08Jan2025

Latest News & Report / Vietnam Briefing

Comments: No Comments.

Vietnam’s electric two-wheeler (E2W) market has emerged as a dynamic and burgeoning market driven by the national shift towards sustainable and eco-friendly transportation. With the government’s commitments to its environmental goals, the E2W sector is poised to see remarkable development in the future.

The situation of Vietnam’s two-wheeler vehicle market

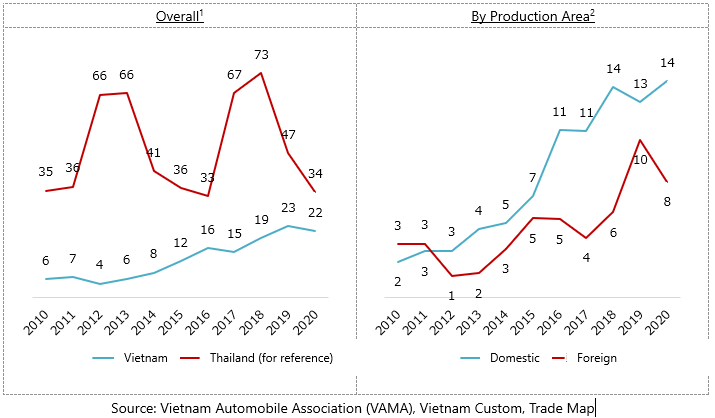

Vietnam’s two-wheeler vehicle market is one of the largest in the world, with motorcycles being the primary mode of transportation for the majority of its population[1]. The Ministry of Transport (MoT) reported that the total number of motorcycles in circulation was 75 million units at the end of 2023[2], making Vietnam the leading ASEAN country in terms of motorcycle usage rate[3]. This dominance stems from their affordability, ease of use in urban environments, and the lack of comprehensive public transportation systems in many areas[4]. However, recent setbacks in sales highlight the saturation of the market, as well as signifying a shift in domestic demand.

Despite these challenges, electric motorbikes have witnessed steady growth over the past decade as environmentally friendly alternatives for traditional internal combustion engine (ICE) vehicles. E2Ws cost just one-tenth to operate and maintain compared to ICE motorcycles while emitting only a third of the CO2[5]. E2Ws are mostly concentrated in central cities[6]. Prices now range between 22 and 70 million VND, making them comparable to ICE scooters, with some manufacturers like Yadea targeting younger buyers with models priced as low as 16 million VND[7]. As infrastructure improves and affordable models emerge, the adoption of electric motorcycles is expected to rise.

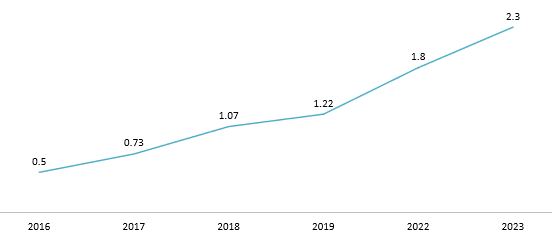

The domestic registration of E2W increased from 500 thousand to over 2.3 million units from 2016 to 2023[8], corresponding with a CAGR of 24%. Such an increase in local consumption has propelled Vietnam to become the largest E2W market in the ASEAN region and the second global market after China[9]. Vietnam’s E2W market is expected to sustain its growth momentum with annual domestic demand for electric vehicles projected to reach 2.5 million units in 2036, including 2 million electric motorcycles[10].

Number of total registered E2W in Vietnam from 2016 to 2023[11] (Unit: Million units)

Source: GIZ

The E2W ecosystem has seen rapid development in technologies and infrastructure.

In terms of technologies, manufacturers are integrating advanced features into their electric motorcycles. VinFast, for instance, utilizes IoT technologies such as the VinFast E-Scooter app and the Phone-as-a-Key feature in premium models[12]. Battery technology improvements remain a priority in addressing consumer concerns. Notable examples include VinFast’s LFP batteries with waterproofing capabilities[13] and Selex’s partnership with Samsung SDI for high-quality battery cells[14].

Regarding the infrastructure, significant investments are being made to enhance charging facilities to support growing E2W adoption. V-Green, founded by Vingroup’s chairman, has committed to establishing 150,000 charging stations across all 63 provinces and cities nationwide[15], while Selex established battery-swap stations in major cities[16].

Player dynamics of Vietnam’s E2W market

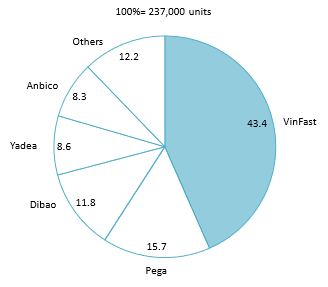

The domestic motorbike market is dominated by foreign brands in Vietnam such as Honda, Yamaha, SYM, Suzuki, and Piaggio. These companies account for over 95% of the domestic two-wheeler vehicle market share[17], with Honda Vietnam contributing over 80% of the proportion[18]. On the other hand, the E2W market has seen a strong dominance of Vietnamese manufacturers such as VinFast and Pega.

Since its market entry in 2017, VinFast has led the E2W market, with 72,469 units sold by the end of 2023, a 21% increase from 2022, accounting for 3% of total two-wheeler sales[19]. Pega, as the first domestic electric vehicle manufacturer, maintains its position with 16% of the market share.

E2W market share by brands in 2020

Source: ICCT

International companies have also invested in local E2W manufacturing to tap into the growing demand. Yadea, a Chinese FDI company, established Vietnam’s first foreign-invested E2W plant in 2019 and plans a $100 million investment in Bac Giang to boost its production capacity to 2 million units annually[20]. Yadea has seen strong growth, becoming the third-largest manufacturer in terms of market share by 2024[21]. The industry leader Honda Vietnam, traditionally focused on ICE vehicles, also plans to introduce two electric models in early 2025 to test the market demand[22].

Government policies on E2W vehicles

The Vietnamese government is committed to promoting electric vehicle adoption through its environmental policies. Decision No. 876/QD-TTg push towards phasing out gasoline-powered vehicles by 2040 aligns with Vietnam’s commitment to achieving net-zero carbon emissions by 2050[23]. Major cities like Hanoi are considering establishing Low Emission Zones (LEZs) in metropolitan areas, banning fossil-fuel vehicles as early as 2030[24].

Strategic goals to support Vietnam’s E2W market according to Decision No. 876/QD-TTg

| No. | Period | Strategic goals |

| 1 | From 2022 to 2030 | – Promote the production, assembly, import, and conversion of electric-powered road transport vehicles;

– Develop charging infrastructure to meet the needs of the public and businesses. |

| 2 | By 2040 | – Gradually restrict and aim to stop the production, assembly, and import of fossil fuel-powered cars, motorcycles, and motorbikes for domestic use |

| 3 | By 2050 | – 100% of road transport vehicles and construction motorcycles participating in traffic will transition to electric and green energy.

– All loading and unloading machinery and equipment using fossil fuels will be converted to electric and green energy. – Complete the nationwide charging infrastructure and green energy supply to meet the needs of the public and businesses |

Source: TVPL

The government has also introduced specific incentive policies to support the adoption of E2W[25]. Ho Chi Minh has proposed a financial scheme to assist low-income households between 80% to 100% of the funding when transitioning to E2W vehicles. Other households will receive 100% coverage for registration fees, license plate issuance, and a preferential loan interest rate when purchasing electric motorcycles on installment. From 2026 to 2027, the government will encourage and support every household to transition to electric motorcycles.

Opportunities and challenges for E2W development in Vietnam

The domestic E2W market presents significant growth potential for both domestic and foreign companies. The ecosystem of E2W is supported by the government with policies to encourage the adoption of electric vehicles. VinFast has introduced E2W models to its taxi and ride-sharing services, helping to raise customer awareness[26]. The demand for electric vehicles in Vietnam is on the rise due to environmental concerns from consumers, especially among younger generations (aged 25 to 44) with strong purchasing powers[27]. The long-term cost savings associated with electric motorbikes, including lower fuel and maintenance costs, make them an attractive option for budget-conscious consumers[28].

Xanh SM launches the Xanh SM Bike Platform

Source: Xanh SM

However, it should be noted that there are some challenges that can hinder the growth of the sector. It has been highlighted that some incentives are limited to the electric automotive sector, and financial support programs have not been popularized nationwide[29]. Although electric motorbikes are economical in the long run, their upfront cost is often higher than that of conventional vehicles[30]. This deters price-sensitive consumers from making the switch. Additionally, the lack of accessible charging facilities and concerns about the performance of electric motorbikes detrimentally impact consumer purchasing decisions.[31].

Conclusion

The electric motorbike market in Vietnam is poised for significant growth, driven by a combination of supportive government policies, increasing environmental awareness, and advances in EV technology. While challenges persist, the opportunities far outweigh the obstacles. To unlock the full potential of this market, stakeholders—including manufacturers, policymakers, and consumers—must work collaboratively to build a robust EV ecosystem. With sustained efforts and strategic investments, Vietnam can position itself as a regional leader in electric mobility, paving the way for a cleaner and more sustainable future.

[1] ICCT. Electric two-wheeler market growth in Vietnam: An overview <Assess>

[2] VnBusiness. Traditional motorcycle consumption ‘cools down’: A stepping stone for electric vehicles to rise? <Assess>

[3] Dan Tri. Vietnam has the highest rate of motorcycle usage in Southeast Asia <Assess>

[4] Dan Tri. Vietnam has the highest rate of motorcycle usage in Southeast Asia <Assess>

[5] Vietnamnews. VN sees great potential for the development of electric motorbikes <Assess>

[6] Thanh nien. 78% of Vietnamese consumers want to use electric vehicles <Assess>

[7] Thanh nien. How are electric motorcycles more economical compared to gasoline motorcycles? <Assess>

[8] GIZ. Electric Two-Wheelers in Vietnam <Assess>

[9] VOIT. Opportunities and challenges of Vietnam’s EV market <Assess>

[10] HSBC. Driving new opportunities in Asia’s auto sector <Assess>

[11] The Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ) GmbH noted that no official data of registered E2W in 2020 and 2021 due to Covid-19 complications <Assess>

[12] Dan tri. Leading technologies on VinFast electric motorcycles <Assess>

[13] Dan tri. Leading technologies on VinFast electric motorcycles <Assess>

[14] Selex. Selex Motors formed strategic partnership with Samsung SDI to supply electric vehicle batteries for Vietnam and Southeast Asia <Assess>

[15] Tuoi tre. VinFast established a company to develop global charging stations <Assess>

[16] Tuoi tre. Battery swap stations to resolve the concern about running out of power <Assess>

[17] VnBusiness. Motorcycle consumption has seen a ‘transformation’ after a period of stagnation <Assess>

[18] Honda. Honda Vietnam Announces Business Results for Fiscal Year 2024 <Assess>

[19] Cafef. Motorcycle Market Declines Sharply, but Electric Vehicles Thrive – VinFast Becomes a TikTok Sensation, Chinese Giant Invests $100 Million in Factory <Assess>

[20] Yadea. Yadea holds groundbreaking ceremony for its second factory in Vietnam <Assess>

[21] McD. Vietnam 2024. Motorcycles Market Is Gaining a Mere 1.9% <Assess>

[22] VnExpress. Honda to enter Vietnam’s E2W market <Assess>

[23] TVPL. Decision No. 876/QD-TTg approving the Action program for Transition to green energy and mitigation of carbon dioxide and methane emissions from transportation <Assess>

[24] Resource and Environment News. Identifying Low Emission Zones – Opportunities to Reduce Pollution in the Capital <Assess>

[25] Vietnamnet. Lack of policies to encourage the development of electric motorcycles <Assess>

[26] Xanh SM. Xanh SM launches the Xanh SM Bike Platform for VinFast electric motorcycle riders <Assess>

[27] KPMG. Driven by Voltage: Navigating the EV landscape <Assess>

[28] GIZ. Electric Two-Wheelers in Vietnam <Assess>

[29] Vietnamnet. Lack of policies to encourage the development of electric motorcycles <Assess>

[30] Cafef. Domestic electric motorcycles “suffer a heavy loss” <Assess>

[31] KPMG. Driven by Voltage: Navigating the EV landscape <Assess>

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |