22Jan2025

Latest News & Report / Vietnam Briefing

Comments: No Comments.

Vietnam’s retail real estate market continues to evolve rapidly, fueled by economic growth and shifting consumer behavior. In 2024, the sector faced both opportunities and challenges, shaped by post-pandemic recovery, e-commerce expansion, and increased urbanization. As of 2025, demand for experiential retail spaces and sustainable development is expected to drive growth, presenting a mix of challenges and opportunities for stakeholders.

The Situation of Vietnam’s Retail Real Estate in 2024

Retail real estate is primarily concentrated in large cities like Hanoi and Ho Chi Minh City, where substantial investments from major corporations align with high economic activity and consumer spending.

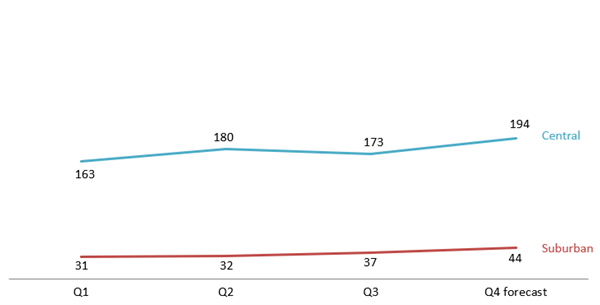

In 2024, rental prices in central locations in Hanoi averaged 178 USD/m²/month, reflecting a 13% increase compared to 2023. Suburban areas experienced a similar trend, with rental prices averaging around 36 USD/m²/month, also up 13% year-on-year. This surge is attributed to the decreasing availability of land in these regions, with vacancy rates dropping to just 2% in central areas and 12% in suburban locations[1].

2024 rental prices in Suburban and Central Areas of Hanoi

Unit: USD/m2/month

Source: CBRE Vietnam

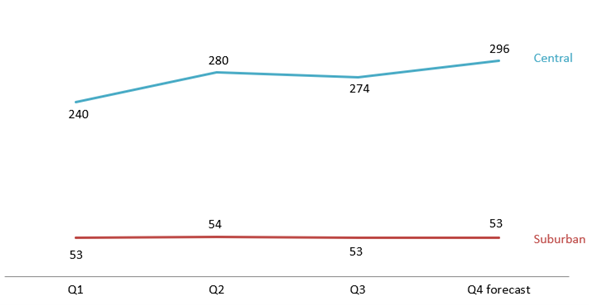

Additionally, average rental prices in central areas of Ho Chi Minh City ranged around 273 USD/m²/month, with significant fluctuations during the year, showing a difference of up to 23%. In contrast, suburban rental prices increased by 10% compared to 2023, reaching 53 USD/m²/month, and remained relatively stable throughout the year[2].

2024 rental prices in Suburban and Central areas of Ho Chi Minh City

Unit: USD/m2/month

Source: CBRE Vietnam

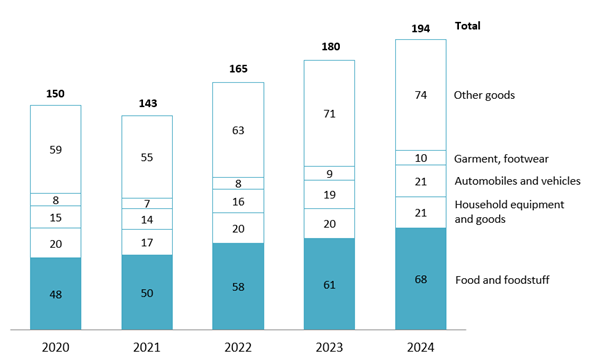

Moreover, the surge of retail real estate in 2024 is supported by the growth in retail market, with retail sales reaching nearly 194 million USD in 2024, reflecting an 8% year-on-year increase[3]. Meanwhile, e-commerce is rapidly transforming the retail sector, achieving a remarkable 20% annual growth rate. Platforms like Tiki, Shopee, TikTok Shop, and Lazada are leading the market, capturing a significant share of consumer spending[4].

Total retail sales in Vietnam by commodity group from 2020 – 2024

Unit: Billion USD

Source: General Statistics Office of Vietnam

The year 2024 also marks the opening of several large-scale shopping centers, with most investors coming from Vietnam. These new shopping malls further drive the growth of the retail real estate sector, providing opportunities for new brands to enter the market and expand their operations as the surplus availability of rental spaces.

Some newly launched shopping malls in Hanoi and Ho Chi Minh City in 2024

| Region | Shopping mall | Main Investor | Country | Rental area

(thousand m2) |

Launched date |

| Hanoi | The Linc Park City | Perdana ParkCity Group | Malaysia | 11 | January |

| The Diamond Plaza | ORIENT Investment&

Development |

Vietnam | 14 | September | |

| Ho Chi Minh City | Parc Mall | VATHA JSC and Song Da Company | Vietnam | 35 | September |

| Central Premium Mall | Quoc Cuong Gia Lai JSC | Vietnam | 30 | December | |

| Vincom Mega Mall Grand Park | Vingroup | Vietnam | 48 | July |

Source: B&Company Compilation

Prospects for the Retail Real Estate Market in Vietnam in 2025

The commercial real estate sector, which includes retail spaces, is projected to achieve a CAGR of 2% from 2025 to 2029, reaching an estimated market volume[5] of 550 billion USD by 2029[6]. According to CBRE’s retail real estate report, rental prices in the sector are expected to continue growing in the coming years, though the rate of increase will stabilize compared to 2024. Furthermore, industries such as F&B (Food & Beverage), Fashion & Cosmetics, and Lifestyle saw remarkable expansion in 2024. This trend is predicted to sustain over the next years.

This expansion is supported by several key factors. Firstly, rapid urbanization, coupled with substantial investments in infrastructure, is enhancing connectivity and accessibility. Major cities like Hanoi and Ho Chi Minh City are experiencing significant improvements in transportation networks, facilitating consumer access to retail centers[7]. In line with Resolution 06-NQ/TW, the government has set a goal to achieve at least 45% urbanization by the end of 2025 and over 50% by 2030[8]. Secondly, there is a noticeable shift in consumer behavior toward modern retail formats that offer integrated shopping, dining, and entertainment experiences. By 2023, Vietnam had approximately 23 million middle-class households, driving strong consumer demand, particularly for premium goods and services[9]. Finally, the revisions and enactments of the Land Law, Housing Law, and Real Estate Business Law in 2024 have significantly improved transparency and professionalism in real estate transactions. These legal enhancements have made the market more stable and appealing to foreign investors, further boosting confidence in Vietnam’s retail real estate sector[10].

In addition, 2025 is expected to see a significant influx of new retail real estate supply in markets like Hanoi and Hung Yen. Most of the newly constructed shopping centers will be concentrated in suburban areas, where available land is abundant and less intense competition compared to central urban markets.

Shopping mall in planning for 2025

| Region | Shopping mall | Main Investor | Country | Rental area

(Thousand m2) |

Expected launch |

| Hai Duong | Aeon Mall | Tuan Kiet Trading & Services JSC | Vietnam | 30 | 2025 |

| Hung Yen | Vincom Megamall Ocean City | Vingroup | Vietnam | 70 | 2025 |

| Hanoi | Tien Bo Plaza | Proprint Company

And TID JSC |

Vietnam | 50 | 2025 |

| Hanoi | Vinaconex Diamond | Vinaconex Invest | Vietnam | 13 | 2025 |

Source: B&Company Compilation

Conclusion

Vietnam’s retail real estate market is well-positioned for growth in 2025, driven by increasing consumer demand for innovative and sustainable retail spaces. To fully unlock the potential of this sector and attract major global investors, strategic investments, supportive policies, and improved management quality will be essential to ensuring the sustainable development of this industry.

[1] CBRE Vietnam (2024). Hanoi Figures in Q3 2024 <Access>

[2] CBRE Vietnam (2024). Ho Chi Minh City Figures in Q3 2024 <Access>

[3] VietnamPlus (2025). Total Retail Sales of Goods and Consumer Services Revenue in 2024 <Access>

[4] Vietnam Investment Review (2025). Vietnam’s E-commerce Market in 2024 <Access>

[5] The total transaction value of commercial real estate sales or leases.

[6]Statista (2024). Vietnam’s Commercial Real Estate market in 2024 <Access>

[7] Savills Vietnam (2024). Vietnam’s Real Estate Market Report in 2024 <Access>

[8] Thu Vien Phap Luat (2024). Resolution No. 06-NQ/TW: Planning, Construction, Management, and Sustainable Development of Vietnamese Urban Areas by 2030 <Access>

[9] Business and Integration Magazine (2025). Opportunities and Prospect of Vietnam’s Retail Real Estate <Access>

[10] Thu Vien Phap Luat (2024). Land Law, Housing Law, and Real Estate Business Law <Access>

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |