15May2024

Industry Reviews / Latest News & Report

Comments: No Comments.

Declining presence of Japanese companies in Vietnam

Abstract

Japan used to rank first in terms of FDI in Vietnam, however, in recent years, Japan has been overtaken by South Korea and China is closing in behind. By using B&Company’s database, we analyzed the presence of Japanese companies in Vietnam in term of revenue and revenue performance relative to the amount invested. The results showed that Japan was lagging behind other countries such as South Korea, Singapore, and China in their presence in Vietnam

———-

Introduction

Japan used to rank first in terms of FDI (foreign direct investment) in Vietnam. In recent years, Japan has been overtaken by South Korea, and China is closing in behind. There have been whispers of a decline in Japan’s share of not only the amount of FDI and trade, but also in the number of residents in Vietnam.

In term of the presence and business results of foreign countries in Vietnam, FDI enterprises accounted for about 23% of Vietnam’s GDP (gross domestic product) in 2022. In this report, we analyzed data on sales, profits, investment, and number of employees of 17,250 FDI enterprises in 2021.

Japanese enterprises were lacking behind

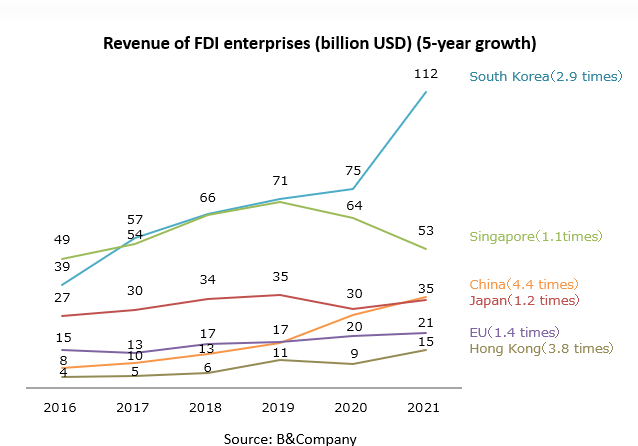

First, by revenue of FDI enterprises, South Korea accounted for the largest proportion with about 30%, and was growing rapidly. China had a similarly high growth rate like South Korea and overtaken Japan in 2021.

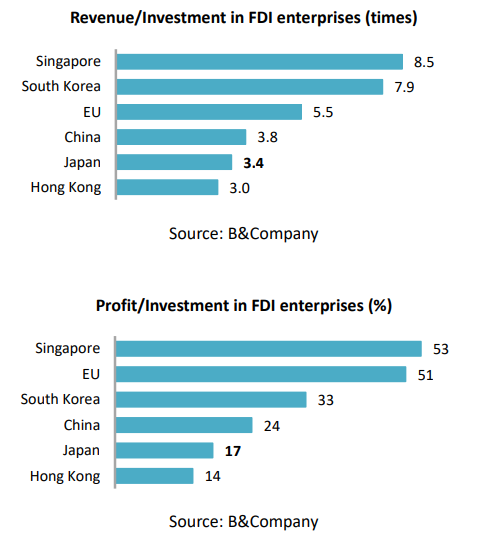

Next, when looking at revenue and profit of FDI enterprises relative to the amount invested in 2021, Singapore ranked first. South Korea was also about twice as large as Japan. On the other hand, EU ranked third in terms of sale/ investment and ranked second in terms of profit/ investment.

Some discussion about Japanese investment

Finally, when looking at the breakdown of large investments. As far as Japan have been able to ascertain since 2017, the largest Japanese investments were in power plants, energy, and real estate development. On the other hand, while South Korea and other top-ranked countries made a smattering of large factory investments of USD 1 billion or more in the manufacturing sector, Japan lags behind in large-scale investments.

What are the reasons for this? One possible factor is that South Korea is increasing its concentration in Vietnam as a trading and investment partner, while Japan is dispersing its investments among ASEAN countries. For this reason, the Vietnamese government has been calling for more active investment by Japan in areas such as semiconductors. In response to these demands, it is tempting to say that Japan has been contributing to infrastructure development, both in the form of ODA (official development assistance) and in the private sector. However, a declining presence is one reality that is casting a shadow over the partnership between Japan and Vietnam. We believe that this time, Japan has once again confirmed how far behind it is in terms of counting corporate activities.

Declining presence of Japanese companies in Vietnam – B&Company

This article has been published in the column “Read Vietnamese trends” of ASEAN Economic News. Please see below for more information

|

B&Company, Inc. The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

Read other articles

[/vc_column_text][/vc_column][/vc_row]

- All

- Agriculture

- AI

- Apparel

- Business

- Business Matching

- Equipment & Appliances

- Finance & Insurance

- Food & Beverage

- IT & Technology

- Manufacturing

- Retail & Distribution

- Seminar