08Apr2025

Latest News & Report / Vietnam Briefing

Comments: No Comments.

Abstract

The seaport system plays a key role in promoting Vietnam’s economic development and international integration. In the context of globalization and the trend of deep integration, upgrading the seaport system and attracting foreign investment has become an urgent task. This article will analyze in detail the current status of Vietnam’s seaport system, the Government’s upgrading orientation, foreign investment movements, and the opportunities and challenges in this process.

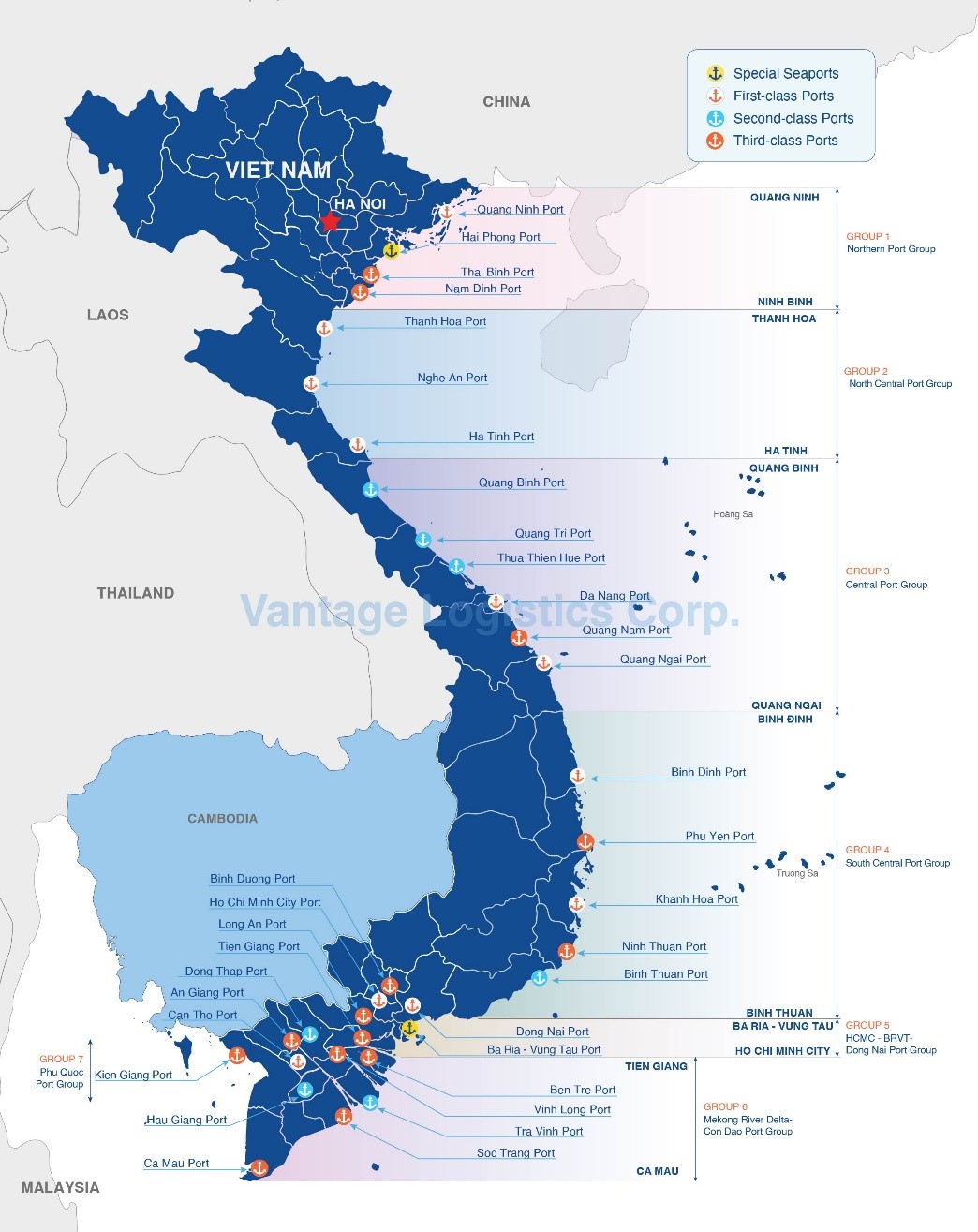

Introduction to the seaport system in Vietnam

As of October 2023, Vietnam has 296 seaports with a total wharf length of about 107 km[1]. Currently, Vietnam has three ports (Ho Chi Minh City, Hai Phong and Cai Mep – Thi Vai) in the list of 50 container ports with the largest throughput in the world. The seaport system has also been planned synchronously, closely connected with the country’s key economic centers and regions[2]. International gateway ports have been established in the Northern and Southern regions; of which, Cai Mep port (Ba Ria – Vung Tau) can receive ships up to 214,000 DWT; and Lach Huyen port (Hai Phong) can receive container ships up to 145,000 DWT. In addition, large-scale specialized ports associated with industrial zones such as crude oil tankers up to 320,000 DWT, steel mills, petrochemical refineries and coal-fired thermal power plants are capable of receiving cargo ships up to 200,000 DWT, liquid cargo ships up to 150,000 DWT (product carriers).

List of seaports in Vietnam

Source: Vantage-logistics.com.vn

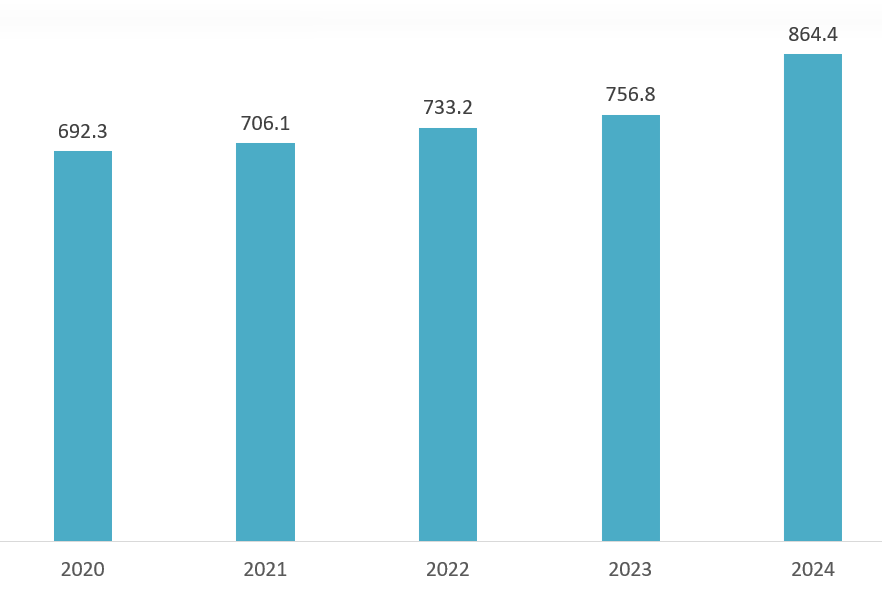

Vietnam’s seaport system has not only grown strongly in quantity but also significantly improved in capacity and service quality, thereby promoting an increase in cargo throughput through ports. It is expected that in 2024, the total volume of cargo through seaports will reach about 864.4 million tons, an increase of 14% compared to 2023.

Volume of goods passing through seaports in the period 2020-2024 in Vietnam

Unit: Million tons

Source: dnse.com.vn

Despite significant development, Vietnam’s seaport system still faces some limitations in infrastructure and information technology (IT) application. According to statistics, only about 25% of warehouse/yard/port enterprises invest in IT applications, leading to low operational efficiency[3]. Vietnam has many dry ports (IDC ports, depots) that need to apply technology.

Although “Make in Vietnam” enterprises currently have many opportunities in providing technology solutions for the port, warehouse and logistics sectors, this market is also full of potential for foreign enterprises. This reality opens up a huge space for international technology solutions such as port management system (PMS), container monitoring using IoT, transport coordination platform, supply chain data analysis using AI… In particular, Vietnam has signed many free trade agreements (FTAs) such as EVFTA, CPTPP, RCEP, contributing to improving the investment environment, reducing tariff barriers and creating conditions for foreign enterprises to expand their operations[4]. In addition, the government is strongly promoting digital transformation in the logistics industry, especially through the public-private partnership (PPP) model, helping international enterprises have more opportunities to participate in key projects[5]. In the context that many domestic enterprises still lack specialized technology solutions, the participation of foreign enterprises will not only supplement capacity but also promote the modernization process of the entire logistics and seaport industry in Vietnam.

The current container handling market is mainly dominated by four large enterprises, including: Tan Cang – Saigon with 47% market share, VIMC with 20%, Gemadept with 15% and Viconship with 7%[6]. Among these, there are two state-owned enterprises: Tan Cang – Saigon (under the Navy – Ministry of National Defense) and VIMC (under the management of the Ministry of Transport).

Government orientation in upgrading seaports

Recognizing the important role of seaports, the Government has issued many decisions to orient and develop the national seaport system. On September 22, 2021, the Prime Minister issued Decision No. 1579/QD-TTg approving the Master Plan for the development of Vietnam’s seaport system for the period 2021 – 2030, with a vision to 2050[7]. The goal of the planning is to develop a synchronous and modern seaport system to meet the needs of socio-economic development and international integration.

To implement this plan, on July 24, 2023, the Prime Minister approved the Plan, policies, solutions and resources to implement the Master Plan for the development of Vietnam’s seaport system for the period 2021 – 2030, with a vision to 2050 according to Decision No. 886/QD-TTg. This plan aims to raise awareness and action in implementing the Plan, identifying tasks, solutions, and a list of specific projects to be implemented in each phase from now until 2030 in accordance with the conditions of ministries, branches and localities[8].

In addition, the master plan for the development of Vietnam’s seaport system in the 2021-2030 period proposes 18 projects with priority for development capital in the next 5 years, including some projects such as:

|

Investment capital |

Project name |

Budget (trillion VND) |

| Public investment | Construction of a channel for large tonnage ships to enter Hau River, phase 2 | 2.2 |

| Upgrading Cai Mep-Thi Vai waterway | 1.4 | |

| Lien Chieu Port Area – shared infrastructure | >3.4 | |

| Private Investment | Construction of berths 3, 4, 5, 6 of Lach Huyen port | 13 |

| Tran De Port Area – Soc Trang | 32 |

Foreign investment moves in seaports

In recent years, Vietnam has attracted the attention of many foreign investors in the seaport sector. In particular, in December 2024, the Can Gio International Transit Port project, proposed by a consortium of Saigon Port Joint Stock Company and Terminal Investment Limited Holding S.A, is progressing positively. This project is expected to enhance Vietnam’s international cargo transit capacity, reducing dependence on transit ports in the region[9].

In addition, investors from Singapore are also looking for investment opportunities in Lien Chieu Port (Da Nang), as shown by the YCH Group expressing interest in this project in March 2025[10]. The participation of foreign investors not only brings capital but also management experience and advanced technology, contributing to improving the operational efficiency of Vietnamese seaports[11].

Assessment of opportunities and challenges in upgrading seaport systems

Upgrading Vietnam’s current seaport system brings many great opportunities, but also comes with many challenges.

First of all, Vietnam has a coastline of more than 3,260 km, located on a very convenient international maritime trade axis. This is a strategic factor that helps our country’s seaports easily become regional and global cargo transit points, especially when the global supply chain is tending to shift to Southeast Asia.

In addition, Vietnam is deeply integrating with the world through free trade agreements such as CPTPP, EVFTA, RCEP… creating conditions for import and export activities to grow strongly, leading to an increase in demand for logistics and maritime transport[12]. Upgrading seaports will help solve the overload situation at some key ports such as Cat Lai, Tan Cang – Cai Mep and improve national competitiveness.

In addition, the digital transformation trend in the logistics industry is also an opportunity for the Vietnamese seaport system to apply information technology and automation to port management and operations. Initiatives such as smart ports and the Port Community System (PCS) will help optimize time, costs and cargo handling efficiency.

Notably, the Government’s determination to invest in and improve logistics infrastructure through major projects has also attracted more attention from foreign investors. The fact that large corporations such as YCH (Singapore), DP World (UAE), Hutchison Ports (Hong Kong), PSA (Singapore) have shown their interest in investing in Vietnam has partly demonstrated the strong development potential of the seaport industry.

However, Vietnam’s current seaport system also faces many challenges.

One of the biggest challenges is the imbalance between seaport regions. While southern seaports such as Cai Mep – Thi Vai are capable of receiving large ships and operate efficiently, many ports in the Central and Northern regions are small in scale, have limited infrastructure, and shallow channels, leading to high transportation costs and low competitiveness[13].

Next is the lack of synchronous connection between seaports and other logistics infrastructure systems such as roads, railways, and inland container depots (ICDs). This reduces the efficiency of transporting goods from ports to industrial zones and distribution centers. For example, Cai Mep port, despite its great potential, is still in the process of completion, causing congestion and prolonging transportation time[14].

In addition, the application of information technology and automation in port management is still limited. Most seaports are still operated manually, heavily dependent on labor, resulting in low operational efficiency. The level of readiness for digital transformation among ports is uneven, leading to difficulties in system integration and data sharing among stakeholders[15].

Finally, regional competition is also a factor worth considering. Countries in the region such as Singapore, Malaysia and Thailand have been investing heavily in port infrastructure and logistics, with the goal of becoming a regional freight hub. If Vietnam does not promptly upgrade and improve its capacity, the risk of losing its position in the global supply chain is entirely possible.

Conclusion

With its favorable geographical location, increasing market demand and interest from international investors, Vietnam has great potential to become a logistics and seaport hub of Southeast Asia.

However, to realize that, it requires the synchronous participation of the Government, businesses and relevant parties. Proper investment in infrastructure, improving port management capacity, promoting digital transformation, along with perfecting institutions and investment attraction policies – all will be key factors to upgrade Vietnam’s seaport system to a new level.

[1] https://vantage-logistics.com.vn/goods-throughput-at-vietnam-seaports-by-2023-and-forecast-to-2030-bv247.htm

[2] https://www.dnse.com.vn/senses/tin-tuc/nganh-cang-bien-viet-nam-nhung-sieu-cang-ket-noi-chuoi-cung-ung-toan-cau-va-tam-nhin-vuon-xa-34094273

[3] https://ictvietnam.vn/nen-tang-cang-bien-viet-nam-canh-tranh-voi-cac-san-pham-tuong-duong-cua-nuoc-ngoai-67123.html

[4] https://tcnn.vn/news/detail/66209/Viet-Nam-tich-cuc-tham-gia-vao-cac-Hiep-dinh-thuong-mai-tu-do-va-cac-Hiep-dinh-thuong-mai-tu-do-the-he-moi.html

[5] https://valoma.vn/wp-content/uploads/2023/12/Bao-cao-Logistics-Viet-Nam-2023.pdf

[6] https://thitruongtaichinh.kinhtedothi.vn/chung-khoan/he-lo-doanh-nghiep-cang-bien-co-muc-xep-hang-tin-nhiem-cao-nhat-128833.html

[7] https://consosukien.vn/quy-hoa-ch-pha-t-trie-n-he-tho-ng-ca-ng-bie-n-vie-t-nam.htm

[8] https://xaydungchinhsach.chinhphu.vn/thu-tuong-chinh-phu-phe-duyet-ke-hoach-thuc-hien-quy-hoach-phat-trien-cang-bien-viet-nam-119230726141229576.htm

[9] https://vimc.co/en/buoc-tien-moi-tai-sieu-du-an-cang-trung-chuyen-quoc-te-can-gio/

[10] https://baodautu.vn/tap-doan-ych-singapore-tim-kiem-co-hoi-dau-tu-vao-cang-lien-chieu-d252023.html

[11] https://vimc.co/en/dinh-huong-chien-luoc-phat-trien-dung-dan/

[12] https://trungtamwto.vn/hiep-dinh-khac/16611-cac-fta-moi-cua-viet-nam-se-bo-tro-cho-nhau-nhu-the-nao

[13] https://vlr.vn/quy-hoach-cang-bien-van-chuyen-manh-mun-thieu-dong-bo-1628.html

[14] https://vlr.vn/phat-trien-ket-cau-ha-tang-cang-bien-phai-phuc-vu-logistics-2604.html

[15] https://www.vcci.com.vn/news/phu-xanh-ha-tang-cang-bien-dang-dat-ra-nhieu-thach-thuc

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |