07Nov2025

Latest News & Report / Vietnam Briefing

Comments: No Comments.

Market Overview

Vietnam’s semiconductor industry is experiencing accelerated growth, underpinned by government policy, rising global demand, and foreign direct investment. According to Mordor Intelligence[1], the market is projected to reach USD 10.16 billion in 2025 and grow to USD 16.51 billion by 2030, representing a 10.23% CAGR over the period.

Vietnam Semiconductor Market Size Projection

Unit: Billion USD

Source: Mordor Intelligence

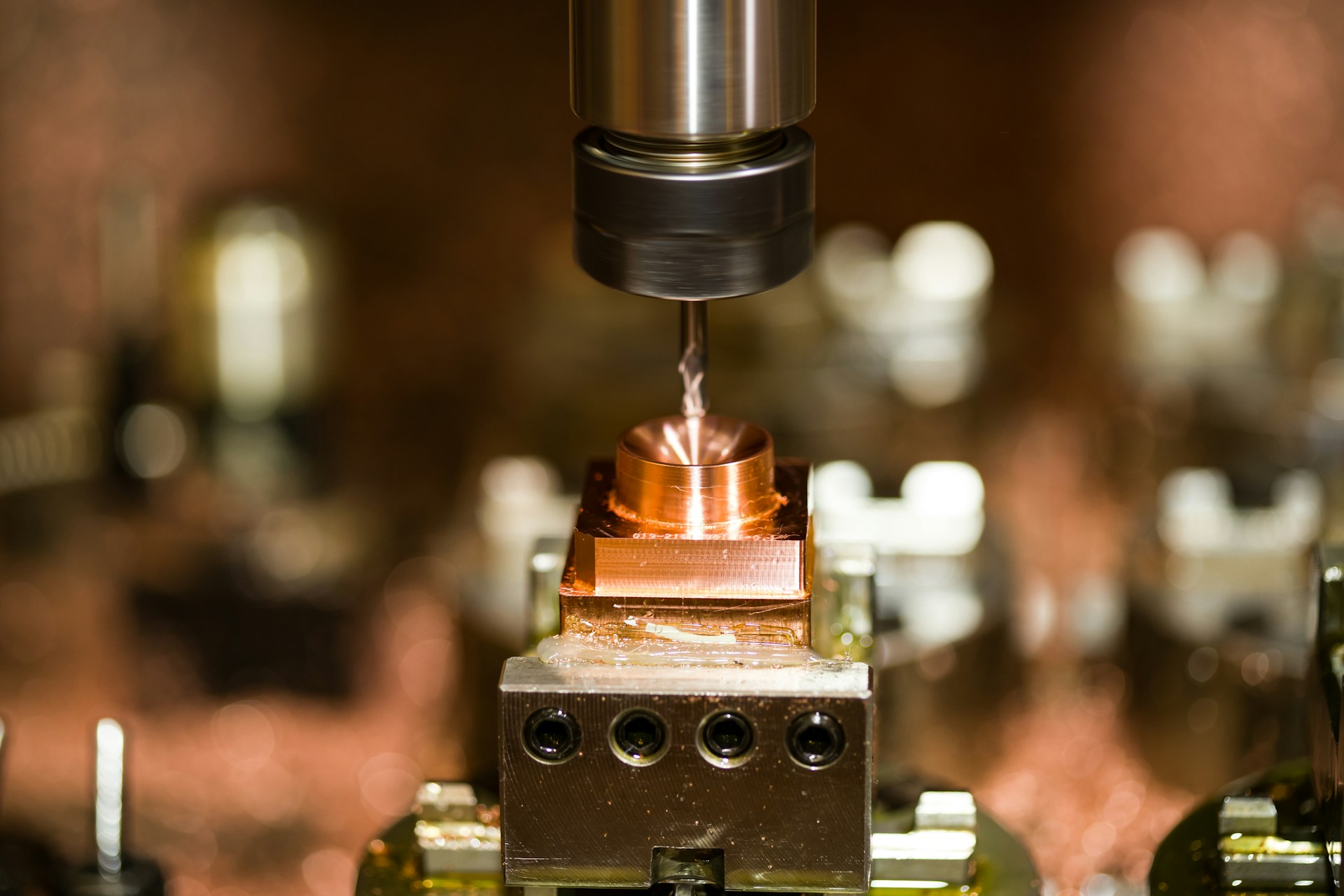

The country’s strength currently lies in outsourced semiconductor assembly and test (OSAT) operations. Multinational corporations such as Intel, Amkor, Samsung, and Hana Micron have established large-scale facilities, especially in northern provinces like Bac Ninh and Thai Nguyen, contributing to Vietnam’s role as a regional manufacturing hub.

While upstream capabilities such as wafer fabrication remain absent, Vietnam is gradually building out its broader semiconductor ecosystem. According to the National Strategy (Decision No. 1018/QD-TTg), the government aims to form at least 100 design companies and one small-scale chip manufacturing facility by 2030. The industry’s growth is also supported by Vietnam’s established electronics manufacturing base and rising semiconductor demand in downstream sectors including smartphones, electric vehicles (EVs), artificial intelligence (AI), and industrial automation.

H1 2025 Highlights: Investment and Expansion

The first half of 2025 reaffirmed Vietnam’s rising profile in the global semiconductor industry, though most major project milestones during this period were tied to earlier-announced investments continuing through development and preparation stages.

One of the most active domestic players was FPT Semiconductor, which made visible progress in promoting Vietnam’s chip design and packaging capabilities. In January 2025, FPT signed a strategic cooperation agreement with Đà Nẵng city to expand semiconductor research, development, and workforce training[2]. As part of this initiative, FPT announced plans to invest in advanced packaging and automated test equipment (ATE) facilities within the Đà Nẵng high-tech zone. The firm also participated in SEMICON Southeast Asia 2025 in May[3], showcasing its “FPT Chip Inside” ecosystem, which includes Vietnamese-designed power management ICs and ambitions to scale local IC packaging and testing.

FPT Corporation has officially become Da Nang City’s strategic partner in semiconductors and AI

Source: FPT News

Several large foreign-invested projects were also in ongoing development during H1 2025, but did not mark new construction or licensing milestones during this period:

– Amkor Technology continued executing its planned USD 1.6 billion expansion in Bắc Ninh, but no new permits or openings occurred in H1 2025[4]. The company reaffirmed its schedule for trial production to begin in Q3 and stable

– NVIDIA’s cooperation agreement with the Vietnamese government to establish an AI R&D and data center was signed in December 2024[5]. However, by June 2025, no public updates or construction activity had been reported; the project remains in early planning.

– BE Semiconductor Industries (BESI) did not begin any new factory work in the first half of 2025. Phase 1 of its Saigon Hi-Tech Park facility has been operating since early 2024, while Phase 2 was planned to start in June 2025 — meaning most of the construction will likely happen in the second half of the year or the near future[6].

– Foxconn’s planned chip-related factory in Bắc Giang, approved in mid-2024, remained in the construction and permitting phase. No new groundbreakings or public announcements were made in H1 2025, with production still projected to begin in mid-2026[7].

In general, H1 2025 was a period of continued momentum and foundational preparation, particularly for large-scale OSAT facilities and AI-focused initiatives announced in 2024. While few new investment announcements were made in this window, domestic actors like FPT advanced local semiconductor initiatives, signaling incremental progress toward Vietnam’s long-term ecosystem goals.

Government Strategy and Policy Support

Vietnam’s government has made semiconductor development a national priority, reflected in a series of policies aimed at attracting foreign investment, building a local capabilities, and moving up the value chain. The cornerstone of this approach is Decision No.1018/QĐ-TTg, issued in September 2024[8], which outlines a phased semiconductor strategy through 2050

Under this roadmap, Vietnam adopts the “C = SET + 1” formula—where C represents chips, and SET stands for Specialization, Electronics, and Talent, with the “+1” signifying Vietnam as a safe and strategic location for global semiconductor operations.

The plan is structured into three phases:

– Phase 1 (2024–2030): Establish at least 100 chip design companies, 1 small-scale fabrication plant, and 10 OSAT (packaging and testing) facilities.

– Phase 2 (2030–2040): Scale up to 200 design firms, 2 fabrication plants, and 15 OSAT centers.

– Phase 3 (2040–2050): Target 300 design companies, 3 fabs, and 20 OSAT plants, aiming for global leadership in both production and R&D.

To support these goals, the government has laid out plans to invest in human capital development. It aims to train 50,000 semiconductor engineers by 2030 through expanded STEM programs, upgraded university curricula, and future partnerships with domestic firms like FPT and Viettel[9]. The strategy also includes plans to modernize four national shared semiconductor laboratories across 20 higher education institutions and to train 1,300 specialized lecturers to enhance technical readiness[10].

Vietnam also offers a competitive incentive framework for high-tech projects. Qualified semiconductor investments can access:

– Corporate income tax rates as low as 10% for up to 15 years

– Four years of full CIT exemption, followed by 50% reduction for nine years

– Land lease exemptions for manufacturing equipment

Additionally, the government established a National Steering Committee on Semiconductor Development[11], chaired by the Prime Minister, to coordinate cross-ministerial efforts and streamline regulatory processes. The passage of the Digital Technology Industry Law and the launch of the Vietnam Semiconductor Innovation Network further demonstrate institutional support for deepening international partnerships and fast-tracking project approvals.

Key Industries Benefiting from Vietnam’s Semiconductor Growth

Vietnam’s growing semiconductor industry is not only attracting foreign investment — it’s also supporting the growth of several other important sectors. As more chips are designed and packaged in Vietnam, many industries are seeing benefits in cost, efficiency, and innovation

Electronics and Telecommunications

Vietnam is a major electronics exporter, with US$126.5 billion in export value in 2024[12]. Companies like Samsung and MediaTek make smartphones and communication devices here, which require many types of chips – such as those used for power control, signals, and memory.

Electric Vehicles (EVs) and Automobiles

Vietnam’s EV market is growing quickly, led by companies like VinFast. Electric vehicles require many semiconductor components for battery systems, sensors, control units, and driving assistance features.

In major cities like Hanoi and Ho Chi Minh City, local governments have announced plans to restrict gasoline-powered motorbikes in central districts starting from 2025–2026, with the goal of reducing air pollution[13]. These policies are expected to increase demand for electric two-wheelers and passenger EVs, which rely heavily on semiconductors. As EV adoption rises, the need for local chip design, packaging, and testing capabilities will grow accordingly.

Artificial Intelligence and Data Centers

Vietnam is working with NVIDIA to develop AI research and data centers, which will increase demand for high-performance chips used in AI and machine learning. In support of this trend, FPT is partnering with NVIDIA to build a USD 200 million ‘AI Factory’[14] — a high-performance computing infrastructure designed to accelerate AI development and smart applications in Vietnam.

Healthcare Technology

Vietnam is also seeing more use of digital health tools and smart medical devices. Chips are used in machines for scanning, monitoring, and diagnostics. The partnership between NVIDIA and VinBrain[15] shows that this area is becoming more important and connected to AI as well.

Outlook and Takeaways

Vietnam’s semiconductor sector continued to build momentum in H1 2025, marked by policy consistency, sustained investment execution, and growing engagement from both global and domestic players. While most headline projects remained in development stages, steady progress — particularly from local firms like FPT — signals a maturing ecosystem beyond just foreign-led manufacturing.

Looking forward, Vietnam’s strengths in OSAT operations, AI collaboration, and supportive government policy provide a solid foundation. However, challenges in workforce scale-up, infrastructure readiness, and upstream capabilities must be addressed to capture more value across the supply chain. As chip demand rises in EVs, AI, healthcare, and electronics, Vietnam is well positioned to become a strategic node in Asia’s semiconductor landscape — provided long-term capability building remains a policy and industry priority.

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

[1] https://www.mordorintelligence.com/industry-reports/vietnam-semiconductor-market

[2] https://fpt.com/en/news/fpt-news/fpt-hop-tac-cung-da-nang-phat-trien-linh-vuc-ban-dan-va-tri-tue-nhan-tao

[3] https://fpt.com/en/news/fpt-news/fpt-gioi-thieu-he-sinh-thai-fpt-chip-inside-tai-semicon-sea-2025

[4] https://theinvestor.vn/amkor-increases-vietnam-investment-to-16-bln-production-to-start-next-year-2025-d10997.html

[5] https://www.mpi.gov.vn/en/Pages/2024-12-9/Vietnam-partner-with-NVIDIA-to-establish-an-AI-Resv6lq3b.aspx

[6] https://english.thesaigontimes.vn/dutch-semiconductor-firm-to-spend-us42-million-expanding-business-in-hcmc

[7] https://vietnamnet.vn/en/foxconn-to-invest-80-million-usd-in-chip-manufacturing-expansion-in-vietnam-2338799.html

[8] https://datafiles.chinhphu.vn/ (Decision 1018/QD-TTg 2024)

[9] https://www.mpi.gov.vn/en/Pages/2024-5-3/Vietnam-to-soon-implement-project-on-human-resourc3s3j0h.aspx

[10] https://vietnamnews.vn/economy/1722855/viet-nam-charts-path-to-deeper-integration-in-global-semiconductor-supply-chain.html

[11] https://en.vneconomy.vn/national-steering-committee-on-semiconductor-industry-set-up.htm

[12] https://vietnamnews.vn/economy/1691325/electronics-industry-booms-in-2024-with-record-export-turnover.html

[13] https://vietnamnews.vn/society/1721291/ha-noi-to-ban-fossil-fuel-motorbikes-from-inner-city-by-july-2026.html

[14] https://vietnamnews.vn/economy/1654395/fpt-and-nvidia-ink-mou-to-build-200m-ai-factory.html

[15] https://vietnamnews.vn/economy/1688629/nvidia-acquires-vingroup-s-ai-healthcare-solution-company.html