19Aug2025

Highlight content / Industry Reviews / Latest News & Report

Comments: No Comments.

A new trend in music consumption

As listening habits shift worldwide, digital music has become embedded in everyday life—and Vietnam is no exception. Rapid growth in internet access, especially among younger users, is fueling adoption: roughly 70% of the population is under 35, and ubiquitous smartphones make streaming the default mode of consumption.

Yet Vietnam’s digital music scene isn’t simply mirroring global trends. High integration with social platforms, strong demand for Vietnamese-language content, and listeners whose tastes span V-Pop, K-Pop, and US-UK all give the market a distinct profile. For distributors, success requires strategies attuned to these cultural and behavioral nuances. It’s no longer enough to push content; designing experiences that resonate—social, localized, and mobile-first—has become the real competitive edge.

2.5 times growth, with streaming music services taking center stage

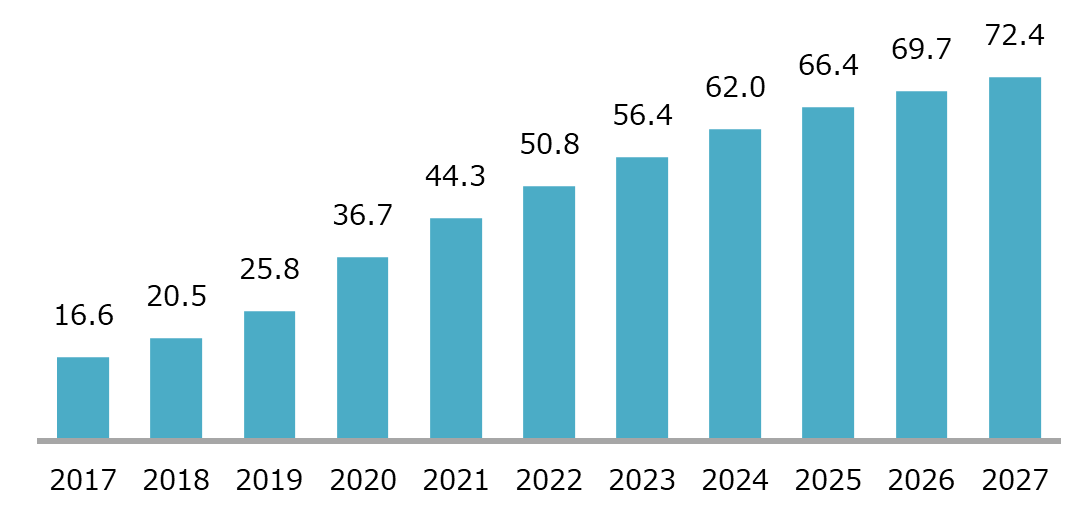

In the music industry, the growth of digital music is particularly noteworthy. In Vietnam, the digital music market, including streaming, downloads, and advertising, is rapidly expanding, and its momentum shows no signs of slowing down. The country’s digital audio market, including music and podcasts, expanded 2.5 times from 2019 to 2024 and reached 62 million USD in 2024[1]. Furthermore, the market is expected to continue growing to reach 72 million USD in 2027[2].

Among them, music streaming services are becoming increasingly prominent. By 2024, it accounted for over 60% of the entire market, amounting to approximately USD 40 million, firmly establishing itself as the leading player[3]. As the mainstream of music consumption is shifting to streaming worldwide, the same trend is becoming evident in Vietnam. With a mobile-centric usage environment in place and the user experience becoming more sophisticated, this is a field expected to see further growth.

Digital audio market size in Vietnam (million USD)

Source: RMIT Vietnam

Diversifying music platforms, choices are becoming polarized into three main options

In Vietnam, where digital music is becoming more widespread, the platforms for enjoying music are also diversifying. Along with the growing demand for streaming, multiple services that can be used according to users’ preferences and lifestyles are emerging.

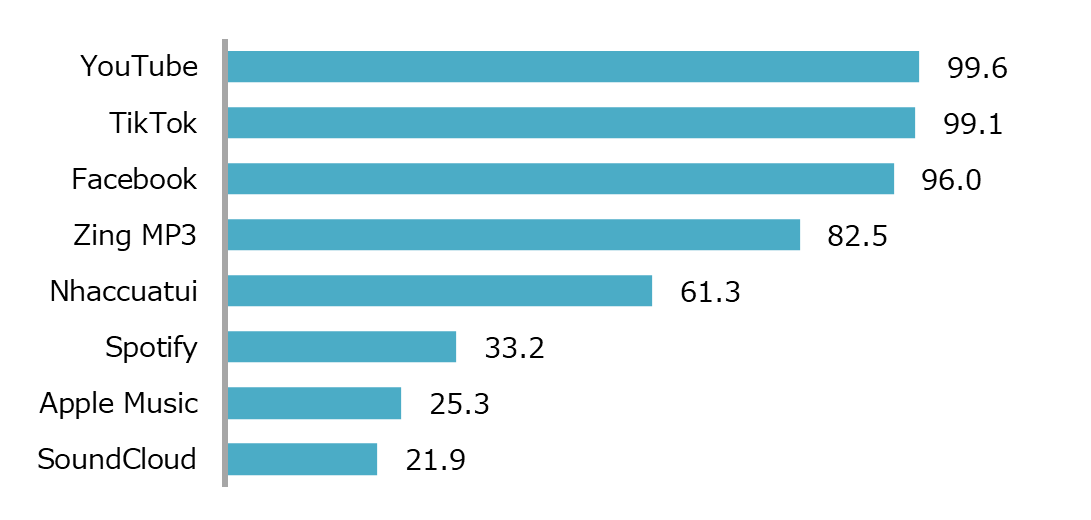

Music streaming usage rate (2024: %)

Source: RMIT Vietnam

Among these, video-based social media platforms such as YouTube, TikTok, and Facebook have made their presence felt. They combine features like commenting, sharing, and live streaming with music playback, enabling two-way connections between artists and fans. Participatory music experiences, where users create their own content rather than simply listening, have become a part of everyday life.

Meanwhile, local platforms like Zing MP3 and NhacCuaTui have a strong following among those who prefer content in their native language, thanks to their extensive Vietnamese music libraries and user-friendly interfaces. Some platforms, like SoundCloud, serve as a gateway for indie artists and serve as a platform for a diverse music culture.

In addition, international streaming services such as Spotify and Apple Music continue to expand. They are valued for their high sound quality, ad-free experience, and sophisticated playlists, particularly among urban and high-income groups, and are increasingly being used as tools to connect with the global music scene.

In this way, Vietnam’s music platform market is a coexistence of global and local platforms, developing by leveraging the strengths of each. The key to competition for each company will be how well they can meet the diverse expectations of their users.

From listening to creation: The changing way we engage with music

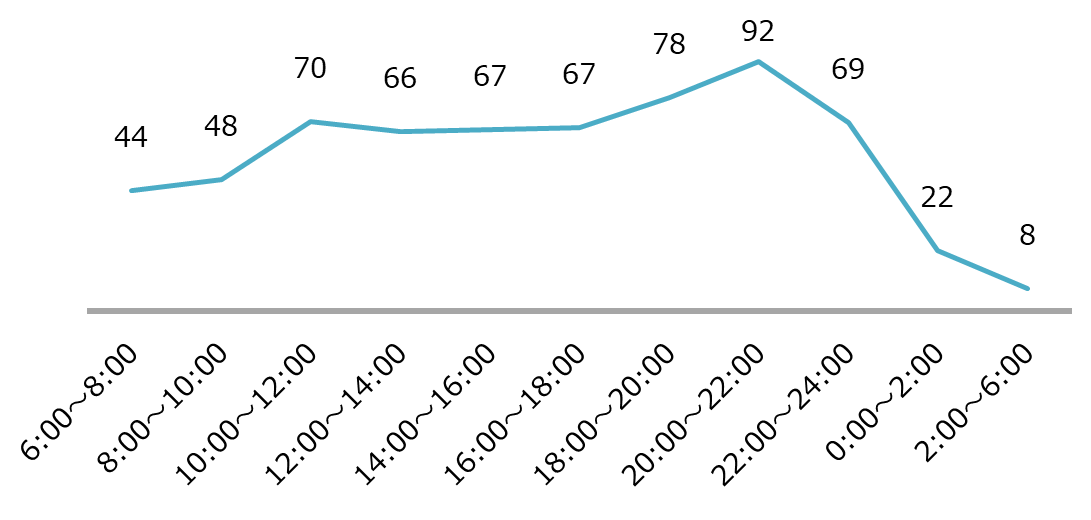

Music is no longer just entertainment in Vietnam. It has become a part of daily life through mobile devices, flowing naturally into daily routines such as the morning commute and evening relaxation. According to a survey, Vietnamese listeners spend an average of 1-2 hours listening to music per day, and the global mobile consumption style is becoming established.[4]

The time when Vietnamese people listen to music (%)[5]

Source: RMIT Vietnam

In response to these changes in user behavior, streaming platforms are also evolving. Recommendation features that suggest the best songs according to mood, activity, or time of day, as well as individually curated playlists, are the result of personalization through AI algorithms.

What’s noteworthy is the shift in how we interact with music, from “listening” to “participating.” Through platforms like TikTok and Instagram, users are singing, dancing, and remixing songs, actively promoting music as content creators. This kind of user-generated content (UGC) creates new hits and is fundamentally reshaping the mechanisms for music discovery and popularity.

Changes can also be seen on the artist’s side. They are focusing on releasing singles rather than albums and aiming for immediate interaction with fans through promotions linked with SNS and influencers. This movement brings flexibility that allows real-time responses to be reflected in strategies while keeping production and marketing costs down.

While this trend is part of a global one, the Vietnamese market has its own unique characteristics: Young people in urban areas are familiar with V-pop, K-pop, and hip-hop, while older people are more likely to listen to Vietnamese folk songs and ballads for extended periods of time.

As diverse tastes, evolving technologies, and new styles of creation and participation intersect, Vietnam’s digital music market is transforming into a dynamic and interactive environment. A “co-creative music ecosystem” where listeners, artists, and platforms resonate with each other is steadily taking shape.

Piracy, competition, and diversity hinder growth

While Vietnam’s digital music industry continues to grow rapidly, structural challenges are also becoming apparent. The biggest obstacle is piracy. According to a 2023 survey by IFPI, 66% of users listen to music from unlicensed sites and apps. This is due to customs from the 2000s, when free access was the norm, a lack of copyright awareness, and a deep-rooted resistance to paid subscriptions. Piracy is becoming more sophisticated, with unauthorized uploads to social media and unofficial apps, making it difficult to eradicate even as legitimate platforms expand. This negative cycle continues, putting pressure on artists’ earnings and hindering the inflow of investment capital.

Furthermore, intensified market competition is also unavoidable. Domestic and international services offer similar features and libraries, making differentiation difficult. Securing exclusive content, flexible pricing plans, student discounts, and bundling with other services are essential measures for retaining users.

Complicating the issue is the diversity of listener preferences. In addition to V-POP, there is also a strong interest in international genres such as K-POP and US-UK music. International services tend to lack local content and payment methods, creating significant barriers to use, especially in rural areas. Meanwhile, local services have advantages in payment and cultural compatibility, but lag in algorithmic recommendations, UI sophistication, and the expansion of global catalogs.

Countering piracy, differentiating services, and catering to diverse tastes: how Vietnam overcomes these three barriers will determine the sustainable growth of its digital music industry.

Awareness of copyright and passionate fans are driving market expansion.

Vietnam’s digital music market contains engines for growth. In addition to a young population, with over 70% under the age of 35, the spread of smartphones and the development of high-speed communication infrastructure are progressing, and there is also a high level of acceptance of new technologies. These conditions provide a foundation for mobile-centric music consumption.

In recent years, the diversification of subscription plans has also been a tailwind. Student discounts and flexible billing systems have been introduced, steadily lowering the threshold for paid services. Behind this is a growing user awareness of copyright. There are signs of change in consumer behavior, which was once dominated by pirated versions, and the use of legal streaming is gradually spreading.

Another area of focus is fan-led engagement. Passionate fan communities, primarily young people, connect directly with artists via social media and streaming services, participating in live streams, exclusive content, and online events. Zing MP3 and Spotify, among others, are leveraging this enthusiasm to launch campaigns aimed at attracting loyal users. Fans are both “consumers” and “supporters.” For platforms, the key to competitive advantage is how to nurture and retain this demographic, which is willing to financially support artists.

The future of Vietnam’s music economy, where culture and technology merge

The market still faces challenges. Eradicating piracy is difficult, and there is fierce competition in content differentiation and pricing. However, at the same time, with users maturing, technological advancements, and increasing opportunities to adapt to cultural localization, the Vietnamese market is entering its next stage of growth.

What is required is not the pursuit of short-term subscriber numbers, but rather strategies based on data, a deep understanding of user behavior, and the design of music experiences co-created by artists, fans, and platforms. In addition to innovation by private companies, collaboration with public support, such as copyright protection and the development of payment systems, is also essential.

In the future, Vietnam’s digital music industry will likely face a major turning point toward maturing as a “music economy” where culture and technology intersect.

[1] Source:RMIT Vietnam「Vietnam Digital Music Landscape 2024-2025」

[2] Source:RMIT Vietnam「Vietnam Digital Music Landscape 2024-2025」

[3] Source:RMIT Vietnam「Vietnam Digital Music Landscape 2024-2025」

[4] Source:RMIT Vietnam「Tune In: Vietnamese Listeners Leading the Digital Music Shift」

[5] Source:Vietnam Digital Music Market Trends 2024-2025″ (RMIT University) The charts and graphs on platform usage and “preferred times” for music consumption published in the report by the Ministry of Economy, Trade and Industry (METI) of Vietnam do not disclose the specific number of survey subjects, attributes, or survey methods used to collect the data. The report states that the analysis is based on the results of multiple surveys conducted in August and November 2023, but the correspondence between the results and the individual data sets reflected in the charts and graphs is unclear. Therefore, additional information is needed to assess the statistical reliability and representativeness of the charts and graphs.

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |