28Mar2025

Latest News & Report / Vietnam Briefing

Comments: No Comments.

With a rich history of tea cultivation, Vietnam benefits from a diverse climate and fertile soil, allowing for the production of various tea types, including green, black, oolong, and specialty teas. As one of the world’s leading tea producers, the country has established a strong presence in the global market despite competition from major exporters like China, India, and Sri Lanka. Increasing domestic consumption and export potential indicate promising growth opportunities, though challenges related to quality control and branding remain.

Production Situation of the Vietnam Tea Industry

The tea industry comprises both small-scale farmers and large corporations, each playing a role in tea production, processing, and distribution. According to the Vietnam Tea Association, in 2024, the country’s total tea cultivation area reached 128,000 hectares, with 230,000 tons of dried tea and 185,000 tons of finished tea produced ([1]). Thai Nguyen province, often dubbed the “tea capital of Vietnam,” is renowned for its high-quality green tea. Other significant tea-growing regions include Lam Dong, known for oolong and specialty teas, and Phu Tho, which produces various black and green teas ([2]).

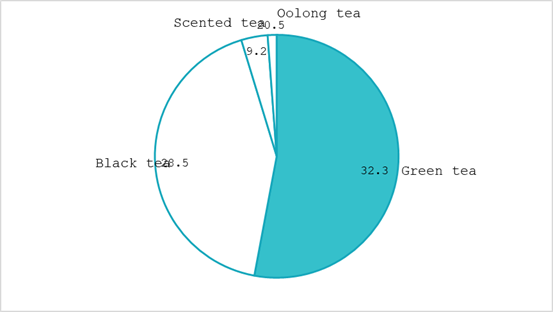

Vietnam’s tea industry offers a diverse range of products catering to various market preferences. Green tea is the most widely produced and consumed tea in Vietnam, appreciated for its fresh and slightly bitter taste. Black tea is primarily exported and is often utilized in global tea blends. Oolong tea, mainly cultivated in Lam Dong province, enjoys popularity in both domestic and international markets. Specialty teas, including scented teas and other high-value varieties, are gaining traction among consumers seeking unique flavors.

Popular Vietnamese Tea by region

Source: Vinavn

Domestic Consumption Rising Trends

Tea consumption in Vietnam is steadily increasing, reflecting the country’s deep-rooted tea culture. On average, Vietnamese consumers drink 0.47 kg of tea per year ([3])and total domestic consumption is projected to reach 139.07 thousand tons by 2029. This marks the eleventh consecutive year of growth, setting a record and highlighting a strong domestic market alongside export opportunities. ([4]).

In addition to traditional tea consumption, bubble tea has become increasingly popular, particularly among younger consumers. Beyond traditional tea consumption, bubble tea has surged in popularity, particularly among younger consumers. As of March 2023, Ho Chi Minh City alone had 192 bubble tea shops, illustrating the rising demand for diverse tea-based beverages. ([5]). This expanding segment has further strengthened Vietnam’s tea industry in the domestic market.

Although domestic tea consumption accounts for only one-third of the country’s total tea exports, it generates higher revenue due to the premium quality of locally sold tea. Vietnamese consumers are willing to pay more for high-quality products, boosting industry revenues compared to raw tea exports ([6]). In 2025, the retail price of black tea in Vietnam ranges from 199,339 VND to 761,200 VND per kilogram, depending on quality and type. ([7]).

Export Potential of Vietnamese Tea

Vietnam currently ranks fifth in the world for tea exports and seventh in global tea production, highlighting its importance in the international tea trade ([8]). Between 2018 and 2023, the country’s tea exports ranged from 120,000 to 140,000 tons annually, generating a turnover of US$220-240 million per year. According to the Vietnam Tea Association, this steady growth reflects the industry’s expanding global presence and rising demand for Vietnamese tea. ([9]). Vietnam’s tea products have been exported to more than 70 countries and territories. Key markets include Pakistan, Taiwan, Russia, China, the US and the EU ([10]).

Tea export from Vietnam by types in 2023

100%= 121,000 tons

Source: Statista ([11])

Vietnamese tea has several competitive advantages, including cost-effective production, which makes it an attractive option for bulk buyers. However, the export price remains significantly lower than the domestic market price, averaging around 40,000 VND/kg, compared to domestic prices ranging from 120,000 VND to millions of VND per kilogram. This disparity is primarily due to most exported tea being sold as raw, unbranded products packed in large bags, rather than as high-value, branded goods ([12]). Despite this, Vietnam’s diverse tea varieties allow it to cater to a wide range of consumer preferences, and many producers are adopting international certifications such as ISO and HACCP to improve quality and tap into premium markets.

Furthermore, Vietnamese tea lacks strong international branding compared to competitors like China and India, making it difficult to establish a premium market presence. Additionally, experts have urged Vietnamese firms to shift their focus towards high-quality tea products, as global consumers are increasingly prioritizing organic and sustainably sourced teas ([13]).

To boost tea exports, Vietnam is focusing on quality control, international certifications (ISO, HACCP), and stronger branding, following the success of its coffee industry. Shifting sustainable, organic production and investing in value-added products like ready-to-drink teas can enhance market appeal and profitability. Trade agreements and tariff reductions will further support export growth.

Main Players in the Vietnam Tea Industry

The Vietnam tea market is dominated by a few key players, including well-established domestic companies and expanding international brands. Local companies like ECO- PRODUCTS Company and Vietnam National Tea Corporation (VINATEA) have significant influence due to their longstanding presence, vast production capacities, and strong distribution networks ([14],[15]). Additionally, in the ready-to-drink (RTD) tea segment, prominent companies like Suntory PepsiCo Vietnam Beverage Co. Ltd and Tan Hiep Phat Beverage Group have made significant contributions. This blend of traditional tea producers and modern beverage companies reflects the diverse landscape of Vietnam’s tea industry ([16]).

| Company Name | Establishment Year | Location | Main Products |

| Eco Products | 2006 | Phu Tho | Ready-to-drink tea, tea bags, instant tea, and loose-leaf tea |

| Vietnam National Tea Corporation (VINATEA) | 1958 | Hanoi | Black tea, green tea, specialty teas |

| Tan Hiep Phat Beverage Group | 1994 | Binh Duong | Herbal teas, green teas, energy drinks |

| Suntory PepsiCo Vietnam Beverage Co., Ltd | 2013 | Ho Chi Minh City | Ready-to-drink teas, carbonated drinks |

Assessment of Vietnam Tea Market Potential

The tea market in Vietnam is poised for substantial growth. In 2024, its market value is forecasted to reach 11.1 trillion Vietnamese dong, with expectations to climb to 16.6 trillion dong by 2028. This projection underscores the expanding domestic market and the increasing popularity of tea consumption ([17]).

By 2030, Vietnam’s organic tea cultivation is projected to expand to roughly 11,000 hectares, with a productive area of 10,000 hectares and an estimated yield of 70,000 tons. These organic tea plantations will be concentrated in the northern provinces of Ha Giang, Lao Cai, Yen Bai, and Thai Nguyen. Additionally, the specialty tea sector is expected to grow, reaching about 34,500 hectares, with a productive area of 32,000 hectares and an output of approximately 290,000 tons ([18]).

Conclusion

Vietnam’s tea industry holds significant potential in both domestic and international markets. With its diverse tea varieties, competitive pricing, and improving quality standards, the country is well-positioned for growth. However, to fully capitalize on its export potential, the industry must address quality control challenges, invest in branding efforts, and explore value-added opportunities. By implementing these strategies, Vietnam can strengthen its position as a leading global tea exporter and enhance its reputation in the international tea trade.

[1] https://english.vov.vn/en/rising-vietnam/vietnamese-tea-and-its-aspiration-to-go-global-post1161598.vov

[2] https://www.statista.com/topics/12647/tea-market-in-vietnam/#topicOverview

[3] https://thanhnien.vn/nhan-ngay-tra-the-gioi-215-nguoi-viet-uong-tra-viet-1851069277.htm

[4] https://www.statista.com/topics/12647/tea-market-in-vietnam/#topicOverview

[5] https://www.statista.com/statistics/1234064/vietnam-number-of-milk-tea-shops-by-city/

[6] https://vietnamagriculture.nongnghiep.vn/domestic-tea-consumption-accounts-for-one-third-of-the-export-volume-but-generates-higher-value-d407783.html

[7] https://www.selinawamucii.com/insights/prices/vietnam/black-tea/?utm_source=chatgpt.com

[8] https://en.vietnamplus.vn/vietnam-ranks-fifth-in-the-world-in-tea-exports-post301531.vnp

[9] https://english.vov.vn/en/rising-vietnam/vietnamese-tea-and-its-aspiration-to-go-global-post1161598.vov

[10] https://vneconomy.vn/vietnam-becomes-fifth-largest-tea-exporter-worldwide.htm#:~:text=Vietnam’s%20tea%20products%20have%20been,the%20US%20and%20the%20EU.

[11] https://www.statista.com/statistics/1483946/vietnam-tea-export-volume-by-type/

[12] https://vneconomy.vn/gia-che-xuat-khau-thap-do-chua-xay-dung-duoc-thuong-hieu.htm

[13] https://vietnamnews.vn/economy/1663919/vietnamese-firms-urged-to-focus-on-high-quality-tea-products.html

[14] https://www.kenresearch.com/industry-reports/vietnam-tea-market

[16] https://www.kenresearch.com/industry-reports/vietnam-ready-to-drink-tea-market?utm_source=chatgpt.com

[17] https://www.statista.com/topics/12647/tea-market-in-vietnam/#topicOverview

[18] https://wtocenter.vn/chuyen-de/26677-creating-an-export-identity-for-vietnamese-tea

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |