1310 月2025

最新消息及报道 / 越南简报

评论: 没有评论.

越南可再生能源市场是东南亚最具活力的市场之一,这得益于快速的经济增长和政府的大力投入。可再生能源已占越南装机容量的约27%。电力发展规划VIII(PDP8)近期出台的政策旨在进一步提升这一水平,目标是到2030年可再生能源发电量达到28-36%。这凸显了外国投资者进军越南可再生能源市场的巨大机遇。

越南可再生能源市场概况

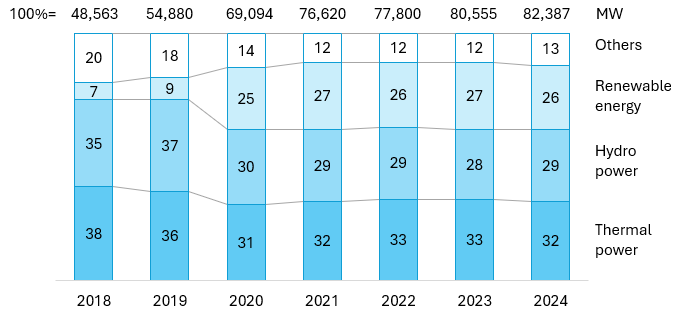

过去十年,越南经历了可再生能源的蓬勃发展,从小角色一跃成为地区领导者。截至2023年底,越南的太阳能装机容量已达18.6吉瓦,位居东南亚第一。[1]可再生能源(主要是太阳能和风能)目前约占该国装机容量的 27%[2]这一显著增长得益于支持性政策和越南有利的地理位置(充足的阳光和 3,000 公里长的海岸线,风力强劲)。

越南电力装机容量

来源:B&Company编译

出于能源安全和气候承诺的考虑,越南政府坚定地支持可再生能源。根据新批准的第八版《2023年电力发展规划》,越南的目标是到2030年可再生能源发电量达到28-361亿吨,到2050年达到74-751亿吨。[3] ——这与过去对煤炭和水电的依赖截然不同。因此,越南的目标是最大限度地利用可再生能源发电,尤其是太阳能和风能。

2030年和2050年越南电源结构

| 电源 | 2030年的电力容量 | 发电容量 2050 | ||

| 兆瓦 | % | 兆瓦 | % | |

| 太阳的 | 46,459 – 73,416 | 25-31 | 293,088 – 295,646 | 35-38 |

| 水电 | 33,294 – 34,667 | 15-18 | 40,624 | 5 |

| 陆上和近岸风电 | 26,066 – 38,029 | 14-16 | 84,696 – 91,400 | 11 |

| 燃煤火电 | 31,055 | 13-17 | 0 | 0 |

| 储能电源 | 10,000 – 16,300 | 5-7 | 95,983 – 96,120 | 11-12 |

| 海上风电 | 6,000 – 17,032 | 3-7 | 113,503 – 139,097 | 15-17 |

| Nuclear power | 4,000 – 6,400 | 2-3 | 10,500 – 14,000 | 1-2 |

| 生物质 | 1,523 – 2,699 | 1 | 4,829 – 6,960 | 1 |

| 废物能源化 | 1,441 – 2,137 | 1 | 1,784 -2,137 | 0.2-0.3 |

| 其他电源 | 14,628-23,453 | 6-13 | 129,496-152,697 | 17-18 |

| 全部的 | 183,291 – 236,363 | 100 | 774,503 – 838,681 | 100 |

来源:第768/QĐ-TTg号决定

越南最初在2019年至2021年期间实施了慷慨的上网电价(FiT),以推动太阳能和风能发展。风电装机容量从2013年的53兆瓦增至2023年的约5888兆瓦。随后,电网瓶颈导致2022年太阳能弃电约13亿千瓦时。目前,政策转向可持续增长,包括电网升级、2024年向大用户销售的直接购电协议,以及推广储能、电网数字化和屋顶太阳能,目标是到2030年实现50%的建筑覆盖率。该政策正在从固定上网电价转向竞争性拍卖,同时保留免税期和进口关税豁免等激励措施,以吸引外国资本和专业知识。

越南可再生能源市场的主要参与者

历史上,外国投资者一直是越南可再生能源发展的主要推动力。来自泰国、新加坡、日本等国的公司带来了资金和技术,用于建设早期的太阳能发电场和风力发电场。然而,这也引发了人们对国内企业在大型项目中所扮演角色的质疑。如今,随着越南大型企业的崛起,这一趋势正在发生转变。一些本土企业集团(Vingroup、Trungnam、TTC、BIM等)正在积极拓展清洁能源领域。

| 不 | 公司 | 成立 | 总部 | 国家 | 轮廓 |

| 1 | 越南电力公司(EVN) | 1995 | 河内 | Vietnam | 国有公用事业垄断企业(发电、电网、零售)。控制着越南大部分电力基础设施,并且是独立发电厂(IPP)项目的唯一承购商。越南电力公司(EVN)运营着大型水电站,在整合新的可再生能源发电能力方面发挥着至关重要的作用。 |

| 2 | 越南能源集团(VinEnergo) | 1993 | 河内 | Vietnam | 越南最大的企业集团(涉足房地产、零售、汽车)通过VinEnergo(2024年成立)进军能源领域。计划大规模开发太阳能和风能项目(例如,拟建4.5吉瓦海上风电项目)。[4]这表明国内对可再生能源的投资正在不断增加。 |

| 3 | 中南集团 | 2004 | 河内 | Vietnam | 越南领先的私营能源开发商。建设了多个最大的可再生能源项目,包括一座450兆瓦的太阳能发电场和该国最大的风力发电场(位于多乐省的400兆瓦Ea Nam风力发电场)。[5]。还投资电网基础设施和电池存储。 |

| 4 | TTC集团(Thanh Thanh Cong) | 1979 | 胡志明市 | Vietnam | 多元化企业集团(糖业、房地产、能源)。TTC通过其能源部门(TTC Energy/GEC)开发了太阳能发电场和风能项目。与海湾集团(泰国)等外国投资者合作开发太阳能发电厂。[6] 并拥有风能项目(例如薄辽省 300 兆瓦)[7]. |

| 5 | 竹资本(BCG) | 2011 | 胡志明市 | Vietnam | 专注于基础设施和可再生能源(通过BCG Energy)的新兴企业集团。已投资多个太阳能发电场(例如Phù Mỹ太阳能综合体)和风能项目。BCG经常与国际合作伙伴合作;旨在将其清洁能源投资组合拓展至全国。 |

| 6 | BIM 集团 | 1994 | 河内 | Vietnam | 大型私营企业集团(房地产、农业),拥有可再生能源部门。与菲律宾ACEN合作开发了越南最大的太阳能发电场之一(位于宁顺,装机容量330兆瓦)。[8]。BIM 也正在扩展到风力发电和其他绿色项目。 |

| 7 | 海湾能源开发公司 | 2011 | 曼谷 | 泰国 | 海湾电力是泰国最大的电力公司之一,积极投资越南能源领域。该公司持有多个项目的股份,包括西宁的太阳能发电场(与TTC集团合资)[9] 陆上和海上风电场(例如,Bến Tre 的 310 MW 海上风电场)[10]. |

| 8 | B.格林·鲍尔 | 1878 | 曼谷 | 泰国 | 泰国历史最悠久的基础设施集团,运营着多家发电厂。B.Grimm 是越南太阳能行业的早期外国投资者,例如,它参与开发了 420 兆瓦的 Dau Tieng 太阳能集群(亚洲最大的太阳能集群之一),并持续在越南探索新的可再生能源项目。 |

| 9 | ACEN(阿亚拉公司) | 2011 | 马尼拉 | 菲律宾 | ACEN是阿亚拉集团旗下的能源子公司,也是东南亚领先的可再生能源投资者。ACEN拥有约7吉瓦的可再生能源装机容量,并通过共同开发太阳能和风能项目进入越南市场。该公司与BIM集团合作,在宁顺省建设了330兆瓦的太阳能发电设施。[11] 并拥有多个风电场的股份(例如 40 兆瓦的 Mũi Né 风电场)。 |

| 10 | 奥斯特德公司 | 2006 | 弗雷德里西亚 | 丹麦 | 全球最大的海上风电开发商。Orsted 正在探索越南的海上风电潜力,并已与当地合作伙伴(例如 T&T 集团)签署协议,研究在越南沿海建设大型海上风电场。尽管项目尚处于初步阶段,但 Orsted 的参与为越南新兴的海上风电领域带来了宝贵的专业知识和信心。 |

资料来源:B&Company汇编

另一个洞察是市场的广度——涵盖太阳能光伏(包括公用事业规模和屋顶)、陆上风电以及海上风电的前沿领域。不同的参与者专注于不同的细分市场。例如,一些公司(如B.Grimm或ACEN)专注于太阳能和陆上风电场,而Orsted和CIP(丹麦)则瞄准海上风电机会。主要的公用事业公司EVN支撑着整个行业,因为所有项目最终都会连接到EVN的电网,并根据长期购电协议向其出售电力。任何投资者都必须遵守EVN的单一买家模式及其不断变化的法规。

越南可再生能源市场的机遇与挑战

进入越南可再生能源市场前景广阔,但也存在诸多陷阱。外国投资者在进入该市场时,应权衡以下机遇和挑战:

关键机遇

| 能源需求旺盛 | 预计到 2030 年,越南的电力需求每年将增长约 10-12%[12]这种增长,加上政府对新建燃煤电厂的限制,为可再生能源的发展创造了巨大的空间。能够提供可靠电力的项目将拥有现成的市场和较高的利用率。 |

| 丰富的自然潜力 | 越南拥有世界一流的可再生资源。南部地区太阳辐射高,海上风电潜力估计达311吉瓦,位居全球前列。[13]。这一无与伦比的资源基础意味着越南可以拥有数吉瓦的盈利性太阳能发电场和风力发电场,包括其他东盟国家很少能够支持的大型海上风力发电场。 |

| 政府支持与净零目标 | 政府的政策环境依然非常有利。税收减免、土地租金减免以及可再生设备低进口关税等激励措施均已到位。[14]越南承诺到2050年实现净零排放(在COP26上承诺)和PDP8目标,表明其支持清洁能源项目的强烈政治意愿[15]具有长远眼光的外国投资者可以受益于总体有利、稳定的政策趋势(尽管随着上网电价演变为拍卖,政策会进行短期调整)。 |

| 尚未开发的领域 | 除了电网规模的电厂外,屋顶太阳能、电池储能和绿色氢能等领域尚处于萌芽阶段,并受到政策鼓励[16]外国投资者可以在提供先进解决方案(如存储系统、智能电网技术)方面占据一席之地,而越南正在鼓励这些解决方案提高电网弹性并整合可再生能源。 |

主要挑战

| 监管不确定性 | 虽然越南的政策方向是支持可再生能源,但政策细节可能会发生变化。从固定上网电价到拍卖模式的转变带来了项目经济的不确定性。[17]项目审批、购电协议谈判和电价制定的程序可能冗长且繁琐。由于相关法规(例如拍卖规则、电网规范)仍在不断演变,投资者必须保持敏捷和知情。监管不一致或实施延迟仍然是首要问题。[18]. |

| 电网基础设施约束 | 相对于可再生能源的快速增长,电网发展相对滞后。许多太阳能/风能项目因输电瓶颈而面临限电。[19]最薄弱的环节恰恰位于可再生资源最丰富的地区(越南中部和南部)。在电网升级(政府正在着手解决,但需要时间)之前,新项目面临产量削减或连接延迟的风险。外国投资者应考虑电网扩建时间表,并可能将投资或倡导电网改进作为项目规划的一部分。 |

| PPA和融资可行性问题 | 越南标准的可再生能源购电协议(PPA)因缺乏某些投资者保护措施而受到批评(例如,缺乏对越南电力公司(EVN)付款义务的主权担保,争议解决困难)。尽管许多项目仍能获得融资,但这些合同和货币风险可能会增加融资成本。除非这些条款得到改善或通过担保得到缓解,否则投资者在筹集无追索权项目融资方面可能会面临挑战。 |

| 土地和许可障碍 | 获得土地权利和许可证可能非常复杂。可再生能源项目必须进行环境影响评估,海上风电项目则需要进行广泛的海洋空间规划。如果不加以管理,与当地社区的重叠(例如,海上项目占用渔区,太阳能项目占用农田)可能会引发社会反对。例如,一些风电场在开工前必须进行长时间的社区协商。外国开发商必须谨慎处理当地土地征用和利益相关者参与事宜,通常依赖当地合作伙伴来处理实际问题。 |

进入越南可再生能源市场的意义

越南可再生能源市场为外国投资者提供了一个绝佳的机会,让他们参与亚洲最快的能源转型之一。成功的关键在于了解当地市场的复杂性:与政府规划保持一致,与当地利益相关者合作,并降低基础设施和监管风险。

– 重点领域:包括风电、太阳能、工商业屋顶太阳能、电池储能、电网数字化。区域内潜力巨大的机遇包括:中南部走廊地区,例如平顺省、宁顺省和巴地头顿省,适合风电和太阳能;湄公河三角洲沿岸地区,例如朔庄省、茶荣省、槟椥省、薄辽省,适合近岸和海上风电;东南太阳能带地区,例如西宁省、平福省、隆安省和安江省,适合大型太阳能与储能配套;北部工业集群地区,例如北宁省、北江省、海防市、海阳省、太原省和广宁省,适合可扩展的屋顶太阳能组合。

– 与值得信赖的本地公司合作: 与越南成熟企业建立合资企业或合作伙伴关系,有助于更好地应对监管流程、土地征用和社区关系,同时满足政府对当地参与的期望。成功的市场进入者通常会效仿这种“本地化”模式——将外国资本和技术与国内利益相关者的参与相结合。

– 专注于电网友好型解决方案: 鉴于电网限制,采用解决方案(储能、电网升级或结合太阳能、风能和储能的混合项目)的投资者将在项目审批和绩效方面占据优势。与越南电力公司和相关部门就电网整合计划进行沟通,或为项目投资专用输电线路,可以降低弃风风险。越南鼓励部署电池储能系统或靠近用电中心的项目。[7],因此相应地定制提案可以提高成功的可能性。

– 长期承诺和灵活性: 与监管机构(例如工业和贸易部、ERAV)建立关系并保持对政策变化的适应至关重要。在政策过渡期间(例如关税调整或冗长的审批流程),可能需要保持耐心。

B&Company 是一家总部位于越南的日资市场研究和投资咨询公司,致力于帮助外国投资者自信地进入越南市场并扩大规模。凭借对越南可再生能源市场的深入了解以及值得信赖的合作伙伴网络,我们通过以下方式为投资者提供支持:

– 市场研究报告: 最新的市场观点(规模、政策、电网、竞争),包括明确的可行/不可行建议以及优先考虑的省份和行业。

– 在越南寻找合作伙伴: 从长到短列出合作伙伴名单、进行声誉检查并策划会议以确保找到合资伙伴。

– 并购咨询: 交易采购和尽职调查支持(技术、商业、法律和 ESG)

*如果您想引用本文中的任何信息,请注明来源以及原始文章的链接,以尊重版权。

| B&Company

自 2008 年以来,日本第一家专门从事越南市场研究的公司。我们提供广泛的服务,包括行业报告、行业访谈、消费者调查、商业配对。此外,我们最近还开发了一个包含越南 900,000 多家公司的数据库,可用于搜索合作伙伴和分析市场。 如果您有任何疑问,请随时与我们联系。 信息@b-company.jp + (84) 28 3910 3913 |