15Nov2020

Industry Reviews

Comments: No Comments.

Recent developments surrounding Industry 4.0 and Internet of Things (IoT) have found traction and interest in the smart home market in Vietnam. The dramatically accelerating pace of technological innovation has resulted in the rising trend of owning a smart home in many developed countries around the world. With its two largest metropolises among top 10 fastest growing cities in terms of economic and real estate development (as listed in the City Momentum Index 2020 by Jones Lang Lasalle – JLL), Vietnam’s smart home market, though still in its infancy, possesses promising investment opportunities thanks to the rapid urbanization and the boom of megacities in the country.

Smart Home Market Revenue is expected to significantly increase in Vietnam

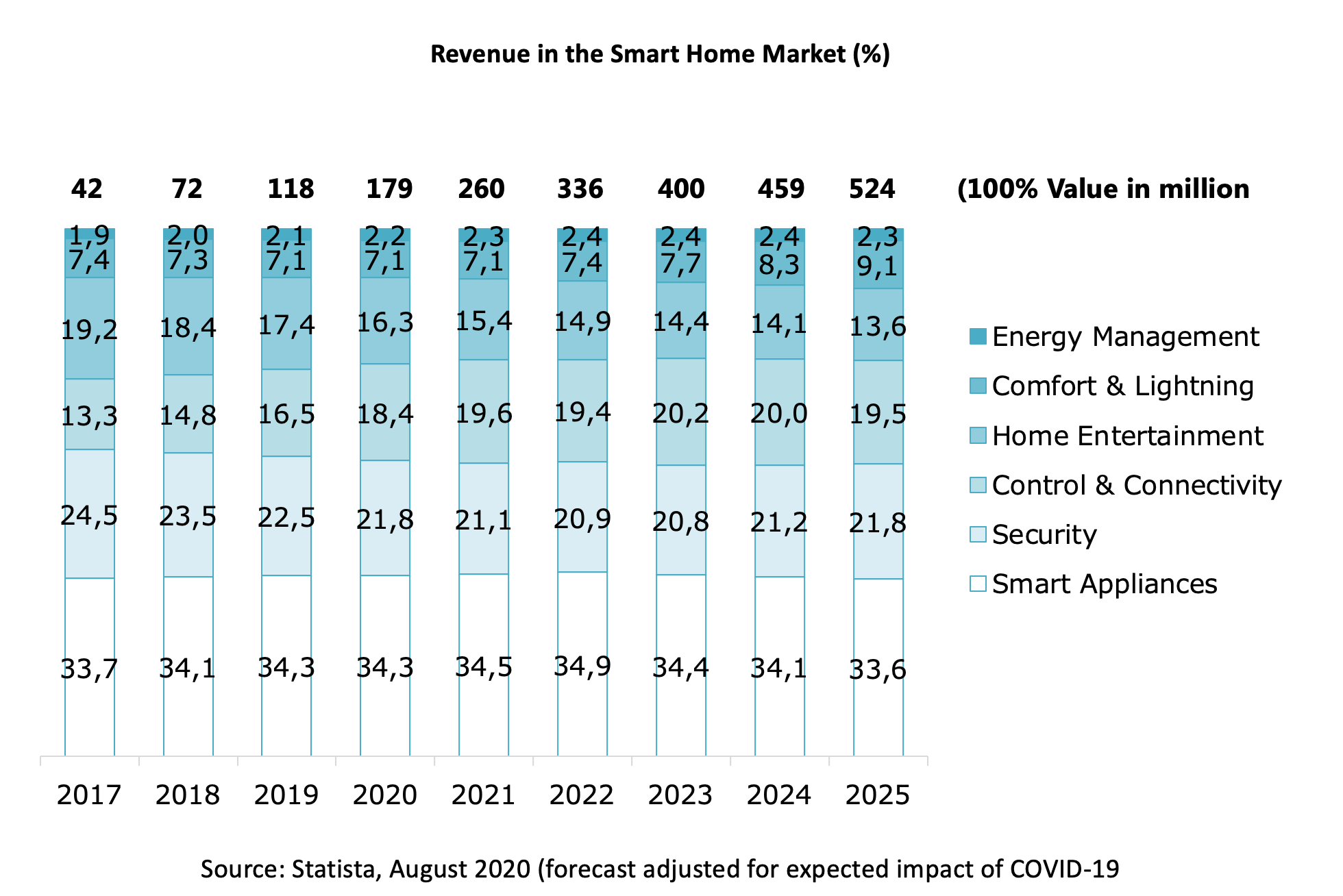

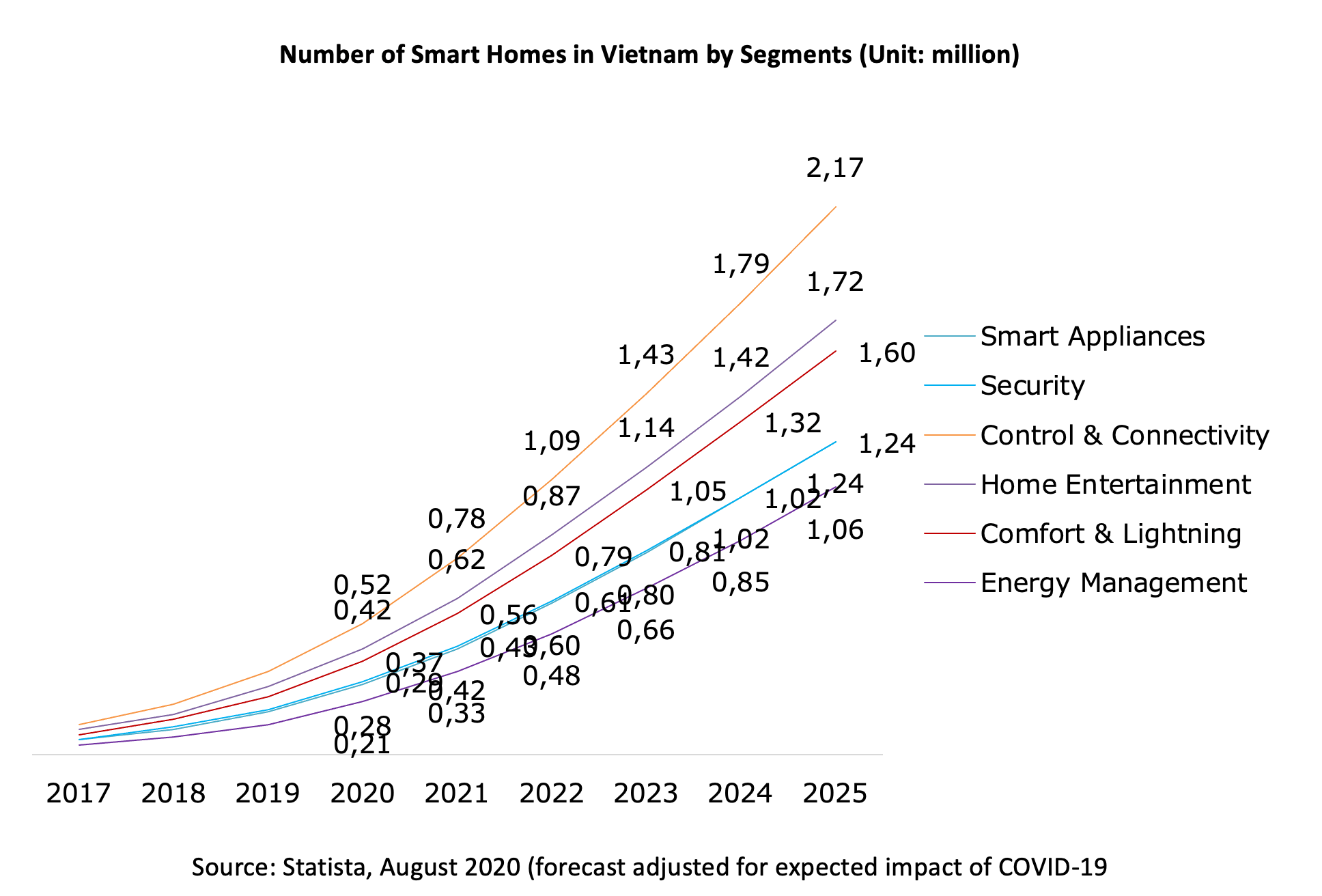

According to Statista, up to August 2020, the Vietnamese smart home market has reached revenue of about 179 million USD and experts predict this figure to reach 524 million USD in 2025 with a CAGR (2020-2025) of 23.9%. Of the total number of smart home product sales value in all 6 segments including control and connectivity, security, smart appliances, energy management, comfort and lighting, and home entertainment, major contributors to revenue are the first three in the list, accounting for more than 70% of total sales value over the researched period. In particular, “control and connect” is forecast to be the segment with most increase in market share over the next 5 years, followed by “comfort & lightning” and “energy management” despite being at a much smaller scale.

In terms of revenue growth, after the dramatic boom in the past 3 years with the peak of 70% growth rate in 2018, the smart home market is expected to slowly reach its stable growth period in the next 5 years at 14%. Remarkable drop point in the revenue growth rate is predicted to follow the impact of COVID-19. “Comfort & Lightning”, “Home Entertainment” and “Security” are the three segments with least growth rate drop.

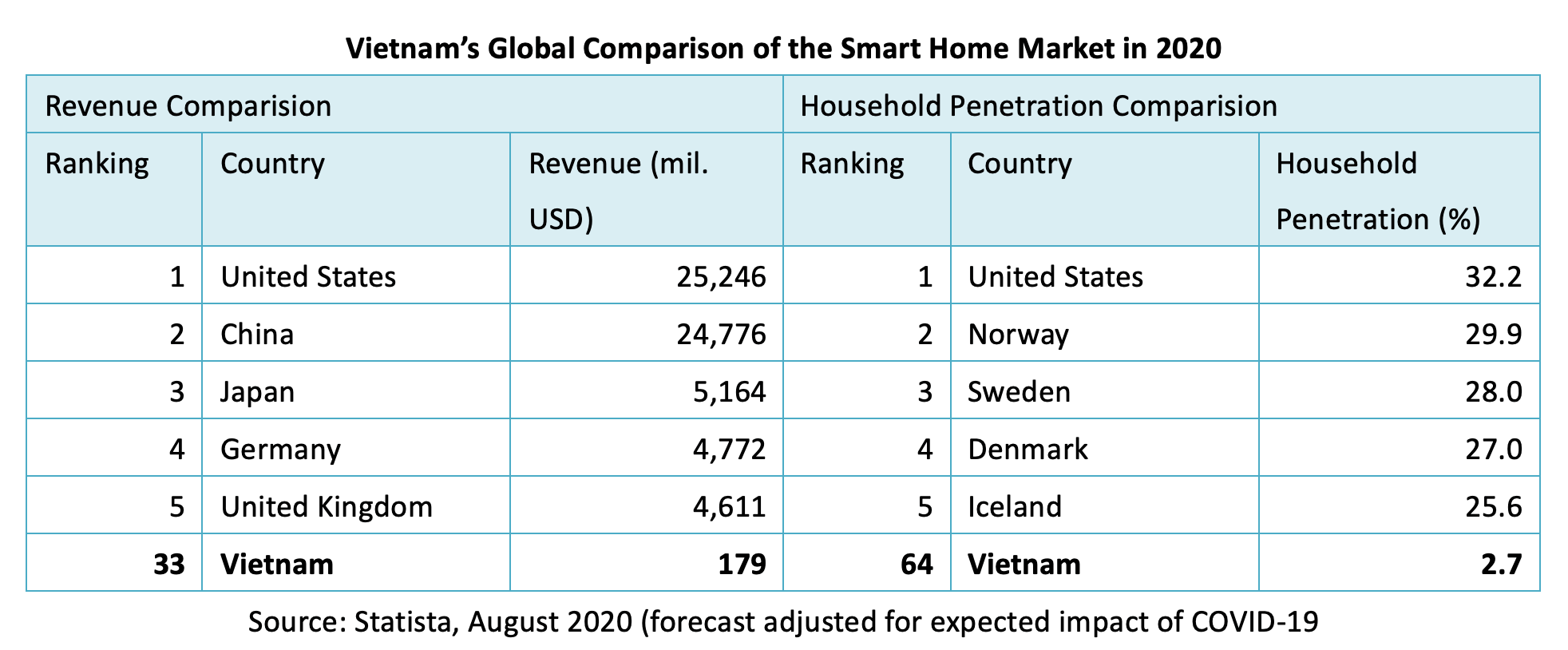

On the global aspect, the smart home market in Vietnam remains quite premature compared to other countries. According to statistics from Statista, by August 2020, Vietnam ranks 33 in terms of revenue and 64 in terms of household penetration. According to Vietnam Investment interview (VIR), Vietnam is still in the phase of “paving the way” for smart home market development, which is the time for customers to become familiar with smart home applications. As a result, investors and customers mainly choose basic solutions, such as a management system for air conditioning, lighting, and electricity. Only after stable demand is established, more advanced and specialized solutions might be able to integrate with the existing ones.

Residential developers of new urban projects to be the pioneers for smart home installation

According to Statista, the total number of smart homes in Vietnam in 2020 is about 0.6 million. This number is relatively small compared to the total number of more than 26.8 million households (General Statistic Office, 2019) in Vietnam. Moreover, as stated by JLL Vietnam, most smart homes are developed in the residential sector of newly built or still under construction projects located mainly in the two most urbanized cities of Vietnam – Hanoi and Ho Chi Minh city. However, installing smart technologies would result in a higher price tag for the properties, which would likely limit the target market to the high-end segment. This consequently explains one of the reasons why it was slow in the first phase to penetrate smart home market in Vietnam. Nonetheless, the potential for market growth is still high as many developers have become more proactive in integrating the concept of smart home in their projects and offering smart techs as extras in a promotion or free experience program.

Particularly, when looking at the six key segments of smart home application, even though not accounting for the highest in terms of revenue as stated above, “control and connectivity”, “home entertainment” and “comfort & lightning” are the most application for smart homes in Vietnam. It can be deduced that the ability to “control and connect” as well as entertainment and comfortness factors are the focal points of the smart home concept which is supposed to bring most added values for the daily life. In addition, integrated devices that can connect to another device will dominate the stand-alone devices because of its usability and functional diversity (Amazon’s Alexa Echo Dot, Hikvision’s Smart Camera, Yale’s Key can be integrated into the smart home system of Lumi Vietnam). Most of the households equipped with smart appliances will be high-end apartments with modern electrical systems.

Players landscape

As the development of smart homes becomes an indispensible trend, many international technology giants have established affliates in Vietnam. Along with the growth of the market is the launch of different brands in various segments to meet diverse users’ demand. The Smart Home market is divided into two groups including foreign brands: Siemens (Germany), Schneider (France), Smartg4 (USA), Gamma (Germany), Fibari (Poland), and well-known domestic brands such as BKAV Smarthome, FPT, Lumi, Acis, etc. Despite major concerns about the quality of domestic smart home products as they are mostly newly developed and not tested much, products by domestic players seem to be highly appreciated for their friendly features and affordable price. Moreover, according to analysis by Vietnam Investment Review, an obstacle for foreign smart home solutions is that they are not really compatible with the infrastructure and the development of the construction sector in Vietnam.

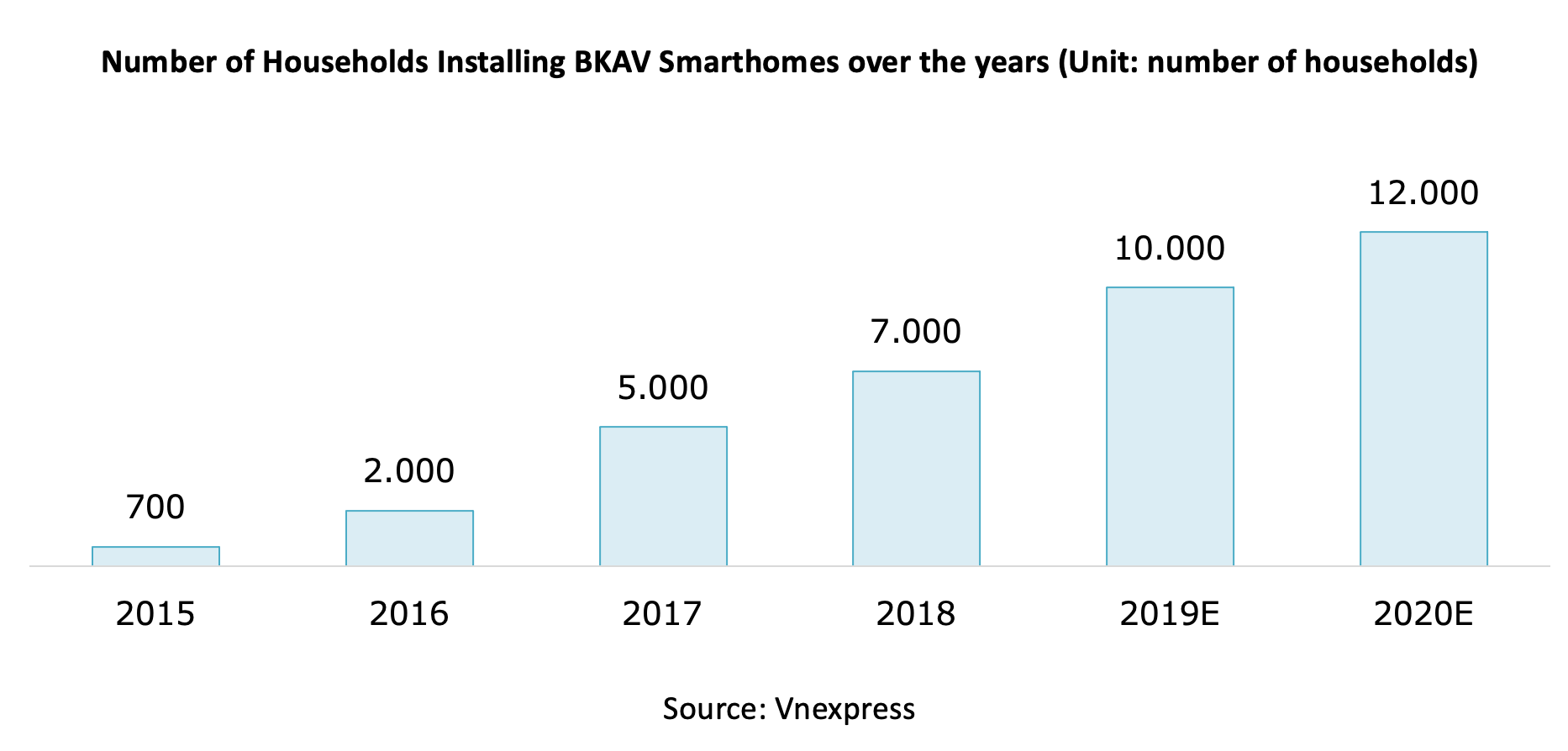

Taking BKAV statistics as an example, the number of households that installed BKAV’s smart home system has steadily increased. After launching the BKAV SmartHome package in 2014, they targeted the high-end segment of customers such as large villas, castles, etc. As a result, from merely 700 households installed BKAV smart home system in 2015 focusing on high-end segments, after 5 years, the estimated number of households installing BKAV smart home solutions is 12,000 with the corporation’s decision to expand the target to the mid-range segments since 2017 by offering the BKAV SmartHome Premium package at a more affordable price. They predicted that there will be many smart homes by well-known developers like Vinhomes, Son Kim Land, and Novaland to be released in Ho Chi Minh City in the future. As one of the dominant players in the smart home market in Vietnam, BKAV directly competes with foreign brands to offer their solutions at affordable prices. The company has won the contract to supply and install a smart home at FLC Sam Son resort complex, Thanh Hoa in 2017. It offers various products like smart appliances, security, home entertainment, and artificial intelligence solutions, etc. According to VIR, Bkav SmartHome has deployed nearly 60 projects in and outside of Vietnam. The most recent projects are Ecolife Capitol in Hanoi, Hanoi Landmark 51, and Condotel Royal Park Bac Ninh.

Lumi is another key player in the smart home market which provides inductive switches, smart electrical equipment, and smart home solutions. Lumi Vietnam had a project to integrate the smart home equipment system to 8,000 apartments at Vinhomes Tan Cang (Vinhomes Central Park) in Ho Chi Minh city as well as other Vinhomes megacities projects in Hanoi (Royal City, Times City). The compay offers three main packages of smart home systems with different price ranges in between 1,500 – 4,500 USD (“Lumi standard”, “Lumi medium”, and “Lumi Vip”). After 4 years of development, Lumi has the largest market share in the mid to high-end segment in Vietnam. Lumi Vietnam also exports products to foreign countries, such as India, Thailand, Australia, and Brazil.

Besides BKAV Corporation and Lumi, Acis is also considered as a successful smart home brand in Vietnam. Acis has successfully developed an exclusive wireless solution for smart homes, called Easy Control. According to the CEO of Acis, this company accounts for 70%-80% of the market share in the South in Vietnam. On an interview with EinPressWire in mid 2020, representative from Acis shared that their solutions have created a revolution in price when bringing the cost for smart home installation to only 1/4 compared to foreign products, and are also applicable for different house types in Vietnam including apartments, dwelling houses and villas.

Millennials and young modern families from middle and high-income groups are the focus of Vietnam smart home market

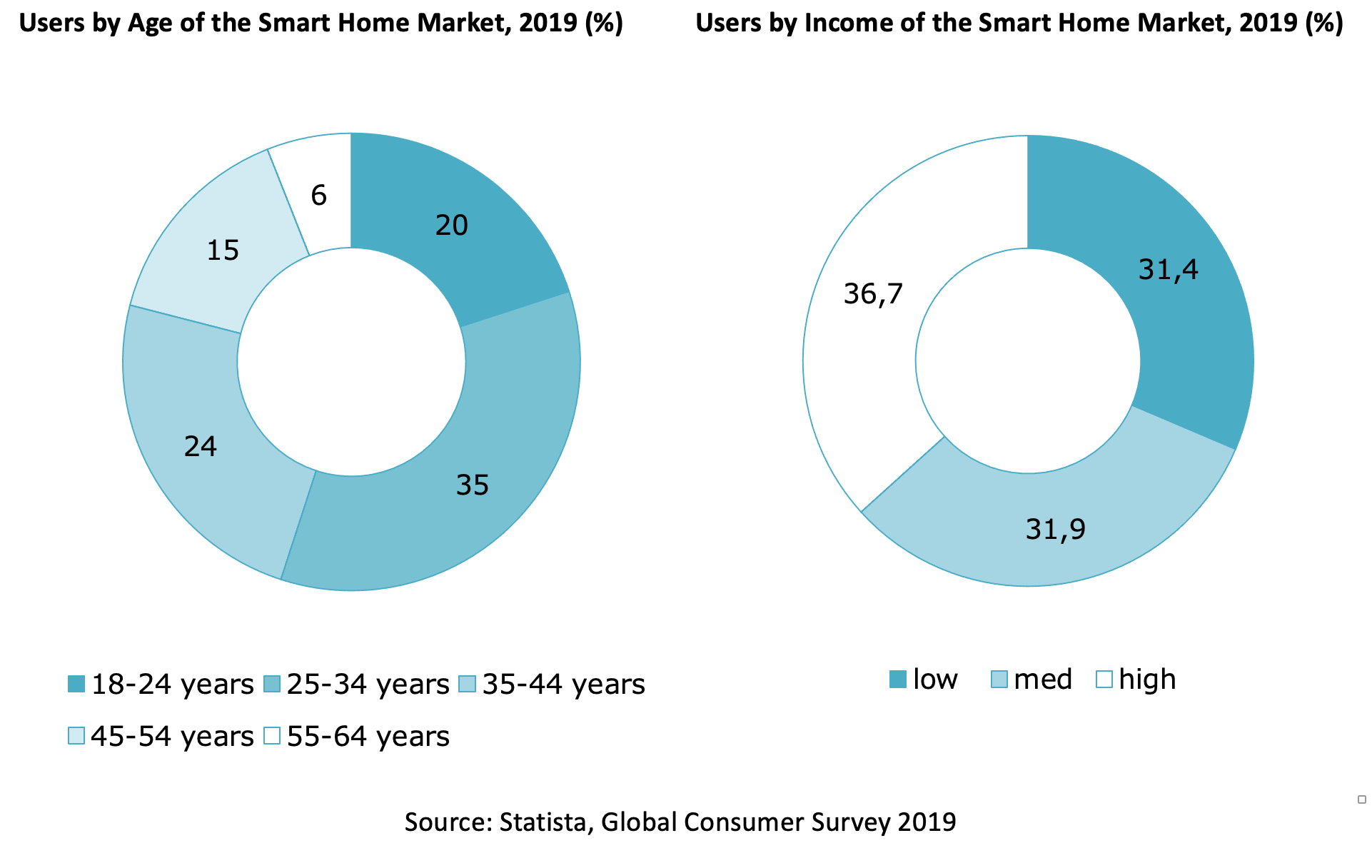

As shown in the figure above, when looking at smart home owners by age, penetration is highest among Millennials aged 25-34, accounting for 35% of smart home owners. Age groups 35 -44 and 18-24 account for 24% and 20% of total smart home owners, respectively. Born between 1980 and 2000, Millennials account for 35% of the population of Vietnam. This generation is the key group in the smart home market. Moreover, their growing tech-savviness can be explained for the acceleration in smart home preferences.

Looking at the smart home owners by income, most smart home owners understandably come from the high-income group (36.7%), medium and low-income groups share the same percentage for the number of users (32% and 31% respectively). The differences lie in the level of smart tech installation. In middle and high-income groups, smart homes are installed under a fully-integrated system and have a central control unit. These devices are interconnected, and can understand customer behavior. On the other hand, in the low-income segment, customers usually purchase selected devices in a smart home package to reduce costs. Customers in this segment are usually individual households, and they often purchase sensor switches or separate smart home appliances.

Factors affecting the potential of the smart homes market development

The key driving factors for the growth of smart home market in Vietnam can be explained by rapid urbanization, high penetration of smartphones and wireless network connection, and the large propotion of Millennials in total population. As mentioned by Vietnaminsider, Vietnam leads the world in the growth of smartphone traffic and the rise of millennials and their growing tech-savviness will boost user preference for technology. According to the article of Vnexpress, some users are very well acquainted with their new smart homes. They said that this system had the advantage of convenience, safety, and energy-saving in operation. However, they also expressed serious concerns about the elderly in the family. As Vietnamese families often live with many generations, the elderly in the family find it troublesome with smart appliances.

As for individuals, there are three key barriers in making decision to install smart home tech as shared by representative of Acis on EinPresswire. Firstly, it is the traditional psychology of which users are familiar with a contactor to control electrical appliances in their homes. This habit has created a psychological barrier in replacing contactor with any other smart devices. Secondly, the price for smart techs is not affordable for many people. Even though product offerings from many domestic brands have created much accessibility for smart home installation (1,500 – 4,500 USD on average for a basic package) compared to the price for foreign branded products, to own a smart home with out-of-the-box solutions and equipment, experts estimate that the lowest cost might be up to 25,000 USD (VIR, 2018). This amount of investment is comparatively high for a country with GDP per capita of 2,715 USD (Worldbank, 2019) and average monthly income per capita of approximately 180 USD (Statista, 2019). The third concern is the anxiety regarding the complexity of installation.

From the perspective of property developers, according to VN Economic Times, it also requires a large amount of homes be built using modern methods of construction so that it becomes easier for smart home technologies to be embed. Additionally, for homes to get truly smart, there is a need for wider and better-quality network connectivity in Vietnam.

Smart Home Market Trends to Expect in the coming years

In some metropolitan areas as Hanoi, Ho Chi Minh City, and Da Nang, smart homes are becoming a new trend for modern residents. They are Millennials who embraced the latest technology as well as potential customers. Moreover, the smart home market is aiming at young families who use technologies to improve their lives.

Smart homes are getting more popular and developers are encouraged to use smart technologies in building projects. The barrier in the growth of this segment is the high cost, considering the high demand. The price offered by smart apartments is higher than the conventional 10-15%. In the technology 4.0 trend, forecasting not only smart homes but also smart buildings have become urgent needs. In addition to technology, smart homes need to satisfy the requirements of a friendly environment, energy efficiency, and safety. Therefore, for long-term sustainable development, it is crucial for developers in Vietnam to make smart apartments truly smart, not just use it as a marketing buzzword.

To conclude, it can be said that smart home adaptation is indispensable as it can enhance user experience, bring more added values to daily life, improve the living standards as well as save time, money, and energy. In that notion, there will come a changing point, when people realize the benefits of smart home solutions, which in result can make them overcome any caution regarding having new technology in the home.

Reference:

- https://www.brandsvietnam.com/congdong/topic/10470-Thi-truong-nha-thong-minh-Viet-Nam-voi nhung-con-so-day-trien-vong-Quy-12018

- https://vneconomictimes.com/article/op-eds/smart-homes-to-grow-in-high-end-real-estate-market

- https://www.statista.com/outlook/279/127/smart-home/vietnam

- https://vnexpress.net/nha-thong-minh-dan-pho-bien-trong-cac-gia-dinh-viet-3863368.html

- https://www.vir.com.vn/smart-house-of-the-future-57134.html

- https://www.einpresswire.com/article/522251325/how-has-vietnam-smart-home-changed-after-10-years

- https://www.joneslanglasalle.com.vn/en/trends-and-insights/research/city-momentum-index-2020

- https://vnexpress.net/nha-thong-minh-no-ro-tai-viet-nam-3822895.html

- https://lumi.net.vn/du-an-hop-tac/du-nha-thong-minh-lumi-tai-vinhomes-tan-cang/

- https://acis.com.vn/don-xuan-dang-cap-cung-easycontrol/

- https://acis.com.vn/acis-smart-home-cong-ty-cong-nghe-viet-khien-nguoi-nhat-phai-ne/

- https://www.worldbank.org/en/country/vietnam/overview