19Nov2025

Latest News & Report / Vietnam Briefing

Comments: No Comments.

Vietnam’s textile industry continues to expand in export volume, yet a less visible dependency shapes its growth: most factories still run on imported raw materials, with a sizable share sourced from China. Rising input costs, tightening sustainability standards, and trade agreement requirements are gradually turning this model into a strategic bottleneck. As global buyers push for traceability and supply stability, Vietnam’s dependence on external materials is becoming more than a cost issue; it is emerging as a key factor that will determine which manufacturers maintain competitiveness, and which ones risk being left behind.

Vietnam’s Import market of raw materials

Source: Vico Logistics

Overview of Vietnam’s Import Dependence on Raw Materials

Vietnam ranks among the top textile and apparel exporters globally, with nearly $44 billion in export revenue in 2024. However, only 30-40% of the sector’s raw material needs are met domestically[1]. The majority of cotton, yarn, and fabric is imported, most notably from China, which supplies over half of all input materials. As a result, Viet Nam’s textile and garment (T&G) industry is highly exposed to external shocks due to a structural over-reliance on imported raw materials. This dependence is substantial: in 2024, Vietnam relies on imports for approximately 40% of its synthetic fiber, 50% of cotton yarn, and a staggering 64% to 80% of its fabric requirements for domestic needs[2]. The total cost of fabric imports alone reached $26.37 billion in 2024, emphasizing the massive scale of these input needs.

The volume and value of these critical imports are rapidly increasing. In the first eight months of 2025, Vietnam imported USD 18.63 billion worth of textile, leather, and footwear materials and auxiliaries, marking a 3% year-on-year increase[3].

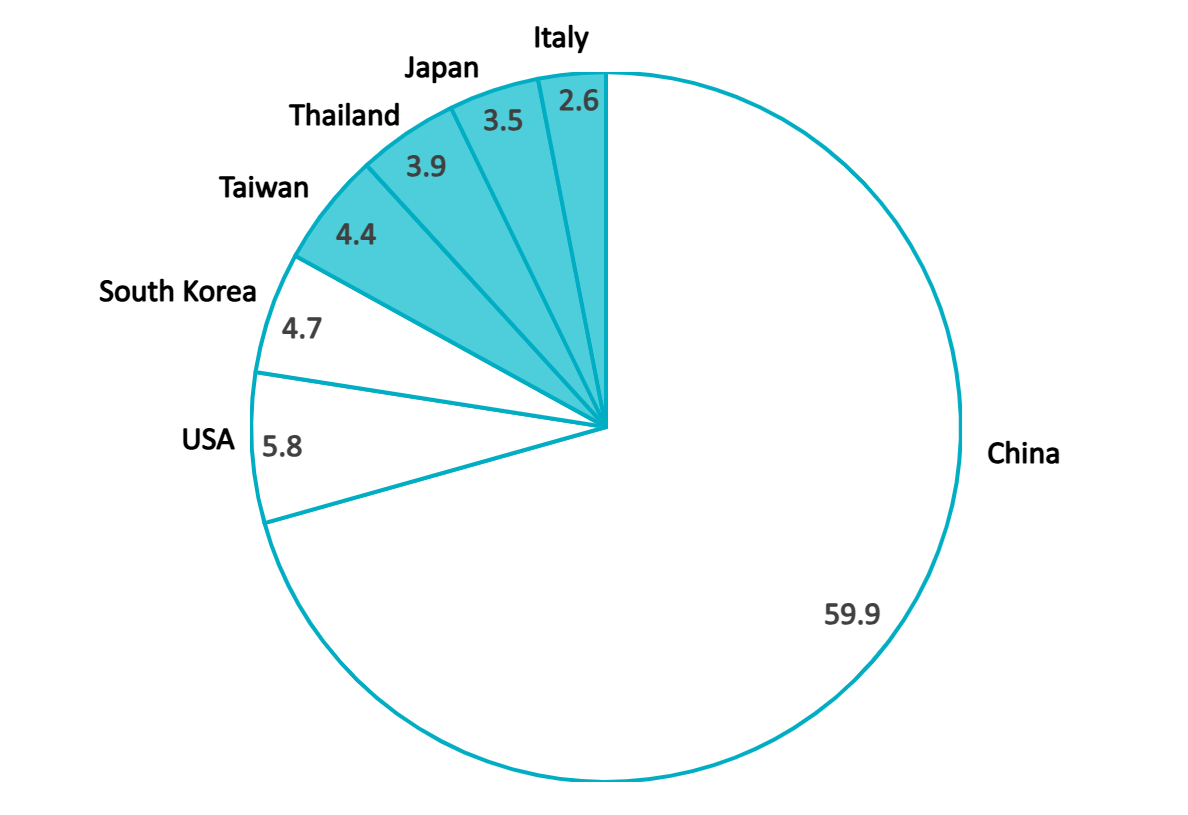

Vietnam’s Textile and Leather material imports by country, September 2025

100% = US$661.94 million

Source: B&Company compilation from The Shiv Data

In the first eight months of 2025, China remained the dominant supplier, with import value rising 7% on a year-on-year basis to USD 10.9 billion despite inputs being sourced from around 30 countries. Taiwan followed with USD 1.4 billion, up 1.8% year-on-year, while imports from the Republic of Korea reached USD 1.29 billion, though this represented a 9.3% decline compared to the previous year. In September 2025, Vietnam’s imports of textile, leather, and footwear materials and auxiliaries climbed to US$661.94 million, reflecting a 13.98% month-on-month increase from August. China continued to be the leading source, supplying US$396.24 million worth of goods, an increase of 5.69% from the previous month[4].

This deep dependency on China’s inputs hinders Vietnam’s efforts to achieve vertical integration and creates significant competitive hurdles.

Root Causes of Import Dependence

Vietnam’s import-heavy structure is shaped by both cost advantages and capacity constraints. Chinese suppliers offer competitive prices, large volumes, and fast delivery, which makes them the most convenient source for factories operating on tight lead times[5]. However, the issue is not price alone: domestic upstream capacity remains limited. Although the textile sector has more than 7,000 enterprises, only about 12% produce yarn and 18% produce fabric, while the majority, around 68%, focus mainly on garment assembly[6]. With spinning, weaving, and dyeing investment lagging behind export growth, local supply is unable to meet the required volume or consistency, and imports continue to fill the gap.

Vietnam’s Fabric and Cotton Import

Source: VICO

Another factor reinforcing import dependence is the dominance of the cut-make-trim (CMT) model, which accounts for around 70% of Vietnam’s garment enterprises[7]. Under CMT, buyers supply all fabrics and trims, while local factories focus only on cutting and sewing. As a result, raw material sourcing remains controlled by foreign partners, and domestic firms have had little incentive to develop their own supply networks.

Foreign investment patterns have reinforced this reliance. Many FDI-backed enterprises continue importing from their home countries to leverage existing supplier networks. Many textile/garment factories in Vietnam are part of regional production networks run by investors from China, Taiwan, South Korea, etc. These investors often import materials from their home countries or from China to leverage existing supplier relationships.

Finally, trade and logistics considerations have historically favored imports. Until recently, Vietnam’s access to major markets did not depend on having local inputs, so there was little immediate incentive to localize the supply chain. The U.S., Vietnam’s largest apparel market, has no free trade agreement with Vietnam, so Vietnamese garments face standard tariffs regardless of input origin, negating any short-term benefit from using local fabrics. However, escalating US-China trade tensions and stricter scrutiny of supply-chain origin have increased regulatory risks for China-sourced materials, pushing buyers toward more diversified and transparent sourcing.

Risks of Overreliance on Imported Inputs

As global markets become more volatile and compliance standards tighten, the risks of depending too heavily on foreign suppliers are increasingly difficult for manufacturers and investors to ignore.

Source: Vietnam Briefing

| Operational Disruptions | Relying on a narrow set of foreign suppliers can disrupt operations if those supply lines falter. Any supply chain disruption, whether from factory shutdowns, shipping delays, or export restrictions in source countries, can leave Vietnamese manufacturers without critical materials, halting production. For instance, geopolitical tensions or public health events in China (Vietnam’s main supplier) could suddenly choke off material supplies. |

| Cost and Currency Volatility | Global price fluctuations in cotton, petroleum (for synthetic fibers), or logistics directly translate into unpredictable costs for Vietnamese firms that must buy these inputs abroad[8]. Currency movements are another factor – if the Vietnamese dong strengthens or the Chinese yuan fluctuates, input costs can change. If major markets impose duties on products containing non-local materials, Vietnamese exporters could face double cost increases – paying more for inputs and losing price competitiveness on exports. |

| Regulatory Risk | Overdependence on Chinese materials (since China is outside these FTAs) can prevent Vietnamese exports from qualifying for zero tariffs, effectively forfeiting the trade advantages that investors expect from Vietnam’s FTA network. This is a regulatory risk: companies that cannot shift their sourcing may continue paying higher tariffs in the EU or CPTPP markets, eroding their competitive edge[9]. |

| Geopolitical Exposure | Tensions between major trading powers can quickly implicate Vietnam’s supply chain. With over 38% of Vietnam’s total imports coming from China in some years[10], any escalation in China-U.S. or China-Vietnam trade frictions is a significant risk. |

| ESG Compliance | U.S. laws like the UFLPA have led to detentions of Vietnamese garments due to links to Xinjiang cotton. ESG risks tied to traceability, labor standards, and environmental compliance are becoming business-critical[11]. |

Vietnam’s Strategies to Diversify Supply Sources

As supply chain vulnerabilities become more visible, Vietnam’s textile industry is shifting from dependency toward diversification. Companies are exploring new sourcing destinations, investing in domestic upstream capacity, and adopting sustainable and traceable material solutions. These strategies to diversify supply sources are not only risk-mitigation measures, but also pathways to strengthen competitiveness, meet trade agreement requirements, and secure long-term growth.

Multi-Country Sourcing

Reducing reliance on any single country, particularly China, is a straightforward way to diversify risk. Vietnamese companies are expanding their network of raw material suppliers to include more countries such as India, Bangladesh, Thailand, South Korea, and the United States. For example, India and the U.S. have become crucial sources of cotton fiber, while South Korea, Taiwan, and Japan supply higher-end fabrics and yarns. By splitting orders across several countries, manufacturers gain flexibility: if one source faces disruption or price hikes, production can continue with materials from elsewhere. Investors can facilitate this by helping Vietnamese partners identify reliable overseas suppliers, negotiate long-term contracts, or even invest in upstream firms abroad (e.g. cotton gins in Australia or mills in India) to secure a dedicated supply. In addition, leveraging FTA partner countries is a smart play, sourcing fabric from Korea or Japan can allow finished garments to meet origin requirements for preferential tariffs.

Domestic Upstream Investment

By expanding spinning, weaving, knitting, and dyeing capacity inside Vietnam, manufacturers can shorten lead times, control quality, and improve compliance. Government incentives and dedicated industrial parks support this shift, creating opportunities for foreign investors to build material plants or form joint ventures, such as the recent US$200 million Top Textiles fabric mill[12]. Smaller high-value projects, including spinning mills or water-saving dye houses, are also in demand. The state is encouraging investment in recycled polyester, spandex yarn, and functional textiles, which are still mostly imported. As domestic demand for these inputs is large, upstream production not only diversifies sourcing but also captures greater value within Vietnam.

Sustainable Inputs

With ESG considerations becoming non-negotiable, a strategic form of diversification is focusing on sustainably sourced materials. This includes using cotton, yarn, and fabric that are certified organic, recycled, or compliant with international labor standards and doing so from varied sources. For instance, Vietnamese manufacturers are increasingly seeking cotton certified by the Better Cotton Initiative (BCI) or the U.S. Cotton Trust Protocol, which not only avoids the Xinjiang issue but also assures buyers of ethical sourcing[13].

Some Vietnamese firms have started importing organic cotton from India and Turkey and recycled yarns from Taiwan, supplementing or replacing standard inputs. There are also emerging opportunities to invest in local sustainable material production, for example, developing organic cotton farming in Vietnam’s northwestern provinces or building a facility to produce fiber from agricultural waste (banana fiber, etc.)[14]. For investors, backing sustainable supply chains can open premium market segments and safeguard against regulatory risks (like UFLPA) because materials come with verifiable provenance.

Digital Procurement

Online sourcing platforms and e-procurement tools allow factories to compare prices, check availability in real time, and order from multiple vetted suppliers instead of relying on a single vendor. Visibility systems that often use blockchain or cloud databases can track materials from origin to factory, supporting compliance and giving buyers greater confidence. Investors can introduce these solutions through partnerships or SaaS models, while AI-driven forecasting helps firms plan inventory and reduce last-minute dependence on any one supplier.

Joint Ventures

These partnerships combine the local market knowledge and labor base of Vietnamese companies with the technical expertise and capital of foreign firms. There are examples such as Vinatex’s joint venture with a Japanese partner, TOMS Co., Ltd., for a dyeing plant. The two sides negotiated and signed a joint-venture agreement to establish a new company developing a textile-dye-garment complex in Dien Sanh Industrial Zone, Quang Tri Province. This project is designed to increase domestic fabric and dyeing capacity, helping Vietnam meet origin requirements under FTAs and reduce reliance on imported materials. Joint ventures can also involve upstream-downstream partnerships, for instance, a hypothetical but practical model would be a major garment exporter teaming up with a cotton producer to invest in a ginning and spinning facility in Vietnam, thereby securing a stable cotton yarn supply.

Investor Implications

Vietnam’s raw material import dependency, particularly on China, poses clear supply chain risks but also opens compelling investment avenues. By aligning with Vietnam’s localization goals, foreign investors can contribute to and benefit from the country’s structural transition toward a more resilient textile supply chain.

For active manufacturers, the time is now to re-evaluate sourcing models, co-invest in upstream capacity, and lock in compliant, diversified suppliers. For new investors, opportunities abound from greenfield textile material projects to technology solutions for supply chain compliance. Government incentives, growing domestic demand, and evolving buyer expectations all point to a promising future for stakeholders who support Vietnam’s diversification journey.

Ultimately, addressing the risk of dependence on imported raw materials from China is not just a risk-management necessity; it is a growth strategy. By helping to build a stable, ethical, and self-sufficient ecosystem, investors will play a vital role in shaping the next phase of Vietnam’s textile success story.

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

[2] Vietcap Securities. (2024, October 18). Textile sector update [PDF]. https://www.vietcap.com.vn/

[3] Vietnam General Department of Customs. (2025, October 6). Preliminary assessment of Vietnam international trade: 4 biggest commodity groups in the first 8 months of 2025. https://www.customs.gov.vn/

[4] the-shiv. (2025, October 20). Textile, footwear materials imports for Vietnam, up 13.98 percent month-on-month in September, China and USA top suppliers. https://the-shiv.com/textile-footwear-materials-imports-for-vietnam-up-13-98-percent-month-on-month-in-september-china-and-usa-top-suppliers/

[5] Vietnam Briefing. (n.d.). Seizing investment opportunities in Vietnam’s textile and garment industry. https://www.vietnam-briefing.com/news/seizing-investment-opportunities-vietnams-textile-garment-industry.html/

[6] Vietcap Securities. (2024, October 18). Vietnam textile sector update. https://www.vietcap.com.vn/

[7] Nguyen, D. (2023). Vietnam’s key apparel export categories: A comprehensive overview. Medium. https://medium.com/@davenguyen95/vietnams-key-apparel-export-categories-a-comprehensive-overview-82ce935298cf

[8] Promotional Products Association International (PPAI). (n.d.). Pros and cons of sourcing from Vietnam. https://www.ppai.org/media-hub/pros-and-cons-of-sourcing-from-vietnam/

[9] Vietnam Briefing. (2020, December 22). Vietnam’s textile industry: Issues and plans for 2020 and beyond. https://www.vietnam-briefing.com/news/vietnam-textile-industry-issues-plan-2020-beyond.html/

[10] Vietnam Briefing. (n.d.). Vietnam’s textile sector amid US tariff pressures: Risks and opportunities. https://www.vietnam-briefing.com/news/vietnams-textile-sector-amid-us-tariff-pressures-risks-and-opportunities.html/

[11] B&Company Vietnam. (n.d.). Supply capacity and investment opportunities in environmentally friendly garment materials in Vietnam. https://b-company.jp/supply-capacity-and-investment-opportunities-in-environmentally-friendly-garment-materials-in-vietnam/

[12] Vy, V. (2024, July 16). Japanese-invested textile and dyeing factory opens in Nam Định. VnEconomy. https://en.vneconomy.vn/japanese-invested-textile-and-dyeing-factory-opens-in-nam-dinh.htm

[13] AINVEST Investment Report. (2025, April 10). Navigating Vietnam’s trade deals: Sector-specific opportunities & risks in a post-tariff world. https://www.ainvest.com/news/navigating-vietnam-trade-deal-sector-specific-opportunities-risks-post-tariff-world

[1] Vietnam Briefing. (n.d.). Seizing investment opportunities in Vietnam’s textile and garment industry. https://www.vietnam-briefing.com/news/seizing-investment-opportunities-vietnams-textile-garment-industry.html/

[2] Vietcap Securities. (2024, October 18). Textile sector update [PDF]. https://www.vietcap.com.vn/

[3] Vietnam General Department of Customs. (2025, October 6). Preliminary assessment of Vietnam international trade: 4 biggest commodity groups in the first 8 months of 2025. https://www.customs.gov.vn/

[4] the-shiv. (2025, October 20). Textile, footwear materials imports for Vietnam, up 13.98 percent month-on-month in September, China and USA top suppliers. https://the-shiv.com/textile-footwear-materials-imports-for-vietnam-up-13-98-percent-month-on-month-in-september-china-and-usa-top-suppliers/

[5] Vietnam Briefing. (n.d.). Seizing investment opportunities in Vietnam’s textile and garment industry. https://www.vietnam-briefing.com/news/seizing-investment-opportunities-vietnams-textile-garment-industry.html/

[6] Vietcap Securities. (2024, October 18). Textile sector update [PDF]. https://www.vietcap.com.vn/

[7] Nguyen, D. (2023). Vietnam’s key apparel export categories: A comprehensive overview. Medium. https://medium.com/@davenguyen95/vietnams-key-apparel-export-categories-a-comprehensive-overview-82ce935298cf

[8] Promotional Products Association International (PPAI). (n.d.). Pros and cons of sourcing from Vietnam. https://www.ppai.org/media-hub/pros-and-cons-of-sourcing-from-vietnam/

[9] Vietnam Briefing. (2020, December 22). Vietnam’s textile industry: Issues and plans for 2020 and beyond. https://www.vietnam-briefing.com/news/vietnam-textile-industry-issues-plan-2020-beyond.html/

[10] Vietnam Briefing. (n.d.). Vietnam’s textile sector amid US tariff pressures: Risks and opportunities. https://www.vietnam-briefing.com/news/vietnams-textile-sector-amid-us-tariff-pressures-risks-and-opportunities.html/

[11] B&Company Vietnam. (n.d.). Supply capacity and investment opportunities in environmentally friendly garment materials in Vietnam. https://b-company.jp/supply-capacity-and-investment-opportunities-in-environmentally-friendly-garment-materials-in-vietnam/

[12] Vy, V. (2024, July 16). Japanese-invested textile and dyeing factory opens in Nam Định. VnEconomy. https://en.vneconomy.vn/japanese-invested-textile-and-dyeing-factory-opens-in-nam-dinh.htm

[13] AINVEST Investment Report. (2025, April 10). Navigating Vietnam’s trade deals: Sector-specific opportunities & risks in a post-tariff world. https://www.ainvest.com/news/navigating-vietnam-trade-deal-sector-specific-opportunities-risks-post-tariff-world

[14] B&Company Vietnam. (2025). Supply capacity and investment opportunities in environmentally friendly garment materials in Vietnam. https://b-company.jp/supply-capacity-and-investment-opportunities-in-environmentally-friendly-garment-materials-in-vietnam/