14Jan2026

Latest News & Report / Vietnam Briefing

Comments: No Comments.

Thanks to its convenience and accessibility, payments using QR codes have been rapidly adopted in Vietnam’s retail landscape, including household businesses and micro-merchants. However, the introduction of Decree 70 and the shift from lump-sum taxation to revenue-based declaration expose structural weaknesses in the widespread use of personal QR codes. Under this regulatory pressure, the use of personal QR codes will inevitably decline, urging household businesses to switch to specialized services.

The popularity of QR Code

Vietnam has experienced rapid growth in cashless transactions over the past decade, with QR code payments emerging as one of the most widely adopted payment methods. According to the State Bank of Vietnam, in the first nine months of 2025, cashless transaction increases 43.3% in volume and 24.2% in transaction value compared to the same period the previous year. Particularly, transactions using QR Code have impressive growth: 61.6% in volume and 150.7% in transaction value[1].

QR codes are particularly popular among household businesses and street vendors because they are inexpensive, easy to deploy, and do not require POS terminals, which significantly lowers adoption barriers for micro-merchants[2]. Any shop-owner can adopt the method quickly by opening a bank account, generating a personal QR code, and placing it at the counter. As a result, QR payments have become embedded in daily consumer behavior, including informal retail environments such as wet markets and roadside stalls[3].

A green sticky rice vendor’s stall with a QR code

Source: Dan Viet

New tax regulation for household businesses

Vietnam’s regulatory landscape for household businesses is undergoing a fundamental shift that directly affects how QR codes can be used. Under the new tax framework introduced through Decree 70, the government is transitioning household businesses away from the lump-sum tax system toward a self-declaration regime based on actual revenue. Household businesses will be required to maintain proper accounting records, declare revenue periodically, and issue electronic invoices connected to tax authorities’ systems[4]. This represents a major departure from the previous model, where household businesses paid a fixed estimated tax and were not required to systematically document each transaction.

Problems of using Personal QR Code

Within this new regulatory context, the widespread use of personal QR Codes for business transactions has emerged as a problem.

Regulatory and Compliance Risks

When the new tax regime is issued, the QR Code for transfer and payment is also differentiated. Despite both relying on QR codes as a scanning interface, QR transfer is a peer-to-peer bank transfer method in which the QR code contains personal account information, allowing money to be sent directly to an individual’s bank account. This is the Personal QR Code method that business households have widely adopted. In contrast, QR payment is a payment solution issued to a registered business account. QR Pay transactions are recognized as commercial payments, are recorded as sales revenue, and can be automatically linked to POS systems, e-invoicing platforms, and tax authority reporting requirements[5].

Using Personal QR codes makes it difficult to distinguish between personal and business income. Under the new tax regime, this creates significant compliance risks, as tax authorities require transparent, auditable transaction records that align with declared revenue and issued e-invoices. The continued use of personal QR codes may expose household businesses to legal risks during tax inspections, including difficulties in explaining transaction flows and potential suspicions of under-reporting revenue[6]. In some cases, this can raise suspicions of tax evasion or unclear revenue reporting.

Lack of consumer protection

Another major drawback of using personal QR codes for business transactions is the limited protection of consumer rights. Payments made via personal QR codes are legally classified as peer-to-peer bank transfers rather than commercial transactions, meaning they fall outside the scope of formal merchant payment regulations. As a result, consumers often do not receive official receipts or invoices, and there is no standardized mechanism for refunds, chargebacks, or dispute resolution when goods are defective, services are not delivered, or fraud occurs. In cases of mistaken transfers or scams involving personal QR codes, banks are generally unable to reverse transactions without the recipient’s consent, leaving consumers exposed to financial loss[7].

Incompatibility with international payment systems

Another limitation of personal QR codes is their inability to connect with international payment networks. Personal QR transfers are typically tied to domestic bank accounts and local payment rails, such as interbank transfer systems within Vietnam, and are not designed to support foreign cards, international wallets, or global settlement standards. The lack of international compatibility not only limits revenue opportunities for household businesses but also creates friction in key sectors such as tourism and services, where foreign customer spending is significant[8]. As Vietnam promotes digital payments as part of its economic modernization strategy, this gap further strengthens the case for transitioning household businesses away from personal QR transfers

Services from major banks to support business households

Amid the regulatory pressure, household businesses face significant challenges when transitioning to registered payment solutions linked to business accounts. Common concerns include transaction fees, which are perceived as reducing already-thin margins; installation or setup costs for POS systems or software; and operational complexity, such as learning new apps, managing digital invoices, and reconciling transactions for tax declaration. Recognizing these barriers, Vietnamese banks have begun positioning themselves not merely as payment service providers but as digital transformation partners for household businesses.

MB Bank – The Digital Solution MB Seller

Through its MB Seller solution, MB offers an integrated digital ecosystem that allows household businesses to accept QR payments, manage transactions, and issue electronic invoices using only a smartphone, without requiring POS devices or additional hardware. This significantly reduces installation and upfront costs, one of the biggest barriers for micro-merchants. Importantly, the mobile phone app – mSeller is designed with tax compliance in mind, enabling transaction records to align with revenue declaration and electronic invoicing requirements under the new tax regime[9]. Using the app, household businesses can issue e-invoices using a smartphone[10].

Vietcombank – Merchant Payment Platform DigiShop

Vietcombank supports household businesses through VCB DigiShop, a merchant-oriented digital platform that emphasizes standardization, transparency, and regulatory alignment. DigiShop enables registered merchant QR payments and integrates transaction records with business account management, helping household businesses clearly separate personal and business cash flows. Importantly, Vietcombank’s solution is designed to connect with Vietnam’s broader digital commerce and tax ecosystem, including compatibility with eTax platforms and third-party POS and store management software such as KiotViet[11].

Agribank – Support Package for Household Businesses

Through its service package, Agribank addresses one of the most pressing barriers to adopting registered payment solutions: installation and service costs. Under this program, Agribank offers free installation and usage of digital payment and POS-related services for household businesses for up to three years (through 2028), significantly lowering the financial burden associated with transitioning to compliant merchant payment systems[12]. Besides, Agribank also leverages its extensive branch network and customer base, particularly in rural and semi-urban areas to provide hands-on guidance and digital banking access for household businesses[13].

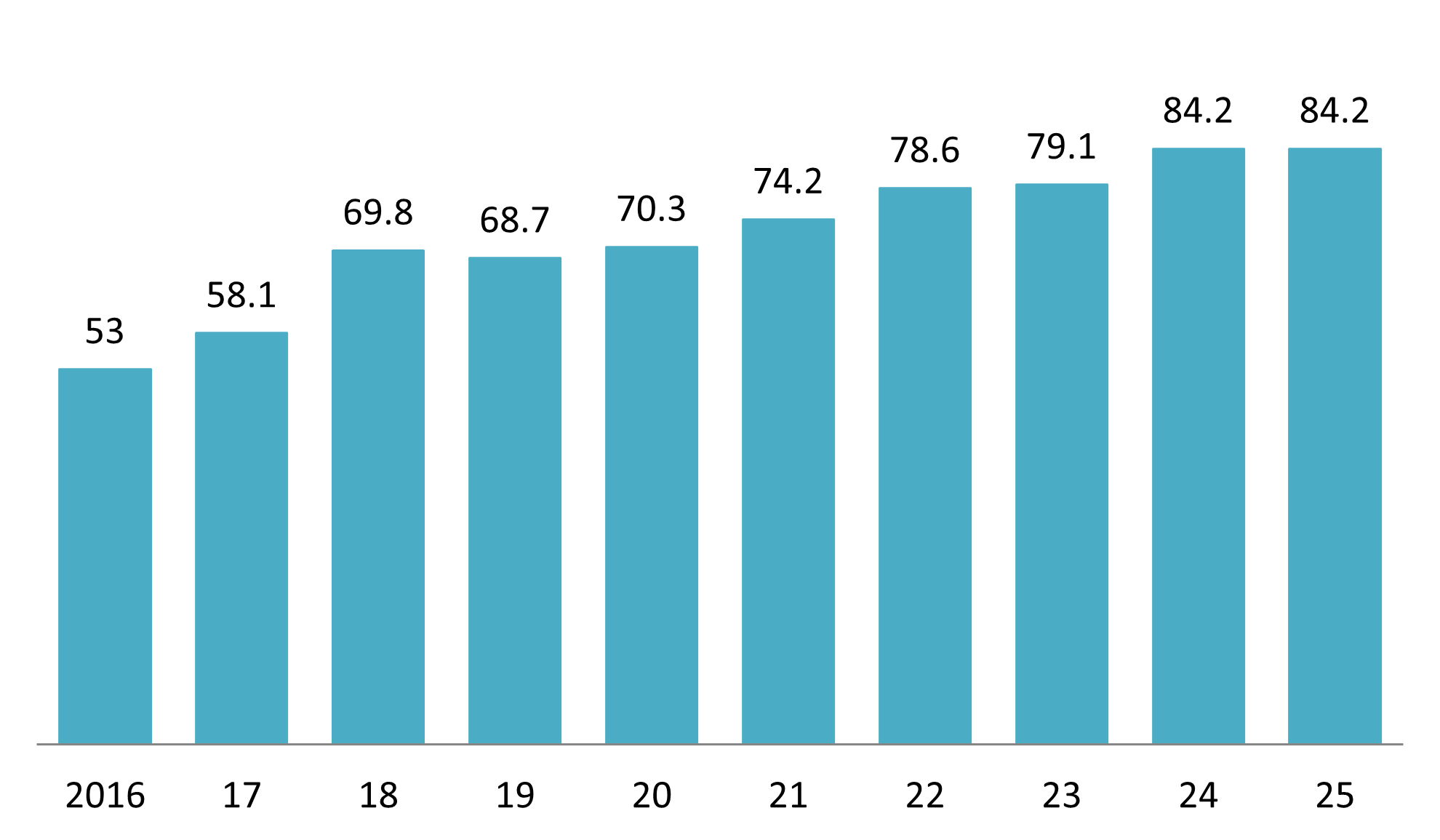

Other banks such as Techcombank, BIDV and Vietinbank also accelerate their support to help household businesses adopt in compliance with Decree 70 with discounted service packages and other innovative solutions. One prominent solution is SoftPOS, which allows merchants to accept card and wallet payments directly on NFC-enabled smartphones without installing traditional POS hardware[14]. This solution is cost-effective and suitable for the Vietnamese context, considering the widespread ownership of smartphones and Internet connections in Vietnam. According to the Ministry of Information and Communications, the smartphone ownership rate among adults is 84.4% in 2023 and is targeted to reach 100% in 2025[15]. The Internet adoption rate is increasing consistently over time.

Vietnam Internet adoption rate (2016-2025)

Unit: %

Source: DataReportal

Conclusion

The decline of personal QR codes and the mandatory shift toward registered payment methods under Decree 70 fundamentally reshape Vietnam’s household business landscape. The formalization of household business transactions creates clearer revenue data, stronger compliance infrastructure, and more standardized payments, improving market transparency. This opens opportunities for foreign fintech firms, payment service providers, POS and accounting software vendors, and cross-border payment networks to partner with local banks, integrate into Vietnam’s evolving digital payment ecosystem, and serve a newly formalized merchant base. In the medium term, the decline of personal QR codes and the rise of specialized accounts are likely to strengthen Vietnam’s investment attractiveness by aligning its retail payment infrastructure more closely with international standards.

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

[1] Government News, QR payments are booming and require comprehensive standardization (https://baochinhphu.vn/thanh-toan-qr-bung-no-va-yeu-cau-chuan-hoa-toan-dien-10225111919305399.htm)

[2] VnEconomy, Opportunities for QR payment growth (https://en.vneconomy.vn/opportunities-for-qr-payment-growth.htm)

[3] Vietnam Education E-Magazine, Digital transformation involves changing habits towards cashless payments (https://giaoduc.net.vn/chuyen-doi-so-bang-thay-doi-thoi-quen-de-thanh-toan-khong-dung-tien-mat-post253763.gd)

[4] Official: businesses with revenue under 500 million VND will still be required to keep accounting records in 2026 (https://thuvienphapluat.vn/phap-luat/ho-tro-phap-luat/chinh-thuc-doanh-thu-duoi-500-trieu-ho-kinh-doanh-van-phai-lam-so-sach-ke-toan-nam-2026-chi-tiet-ra-177463-250119.html)

[5] VnEconomy, Shift towards merchant-based QR payments (https://en.vneconomy.vn/shift-towards-merchant-based-qr-payments.htm)

[6] VnEconomy, Who benefits when upgrading QR money transfers to QR payments? (https://vneconomy.vn/ai-huong-loi-khi-nang-hang-qr-chuyen-tien-len-qr-thanh-toan.htm)

[7] VnEconomy, Shift towards merchant-based QR payments (https://en.vneconomy.vn/shift-towards-merchant-based-qr-payments.htm)

[8] Business and Integration E-Magazine, QR Code payments are booming, but many businesses still use personal codes? (https://doanhnghiephoinhap.vn/thanh-toan-qr-code-bung-no-nhung-nhieu-ho-kinh-doanh-van-dung-ma-ca-nhan-121646.html)

[9] MB Bank, MB provides MB Seller digital solutions (https://www.mbbank.com.vn/chi-tiet/tin-mb/mb-cung-cap-bo-giai-phap-so-mb-seller-dong-hanh-cung-ho-kinh-doanh-but-toc-60-ngay-chuyen-doi-ke-khai-thue-2025-11-24-16-3-3/6828)

[10] Government News, MB offers the mSeller app: Businesses can issue electronic invoices with just a phone (https://baochinhphu.vn/mb-tang-ung-dung-mseller-ho-kinh-doanh-chi-can-dien-thoai-la-co-the-xuat-hoa-don-dien-tu-102250614201231134.htm)

[11] Vietcombank, VCB Digishop – A comprehensive solution to support household businesses. (https://www.vietcombank.com.vn/vi-VN/To-chuc/SMEs/Danh-sach-tin-noi-bat-KHSMEs/Articles/2025/06/25/VCB-DIGISHOP-dong-hanh-cung-ho-kinh-doanh)

[12] Agribank, Agribank launches the product and service package “Agribank accompanies household businesses” (https://www.agribank.com.vn/vn/khuyen-mai/khuyen-mai-ca-nhan/khuyen-mai-ngan-hang-so/agribank-ra-mat-goi-san-pham-dich-vu-agribank-dong-hanh-cung-ho-kinh-doanh)

[13] Agribank, Agribank accelerates support for business households in digital transformation and implementation of Decree 70/2025/ND-CP (https://www.agribank.com.vn/vn/ve-agribank/tin-tuc-su-kien/tin-ve-agribank/hoat-dong-agribank/agribank-tang-toc-ho-tro-ho-kinh-chuyen-doi-so-va-thuc-thi-nghi-dinh-70-2025-nd-cp)

[14] Techcombank, SoftPOS – A convenient and cost-effective card payment solution (https://techcombank.com/thong-tin/blog/softpos)

[15] Decision No. 36/QĐ-TTg, Approval of the Information and Communication Infrastructure plan for the period 2021 – 2030, with a vision to 2050 (https://thuvienphapluat.vn/van-ban/Xay-dung-Do-thi/Quyet-dinh-36-QD-TTg-2024-phe-duyet-Quy-hoach-ha-tang-thong-tin-va-truyen-thong-2021-2030-595184.aspx)