vietnam’s manufacturing sector remains a top choice for foreign investors, accounting for 67% of total FDI in 2024, with nearly $26 billion in investments[5]. The industry is shifting toward technology-intensive sectors, particularly computers and electronics, which have seen significant expansion and entry by global tech leaders.

Table 2: Some notable foreign investment projects in 2024

| No. | Company | Source country | Investment value (Unit: million USD) | Location | Description |

| 1 | Samsung Display Vietnam | South Korea | 1,800 | Bac Ninh | Establishing a new factory to manufacture OLED displays for automobiles and technological devices |

| 2 | Amkor Technology Inc. | United States | 1,070 | Bac Ninh | Expansion of its 530 million USD semiconductor packaging and test factory in Bac Ninh |

| 3 | Luxcase Precision Technology (Vietnam) | Singapore | 299 | Nghe An | Raising its production of precision mechanical components for electronic devices to 23 million items a year |

| 4 | Meiko Electronics Vietnam | Japan | 200 | Hoa Binh | Constructing its 5th factory in Vietnam, focusing on electronic circuits for peripherals, computers, electronic appliances, etc. |

Source: B&Company Vietnam synthesis

Samsung Display Vietnam’s 1.8 billion USD factory in Bac Ninh

Source: VnEconomy

Driven by rising global semiconductor demand and government-backed strategies, the semiconductor manufacturing industry has recorded substantial growth in recent years. As of December 2024, the industry was projected to reach 6.16 billion USD[6], attracting a total of 174 FDI projects with a total investment capital of 11.6 billion USD[7]. Decision No. 1018/QD-TTg signed in 2024 also lays out the development formula for the semiconductor industry until 2030, with a vision to 2050[8]. The “C = SET + 1” formula aims to develop the semiconductor industry through the development of specialized chips, of the electronics and supporting industries, and the preparation of the Vietnamese workforce in order to position Vietnam as an attractive “+1” option, providing security for the global semiconductor industry.

Table 3: Objectives and roadmap for Vietnam’s semiconductor industry to 2030, with a vision to 2050 under Decision No. 1018/QD-TTg signed in 2024

| Phase | Period | Objectives |

| Phase 1 | 2024 – 2030 | – Establishing 100 design firms, 1 small-scale chip factory, and 10 packaging & testing plants, developing specialized semiconductor products for key industries;

– Semiconductor industry revenue to exceed 25 billion USD/year, Electronics industry revenue to exceed 225 billion USD/year, with 10-15% value-added in Vietnam; – 50,000 skilled engineers trained to meet industry demand. |

| Phase 2 | 2030 – 2040 | – Strengthening domestic capacity alongside FDI, expanding to 200 design firms, 2 chip factories, and 15 packaging & testing plants;

– Semiconductor industry revenue to exceed 50 billion USD/year, Electronics industry revenue to exceed 485 billion USD/year, with 15-20% value-added in Vietnam; – Workforce to grow to 100,000 engineers. |

| Phase 3 | 2040 – 2050 | – Expanding to 300 design firms, 3 chip factories, and 20 packaging & testing plants, achieving R&D mastery;

– Semiconductor industry revenue to exceed 100 billion USD/year, Electronics industry revenue to exceed 1,045 billion USD/year, with 20-25% value-added in Vietnam; – Establishing a self-sufficient semiconductor ecosystem, positioning Vietnam as a key global player. |

Source: Vietnam Government Portal

Government policies to support the Computers and Electronics manufacturing sector

The recent growth underscores Vietnam’s computer and electronic manufacturing sector’s resilience and attractiveness amidst global competition, and the sector is poised to see further growth benefiting from the government’s attractive policies and capital from international sources. High-tech enterprises can benefit from a preferential CIT rate of 10% for up to 15 years, compared to the standard rate of 20%[9]. Decision No. 29/2021/QD-TTg prescribing special investment incentives signed in 2021 also introduces greater tax rate cuts for high-tech foreign companies and encourages the participation of Vietnamese firms in the supply chain.

Table 4: Preferential tax rates for high-tech investment projects under Decision No. 29/2021/QD-TTg signed in 2021

| No. | Preferential tax rate | Criteria |

| 1 | 9% in 30 years | Investment projects fall under the provisions specified in point b, clause 2, Article 20 of the Investment Law:

– Investment projects in specially incentivized industries; – Total capital scale of at least 30 trillion VND; – Minimum disbursement of 10 trillion VND within 3 years from the date of issuance of IRC or approval of the investment policy. |

| 2 | 7% in 33 years | Criteria (1):

– Investment projects for establishing new innovation centers or research and development (R&D) centers (including the expansion of such newly established projects); – Total capital scale of at least 3,000 billion VND; – Minimum disbursement of 1,000 trillion VND within 3 years from the date of issuance of IRC or approval of the investment policy. Criteria (2): An investment project specified in Point b Clause 2 Article 20 of the Law on Investment and meets any of the following criteria: – A level-1 high technology project; – Having Vietnamese enterprises join the value chain at level 1; – Value added accounting for over 30% to under 40% of the prime costs of total finished products; – Meeting level-2 technology transfer criteria. |

| 3 | 5% in 37 years | Criteria (1): The National Innovation Center established under the Prime Minister’s decision

Criteria (2): An investment project specified in Point b Clause 2 Article 20 of the Law on Investment and meets any of the following criteria: – A level-2 high technology project; – Having Vietnamese enterprises join the value chain at level 2; – Value added accounting for more than 40% of the prime costs of total finished products; – Meeting level-2 technology transfer criteria. |

Source: Vietnam Government Portal

Conclusion

Vietnam’s electronics manufacturing sector has transformed into a major player in the global market. The presence of industry giants like Samsung, Intel, and Foxconn highlights the country’s attractiveness as a manufacturing hub. As foreign investments continue to pour in, Vietnam’s electronics manufacturing industry is poised for continued growth, and its role in global supply chains will only strengthen.

[1] GSO. Electronics, Computer, and Component Imports and Exports – Growth Driver and Expectations for 2024 <Assess>

[2] GSO. Electronics, Computer, and Component Imports and Exports – Growth Driver and Expectations for 2024 <Assess>

[3] Vietnam Government Portal. Decision No. 27/2018/QĐ-TTg of the Prime Minister: Establishing the Vietnam Standard Industrial Classification System <Assess>

[4] VnEconomy. Samsung Launches New $1.8 Billion Project in Bac Ninh <Assess>

[5] MPI. Foreign Investment Attraction Situation in 2024 <Assess>

[6] MoIT. Developing Supporting Industries: Boosting Vietnam’s Semiconductor Industry <Assess>

[7] Government News. Many leading technology corporations plan to shift their supply chains to Vietnam <Assess>

[8] Vietnam Government Portal. Decision No. 1018/QD-TTg on the strategy for the development of Vietnam’s Semiconductor industry to 2030 and vision to 2050 <Assess>

[9] Vietnam Government Portal. Law No. 32/2013/QH13 on the amendments to the Law on Corporate Income Tax <Assess>

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |