27Jan2026

Latest News & Report / Vietnam Briefing

Comments: No Comments.

Biomass energy is gaining increasing attention in Vietnam as part of the country’s broader renewable energy and green transformation agenda. Supported by plentiful agricultural and forestry resources, biomass offers opportunities for sustainable power generation, waste reduction, and rural economic development. Growing international cooperation and technology transfer are shaping new investment pathways and positioning biomass as a dispatchable solution within Vietnam’s long-term low-carbon power system.

Overview of biomass energy

Biomass energy refers to energy produced from organic materials such as agricultural residues (rice husks, straw, bagasse), forestry by-products, livestock waste, and municipal organic waste. These materials can be converted into heat, electricity, biogas, or biofuels through processes like combustion, anaerobic digestion, and gasification. Biomass is considered a renewable and low-carbon energy source, contributing to both waste management and climate goals[1].

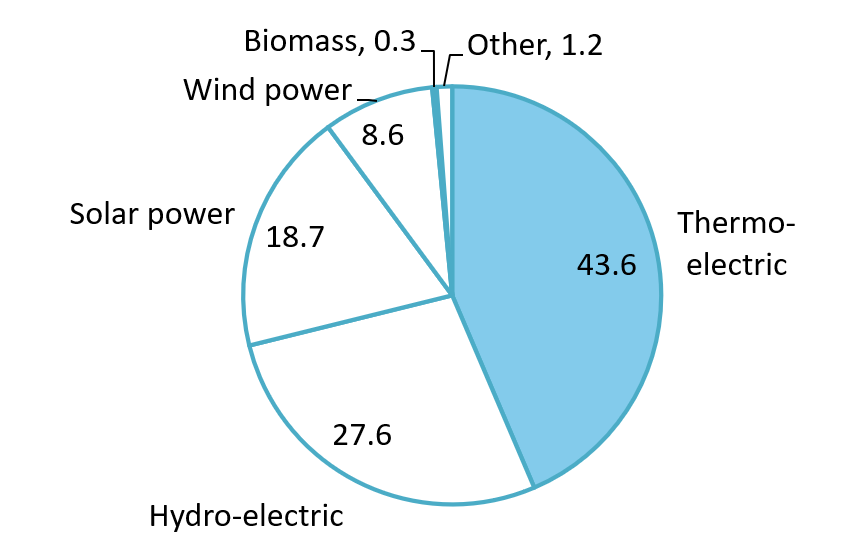

Vietnam’s total installed electricity generation capacity reached 91,206 MW as of January 2026. At this scale, biomass energy currently makes up only about 0.3% of the national power generation mix, making it one of the smallest contributors among primary power sources.

Total installed capacity of Vietnam’s national power system (Jan/2026)

100% = 91,206 MW

Source: National Electricity System and Market Operation (NSMO) – Day 19/01/2026

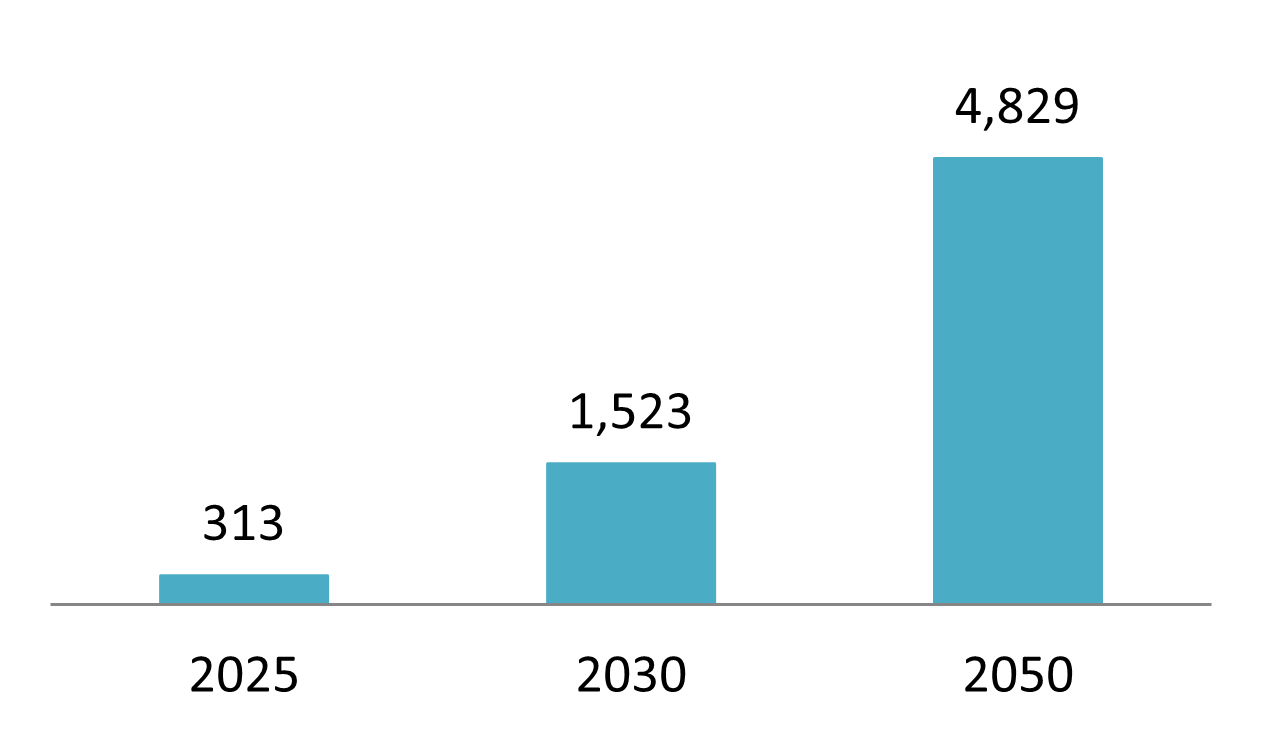

Under national planning and updated energy strategies, biomass generation capacity is projected to grow significantly. By 2030, biomass capacity is expected to increase 5–8 times its current level by 2030, potentially accounting for around 0.8% – 1.1% of total installed capacity in the national power system by that time (Decision No. 768/QD-TTg)[2].

Growing drivers of biomass energy in Vietnam

Abundant Biomass Resources

Vietnam possesses one of the most abundant biomass resource bases in Southeast Asia, thanks to its strong agricultural, forestry, and food-processing sectors. According to assessments by Vietnamese energy authorities and research institutions, the country has the potential to exploit approximately 150 million tons of biomass feedstock per year[3]. The main biomass sources include agricultural residues such as rice husks, rice straw, sugarcane bagasse, corn cobs, and cassava residues; forestry by-products including wood chips, sawdust, and logging residues; and livestock waste and organic industrial by-products[4].

Despite this abundance, only a small proportion of biomass residues is currently used for modern energy production, indicating significant untapped potential for power generation. Biomass energy has strong advantages in rural and agricultural areas, where feedstock availability is high and grid-connected or distributed biomass plants can help reduce waste while supplying local electricity and heat demand.

Government Initiatives and Policy Support

Vietnam’s commitment to green transformation and climate action is a major driver of biomass energy development. At COP26, the Vietnamese Government pledged to achieve net-zero greenhouse gas emissions by 2050, thus the transition from fossil fuels to renewable and low-carbon energy sources. Biomass energy is recognized as an important component of this transition, particularly due to its ability to provide dispatchable and stable power, unlike intermittent sources such as solar and wind.

The Vietnamese Government has repeatedly emphasized support for biomass electricity development. Some supporting policies include:

– Feed-in Tariff (FiT) mechanisms for renewable energy, which provide guaranteed electricity purchase prices for biomass power projects, helping improve bankability and attract private investment

– Direct Power Purchase Agreement (DPPA) framework, which is being developed to allow large electricity consumers to purchase renewable electricity directly from generators, creating new commercial opportunities for biomass projects

– National power development strategies that prioritize renewable energy expansion, energy security, and diversification of the power mix

Biomass planning capacity (2030 and 2050)

Unit: MW

Source: NSMO, Decision No. 768/QD-TTg

Biomass projects and development orientation in Vietnam

Biomass energy has long existed in Vietnam, especially within the sugar industry, where sugar mills have used bagasse to generate electricity for internal use and, in many cases, sell the surplus to the national grid. Companies such as Lam Son Sugar Cane JSC and Ninh Hoa Sugar JSC have their biomass power plants built together with their sugar production plants in small capacity to take advantage of a huge amount of sugarcane waste[5].

With the development of national power structures, those plants are under expansion. For example, An Khe Biomass Power Plant of Quang Ngai Sugar JSC had been upgraded from 29MW to 95MW in 2018[6]. It is planned to expand to 135MW of total capacity[7]. KCP Phu Yen Biomass Power Plant also plans to upgrade its capacity to 45MW[8].

Recently, Vietnam’s biomass sector witnessed a lively development thanks to the active participation of Japanese renewable energy firm Erex, notably through Japan’s Joint Crediting Mechanism (JCM). Erex plans to establish up to 19 biomass power plants and related wood pellet factories across Vietnam by the mid-2030s, significantly scaling the country’s biomass generation capacity[9]. Their first establishment was Hau Giang Biomass Power Plant, in collaboration with Hau Giang Bioenergy JSC. They have been authorized the construction of biomass power plants in Lao Cai and Tuyen Quang, which will be in operation in 2027[10].

Some biomass energy projects in Vietnam (updated in Jan/2026)

| # | Projects | Capacity (MW) | Location* | Biomass feedstocks | Project Owner | Status | Year of operation |

| 1 | Can Tho Biomass Power Plant | 150 | Can Tho | Rice straw & husk | Vietnam Power Development JSC | Planning | N/A |

| 2 | Yen Bai 1 Biomass Power Plant | 50 | Lao Cai | Wood chips / residues | Erex Yen Bai Biomass Power Co., Ltd (Japan) | Planning | 2027 |

| 3 | Tuyen Quang Biomass Power Plant | 50 | Tuyen Quang | Wood chips / residues | Erex Tuyen Quang Biomass Power Co., Ltd (Japan) | In Construction | 2027 |

| 4 | Hau Giang Biomass Power Plant | 20 | Can Tho | Husk | Hau Giang Bioenergy JSC (with PECC2 & Erex involvement) | In Operation | 2025 |

| 5 | An Khe Biomass Power Plant | 95 | Quang Ngai | Sugarcane bagasse | Quang Ngai Sugar JSC | In Operation | 2018 |

| 6 | Tuyen Quang Sugarcane Biomass Power Plant | 25 | Tuyen Quang | Sugarcane bagasse | Son Duong Sugar and Sugarcane JSC | In Operation | 2018 |

| 7 | Ninh Hoa Sugar Biomass Power Plant | 30 | Khanh Hoa | Sugarcane bagasse | Ninh Hoa Sugar JSC | In Operation | 2014 |

| 8 | Phu Tho Biomass Power Plant | 40 | Phu Tho | Agricultural by-products | Viet Nam High-tech Renewable Bioenergy JSC | In Operation | 2013 |

| 9 | KCP Phu Yen Biomass Power Plant | 30 | Dak Lak | Sugarcane bagasse | KCP Viet Nam Industries Limited | In Operation | 2001 |

*The location is updated in accordance with the national administrative merger in July/2025

B&Company’s synthesis

Beyond new project development, Vietnam’s biomass energy orientation increasingly emphasizes the conversion and repurposing of existing thermal power plants, particularly coal-fired facilities, toward biomass or biomass-ammonia fuel use. By 2030, coal plants operating for 20 years will be oriented toward fuel conversion to biomass or ammonia when economically feasible, and plants older than 40 years will be retired if conversion is not possible. By 2050, Vietnam will completely phase out coal-fired power generation[11].

A notable example is the energy transition program at Vinacomin-Power Holding Corporation (TKV Power), where Na Duong and Cao Ngan coal-fired power plants are being evaluated for fuel conversion pathways. These efforts are supported by Erex (Japan), reflecting international cooperation in technology transfer and emissions reduction, and marking a shift from traditional coal dependency toward cleaner biomass-based generation[12].

Challenges and implications

Despite strong resource potential and clear long-term policy signals, the development of biomass energy in Vietnam faces several structural challenges. Biomass projects remain capital-intensive relative to their current scale, while feedstock supply chains (collection, aggregation, transportation, and price stability of agricultural and forestry residues) are fragmented and region-specific, increasing operational risk. In addition, permitting procedures, land access, and grid connections for biomass projects (especially greenfield plants) can be complex and time-consuming, requiring strong local coordination and regulatory familiarity.

Given these challenges, foreign investors should adopt strategic, partnership-driven approaches when entering Vietnam’s biomass sector:

Prioritize partnerships with local industrial players and state-linked entities

Collaborating with sugar producers, forestry companies, or state-owned groups (e.g., EVN affiliates or Vinacomin Power) can mitigate feedstock risk, ease permitting processes, and enable access to existing infrastructure, particularly for plant upgrades or fuel-conversion projects. The collaboration with local players is also helpful for the greenfield establishment of biomass power projects.

Focus on fuel-conversion and brownfield opportunities

Vietnam’s policy orientation toward converting ageing coal-fired power plants to biomass or ammonia by 2050 creates attractive opportunities for foreign investors with conversion technologies, co-firing solutions, and operational expertise, where project risks are typically lower than greenfield developments.

Leverage international mechanisms and green finance frameworks

Mechanisms such as Japan’s Joint Crediting Mechanism (JCM), climate finance, and carbon credit schemes can significantly improve project bankability. Investors should structure projects to align with Vietnam’s net-zero and green transformation agenda to access concessional financing and policy support.

Develop integrated biomass value chains rather than stand-alone power plants

Successful long-term investment is likely to depend on integrating fuel sourcing, pellet production, power generation, and industrial heat supply, enhancing resource efficiency and reducing exposure to feedstock price volatility.

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

[1] Vietnam Energy, Industrial biomass – A new energy source to help neutralize carbon (https://nangluongvietnam.vn/sinh-khoi-cong-nghiep-nguon-nang-luong-moi-giup-trung-hoa-carbon-28479.html)

[2] Decision No. 768/QD-TTg, Approving Amendment to National electricity Development planning of 2021 – 2030 Period and vision to 2050 (https://thuvienphapluat.vn/van-ban/Tai-nguyen-Moi-truong/Quyet-dinh-768-QD-TTg-2025-Dieu-chinh-Quy-hoach-phat-trien-dien-luc-quoc-gia-thoi-ky-2021-2030-651977.aspx)

[3] Vietnam.net, Biomass energy and its potential in Vietnam (https://vietnamnet.vn/nang-luong-sinh-khoi-va-tiem-nang-tai-viet-nam-i264624.html)

[4] Vietnam Electricity, Biomass power potential in Vietnam (https://www.evn.com.vn/d/vi-VN/news/Tiem-nang-dien-sinh-khoi-tai-Viet-Nam-60-17-501116)

[5] GIZ ESP, Developing biomass power in the sugar industry (https://www.esp.org.vn/vi/news/phat-trien-dien-sinh-khoi-trong-nganh-mia-duong/)

[6] Vietnam Energy, Add the An Khê biomass power project to the VII Power Development Plan (https://nangluongvietnam.vn/bo-sung-du-an-dien-sinh-khoi-an-khe-vao-qhd-vii-13884.html)

[7] Tạp chí Công thương, Gia Lai: An Khe Biomass Power Plant to be expanded, raising total investment to over 2,753 billion VND (https://tapchicongthuong.vn/gia-lai–mo-rong-nha-may-dien-sinh-khoi-an-khe–nang-tong-von-len-hon-2-753-ty-dong-233063.htm)

[8] Nhà đầu tư, KCP will invest an additional $60 million in biomass power and a sugar factory in Phu Yen. (https://nhadautu.vn/kcp-se-rot-them-60-trieu-usd-cho-dien-sinh-khoi-nha-may-duong-o-phu-yen-d95762.html)

[9] EREX, Solutions (https://www.erex.vn/solutions)

[10] EREX, Groundbreaking Ceremony for Yen Bai Biomass Power Plant and Tuyen Quang Biomass Power Plant (https://www.erex.vn/news/191/)

[11] Decision No. 768/QD-TTg, Approving Amendment to National electricity Development planning of 2021 – 2030 Period and vision to 2050 (https://thuvienphapluat.vn/van-ban/Tai-nguyen-Moi-truong/Quyet-dinh-768-QD-TTg-2025-Dieu-chinh-Quy-hoach-phat-trien-dien-luc-quoc-gia-thoi-ky-2021-2030-651977.aspx)

[12] Báo Công thương, Energy transformation at TKV Power Corporation (https://congthuong.vn/chuyen-doi-nang-luong-o-tong-cong-ty-dien-luc-tkv-381246.html)