22Dec2025

Latest News & Report / Vietnam Briefing

Comments: No Comments.

Vietnam’s artificial intelligence (AI) market has become Southeast Asia’s fastest-growing AI hub, ranking 6th in the WIN World AI Index 2025, placing it among the Top 10 countries globally in terms of AI readiness and adoption. With groundbreaking legislation, including the Law on Artificial Intelligence, passed in December 2025, robust government backing, and nearly 300 active AI startups receiving $130 million in Q1 2025 alone, Vietnam is positioning itself as Southeast Asia’s premier AI innovation destination.

Market Overview

Market size and Growth trajectory

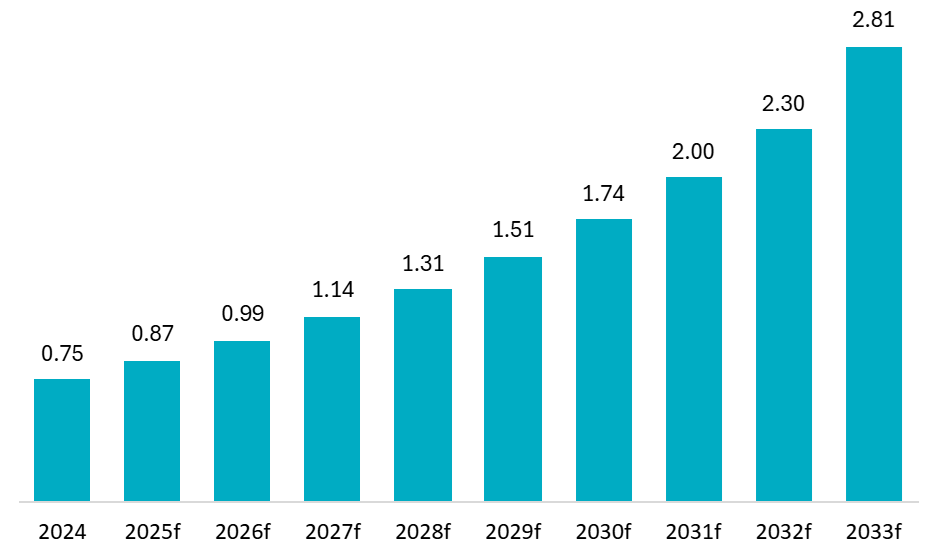

Vietnam’s AI market reached $0.75 billion in 2024 and is expected to reach $2.81 billion by 2033, exhibiting a CAGR of 14.96% during 2025-2033[1]. According to Oxford Insights’ Global AI Readiness Index 2024, Vietnam ranks 59th out of 193 countries, placing it among the top five in ASEAN and above the global average for three consecutive years[2]. This performance reflects Vietnam’s strategic vision and sustained efforts by the government, businesses, and the national AI talent pool. In addition, the World AI Index 2025 (WIN) ranks Vietnam 6th out of 40 countries with a score of 59.2, 3rd globally in AI trust, and 5th in AI acceptance, highlighting Vietnam’s openness and confidence in embracing AI-driven transformation[3].

Vietnam artificial intelligence market size (2024 – 2033)

Unit: USD billion

Source: Imarc

The economic significance extends beyond immediate market valuation. The potential contribution of AI to Vietnam’s economy is projected by Google to reach $79.3 billion by 2030, representing approximately 12% of GDP[4]. This positions Vietnam’s artificial intelligence ecosystem as not merely a technological advancement but a fundamental pillar of national economic strategy. Investment and adoption in AI are also accelerating rapidly in Vietnam. Within just one year, funding for domestic AI companies surged from USD 10 million in 2023 to USD 80 million in 2024, representing an eightfold increase[5].

Vietnam AI adoption situation

AI adoption in Vietnam surged in 2024, with 47,000 new enterprises implementing AI, bringing total adoption to nearly 170,000 firms, accounting for around 18% of all enterprises nationwide, and increasing by 13% compared to the previous year, representing a year-on-year growth rate of approximately 39% in AI adoption. AI solution provision is concentrated primarily in the IT sector, which accounts for 31%, followed by finance and banking (22%), education (17%), and healthcare and e-commerce (15%)[6].

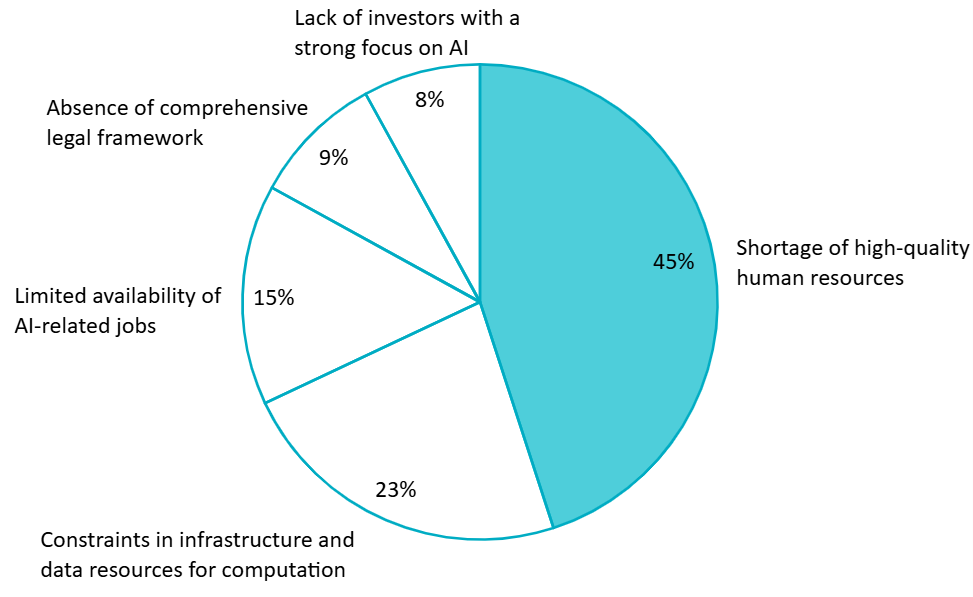

Despite strong growth momentum, Vietnam’s AI market continues to face several structural challenges that may constrain its long-term scalability and competitiveness. According to the Vietnam Artificial Intelligence Annual Report 2025 by the Institute of Information Technology, Vietnam National University, based on a survey of nearly 500 enterprises and organizations conducted from July 2025, the most significant challenge facing AI solution providers is the shortage of high-quality talent (45%), while 23% struggle with data and computing infrastructure constraints.

Main difficulties and challenges faced by Vietnam’s AI providers in the research, development, and deployment of AI solutions (July 2025)

100% = 500 enterprises

Main Players

The market demonstrates clear segmentation between established technology conglomerates (FPT, Viettel, VNPT, VinGroup) with substantial resources and emerging startups focusing on specialized applications. Large corporations lead in infrastructure and research capacity but often confine applications within their ecosystems.

Vietnamese AI companies are achieving global visibility. Abivin won the 2019 Startup World Cup in San Francisco, earning $1 million for AI-powered logistics optimization[7]. VinAI regularly publishes in top-tier international journals, while VinBrain’s NVIDIA acquisition validates Vietnam’s healthcare AI capabilities. Successful players increasingly focus on domain-specific solutions rather than horizontal platforms. ELSA Speak dominates AI-powered English learning, VinBrain leads healthcare diagnostics, and Trusting Social excels in alternative credit scoring – demonstrating that specialized expertise creates defensible competitive advantages. The largest players dominate infrastructure investment. FPT, Viettel, VNPT, and VinGroup operate dedicated AI centers with substantial R&D budgets. However, their products largely remain confined within their own ecosystems with limited reach to SMEs or the public sector.

Table 1. Key AI Solution Providers in Vietnam

| No. | Company Name | Year Founded | Country | Main Products | Profile |

| 8 | CMC Corporation | 1993 | Vietnam | C-OCR, CATI-VLM model, government AI services | CATI-VLM model achieved top 12 global ranking in 2025 Robust Reading Competition. C-OCR processes thousands of official documents daily for government services[8]. |

| 1 | FPT Software | 1999 | Vietnam | AI Center, FPT.AI platform, chatbots, NLP, computer vision | Vietnam’s largest IT services company with $7.7 billion market cap and $2.47 billion revenue in 2024[9]. Developing $200M “AI Factory” using NVIDIA H100/H200 chips, targeting 6,000 AI engineers by 2028. |

| 2 | VNG Corporation (Zalo AI) | 2004 | Vietnam | Zalo messaging, KilM LLM, GreenNode AI Cloud | Vietnam’s first tech unicorn valued at $3 billion with 2,000+ employees including 300+ AI specialists[10]. Zalo processes nearly 2 billion messages daily, with 20% of users utilizing AI features. |

| 7 | Cinnamon AI | 2012 | Japan | Intelligent Document Processing (IDP), knowledge mining, OCR | Global enterprise AI startup with strong Vietnamese presence. Specializes in document intelligence for business process automation across finance and logistics sectors. |

| 4 | Viettel AI | 2014 | Vietnam | Cyberbot Platform, AI Robot Platform, Digital Twin, facial recognition | Military-backed telecommunications conglomerate’s AI division. Developing five core product lines covering chatbots, robotics, analytics, and digital twin technologies. Targets Asia-Pacific leadership by 2030. |

| 3 | VinAI Research | 2018 | Vietnam | Automotive AI (DrunkSense, MirrorSense, Touch2Park), computer vision | Positioned among top 20 AI R&D companies globally with 200+ researchers[11]. Deployed in 80,000+ vehicles, projecting 800,000 within five years. CES 2024 Innovation Award winner. |

| 5 | VNPT AI | 2018 | Vietnam | VNPT BioID, computer vision, ASR, video analytics | State-owned telecommunications provider’s AI arm. BioID platform serves banking and securities sectors with high-speed biometric processing. Integrating NVIDIA DeepStream SDK for real-time video analytics. |

| 6 | VinBrain | 2018 | Vietnam | AI-powered medical diagnostics, X-ray analysis, pathology imaging | Healthcare AI startup with solutions deployed in 182+ hospitals[12]. NVIDIA announced acquisition in December 2024 to accelerate healthcare AI innovation. |

B&Company’s synthesis

Table 2. Key companies Using AI in Operations

| No. | Company Name | Year Founded | Country | Main Products | AI Application Profile |

| 6 | Vietcombank | 1963 | Vietnam | Commercial banking | Largest Vietnamese bank by assets. Deploys AI for customer service automation, fraud prevention, credit risk assessment, and personalized banking experiences. |

| 7 | Vingroup | 1993 | Vietnam | Conglomerate (real estate, retail, automotive) | Launched VinVentures fund with $150M AUM focused on AI and semiconductor startups. Integrates AI across VinFast automotive, VinMart retail, and VinHomes real estate. |

| 3 | MoMo | 2007 | Vietnam | Digital payments, e-wallet | Vietnam’s fintech unicorn using AI for fraud detection, credit scoring, and personalized financial services. 30+ million users leveraging AI-driven payment recommendations[13]. |

| 1 | Tiki Corporation | 2010 | Vietnam | E-commerce platform | Uses AI recommendation engines analyzing 50M+ searches monthly, computer vision for product categorization, and robotics processing 50,000 orders daily. 800 distribution hubs nationwide[14]. |

| 8 | Trusting Social | 2013 | Vietnam | Alternative credit scoring | FinTech startup using AI and machine learning to analyze non-traditional data for credit decisions, helping underbanked populations access financial services. |

| 2 | Shopee Vietnam | 2015 | Singapore | E-commerce marketplace | Employs machine learning for personalized shopping, resulting in 20% increase in customer retention. AI-powered inventory and demand forecasting systems. |

| 5 | ELSA Speak | 2015 | Vietnam | English pronunciation AI coaching | Serves 50 million users worldwide with AI speech recognition technology achieving 95% accuracy. Raised $60M total funding, representing Vietnam’s EdTech success[15]. |

| 4 | Be Group | 2018 | Vietnam | Ride-hailing, delivery platform | Applies AI across its ride-hailing platform to improve real-time route optimization, demand forecasting, and driver-passenger matching, enabling trip allocation and pricing decisions within seconds |

B&Company’s synthesis

Government Policies

Law on Artificial Intelligence (2025)

In December 2025, the Vietnamese National Assembly officially passed the Law on Artificial Intelligence (AI), marking the first comprehensive legislation in Vietnam dedicated to AI and positioning the country among a small group of nations with a full legal framework for this technology. Scheduled to take effect on March 1, 2026, the law spans 35 articles and applies to all organizations and individuals involved in AI research, development, deployment, and use in Vietnam. It emphasizes a “management-for-development” approach that proactively supports AI commercialization, ecosystem growth, and international integration while safeguarding societal and ethical considerations[16].

. National AI Development Fund is a non-profit, off-budget state financial fund designed to mobilize and allocate resources for the development of AI infrastructure, core technology research, and high-quality human capital, thereby supporting national technological autonomy and the growth of Vietnam’s AI ecosystem. AI Law also outlines civil and administrative responsibilities and prohibits misuse of AI systems for unlawful or harmful activities. Provisions also address AI-generated content, algorithmic ethics, cross-border platform responsibilities, and state secrets protection.

Digital Technology Industry Law (2025)

On June 14, 2025, Vietnam became the first country to enact a standalone law dedicated exclusively to the digital technology industry. The Law on Digital Technology Industry (DTI Law) taking effect on January 1, 2026 establishes Vietnam’s first comprehensive legal framework for AI, digital assets, semiconductors, and data services. AI systems are categorized into , with high-risk applications subject to stringent compliance obligations, technical standards, and oversight[17].

High-risk AI systems are those that pose a serious risk to protected interests such as human health, fundamental rights, public interests, or social order and safety, and are therefore subject to stringent compliance, technical standards, and regulatory oversight. Large-impact AI systems refer to AI models or systems with large-scale deployment or general-purpose capabilities, such as those involving many users, parameters, or datasets which may generate widespread societal effects depending on their use cases. All AI-powered products must be clearly labeled to ensure transparency and accountability[18].

The law also creates several investment incentives for tech companies. For digital tech companies with projects exceeding 6 trillion VND (around $235 million) capital, the law offers 5% corporate income tax rate for 37 years, six-year tax exemption, and 50% tax reduction for the following 13 years. These projects benefit from up to 22 years of land rent exemption and 75% reduction thereafter. Foreign-invested enterprises are encouraged to transfer advanced technologies and collaborate with domestic firms, receiving long-term corporate income tax reductions and investment incentives. Foreign experts receive five-year visas and exemption from work permit requirements.

Personal Data Protection Law (2025)

In June 2025, the National Assembly passed the Personal Data Protection (PDP) Law, superseding the earlier 2023 decree. This legislation establishes comprehensive data protection measures crucial for responsible AI development. The PDP Law requires strict consent-based data handling practices and gives individuals control over their personal information. Organizations developing AI systems must inform data subjects about how AI algorithms impact their rights and allow subjects to withdraw from R&D activities involving their data[19].

Regulatory Sandbox

Vietnam introduced a regulatory sandbox allowing companies to develop and test new digital technology products and services for up to 2 years without rigid legal restrictions. This mechanism enables controlled experimentation while maintaining regulatory oversight, reducing market entry barriers for innovative AI applications. For digital assets, Government Resolution No. 05/2025/NQ-CP issued on September 9, 2025, initiated a five-year pilot program covering crypto asset issuance, trading markets, and state supervision[20].

Startup Ecosystem in Vietnam AI landscape

Ecosystem Scale and Growth

Vietnam’s AI startup ecosystem has experienced remarkable expansion, establishing the country as Southeast Asia’s second-largest Generative AI hub by startup volume. According to PitchBook Data Inc., Vietnam currently has 765 startups operating in the AI and machine learning space, ranking second in Southeast Asia after Singapore. These companies account for around 25% of the country’s total tech startups, highlighting AI as a rapidly emerging and highly attractive sector. The number of AI-focused startups grew from 60 in 2021 to nearly 300 by end-2024 – a 450% increase within three years[21].

Funding Landscape

Investment flows into Vietnamese AI startups demonstrate accelerating momentum despite global economic uncertainties. Investments into Vietnamese AI startups grew from $80 million in 2024 to over $130 million in Q1 2025 alone[22], with major investors including GGV Capital, Sequoia, and regional VCs from Singapore and Japan.

For instance, Filum AI secured $1 million in Series A funding (March 2025) from Nextrans, VinVentures, and TheVentures to accelerate R&D and commercial deployment[23]. AI Hay completed a $10 million Series A round in July 2025 led by Argor Capital, pushing total funding beyond $18 million[24]. Techcoop raised $70 million in Series A (February 2025) led by TNB Aura and Ascend Vietnam Ventures[25].

Google for Startups supports Vietnamese AI startups through AI Bootcamp and AI Solutions Lab, combining hands-on AI training, mentorship from Google engineers, and up to USD 350,000 in Cloud credits per startup. To date, the programs have trained around 120 startups and helped develop 50 GenAI MVPs addressing economic, social, and environmental challenges.

established in June 2025 as an off-budget state financial fund under Decree No.160/2025/ND-CP provides grants, loans, and preferential financing to domestic startups, SMEs, and foreign investors developing AI capabilities in Vietnam with an initial capital of 1 trillion VND (38.4 billion USD), to strengthen digital infrastructure and promote data governance[26].

Government Support Infrastructure

National Innovation Center (NIC) serves as the primary coordinator for startup ecosystem development. In July 2024, NIC partnered with Google to launch the ‘Build for the AI Future’ initiative, focusing on building talent and supporting startups[27].

NIC and the Vietnam Private Capital Association signed MoUs at the VIPC Summit 2025 with the Korea Venture Capital Association, Singapore Venture & Private Capital Association, and Hong Kong Venture Capital and Private Equity Association – representing combined assets under management of over $5 trillion.

Challenges and Bottlenecks

Despite rapid growth, Vietnam’s AI ecosystem faces several structural challenges. A major bottleneck is the lack of late-stage funding, as domestic capital is largely limited to seed and early rounds, making it difficult for AI startups to scale beyond Series B. At the same time, shortages of specialized AI talent persist, leading the government to expand and strengthen existing programs aimed at training internationally qualified AI experts by 2030.

On the demand and infrastructure sides, AI adoption among SMEs remains limited, with low sustained usage due to high costs, skill gaps, and weak implementation support. In addition, Vietnam’s AI computing infrastructure is still underdeveloped, forcing firms to rely on foreign cloud and GPU providers, which raises costs and creates dependency risks.

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

[1] IMARC, Vietnam Artificial Intelligence Market Report, (https://www.imarcgroup.com/vietnam-artificial-intelligence-market

[2] VnEconomy, Muốn phát triển AI, phải tạo ra thị trường cho AI, https://vneconomy.vn/muon-phat-trien-ai-phai-tao-ra-thi-truong-cho-ai.htm

[3] Nhan Dan, Việt Nam đứng thứ 6/40 thế giới về Chỉ số AI toàn cầu, https://nhandan.vn/viet-nam-dung-thu-640-the-gioi-ve-chi-so-ai-toan-cau-post895822.html

[4] VnEconomy, More and More AI Products to Be Developed in Vietnam, https://en.vneconomy.vn/more-and-more-ai-products-to-be-developed-in-vietnam.htm

[5] Bao Chinh Phu (Vietnam Government Portal), Investment in Domestic AI Enterprises Increases Eightfold, https://baochinhphu.vn/von-dau-tu-vao-doanh-nghiep-ai-trong-nuoc-tang-8-lan-102251009151731869.htm

[6] VnEconomy, “To Develop AI, a Market Must Be Created for AI”, https://vneconomy.vn/muon-phat-trien-ai-phai-tao-ra-thi-truong-cho-ai.htm

[7] VietnamPlus, “Abivin Crowns Start-Up World Cup Champions”, https://en.vietnamplus.vn/abivin-crowns-start-up-world-cup-champions-post152853.vnp

[8] VietnamNet, “CMC’s Vietnamese AI Model Ranks Top 12 Globally in Document Understanding”

https://vietnamnet.vn/en/cmc-s-vietnamese-ai-model-ranks-top-12-globally-in-document-understanding-2417697.html

[9] FPT Software, “FPT Global IT Services Signed; Revenue Surpassed USD 1.3 Billion”

https://fptsoftware.com/newsroom/news-and-press-releases/news/fpt-global-it-services-signed-revenue-surpassed-1-3-b-usd

[10] Second Talent, “Top AI Companies in Vietnam”

https://www.secondtalent.com/resources/vietnam-ai-companies/

[11] VinAI, “VinAI Recognized as a Beacon of Innovation in Deloitte’s Edges of Southeast Asia 2024”

https://www.vinai.io/vinai-recognized-as-beacon-of-innovation-in-deloittes-edges-of-southeast-asia-2024/

[12] Med-Tech World, “NVIDIA Acquires VinBrain, Accelerating AI Healthcare”

https://med-tech.world/news/nvidia-acquires-vinbrain-accelerating-ai-healthcare/

[13] MoMo, “15 Years of MoMo: Journey of Transformation and Growth”

https://www.momo.vn/tin-tuc/thong-cao-bao-chi/15-nam-momo-hanh-trinh-chuyen-minh-cung-su-lon-8211

[14] Second Talent, https://www.secondtalent.com/resources/vietnam-ai-companies/

[15] VnExpress International, “How Vietnamese Entrepreneur Utilizes AI to Teach English to 50 Million Learners Worldwide”

https://e.vnexpress.net/news/tech/how-vietnamese-entrepreneur-utilizes-ai-to-teach-english-to-50-million-learners-worldwide-4849115.html

[16] MIC (Ministry of Information and Communications), “First-Ever Law on Artificial Intelligence Approved”

https://beta-en.mic.gov.vn/first-ever-law-on-artificial-intelligence-approved-197251215231241888.htm

[17] LuatVietnam, “Law on the Digital Technology Industry No. 71/2025/QH15 Dated June 14, 2025 of the National Assembly”

https://english.luatvietnam.vn/lawonthedigitaltechnologyindustryno71-2025-qh15datedjune142025ofthenationalassembly-405695-doc1.html

[18] People’s Representatives. https://daibieunhandan.vn/phan-loai-he-thong-ai-theo-muc-do-rui-ro-10373456.html

[19] LuatVietnam, “Law on Personal Data Protection (Law No. 91/2025/QH15)”

https://english.luatvietnam.vn/dan-su/law-on-personal-data-protection-law-no-91-2025-qh15-405135-d1.html

[20] Vietnam.vn, “Urgently Improving the Legal Framework for Digital Assets”

https://www.vietnam.vn/en/cap-bach-hoan-thien-khung-phap-ly-cho-tai-san-so

[21] MIC (Ministry of Information and Communications), “Vietnamese AI for Vietnamese People”

https://beta-en.mic.gov.vn/vietnamese-ai-for-vietnamese-people-197250206103526407.htm

[22] Invest Vietnam Blog, “The State of AI in Vietnam for 2025 – Foreign Direct Investment (FDI) and Venture Capital (VC) Trends in AI Startups”

https://blog.investvietnam.co/the-state-of-ai-in-vietnam-for-2025/#Foreign-Direct-Investment-(FDI)-and-Venture-Capital-(VC)-Trends-in-AI-Startups

[23] VIR, “Filum AI Raises USD 1 Million from Investment Funds”

https://vir.com.vn/filum-ai-raises-1-million-from-investment-funds-124712.html&link=autochanger

[24] VIR, “Vietnam Sees USD 786 Million in July M&A Across Key Sectors”

https://vir.com.vn/vietnam-sees-786-million-in-july-ma-across-key-sectors-134657.html

[25] VnEconomy, “Vietnamese AgTech Startup Secures USD 70 Million in Funding”

https://vneconomy.vn/mot-startup-cong-nghe-nong-nghiep-viet-goi-von-thanh-cong-70-trieu-usd.htm

[26] VietnamPlus. https://en.vietnamplus.vn/vietnam-launches-384-billion-usd-national-data-development-fund-to-fuel-digital-transformation-post321846.vnp

[27] Vietnam News, “NIC, Google Launch ‘Build for the AI Future’ Initiative to Propel AI Development in Vietnam”

https://vietnamnews.vn/economy/1659103/nic-google-launch-build-for-the-ai-future-initiative-to-propel-ai-development-in-viet-nam.html