17Apr2025

Latest News & Report / Vietnam Briefing

Comments: No Comments.

Korea is one of the largest investors in the Vietnamese market, particularly in sectors such as manufacturing, technology, and real estate. With a large number of Korean enterprises and the stable growth of Vietnam’s economy in recent years, Vietnam presents a promising market for Korean investors to enter.

Overview of Korea FDI in Vietnam

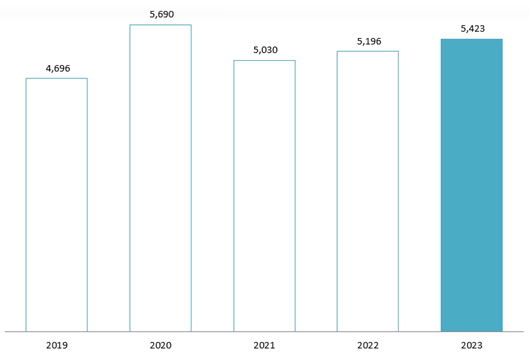

As of 2024, the total registered FDI from Korea to Vietnam has reached 92 billion USD, accounting for approximately 18% of Vietnam’s total FDI, and making Korea the largest investor. Overall, since 2015, newly registered FDI from Korea to Vietnam has fluctuated significantly, with 2020 experiencing a sharp decline due to the COVID-19 pandemic, leading to a drop to around 4 billion USD. However, with the continued development of Vietnam’s economy, newly registered FDI from Korea began showing signs of recovery in 2022, with a CAGR of 20%, ultimately reaching approximately 7 billion USD in 2024.

Newly registered FDI from Korea to Vietnam by year

Unit: Billion USD

Source: Vietnam Chamber of Commerce and Industry

The primary investment sectors of Korean in Vietnam include manufacturing, real estate, construction, energy, high technology, services, and automotive industries.

Some notable investment from Korean enterprises in recent years

| Company name | Sector | Investment year | Investment project |

| Samsung | High technology | 2024 | Invest 2 billion USD to manufacture OLED screen for cars and other electric devices |

| Daewoo Engineering & Construction | Real estate and Construction | 2024 | 105 million USD investment in real estate project in Thai Binh and Dong Nai |

| Lotte Group | Retails, F&B, Finance and others | 2023 | Investing 643 million USD to build Lotte West Lake Shopping mall in Hanoi |

| Hyosung Group | Industrial & Energy | 2024 | Starting in 2024, Hyosung Group committed to investing 4 billion USD in the energy, industrial, and IT sectors. |

Source: Vietnam Chamber of Commerce and Industry

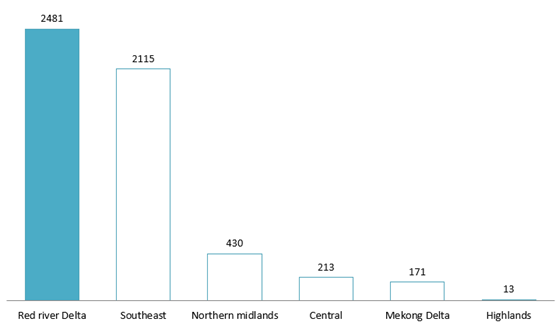

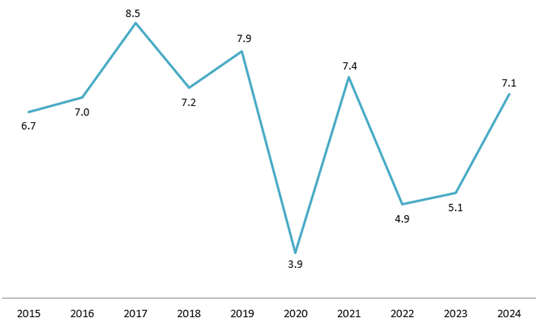

Overview of Korean companies in Vietnam

According to B&Company’s database, there were over 5,400 Korean enterprises in Vietnam in 2023, leading the number of FDI companies in the country. This represents a subtle 4% increase compared to 2022 and a CAGR of 7% from 2019 to 2023. These companies are primarily located in the northern region and several provinces in the south, with key industrial provinces such as Bac Ninh, Hai Phong, Dong Nai, Vinh Phuc, and Ho Chi Minh City.

Number of Korean companies in Vietnam from 2019 – 2023

Unit: Enterprises

Source: B&Company Enterprises Database

Areas of operation of Korean companies in Vietnam in 2023

Unit: Enterprises

Source: B&Company Enterprises Database

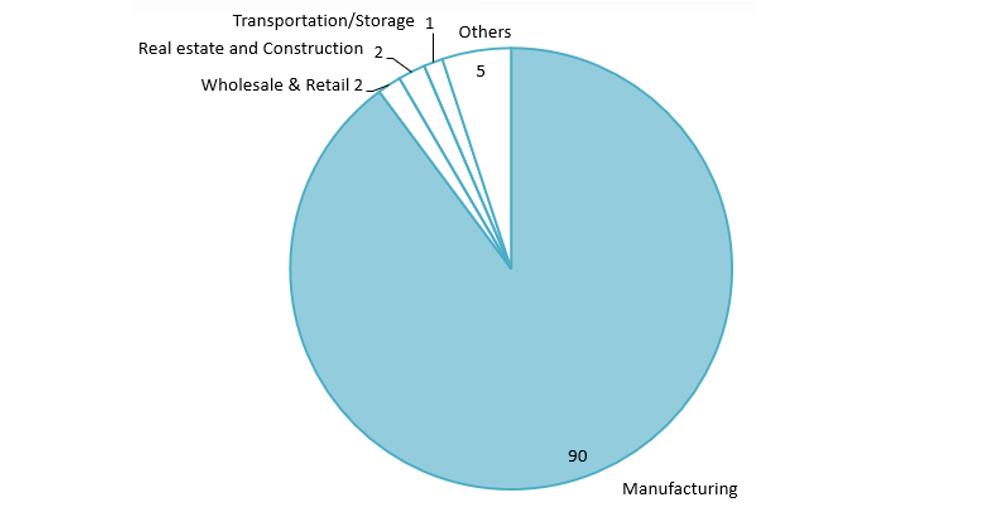

Korean businesses with significant investments in Vietnam primarily operate in the manufacturing sector, which accounted for 90% of their revenue in 2023. The remaining 10% of revenue is distributed evenly across other sectors such as Wholesale & Retail, Transportation/Storage, Real estate and Construction. Within the manufacturing sector, communication equipment manufacturing leads in revenue, followed by electronic components and boards, footwear, textile products, and others.

Total revenue of Korean companies in Vietnam in 2023 by sectors

Unit: 100% = 106 billion USD

Source: B&Company Enterprises Database

Main Korean companies in Vietnam by revenue

| Company name | Main sector | Operation year | Location |

| LG Display Vietnam Hai Phong | Communication equipment manufacturing | 2013 | Hai Phong |

| Samsung Electro-Mechanics Vietnam | Electronic components and boards manufacturing | 2008 | Thai Nguyen |

| Hyosung Vietnam Limited company | Textile manufacturing | 2007 | Dong Nai |

| BHFlex Vina Limited company | Electronic components and boards manufacturing | 2013 | Vinh Phuc |

| TXG Taekwang Vina JSC | Footwear manufacturing | 1994 | Dong Nai |

Source: B&Company Enterprises Database

Opportunities and challenges for Korean companies in Vietnam

On December 5th, 2022, Vietnam and Korea officially established a strategic partnership, further strengthening their cooperative relationship[1]. This development opens up more investment opportunities for Korean businesses seeking to enter the Vietnamese market. Vietnam benefits from a strong economic foundation, favorable support policies, a strategic location, and abundant resources. Additionally, the country’s economic growth, along with expansion in sectors such as energy, semiconductors, and infrastructure, presents promising prospects. Vietnam’s focus on large-scale projects, such as nuclear power plants, gas power plants, semiconductor chip manufacturing, and the North-South high-speed railway, creates favorable conditions for major Korean corporations to consider expanding their investments into the Vietnamese market[2].

However, alongside these significant opportunities, Korean investors also face several challenges. Firstly, there is intense competition from investors in countries such as Singapore and Japan, which can make investment more difficult. Cultural differences may also present challenges, as while Vietnamese consumers generally view Korean products favorably, differences in management styles and business practices could lead to friction. Finally, Vietnam’s regulatory environment can be complex, with multiple layers of government and inconsistent enforcement of laws and regulations, which may impact the ease of doing business, especially for foreign investors.

Conclusion

Korean companies in Vietnam have significant opportunities, particularly in sectors like electronics, textiles and footwear manufacturing. However, challenges such as regulatory complexity, local competition, cultural differences, will become a hurdle for investors. By leveraging the strong cultural ties between the two nations and tapping into Vietnam’s growing economy, Korean companies can expand their market share while maintaining awareness of the local business landscape.

[1] The Government News (2022). Vietnam – South Korea Elevates Relations to ‘Comprehensive Strategic Partnership <Access>

[2] Business Forum Magazine (2025). The New ‘Taste’ of South Korean Investors <Access>

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |