09Sep2025

Latest News & Report / Vietnam Briefing

Comments: No Comments.

Education demand in Vietnam

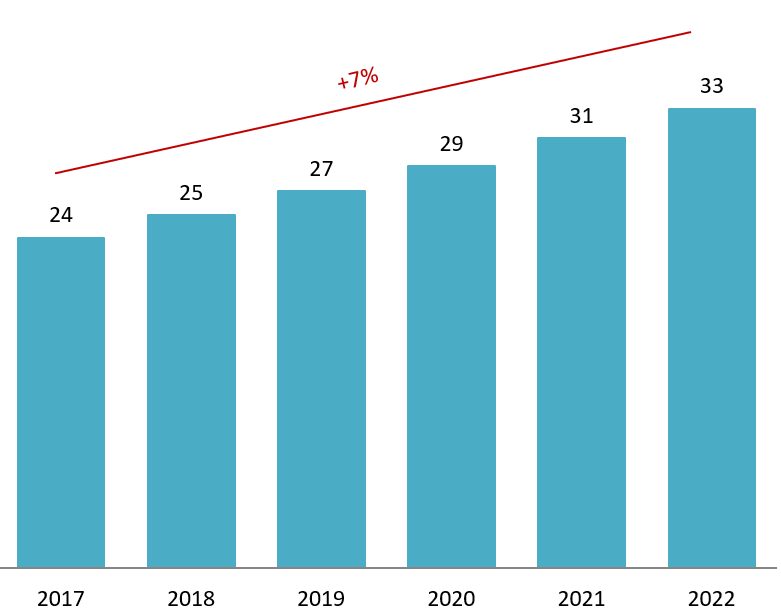

Total spending on education in Vietnam grew steadily from 2017 to 2022, rising from USD 23.6 billion to USD 32.8 billion — a compound annual growth rate (CAGR) of 7% [1]. This figure includes both public sector spending and household expenditures, reflecting a clear increase in awareness, prioritization, and investment behavior toward education among Vietnamese citizens.

Vietnam education spending 2017-2022

Unit: billion USD

Source: FiinGroup

Vietnamese parents consider education a top priority and are willing to allocate a significant portion of their income to their children’s learning. In major cities, education accounts for up to 47% of household budgets [2]. Even during periods of declining income due to the pandemic, investment in education continued to rise — from USD 29 billion to USD 31 billion — demonstrating a strong “no compromise on learning” mindset [3]. This unwavering commitment forms a solid foundation for the long-term growth and sustainability of Vietnam’s after-school education sector.

Traditional education centers located near schools remain popular, especially for academic subjects and exam preparation. This long-standing model has given rise to densely packed “exam prep streets” in major cities, where centers cluster around top-tier schools. For many, this image is still the default when thinking about supplementary education.

Beyond education itself, location and accessibility are critical factors. In Vietnam, public transportation is not convenient, and students are not legally permitted—or are unsafe—to drive motorbikes. As a result, centers with easy, safe access play a decisive role in parental choice.

However, a new trend is emerging: education centers within residential communities. Driven by changing needs and a broader definition of “convenience,” modern parents now prioritize locations close to home that are safe and easy for the whole family. These centers offer more than just academic support—they integrate arts, life skills, and foreign languages to meet the diverse needs of residents. This model offers a clear competitive edge, especially in new urban developments with high population density and growing demand for on-site services.

Comparing Education Models: Near Schools vs. Within Residential Communities

Comparison of Two Education Center Models

| Near Schools | Within Residential Communities

(New Urban Areas) |

|

| Advantages | – High student density and natural foot traffic – Strong brand recognition from proximity to reputable schools – Easy to tailor supplementary programs to students’ immediate academic needs |

– Built-in audience within the residential community – High convenience and safety for parents – Strong community integration and trust-building – Modern facilities (e.g., shophouses in new urban areas) |

| Challenges | – Intense competition, highly saturated market – High rental costs for prime locations – Price wars and difficulty in differentiation – Greater scrutiny from regulatory authorities |

– Customer base limited to the size and occupancy of the community – Harder to build citywide brand recognition – Dependence on developers and property management – Less demographic diversity, limiting course variety |

The near-school model operates in a fiercely competitive environment, where growth often comes from taking students from competitors. Market saturation requires centers to differentiate clearly, often through specialization such as exam preparation, unique teaching methods, or niche skill programs. High rental costs in central locations add further pressure, forcing centers to maintain high occupancy rates, which can lead to overcrowding and a decline in teaching quality.

In contrast, the residential community model is emerging as a sustainable solution. Beyond providing education services, these centers serve as a “Third Place” – a safe, trusted space for children outside of home and school. The added value goes beyond academics, fostering loyalty and premium pricing power. Moreover, a successful education center enhances the livability and property value of the entire community, creating a symbiotic relationship with developers. This opens doors for strategic partnerships and preferential leasing terms, moving beyond a simple landlord-tenant relationship.

Opportunities

Vietnam’s after-school education sector is entering a phase of strategic diversification, offering distinct opportunities for providers depending on their positioning and specialization.

For academic-focused institutions—such as those offering exam preparation, tutoring for core subjects, or reinforcement of school curricula—the traditional near-school model remains highly relevant. These centers benefit from natural foot traffic, proximity to high-performing schools, and a concentrated student base with immediate academic needs. The opportunity here lies in deep specialization: mastering entrance exam formats, offering targeted prep for elite schools, and building reputations as academic powerhouses. However, success in this saturated environment requires differentiation through teaching quality, proven outcomes, and brand credibility.

Top 3 highest population wards in Hanoi [4]

| Ward | Population |

| Hong Ha | 126,062 |

| Xuan Phuong | 108,984 |

| Thanh Xuan | 99,491 |

Top 3 highest population wards in Ho Chi Minh [4]

| Ward | Population |

| Hiep Binh | 215.638 |

| Tang Nhon Phu | 208.233 |

| Ba Diem | 204.289 |

Source: Tuoi Tre news, Tien Phong news

In contrast, the rise of residential community-based education centers opens up a new frontier for skill-based and holistic learning models. These centers are ideally positioned to serve families seeking convenience, safety, and well-rounded development for their children. Opportunities in this space include offering programs in soft skills, foreign languages, arts, STEM, and emotional intelligence—areas often underserved by traditional tutoring centers. By embedding themselves within the daily lives of residents, these centers can become trusted “Third Places” for children, fostering long-term loyalty and premium pricing potential.

Conclusion

Vietnam’s demand for after-school education is creating a highly promising market, with steady growth and strong household spending. The near-school model remains suitable for academic-focused programs, especially exam preparation, while the residential community model is better aligned with holistic development, convenience, and community engagement. This clear market segmentation presents valuable opportunities for education providers: by choosing the right location strategy and designing programs that match both geography and parental expectations, businesses can build competitive advantages in a rapidly evolving landscape.

[1] FiinGroup, Rising demand for private education in Vietnam <Access>

[2] VnExpress, Rural Vietnamese parents pour money into children’s English education <Access>

[3] Advertising Vietnam, Vietnamese parents are increasingly making bold investments in their children’s education—even in times of declining income <Access>

[4] Tien Phong, Hanoi: Expected names, areas, and populations of 47 wards after administrative unit arrangement <Access>

[5] Tuoi Tre, Top 3 largest and 3 most populous communes of the new Ho Chi Minh City <Access>

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |