18Mar2025

Latest News & Report / Vietnam Briefing

Comments: No Comments.

Overview of Vietnam’s Waste Treatment

As of 2024, Vietnam generates approximately 60 thousand tons of waste daily, with urban areas contributing over 60% of this volume. Ha Noi, Da Nang and Ho Chi Minh City alone made up for over 20 thousand tons of daily waste. A significant portion is household waste, followed by industrial, agricultural, and medical waste[1]. Waste treatment in Vietnam remains largely manual and rudimentary. In 2023, 55% of waste was disposed of through unsanitary landfilling, while 20% was managed by open burning. In contrast, only 25% underwent proper waste treatment, with 15% buried in sanitary landfills and 10% processed for recycling.

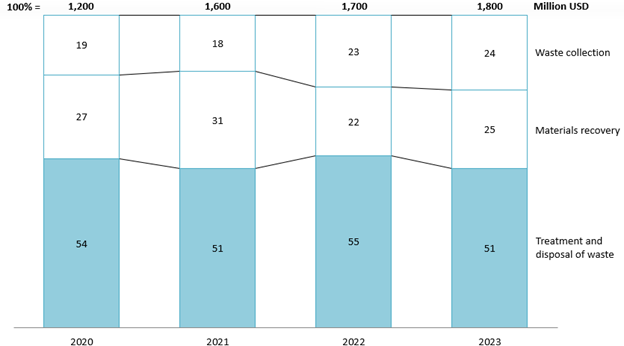

According to B&Company Enterprises Data, in 2023, the industry has around 3 thousand companies in operation, accounted to a total of around 1.8 billion USD. In which, Vietnam has divided the industry into major sectors per Decision No 27/2018/QĐ-TTg[2].

– Treatment and disposal of waste (code 382): This sector involves the treatment and disposal of both inorganic and organic waste, including radioactive and medical waste. Additionally, it generates electricity as a byproduct of burning waste. Notably, this segment holds the largest share within the waste treatment industry, accounting for 51% of the market. Between 2020 and 2023, the sector experienced a compound annual growth rate (CAGR) of 12%, reaching a total revenue of 939 million USD in 2023.

– Waste collection (code 381): Waste collection includes the gathering of household and commercial waste through various means such as bags, garbage trucks, and containers. This sector covers both hazardous and non-hazardous waste collection. Although it represents a smaller share at 25%, it follows a similar growth trajectory, maintaining a 12% CAGR and generating 459 million USD in revenue in 2023.

– Materials recovery (code 383): The action of collecting, sorting and recycling metallic materials, record the highest growth of CAGR 23% from 2020 – 2023, and ultimately achieving a net revenue of 437 million USD in 2023.

Net revenue of Vietnam waste treatment industry by sectors

Source: B&Company Enterprises Database

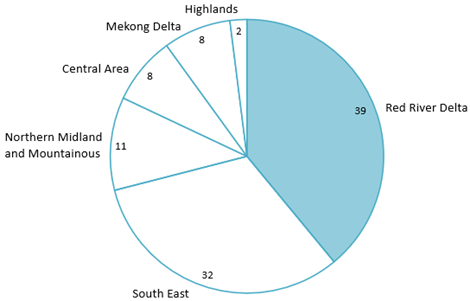

The waste treatment industry is primarily concentrated in the Red River Delta region, which accounts for 39% of total revenue. It is followed by the Southeast region and the Northern Midland and Mountainous region, contributing 32% and 11%, respectively.

Net revenue of Vietnam waste treatment industry by region in 2023

Unit: 100% = 1.8 billion USD

Source: B&Company Enterprises Database

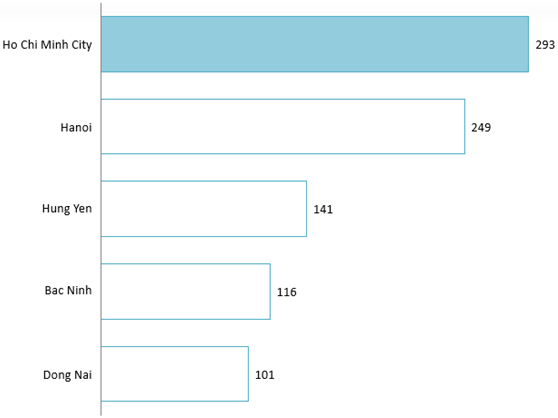

Among Vietnam’s cities and provinces, Ho Chi Minh City and Hanoi account for the most revenue in the waste treatment industry, contribute to 16% and 14%, respectively. Hung Yen ranks third, contributing approximately 8% of total revenue. The remaining revenue is relatively evenly distributed across other provinces.

Net revenue of Vietnam’s top 5 cities in the waste treatment industry (2023)

Unit: Million USD

Source: B&Company Enterprises Database

This concentration is driven by rapid urbanization, large populations, and strong economic growth, which result in higher waste generation and demand for treatment facilities. For instance, Ho Chi Minh City and Hanoi serve as major business hubs with a high concentration of enterprises, while provinces such as Hung Yen, Bac Ninh, and Dong Nai host numerous industrial parks, further increasing the need for efficient waste management solutions.

The sector is dominated by Vietnamese companies, with notable names in the industry sectors such as Thien Y Environmental Energy, Vietnam Waste Solutions, and Mien Dong Environment.

Top companies in the waste treatment industry in Vietnam by net revenue (2023)

| No. | Company Name | Website | VSIC Code | Region |

| 1 | Ha Noi Thien Y Environmental Energy JSC | vnty.com.vn | 382 | Ha Noi |

| 2 | Vietnam Waste Solutions Company Limited | vnwaste.com | 382 | HCMC |

| 3 | Mien Dong Environment JSC | mtmiendong.vn | 382 | Binh Phuoc |

| 4 | Ho Chi Minh City Urban Environment Company Limited | citenco.com.vn | 381 | HCMC |

| 5 | Nguyet Minh 2 Trading-Services-Environment JSC | moitruongnguyetminh.vn | 383 | Long An |

| 6 | Urban Environment Limited Company | urenco.com.vn | 381 | Ha Noi |

| 7 | Hoa Binh High Tech Environment JSC | hoabinhhte.com.vn | 382 | Hoa Binh |

| 8 | Viet Xuan Moi Environment JSC | moitruongvietxuanmoi.com | 382 | Thai Nguyen |

Source: B&Company Enterprises Database

Foreign Investment Moves in Vietnam’s Waste Treatment Industry

Overall, Vietnam’s infrastructure in this industry is poorly developed. Many existing treatment plants are outdated and underfunded, with some projects remaining incomplete despite being initiated over a decade ago. In several provinces, such as Da Nang, Tien Giang, Can Tho, and Ben Tre, waste collection points have already reached maximum capacity, resulting in excessive waste accumulation and severe environmental pollution[3].

However, with strong support from foreign investors in recent years, Vietnam has seen positive developments in its waste treatment industry, including the rise of high-tech and environmentally friendly treatment plants. Notably, Japan has played a significant role in this progress, with two new projects already invested in and put into operation in 2024.

Some waste treatment factories project in 2024

| Factory name | Daily Capacity | Location | Main Investor | Invesment value

(million USD) |

Project situation |

| JFE Engineering Corporation | · Processing 500 tons of waste

· Producing 12MW of electricity |

Bac Ninh | Japan | 18 | In operation since February 2024 |

| Biwase | · Processing 2520 tons of waste

· Producing 5 MW of electricity |

Binh Duong | Japan | 19 | In operation since January 2024 |

| Asia New Generation | · Processing 400 tons of waste

· Producing 1.8 MW of electricity |

Dong Nai | German | 40 | Pending Government Approval |

Source: B&Company Compilation

Additionally, on 11th January 2024, Vietnam and Japan held meetings to strengthen cooperation and propose an investment plan for waste-to-energy recycling plants in four provinces: Dong Nai, Thanh Hoa, Khanh Hoa, and Tien Giang[4].

Conclusion

Vietnam’s waste treatment industry is rapidly evolving, driven by the participation of domestic stakeholders, along with support from strategic partner countries such as Japan. With the Vietnamese government’s commitment to achieving net-zero emissions by 2050[5], this industry plays a vital role in the country’s sustainability efforts and environmental progress.

[1] VnExpress (2024). Vietnam’s Requirement for Waste Treatment Starting from 2025 <Access>

[2]Vietnam Government Portal (2018). Decision No. 27/2018/QĐ-TTg of the Prime Minister: Establishing the Vietnam Standard Industrial Classification System

[3] Voice of Vietnam Traffic Service (2024). Waste Treatment Area for the Entire Mekong Delta is Still Limited <Access>

[4] Environments and Resources Online Newspaper (2024). Vietnam and Japan Strengthen Cooperation on Waste Management <Access>

[5] Tuoi Tre Newspaper (2023). Vietnam Commitment to Achieve Net-Zero by 2050 <Access>

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |