운동 시장 개요 신발 제품

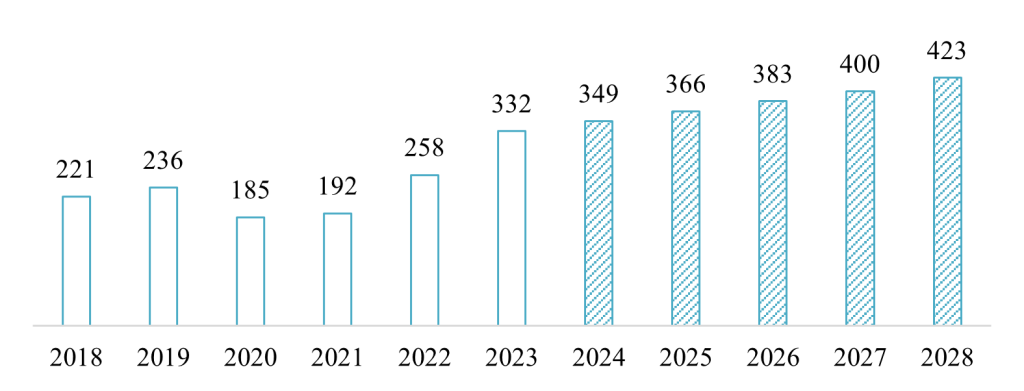

최근 몇 년 동안 베트남에서는 러닝과 트레킹의 인기가 크게 상승하며 운동화 시장의 상당한 성장을 이끌었습니다. 이러한 추세는 국내 및 해외 브랜드 모두에게 새로운 기회를 창출했습니다. Statista에 따르면 베트남 운동화 시장 매출은 2018년부터 2023년까지 연평균 8.5조 1,300억 원의 성장률을 기록하여 2023년에는 1,400억 원, 3억 3,300만 원에 도달할 것으로 예상됩니다.

수익 운동화 2018년부터 2028년까지의 베트남

단위: 백만 달러

원천: 스타티스타

이러한 놀라운 성장은 몇 가지 주요 요인에 기인합니다. 첫째, 특히 COVID-19 팬데믹 이후 건강에 대한 인식이 눈에 띄게 높아졌습니다. 베트남 스포츠청은 2022년 기준으로 약 36%가[1] 베트남 국민의 90%가 규칙적으로 운동을 합니다. 둘째, 조직적인 달리기 행사의 확산이 중요한 역할을 했습니다. 2023년에는[2]베트남에서는 41개의 풀 마라톤 대회가 개최되어 전년 대비 25% 증가했습니다. 이 대회들은 27개 성과 도시에서 264,000명 이상의 참가자를 모았으며, 13개 대회는 각각 최소 10,000명의 참가자를 기록했습니다. 셋째, 사파와 달랏과 같은 지역에서 트레킹을 포함한 모험 관광이 국내외 관광객들 사이에서 인기를 얻고 있습니다.

Da Nang 11th International Marathon in March 2024

원천: 라오동

주요 플레이어

베트남 운동화 시장은 다양한 국내 및 해외 브랜드가 혼재되어 있으며, 각 브랜드는 성장하는 러닝 및 트레킹 시장에서 시장 점유율을 확대하기 위해 경쟁하고 있습니다. 국내 브랜드 중 비티스(Biti's)는 "헌터(Hunter)" 라인으로 러닝 시장을 성공적으로 공략했으며, 비엣렉(Vietrek)은 아웃도어 및 트레킹 장비 부문에서 인기를 얻고 있습니다. 주로 패션 브랜드인 카니파(Canifa)는 러닝 의류를 포함한 스포츠웨어 분야로 사업을 확장했습니다.

비티의 헌터의 예

원천: 도시

나이키와 아디다스 같은 글로벌 대기업들이 프리미엄 시장을 장악하고 있으며, 언더아머와 뉴발란스는 최근 몇 년간 상당한 시장 진출을 이뤄냈습니다. 노스페이스와 컬럼비아는 트레킹과 트레일 러닝 부문에서 강력한 입지를 구축했습니다. 전자상거래의 발전은 시장 성장을 더욱 촉진하여 베트남 소비자들이 해외 스포츠 제품을 쉽게 접할 수 있도록 했습니다. 예를 들어, 데카트론(프랑스)은 베트남에서 멀티채널 전략을 성공적으로 실행하여 2019년 베트남 진출 이후 인스타그램 팔로워 약 50만 명을 보유한 탄탄한 온라인 입지를 구축했으며, 7개의 오프라인 매장도 운영하고 있습니다.

특히 일본 스포츠 브랜드들은 베트남 시장에서 특히 성공을 거두었는데, 이는 양국 간의 높은 품질과 문화적 유사성에 대한 인식을 바탕으로 이루어졌습니다. 아식스는 특히 열정적인 러너들 사이에서 상당한 성장을 이루었고, 몽벨은 아웃도어 장비 시장에서 틈새시장을 개척했습니다. 이러한 일본 브랜드들은 서구 브랜드에 비해 고품질을 추구하면서도 가격은 다소 저렴한 대안으로 자리매김했습니다.

ASICS 런닝화 예시

원천: 아식스

미래 전망 및 비즈니스 통찰력

베트남 운동화 시장의 미래는 밝습니다. Statista는 이 부문이 2024년부터 2028년까지 연평균 성장률 51%(TP3T)로 꾸준한 성장을 보일 것으로 전망합니다.[3]이러한 낙관적인 전망은 여러 요인에 의해 뒷받침되는데, 그중 하나는 베트남의 지속적인 경제 성장으로 가처분소득이 증가하고 스포츠 용품 지출이 증가할 것으로 예상되는 점입니다. 베트남의 젊고 건강에 관심이 많은 인구와 하이킹, 트레킹, 그리고 운동의 증가 또한 주요 요인입니다. 또한, 환경에 대한 인식이 높아짐에 따라 친환경 스포츠 용품에 대한 수요도 증가할 수 있습니다.

비즈니스에 대한 통찰력

이러한 트렌드를 활용하고자 하는 기업들은 몇 가지 중요한 통찰력을 얻을 수 있습니다. 급성장하는 러닝 트렌드는 투자자들에게 촉매제로 작용하여 이벤트 기획, 러너를 위한 특화 제품 및 서비스 제공 등 다양한 분야에서 매력적인 기회를 제공합니다. 성공적인 브랜드는 현지화를 우선시하고, 베트남 소비자의 선호도와 체형에 맞춰 제품 및 마케팅 전략을 조정해야 합니다. 프리미엄 세그먼트가 성장하고 있지만, 대부분의 소비자는 가격에 민감하기 때문에 다양한 시장 세그먼트에 맞춰 다양한 가격대를 제시해야 합니다. 진화하는 소매 환경에서는 강력한 이커머스 입지와 제품 체험을 위한 오프라인 매장을 결합하는 옴니채널 전략이 매우 중요할 것입니다. 이벤트나 소셜 미디어 참여를 통해 제품 관련 커뮤니티를 성공적으로 조성하는 브랜드는 더욱 강력한 고객 충성도를 확보할 가능성이 높습니다. 또한, 가시적인 성능 이점을 제공하는 제품은 점점 더 정교해지는 시장에서 우위를 점할 것입니다.

결론적으로, 베트남의 러닝 및 트레킹 트렌드는 스포츠 제품 사업에 중요한 기회를 제공합니다. 시장이 지속적으로 발전함에 따라, 적응력과 현지 소비자 선호도에 대한 심층적인 이해는 시장 점유율 확보 및 브랜드 충성도 구축의 핵심이 될 것입니다. 적절한 접근 방식을 통해 국내 및 해외 브랜드 모두 성장하는 이 시장에 진출하여 베트남 스포츠 및 피트니스 문화의 지속적인 발전에 기여할 수 있습니다. 경제 성장, 건강 인식 향상, 그리고 젊고 활동적인 인구의 조합은 베트남을 글로벌 스포츠 제품 산업의 새로운 개척자로 자리매김하게 했습니다.

[1] https://polylionwool.com/dieu-huong-boi-canh-nang-dong-phan-tich-nganh-thi-truong-do-the-thao-viet-nam-nam-2024/

[2] https://cafebiz.vn/cu-hich-lon-cua-phong-trao-chay-bo-den-linh-vuc-kinh-doanh-the-thao-tai-viet-nam-176240623080055995.chn

[3] https://www.statista.com/outlook/cmo/footwear/athletic-footwear/vietnam#:~:text=Vietnam%20is%20expected%20to%20contribute,(CAGR%202024%2D2028).

| 주식회사 비앤컴퍼니

2008년부터 베트남에서 시장 조사를 전문으로 하는 최초의 일본 기업입니다. 업계 보고서, 업계 인터뷰, 소비자 설문 조사, 비즈니스 매칭을 포함한 광범위한 서비스를 제공합니다. 또한, 최근 베트남에서 900,000개 이상의 기업에 대한 데이터베이스를 개발하여 파트너를 검색하고 시장을 분석하는 데 사용할 수 있습니다. 문의사항이 있으시면 언제든지 문의해주세요. info@b-company.jp + (84) 28 3910 3913 |

다른 기사를 읽어보세요