Vietnam and Japan officially established diplomatic relations on September 21, 1973. After more than 50 years of nurturing and tightening, the relationship has become increasingly closer and stronger, reflected in many fields: economy, culture, education, health… Currently, there are more than 2000 Japanese enterprises investing and doing business in Vietnam[1]. With the presence of many Japanese enterprises in Vietnam as well as its favorable business environment, Vietnam has emerged as a prominent destination for Japanese expatriates.

Vietnam – one of the top destinations for Japanese expatriates

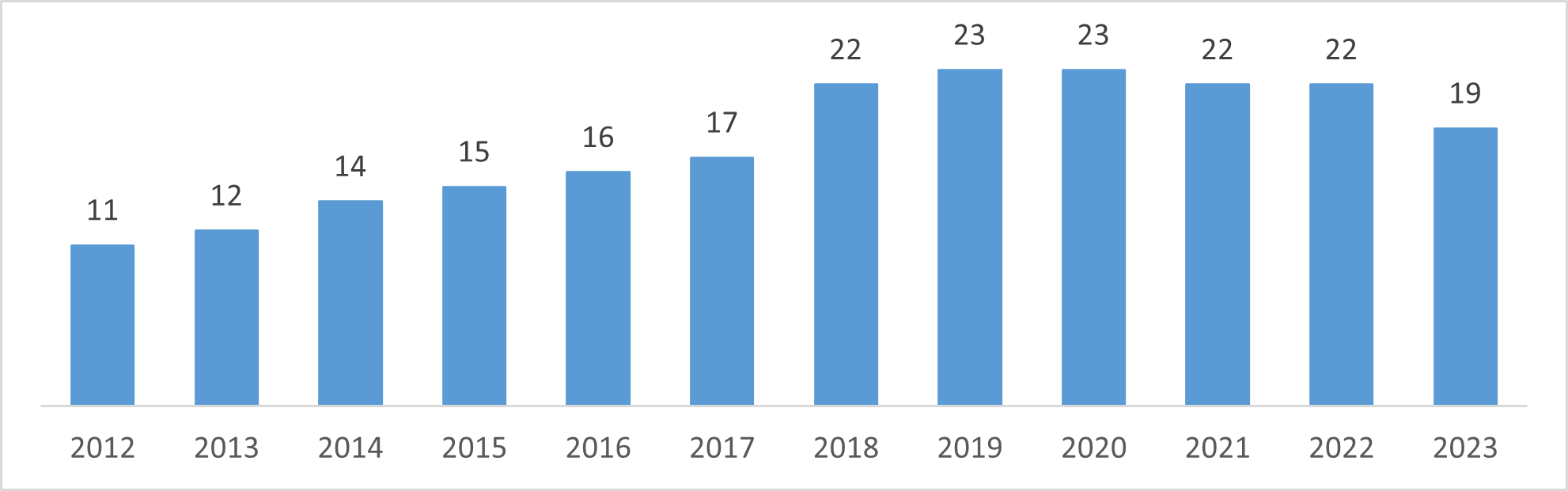

According to data from the Japanese Ministry of Foreign Affairs, the number of Japanese residents in Vietnam has shown significant growth over the years. In 2013, there were approximately 11,200 Japanese people living and working in Vietnam. This number doubled over the next seven years, reaching nearly 23,400 by 2020. Although, after 2020, the number of Japanese residents in Vietnam has decreased a bit due to Covid 19, but still maintained at around 20,000 people. showing the attractiveness of the living and working environment in Vietnam to Japanese people.

Number of Japanese Residents* in Vietnam by Year

Unit: 1000 people

Note: * Japanese citizens with a stay of longer than three months

Source: Bank of Japan, Vietnam Ministry of Foreign Affairs (MOFA)

The significant presence of Japanese expatriates in Vietnam is closely linked to the extensive operations of Japanese companies within the country. Based on the data of Japanese Chamber of Commerce in Vietnam, the number of Japanese companies in Vietnam has been sharply growing from 1,300 firms in 2013 to 2,100 firms in 2023 (CAGR=4.91%), marking the highest number among ASEAN countries. These companies span various sectors, including manufacturing, construction, and finance, and often employ Japanese professionals to manage and oversee their operations.

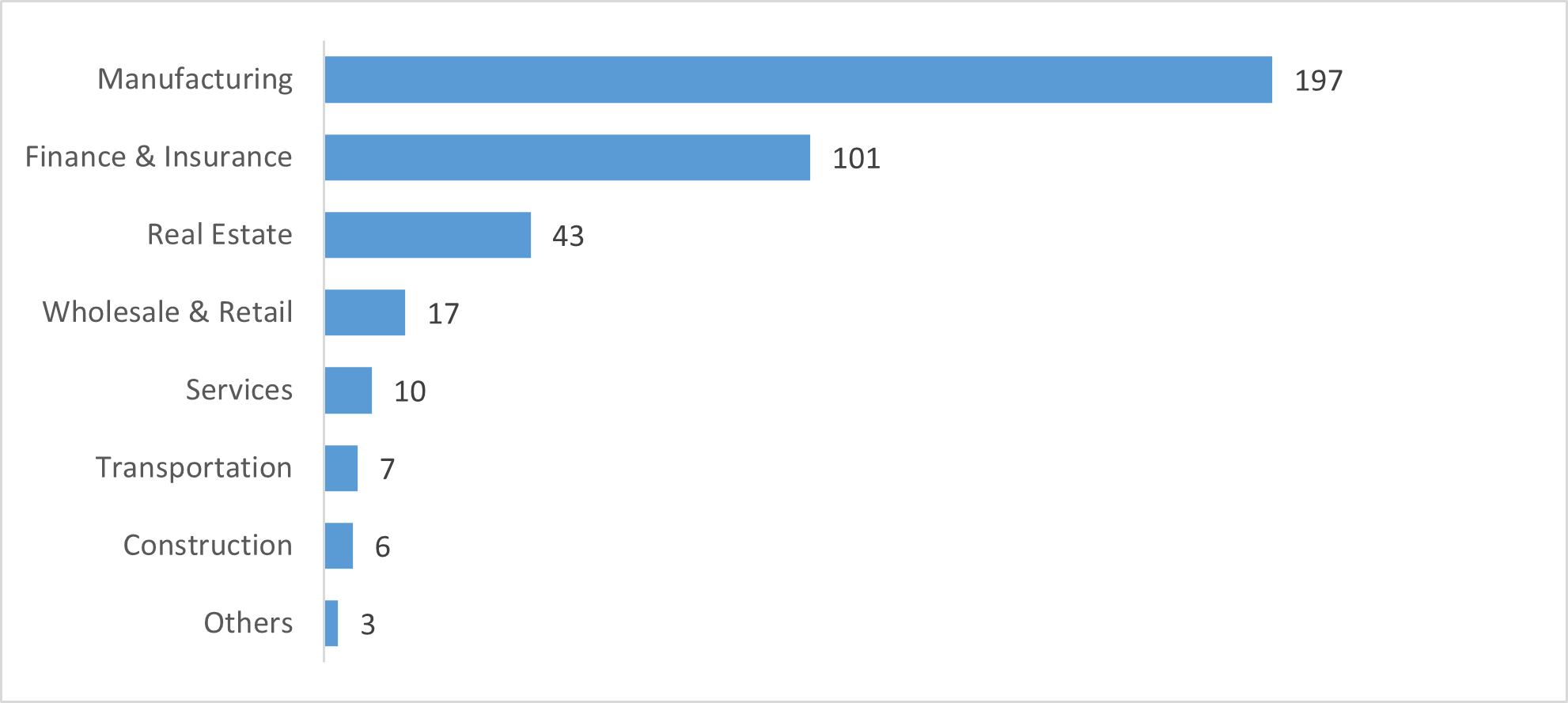

Japanese FDI to Vietnam- Breakdown by Industry (Cumulative total from 2005-2023)

Unit: 10 billion Yen

Source: Bank of Japan, Vietnam Ministry of Foreign Affairs (MOFA)

As showed in above chart, Manufacturing is the sector that attracts the most FDI capital and creating most occupation opportunities for Japanese labors. Many Japanese labors are employed in factories or industrial zones, often in managerial or technical roles related to production, quality control, or machinery design. Other popular sector is Finance & Insurance with high demands for talents in both Japanese enterprises and Vienamese firms collaborating with Japanese partners. Besides, high number of Japanese labors have been taking important roles in Wholesale & Retail, Services and Transportation as well as Constrution. These sectors demonstrate the diverse roles that Japanese professionals fill in Vietnam, reflecting the growing economic and cultural ties between the two nations.

Why Vietnam attract Japanese?

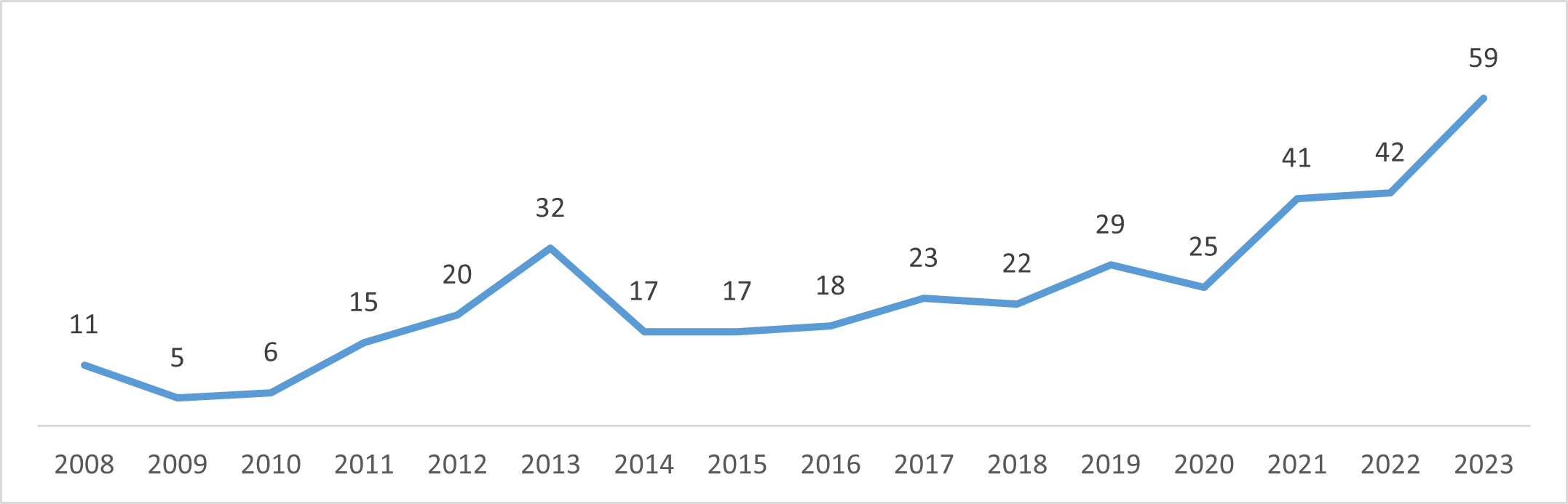

One of the main drivers of Japanese moving to Vietnam are economic factors. As recorded by Vietnam Ministry of Foreign Affairs, in the period of 2008-2023, Japan’s FDI to Vietnam has increased more than 5 times from 110 billion Yen to 590 billion Yen (CAGR = 11.85%). The growth of Japanese FDI has created more work opportunities as well as a strong demand for skilled labor, especially in areas such as manufacturing, construction management and financial services. Japanese labors with technical expertise find many opportunities in the blooming economy and rapid industrialization like Vietnam. In addition, the income of Vietnamese, as report of General Statistics Office, has grown 2.3 times over 10 years [2] combining with the weakening of the Japanese yen against other currencies, including the Vietnamese dong, increases the appeal of higher-paying jobs in Vietnam.

Japan’s FDI to Vietnam

Unit: 10 billion Yen

Source: Bank of Japan, MOFA

Especially, when comparing benefits by Labor Law and living cost between Japan and Vietnam, work environment in Vietnam shows the superiority in terms of attractiveness to labors.

Differences between Japan and Vietnam

| Benefits by Labor Law | Cost Living in Big Cities (USD) | ||||

| Japan | Vietnam | Tokyo | Hanoi | ||

| Overtime salary | 150% basic salary | +25% basic salary | Rent prices (1 bedroom) | 1,164 | 339 |

| Overtime | Max 200 hours/year | Max 360 hours/year | 1 main meal | 46 | 24 |

| Number of days off | 12 paid vacation days | 10 paid vacation days | Basic utilities/month | 176 | 82 |

Source: Vietnam Labor Law, Japan Labor Law, Numbeo.com (https://s.net.vn/BipV)

As some examples in above table, the cost of living in Japan much higher than in Vietnam. Therefore, usually, Japanese labors find they are “significantly richer” in Vietnam.

The second important reason for the trend is the life quality. Japanese labors often face a demanding work culture that prioritizes long hours and dedication to work. As showed in the above table, in Vietnam, the maintenance of work-life balance is more respected and is protected by Labor Law. In particular, Vietnam’s friendly and diverse social environment, along with its growing international community, attracts Japanese workers who are looking for new experiences and opportunities for personal growth.

Finally yet importantly, socio-cultural factors are also driving Japanese labors to work in Vietnam. In addition to economic considerations, Japanese workers appreciate the rich cultural heritage, favorable climate and the availability of facilities for foreigners, such as Japanese international schools and community centers in Vietnam.[3]

Implications

The increasing number of Japanese residents in Vietnam has many economic, social and diplomatic implications.

Regarding economic implications, the increasing presence of Japanese professionals supports deeper trade and investment cooperation. It promotes the activities of Japanese companies in Vietnam, especially in the fields of manufacturing, technology, finance and education. This boosts the Vietnamese economy through job creation and knowledge transfer. Besides, due to more and more Japanese residents settling their life in Vietnam, the demand for Japanese goods also has been increasing strongly, leading to business opportunities for Japanese products in Vietnam.

Regarding cultural effects, with more Japanese residents in Vietnam, opportunities for cultural exchange are expanding. This promotes mutual understanding between the two countries, contributing to closer diplomatic relations and increasing demand for Japanese language education and cultural programs.

Regarding social influence, the influx of Japanese labors and businesses into Vietnam, setting up operations, has increased the demand for infrastructure, such as roads, public transport, utilities and communication networks, to facilitate operations and supply chain connectivity. In addition, the increased demand for housing for foreigners and office space, the growing need for various social services (health care, education, entertainment, etc.), especially in cities such as Ho Chi Minh City and Hanoi, has led to improved urban services and higher real estate demand, creating both opportunities and challenges for local communities. Overall, the growing Japanese community in Vietnam has increased social and cultural interactions, benefiting both countries.[4]

Conclusion

The migration of Japanese labors to Vietnam has created many economic, social and cultural benefits, enriching the bilateral relationship between Japan and Vietnam. The migration promotes trade, supports investment and strengthens the Vietnamese economy through job creation and skills transfer. In addition, the influx of Japanese labors has contributed to increased demand for Japanese products and cultural exchanges, thereby deepening mutual understanding and cooperation.

The working environment and cost of living in Vietnam offer advantages that attract Japanese labors seeking economic opportunities and a better work-life balance. The trend reflects the growing desire of Japanese expatriates to change their lifestyles and escape Japan’s strict work culture. As this migration continues, it may also affect Japan’s labor policies, prompting adjustments to retain domestic talent.

[1] VnEconomy (2024), Ample potential exists for continued Vietnam-Japan cooperation https://by.edu.vn/3Tr7

[2] Tuoitre.vn (2024), 10 years Vietnamese’s Incomes has increased 2.3 times https://by.edu.vn/sDSh

[3] Reeracoen (2024), Why Japanese Workets are Leaving Japan and Moving to Vietnam? < https://www.reeracoen.com.vn/employers/articles/why-japanese-workers-are-leaving-japan-and-moving-to-vietnam>

[4] JapanBiz (2022), Japanese in Vietnam and Updated Information 2023-2024 < https://japanbiz.vn/nguoi-nhat-o-viet-nam-va-cac-thong-tin-cap-nhat-moi-nhat/>; Vietnam Investment Review (2022), Nearly 55 percent of Japanese firms in Vietnam gained profits despite pandemic < https://vir.com.vn/nearly-55-per-cent-of-japanese-firms-in-vietnam-gained-profits-despite-pandemic-90943.html>

| B&Company, Inc.

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

Read other articles