21Apr2025

Latest News & Report / Vietnam Briefing

Comments: No Comments.

Vietnam’s surveillance camera market has experienced significant growth, driven by rapid urbanization, heightened public safety concerns, and the government’s commitment to developing smart city infrastructures.

Overview of surveillance cameras market in Vietnam

As of 2023, Vietnam’s surveillance camera market reached approximately 175 million USD in revenue, with a market volume of around 10 to 15 million units, according to the CEO of Pavana Technology JSC[1]. Among these, home surveillance cameras accounted for 48% of the total revenue and 60% of the total units sold, while cameras for public sector use represented only about 40% of the total volume[2].

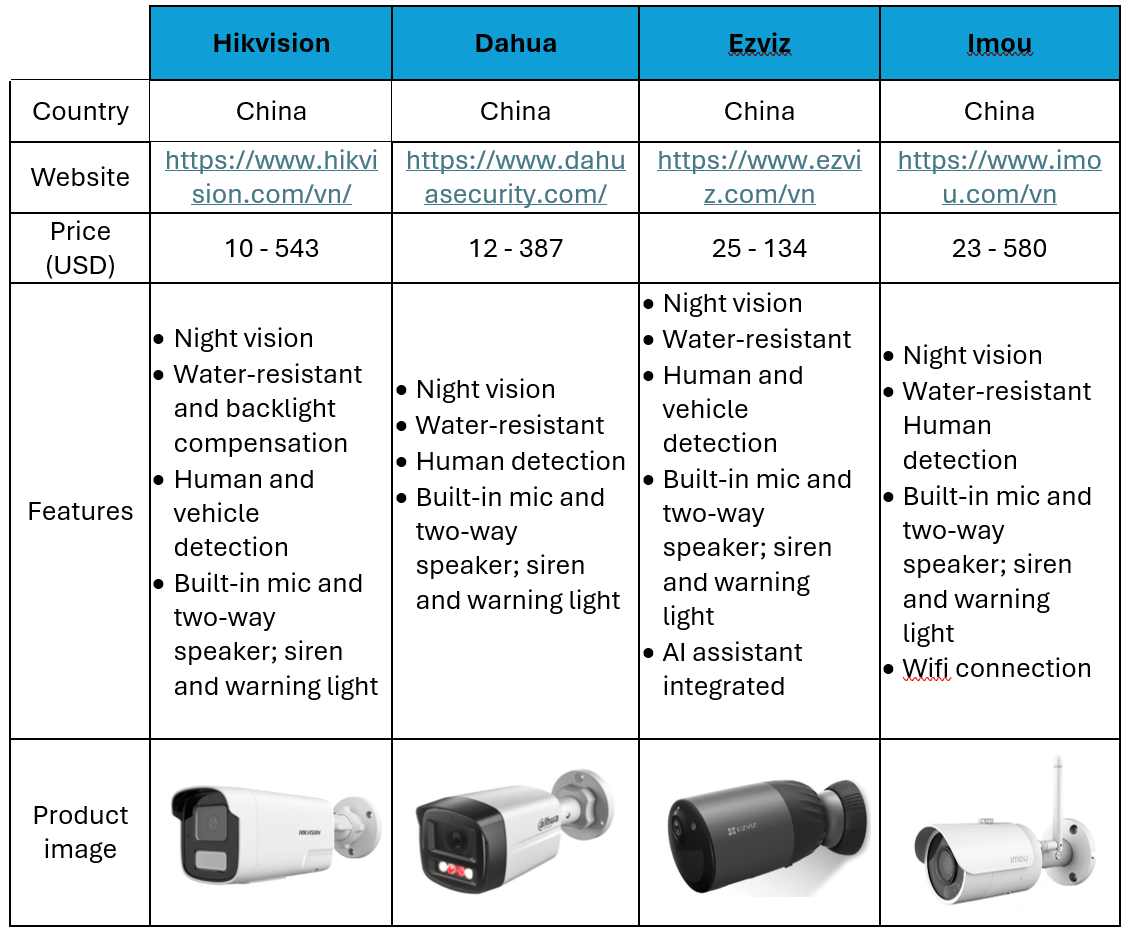

The market is currently dominated by Chinese manufacturers, with Dahua, Hikvision, and their subsidiaries accounting for nearly 90% of the market. Their popularity is largely attributed to their affordability and wide range of features, with prices typically ranging from 200,000 to 1 million VND[3].

Some popular surveillance cameras brand in Vietnam

Source: B&Company Synthesis

However, the global surveillance camera market is primarily driven by enterprise and government demand, which accounts for approximately 70% of the total market, while home-use cameras represent only 15%. In contrast, nearly 60% of surveillance devices in Vietnam are used for residential monitoring. To address this imbalance and enhance public safety, major cities such as Hanoi, Ho Chi Minh City and others have actively accelerated the installation of surveillance cameras to improve security in urban areas.

Government Initiatives to Implement Cameras

To enhance public safety, on January 17th, 2025, the Hanoi People’s Committee issued Decision No. 319/QĐ-UBND on the Management of the Centralized Surveillance Camera System in Hanoi[4]. Under this decision, the city plans to install a total of 40,210 surveillance cameras across its city, including the following:

– 23,736 cameras dedicated to monitoring public security, maintaining order, and supporting law enforcement activities.

– 227 cameras designated for national defense purposes.

– 16,247 cameras intended for state management tasks, including traffic safety, transportation infrastructure, environmental monitoring, and urban order.

In line with this effort, Hanoi Police Department also announced the implementation of four surveillance camera system projects, involving the installation of approximately 3,700 cameras integrated with artificial intelligence (AI). These projects aim to optimize operational procedures, enhance work efficiency, reduce administrative burdens, and ultimately deliver practical benefits to the public[5].

Hanoi launches projects to install additional AI-integrated surveillance cameras

Source: VnEconomy

In popular tourist destinations in Vietnam, such as Phu Quoc, have also begun implementing projects to install AI-integrated surveillance cameras. Specifically, the Kien Giang Provincial Police have installed 41 AI-powered cameras at seven key locations, including major traffic gateways and densely populated areas[6]. At the same time, Ho Chi Minh City has invested over 9,000 USD in its surveillance and traffic control systems as part of its efforts to develop into a smart urban area and enhance state management capabilities[7].

In mining areas, the Ministry of Agriculture and Environment has proposed that organizations and individuals involved in mineral extraction and recovery be required to install smart surveillance systems. These cameras must be placed at key points where raw minerals are transported out of mining sites, excluding cases of extraction from rivers, lakes, marine areas, or the exploitation of natural hot water and mineral springs. The aim is to promote transparency, ensure compliance with legal regulations, and facilitate effective oversight by the government[8].

Surveillance cameras at mineral extraction sites

Source: VnExpress

Opportunities for Foreign Investors

Vietnam’s intensified deployment of surveillance cameras to enhance public safety and urban management presents significant opportunities for foreign investors. Recent developments, Hanoi, Ho Chi Minh City or Kien Giang, signal a strong government commitment to expanding digital infrastructure. These projects create a growing demand for advanced surveillance equipment that includes intelligent systems powered by AI technologies like facial recognition and behavior analytics. Additionally, local companies are open to collaboration, offering a pathway for joint ventures, technology transfer, and regulatory navigation. As privacy and data security concerns intensify—especially after incidents of camera hacks and leaks—cybersecurity firms also have a critical role to play in providing trusted protection solutions.

Conclusion

Vietnam’s strategic plan to expand its surveillance infrastructure underscores the country’s broader vision for smart, secure urban development. This opens the door for foreign investors to contribute cutting-edge technologies, cybersecurity expertise, and smart city solutions. By aligning with Vietnam’s goals and forming strong partnerships with local stakeholders, foreign companies can play a pivotal role in shaping the future of surveillance and public safety in one of Southeast Asia’s fastest-growing economies.

[1] The company specializes in security and surveillance cameras, serving both domestic and international customers

[2] VnEconomy (2024). Opportunities for Vietnamese Surveillance Camera Companies <Access>

[3] The Investment Newspaper (2024). Competition for the Surveillance Camera Market Share: Domestic Companies Need Alliances and Partnerships <Access>

[4] Hanoi City Information Portal (2025). Decision No. 319/QĐ-UBND: Management of the Centralized Surveillance Camera System in Hanoi <Access>

[5] VnEconomy (2025). Hanoi Plans on Installing 3,700 AI Integrated Surveillance Camera <Access>

[6] VnEconomy (2025). Phu Quoc Launches Pilot Operation of AI Camera System <Access>

[7] Vietnam.vn (2024). Ho Chi Minh City Invest Over 9,000 USD in Camera Systems <Access>

[8] VnEconomy (2025). Proposal to Require Companies to Install Smart Cameras at Mining Areas <Access>

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |