20Jan2026

Highlight content / Highlight Content JP / Highlight content vi / Industry Reviews / Latest News & Report

Comments: No Comments.

Vietnam’s fruit and vegetable sector is a promising market open for foreign players. While the country remains a strong exporter of agricultural goods, a parallel and robust rise in imported fruits and vegetables highlights shifting consumer patterns and widening opportunities for foreign brands. This market report examines the landscape of fruit and vegetable imports, the drivers behind rising premium demand, and the implications for businesses seeking to capitalize on this market.

Vietnam’s increase in imported fruit and vegetables

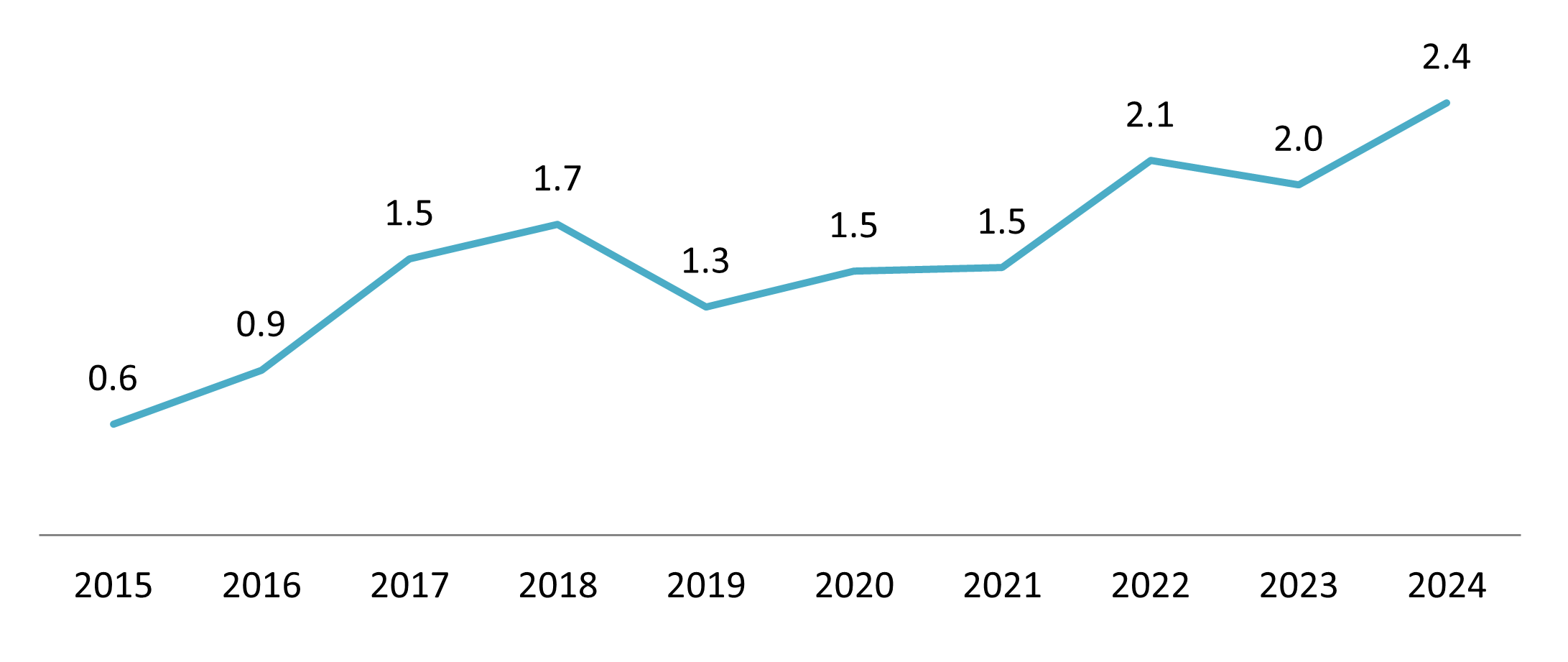

Vietnam’s import value of fresh and processed vegetables and fruit has trended upward over the past decade, reflecting expanding demand. According to statistics from the National Statistics Office, the import value reached USD 2.4 billion in 2024. The long-term trend shows sustained growth with some fluctuations due to disruptions and is constrained by the pandemic period. During 2015-2024, the CAGR is 16.6%, reflecting structural, long-term demand for imported fruit and vegetables by Vietnamese consumers[1].

Vietnam import value of Fresh, processed vegetables and fruit (2015-2024)

Unit: Billion USD

Source: National Statistics Office

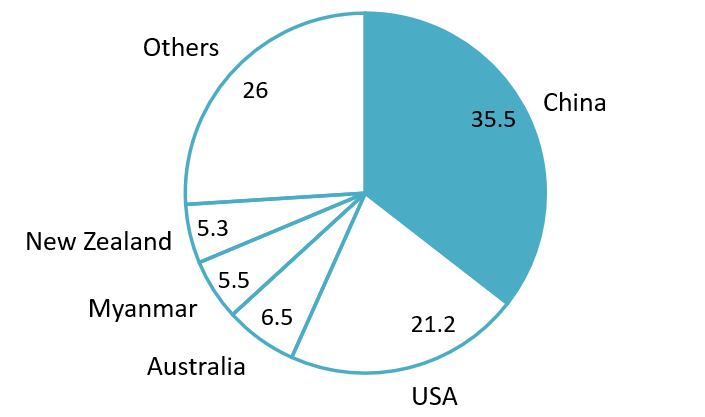

For the first 11 months of 2025, preliminary data suggest total fruit and vegetable imports approaching USD 2.6 billion[2]. Vietnam’s import base for fruit and vegetables is broad but dominated by a few key countries. China remains the largest supplier, contributing a significant share (over a third) of the total import value. The United States is the second-largest supplier with strong year-on-year growth, particularly in nuts (pistachios and almonds) and fruits (apples, cherries, and grapes)[3]. Australia and New Zealand also hold notable shares, especially in premium and counter-seasonal products (kiwifruits, cherries, grapes, blueberries) that are increasingly sought after[4].

Vietnam import value of fresh, processed vegetables and fruit by countries (11M/2025)

100% = 2.6 Billion USD

Source: Institute of Strategy and Policy on Agriculture and Environment (ISPAE)

Rising Premium demand for imported fruit and vegetables

Expansion of the Middle-class household

Vietnam’s middle class is growing rapidly. It is projected that middle-income households are expected to make up almost 30% of Vietnam’s population by 2026[5]. This translates into tens of millions of consumers with increasing disposable income and evolving consumption priorities. Middle-income households are increasingly allocating spending toward higher-quality foods, health-oriented products, and lifestyle enhancements, which include premium fruits and vegetables. Long before, imported fruits and vegetables displayed in supermarket stalls were considered luxury items. Now, they become more accessible and sought after by health-conscious households[6].

Consumer Priorities: Quality, Safety, and Traceability

Vietnamese consumers are becoming more discerning in their food purchases, increasingly prioritizing products that offer clear origin, safety assurance, and trusted certification. Many consumers value transparency and product quality even amid price sensitivity. High standards of traceability and third-party certification are viewed as key elements of trust that influence buying decisions in fresh produce, including fruits and vegetables[7].

Imported fruits with labels and quality marks in supermarket stalls

Source: Dung Ha agro-products

Customer expectations in Vietnam’s urban centers also emphasize safe agriculture and traceable supply chains. Hanoi initiates safe production and traceability to address concerns around pesticide use and unknown origins, reinforcing consumer confidence in products with verified safety credentials[8]. As a result, imported fruit and vegetable products with recognized quality marks and clear provenance increasingly attract Vietnamese buyers who are willing to pay a premium for trusted, high-quality options.

Preferences for Exotic and Seasonal products

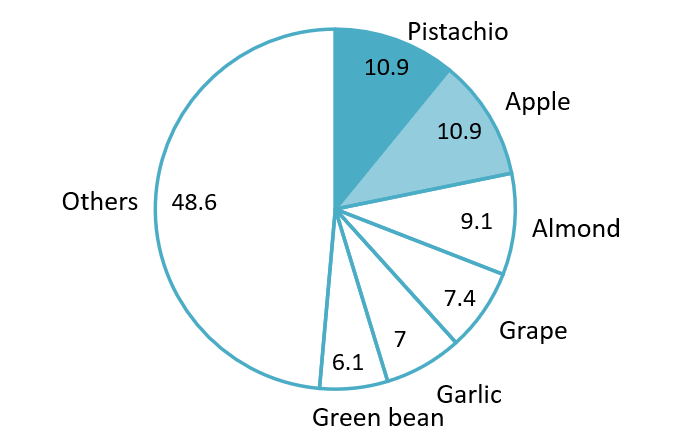

Vietnam’s tropical climate supports abundant local production such as bananas, mangoes, and durian, yet consumer interest in exotic and off-season fruits and vegetables remains high. Within 11 months of 2025, pistachios and apples each account for about 10.9% of total import value, while almonds (9.1%) and grapes (7.4%) also represent significant shares. These products cannot be produced competitively in Vietnam due to climate constraints, thus reinforcing reliance on imports.

Vietnam import value of fresh, processed vegetables and fruit by commodities (11M/2025)

100% = 2.6 Billion USD

Source: Institute of Strategy and Policy on Agriculture and Environment (ISPAE)

For pistachios and almonds, the US is the major supplier. These products are increasingly positioned as a “luxury nut,” favored for festive occasions, corporate gifts, and health-oriented use due to their high protein content and cardiovascular benefits. They are consumed not only as snacks but also as ingredients in plant-based milk, bakery products, and healthy foods[9].

Apples remain one of Vietnam’s most consistently imported fruits. While they are widely consumed across income groups, demand growth has increasingly shifted toward premium varieties from the United States, New Zealand, and Australia, which are perceived as safer, better tasting, and more reliably certified[10].

Foreign exporters benefit from FTA

Vietnam’s multiple free trade agreements (FTAs) have substantially reduced import tariffs on agricultural products. Under the EU–Vietnam Free Trade Agreement (EVFTA), most fresh and processed fruits and vegetables from the EU are subject to tariff elimination or sharp reductions over short transition periods[11]. Similarly, the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP)[12] provides preferential tariff treatment for nuts, fruits, and vegetables.

These tariff advantages have lowered retail prices for imported fruits and vegetables while maintaining quality differentiation, making premium products more accessible to middle-income consumers. As a result, imported apples, grapes, and nuts are no longer confined to niche segments but are increasingly present in mainstream supermarkets and modern retail chains.

Takeaways for Foreign Brands in Vietnam’s Fruit and Vegetable Market

The rapid growth of Vietnam’s imported fruit and vegetable market presents clear opportunities for foreign players, but success is not without challenges. Price sensitivity remains a prominent constraint, particularly beyond major urban centers, while logistics costs, cold-chain limitations, and complex import procedures can erode margins. In addition, competition from lower-priced but still attractive imports is notable, especially when neighboring countries like China have large production capacity and the advantage of quick distribution for perishable goods[13]. Taking these challenges into account, foreign brands are suggested to take these actions:

– Clearly justifying premium differentiation, which is rooted in quality, safety, and origin transparency

– Leveraging Vietnam’s extensive FTA network, optimize rules-of-origin compliance to fully capture tariff advantages, thus penetrating the mainstream customer segment.

– Leveraging modern retail channels (supermarkets, hypermarkets, specialty fruit stores) and online platforms as they offer cold-chain control and branding visibility (lack in traditional wet markets)

– Partnering with local distributors, who play a significant role in navigating regulations, logistics, and retail access

– Localizing marketing (particularly those that resonate with Vietnamese cultural preferences), seasonal promotions and consumer education to shift imported fruits and nuts from “occasional luxury” to habitual consumption

Overall, Vietnam’s premium fruit and vegetable market is moving toward greater sophistication, where trust, quality perception, and brand credibility increasingly shape purchasing decisions. Those able to align global strengths with local consumer expectations are best placed to capture sustainable growth as Vietnam’s demand continues to mature.

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

[1] National Statistics Office, Some main goods for importation (https://www.nso.gov.vn/)

[2] ISPAE, Market Report Fruit and Vegetables Industry, 12/2025 (https://thitruongnongsan.gov.vn/)

[3] Giao Thuong, Pistachio imports in the first 5 months of 2025 increase by 77% (https://giaothuong.congthuong.vn/nhap-khau-hat-de-cuoi-5-thang-nam-2025-tang-77-410773.html)

[4] Vietnam Investment Review, Imported fruit gaining a bigger foothold in market (https://vir.com.vn/imported-fruit-gaining-a-bigger-foothold-in-market-108233.html)

[5] Eastspring Investments, Investing in Vietnam’s middle-income boom (https://www.eastspring.com/vn/en/insights/thought-leadership/investing-in-vietnam-s-middle-income-boom)

[6] Vietnam Huong Sac Magazine, Consumption trends 2025: Imported fruits continue to attract Vietnamese customers (https://tapchivietnamhuongsac.vn/xu-huong-tieu-dung-2025-trai-cay-nhap-khau-tiep-tuc-hut-khach-viet-2212.html)

[7] PwC, Voice of Consumer (https://www.pwc.com/vn/vn/publications/vietnam-publications/voice-of-consumer-2025.html)

[8] Department of Agriculture and Environment – Hanoi, Promote the production and consumption of safe vegetables and fruits in Hanoi City (https://sonnmt.hanoi.gov.vn/cat172/812/Day-manh-san-xuat-va-tieu-thu-rau-qua-an-toan-tren-dia-ban-Thanh-pho-Ha-Noi)

[9] Giao Thuong, Pistachio imports in the first 5 months of 2025 increase by 77% (https://giaothuong.congthuong.vn/nhap-khau-hat-de-cuoi-5-thang-nam-2025-tang-77-410773.html)

[10] Investment Newspaper, Vietnam imports apples from the US, Australia, New Zealand… nearly 240 million USD/year (https://baodautu.vn/viet-nam-nhap-khau-tao-tu-my-australia-new-zealand-gan-240-trieu-usdnam-d215812.html)

[11] WTO Center, EVFTA and Vietnam’s fruit and vegetable industry: Commitments on tariffs (https://trungtamwto.vn/chuyen-de/18940-evfta-va-nganh-rau-qua-viet-nam-cam-ket-ve-thue-quan)

[12] WTO Center, CPTPP and Vietnam’s fruit and vegetable sector (https://wtocenter.vn/chuyen-de/15461-cptpp-and-vietnams-fruit-and-vegetable-sector)

[13] VnExpress, Chinese fruits and vegetables flock to Vietnam (https://vnexpress.net/rau-qua-trung-quoc-do-ve-viet-nam-4805765.html)