2025年8月19日

最新ニュースとレポート / ベトナムブリーフィング

コメント: コメントはまだありません.

移行期の市場:内燃機関(ICE)車と電気自動車(EV)車の所有

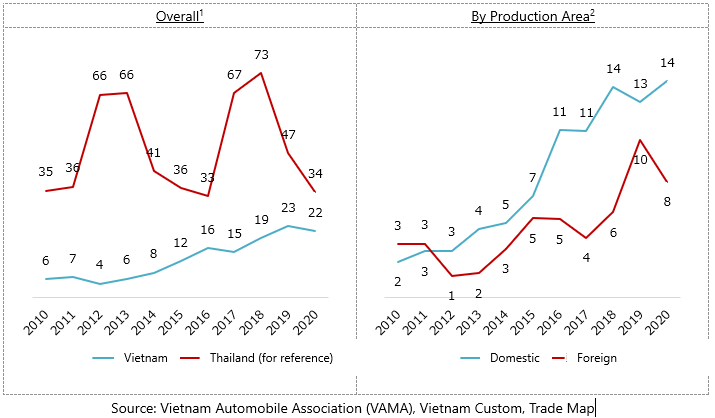

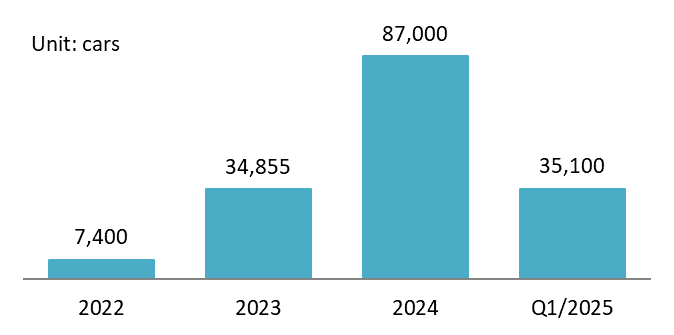

2025年時点で、ベトナムでは500万台以上の自動車と約700万台のバイクが路上を走っており、その大半はまだガソリンまたはディーゼルエンジンで動いています[1]。しかし、EVの波は前例のないペースで広がっています。2024年には、電気自動車は新車販売の17.6%を占め、2023年の8.6%からほぼ倍増します[2]。その先頭を走るのは、ベトナムの国産EVメーカーであるVinFastで、2024年には87,000台以上の電気自動車を販売し、前年比150%増加を記録しました。2025年上半期末までに、VinFastはすでに35,100台の車両を納入していました[3]。

2025年上半期までに納入されるVinFast車両数

出典: B&Company 編集

ベトナム自動車工業会(VAMA)の予測によると、2028年までに100万台のEVが流通し、2040年には350万台に達すると見込まれています。EVの普及は四輪車に限ったことではありません[4]。電動二輪車市場、特に排気量50cc未満(L1カテゴリー)の市場も、学生や都市部の通勤客の需要に牽引され、活況を呈しています。

VinFastは、コンパクトなVF 3とVF 5からハイエンドSUVのVF 8とVF 9まで、包括的な製品ラインナップを揃え、ベトナムのEV市場を席巻しています。BYD(Atto 3、Dolphin)、Wuling(Mini EV、Bingo)、Aion(Y Plus)といった強力な中国ブランドの参入により、市場はさらに多様化しています。Hyundaiのような大手自動車メーカーもIoniq 5などのモデルを現地生産することで競争に参入し、BMWやMercedes-Benzといった欧州の高級ブランドもハイエンドのEVオプションを提供しています。

自動車修理工場の現状

ベトナムにおける電気自動車(EV)の急速な普及は、顧客の需要と国内の修理インフラの整備状況の間に大きなギャップがあることを露呈させています。全国には1万以上の自動車修理工場がありますが、そのほとんどは依然として内燃機関(ICE)車向けであり、EV技術への移行が進んでいません[5]。

EV関連のサービスを提供し始めたのは、主にハノイやホーチミン市などの大都市圏にあるごく一部の整備工場に限られています。一方、EVのアフターセールス市場は、OEMサービスネットワーク、特にVinFastが独占しています。現在、VinFastは全国に200以上のサービスセンターを展開し、EVの初期段階におけるサービス提供を強化しています[6]。しかし、VinFastのサービスセンターは他社のEVを受け入れていないため、VinFast以外のEVのオーナーは、認定サービスプロバイダーまたは専門の民間整備工場を利用する必要があります。EVの修理を行う整備工場には、以下のものがあります。 自動車のみ や カーオン EVの場合、 タオ・グエン・ハイブリッド ハイブリッド車の修理を専門としています。

政府の政策により、EVの普及はさらに加速しています。登録料の全額免除(2025年2月まで有効)や3%特別消費税の減税(2027年2月まで)などの施策により、特にハノイ、ホーチミン市、ダナンなどの人口密集都市では、EVの魅力がますます高まっています[7]。

しかし、普及が進む一方で、独立系整備工場は対応に苦戦しています。その結果、サービス格差が顕著になり、多くのEVオーナーは公式サービスセンターに頼るしか選択肢がなくなってしまいました。この状況は、市場の限界と、独立系整備工場にとっての潜在的な成長機会の両方を浮き彫りにしています。ただし、技術的および財務的な障壁を克服できればの話です。

いくつかの重要な課題が、この移行を妨げ続けています。

– 技術文書および診断ソフトウェアへのアクセスは制限されており、OEM が管理しています。

– 特に新しい EV モデルやあまり一般的でない EV モデルの場合、認定部品の調達が困難です。

– 高電圧システムを扱う際のリスク、資格を持った技術者の不足、特殊なツールや機器の取得にかかる多大なコストなどにより、投資意欲が限られています。

独立系ガレージにとって、この能力ギャップを埋めることは不可欠です。電動化の時代に生き残るためだけでなく、自動車サービス市場において急成長しているが、サービスが行き届いていないセグメントを開拓するためにも重要です。

EV修理における需給不均衡

現在、ベトナムのEVオーナーのほとんどは、事実上、自動車メーカーの公式サービスネットワークに縛られています。最大の障壁となっているのは、数年に及ぶことが多い長期保証ポリシーです。こうしたポリシーにより、ユーザーは独立系整備工場での修理を躊躇し、保証権が無効になるのではないかと懸念しています。

しかし、市場が成熟するにつれて、このギャップを埋める独立したサービスプロバイダーのニッチな市場が出現し始めています。 EVバッテリー, ブロラブ ホーチミン市の二輪車修理工場は、二輪車の代替として有望な選択肢として台頭しています。OEMと直接競合するのではなく、従来の修理工場では提供できないハイテクサービスに重点を置いています。

– バッテリーセルの交換および高電圧バッテリーパックに関連する問題の修理、

– バッテリー管理システム(BMS)の修理、

– 高電圧電気システムの複雑な故障の診断、

– EV特有の専門知識を活かして、定期的な修理(タイヤ、ブレーキ、車体)を実行します。

これらのサービスは、保証期間の切れた車両や、OEM サービス センターで高価なコンポーネント全体を交換するのではなく、より柔軟でコスト効率の高い修理ソリューションを求めているユーザーにとって特に重要です。

訓練と人材:重大なボトルネック

市場の需要が急増しているにもかかわらず、ベトナムは皮肉な課題に直面しています。それは、熟練した電気自動車(EV)修理技術者の深刻な不足です。VATC、ハノイ高技術職業訓練校、バクコア職業訓練校といった評判の高い訓練機関は、EVに特化した訓練プログラムを導入していますが、受講生数は依然として少ない状況です[8]。

この状況には、3つの主要な障壁が影響しています。まず、研修費用の高さです。包括的な研修コースは1,200万~3,000万ドンかかることもあり、多くの整備士にとって大きな投資となります[9,10]。次に、EVの修理には全く異なるスキルセットが求められます。整備士は機械に関する知識だけでなく、ソフトウェア診断、バッテリーシステム、高電圧部品を扱う際の厳格な安全手順にも精通している必要があります。これらは、従来の内燃機関(ICE)整備士のほとんどが経験不足である分野です。

最後に、心理的および文化的な障壁があります。経験豊富な内燃機関(ICE)整備士の多くは、特にキャリアの中堅または後期においては、「最初からやり直す」ことや全く新しい技術を学ぶことに躊躇します。毎年数百人の学生が自動車整備士養成コースに入学しますが、EVを専門に選ぶのはごくわずかです。そのため、有資格者は非常に不足し、需要も高く、ベトナムのEVアフターサービス業界の持続的な発展にとって深刻なボトルネックとなっています。

参入機会

ベトナムの進化するEV市場は、新規サービスプロバイダーにとって、ゼロから立ち上げ、専門性を発揮して市場をリードする絶好の機会です。従来の整備工場は適応に時間がかかっていますが、新規参入企業はバッテリー診断、BMS修理、ADASキャリブレーションといった高付加価値サービスに注力することで、時代遅れのモデルを回避できます。これらのサービスは需要が伸びている一方で、供給が限られている分野です。

ベトナムに進出する中国のEVブランドは、サービスネットワークが脆弱なまま参入しており、明確なビジネスチャンスが存在します。これらのモデルのサポートに特化したプロバイダーは、すぐに重要なパートナーとなる可能性があります。さらに、モバイル修理ユニットや遠隔診断など、テクノロジー、モビリティ、データを活用するスタートアップ企業は、OEMでさえ対応に苦労しているサービスギャップを埋めることができます。

技術的な能力に加え、充電ネットワーク、EVフリート、あるいはトレーニング機関といったエコシステムを構築することで、長期的な価値と顧客ロイヤルティを獲得することができます。細分化され、十分なサービスが提供されていない市場において、適切な焦点を持つ先行企業は、競争に勝つだけでなく、ベトナムにおけるEVアフターセールスの未来を決定づけるチャンスを得ることになります。

まとめ

ベトナムの電気自動車ブームはもはや未来のトレンドではなく、自動車サービス業界を積極的に変革しています。主要都市では、強力な政策と消費者習慣の変化に後押しされ、電気自動車が主流になりつつあります。しかし、資格を持つ電気自動車修理工場の不足は依然として大きな課題です。VinFastのようなOEMが初期段階のサービスを独占している一方で、独立系修理工場には、特に保証期間外や輸入された電気自動車の整備において、成長の余地がまだ残されています。今後の道筋は明確です。適応するか、取り残されるかです。修理工場は競争力を維持するために、スキル、ツール、そして新しいビジネスモデルに投資する必要があります。今行動を起こす者が、電気自動車時代をリードする最良の立場に立つことができるでしょう。

[1] VnExpress、ハノイのガソリンバイクからの移行における課題

[2] CafeF、VinFastが過去最高の売上を達成、ベトナムのEV市場シェアが急上昇 — タイとインドネシアを上回り、米国とインドを上回る

[3] DNSEによると、VinFastは2025年第1四半期に35,100台の電気自動車を納入し、国内市場で第1位の地位を維持した。

[4] VnEconomy、ベトナム市場を制覇するミニEVの機会

[5] タン・ニエン、ベトナムの自動車所有率が急増、多くのガレージが経営難に

[6] バオモイ、ビンファストは正式にベトナム最大のサービスネットワークを持つ自動車メーカーとなる

[7] 政府法令第10/2022/ND-CP号:登録料に関する規則

B&Company株式会社

2008年に設立され、ベトナムにおける日系初の本格的な市場調査サービス企業として、業界レポート、業界インタビュー、消費者調査、ビジネスマッチングなど幅広いサービスを提供してきました。また最近では90万社を超える在ベトナム企業のデータベースを整備し、企業のパートナー探索や市場分析に活用しています。

お気軽にお問い合わせください

info@b-company.jp + (84) 28 3910 3913