22Jan2026

Latest News & Report / Vietnam Briefing

Comments: No Comments.

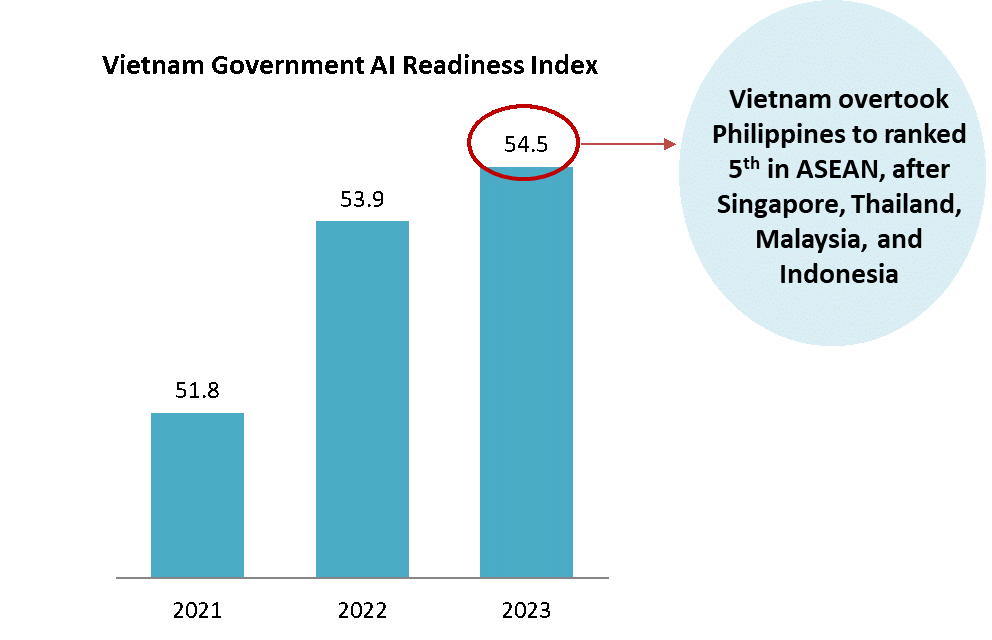

Vietnam has emerged as one of the fastest–growing AI markets in Southeast Asia, ranking 5th in ASEAN in AI readiness with a score of 54.5 according to Oxford Insights. Over the year, the market experienced a strong transition from AI experimentation toward practical and commercial execution, supported by two key forces: the arrival of high-quality foreign direct investment (FDI) in AI research and development, and the Government’s efforts to standardize and regulate AI and data usage.

Source: Oxford Insights

Major milestones in 2025 included Qualcomm’s deepened AI R&D presence, the expansion of SAP Labs Vietnam into a regional AI hub, the passage of the Personal Data Protection (PDP) Law, and the approval of Vietnam’s first AI Law. These developments proved that Vietnam is ready to shift toward an AI–focused ecosystem with more opportunities for foreign investors.

Market Context & Domestic Status

Market Size and Growth Outlook

By 2024, Vietnam’s AI market was valued at approximately USD 0.75 billion and is widely expected to reach around USD 2.0 billion by 2030, implying a compound annual growth rate (CAGR) of roughly 15% from 2025 onward. This growth has been driven by increasing business digitalization, expanding e-government initiatives, and the steady advancement of domestic technology capabilities.

Business AI Adoption in Vietnam

Based on the Vietnam AI Adoption Status and IT Hiring Insight 2025 report by ITviec, AI adoption at the enterprise level in Vietnam has moved firmly into the mainstream. By 2025, 73% of Vietnamese companies had adopted AI in some form, confirming that AI has been widely applied across industries. However, the adoption rate is still fluctuating, as only 13.8% of firms had deployed AI at scale, while the majority were still operating at pilot or limited-production stages. Despite strong adoption momentum, companies still need more time and experience to expand their application of AI into their core business strategy. Only 36.5% of companies had a documented AI strategy, while talent shortages represented the most critical constraint (46.4% of companies lacked sufficient internal AI skills).

Against these limitations of enterprises’ AI readiness, 2025 marked a significant year for transition, characterized by the convergence of high-quality foreign investment and decisive government action to standardize Vietnam’s AI landscape.

2025 Timeline: A Year of Transformation

Q1/2025 – Standardization and Early Trust-Building

In March–April 2025, Vietnam’s Ministry of Science and Technology (MOST) initiated the evaluation and ranking of Vietnamese large language models. This marked one of the Government’s first concrete steps toward setting technical benchmarks for domestic AI systems.

Rather than focusing solely on promotion, the Government began addressing quality, safety, and performance standards, helping build initial trust among enterprises and public-sector users. This initiative laid the groundwork for future procurement and wider deployment of Vietnamese-developed AI solutions.

Q2/2025 – FDI Surge and Policy Response

In April 2025, Qualcomm integrated the Research and Generative AI teams of VinAI into its global AI organization, following its acquisition of Movian AI. This move shifted cooperation from project-based collaboration toward deep talent and intellectual property integration, positioning Vietnam within Qualcomm’s global AI R&D value chain.

In June 2025, Qualcomm further reinforced this commitment by launching a large-scale AI R&D center in Vietnam, focusing on generative and agentic AI applications across smartphones, automotive systems, IoT, and XR. The center was designed to support end-to-end innovation—from foundational research to platform development—while contributing to local talent development and academic collaboration.

The launch of Qualcomm’s Artificial Intelligence Research & Development (AI R&D) Center

Source: Government News

By the time data-intensive AI R&D activities expanded rapidly on the market, the Personal Data Protection (PDP) Law (Law No.91/2025/QH15) was passed, showing the government’s support in digital transformation effort. The law provided a legal framework to govern data collection, processing, and cross-border transfer with the aim of reducing regulatory ambiguity and lowering long-term legal risks for investors, particularly in fintech, healthcare, and consumer-facing AI applications.

Q3/2025 – Market Validation

In August 2025, SAP announced the expansion of SAP Labs Vietnam into a strategic R&D hub, with a planned investment of over EUR 150 million within five years. The center was positioned to contribute directly to core enterprise AI, data analytics, and cloud-based business applications, rather than functioning solely as a delivery or outsourcing unit.

This expansion shows SAP’s validation of Vietnam as a long-term R&D destination for enterprise AI. This reinforced the perception that Vietnam was evolving beyond cost-driven IT services toward higher-value AI innovation embedded in global product development pipelines.

Q4/2025 – Completing the Governance Framework

In December 2025, Vietnam’s National Assembly passed the country’s first Law on Artificial Intelligence, scheduled to take effect in March 2026.

By introducing risk classification, accountability requirements, and governance obligations for high-impact AI systems, the law moved Vietnam from policy guidance to enforceable regulation. This provided greater certainty for the 2026 fiscal year and beyond, particularly for AI deployment in regulated sectors such as finance, healthcare, and public administration.

Implications for Foreign Investors

By the end of 2025, Vietnam’s AI market has become increasingly investment-ready, offering multiple opportunities for foreign investors, especially in B2B AI solutions, as domestic enterprises actively seek productivity – enhancing and compliance – ready technologies.

However, along with great growing potential, the market also faces several challenges, such as the increase of compliance costs under the new legal framework, or intensified competition for AI talent from multinational R&D centers, which FDI enterprises might need a clear market infiltration strategy. A great implication can be partnering with local firms, which are familiar with Vietnam’s regulatory environment, or by investing directly in talent development and training, to solve the market’s most persistent barriers.

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

Reference:

- https://www.linkedin.com/pulse/vietnams-ai-journey-market-rise-th%C3%A1i-v%C3%A2n-linh-pjl3c/

- https://www.nexdigm.com/market-research/report-store/vietnam-artificial-intelligence-market-research-report/

- https://b-company.jp/vietnam-ai-landscape-2025-government-policy-key-players-and-startup-ecosystem/

- https://www.qualcomm.com/news/releases/2025/04/qualcomm-expands-generative-ai-capabilities-with-acquisition-of-

- https://en.baochinhphu.vn/qualcomm-to-build-third-largest-ai-rd-center-in-viet-nam-111250610163258466.htm

- https://www.vietnam-briefing.com/news/vietnam-law-on-personal-data-protection-latest-developments-and-insights.html/

- https://vietnamnet.vn/en/vietnamese-llms-to-be-evaluated-and-ranked-by-experts-in-march-2382536.html

- https://news.sap.com/sea/2025/08/sap-plans-to-invest-more-than-e150-million-to-launch-research-development-hub-in-vietnam/

- https://www.tilleke.com/insights/a-closer-look-at-vietnams-new-ai-law-what-it-means-for-ai-businesses/61/

- Vietnam AI Adoption Status and IT Hiring Insight 2025 – ITviec