Vietnam’s textile and garment industry is a key economic sector, contributing significantly to the country’s export revenue and providing employment for millions of workers nationwide. As one of the world’s leading manufacturers and exporters of apparel, the industry has established a strong reputation for product quality and production flexibility, being an ideal hub for numerous global brands.

Production situation of textile and garment products in Vietnam

Vietnam is a key manufacturing hub for many of the world’s leading fashion brands. With its strategic position in the global supply chain, Vietnam’s textile and garment industry has attracted significant investment from major corporations. Ho Chi Minh City is recognized as home to Vietnam’s largest port, and the southern region is a major concentration of garment factories. This area, considered a textile and garment hub for decades, is known for its skilled and abundant workforce. Brands such as NIKE, ADIDAS, and UNIQLO have chosen Vietnam as a key production base.

Example for brands manufactured in Vietnam

| Brands | Activities (until 2024) | Main products |

| NIKE | – 155 partner factories, primarily concentrated in the Ho Chi Minh

– Vietnam accounts for 28% of NIKE’s total production, making it the largest among NIKE’s suppliers |

– Footwear

– Apparel – Accessories and sports equipment |

| ADIDAS | – 51 partner factories, located primarily in Ho Chi Minh City, Dong Nai, and Binh Duong.

– Vietnam accounts for 38% of the total footwear production and 20% of the total apparel production. |

– Footwear

– Apparel – Accessories and sports equipment |

| UNIQLO | – Fast Retailing, the parent company of Uniqlo, collaborates with 61 garment factories in Vietnam

– Vietnam is Uniqlo’s second-largest production base, only after China. |

- Apparel

|

Source: B&Company Compilation

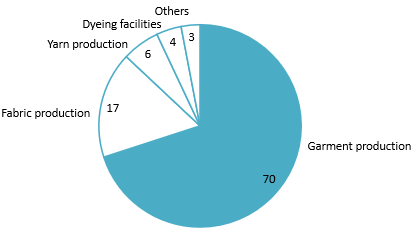

According to Vitas, in 2023, Vietnam’s textile and garment industry comprised approximately 7,000 enterprises. Notably, 80% of these are small and medium-sized enterprises (SMEs), with foreign direct investment (FDI) companies accounting for just over 10%. The industry employs 3 million workers, with 70% of its capacity dedicated to manufacturing. Vitas’s statistics also reveal that 70% of the more than 3,800 textile factories are engaged in garment production, while only 6% produce yarn, 17% produce fabric, and 4% are dyeing facilities.

Textile and Garment Factories in Vietnam, updated until 2023

100%= ~3,800 factories

Source: VnEconomy

Export situation of textile and garment products in Vietnam

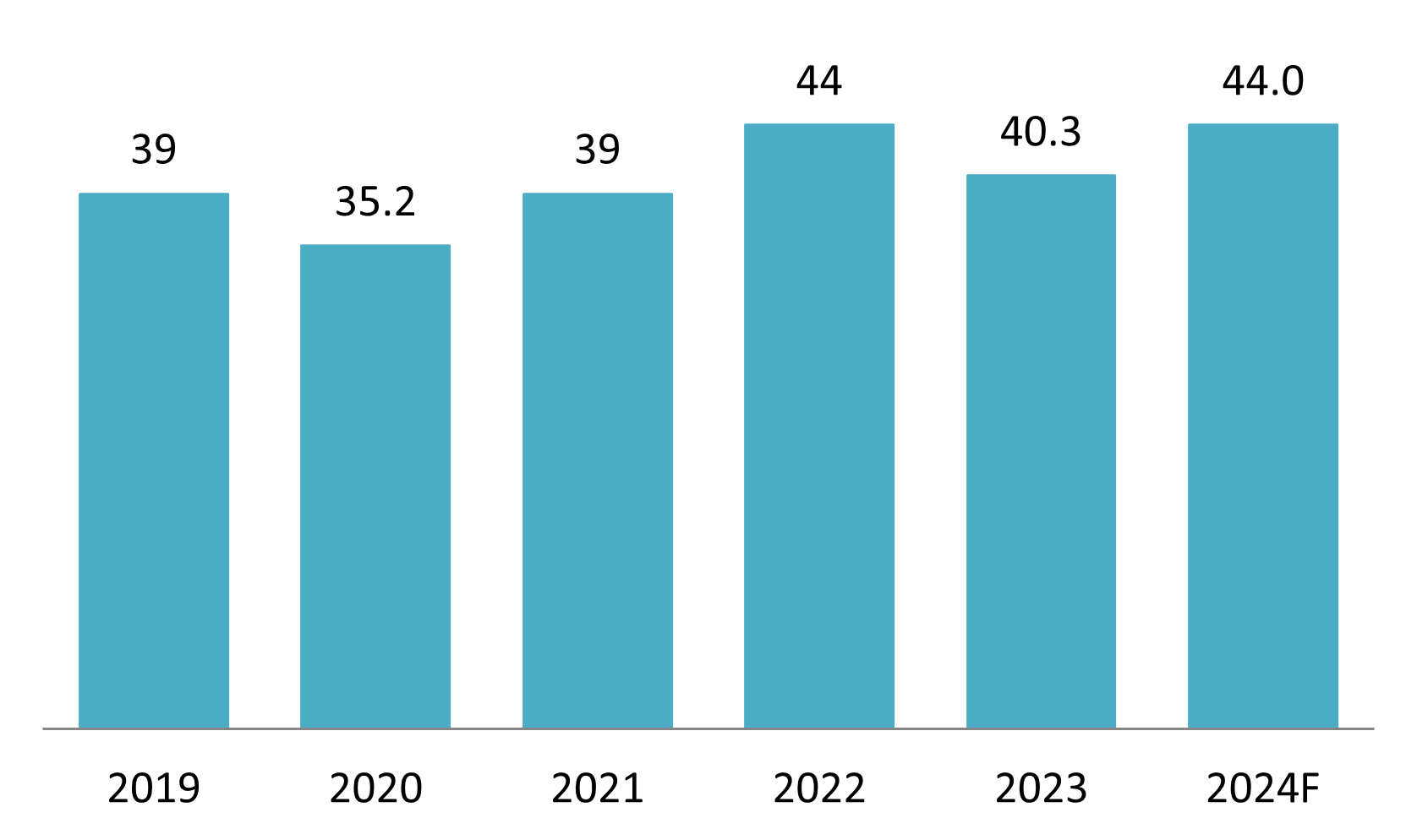

As a key manufacturing hub for textiles and garments, Vietnam has become a global leader in textile and garment exports. Notably, the industry has demonstrated remarkable resilience, bouncing back strongly from the Covid-19 pandemic. According to the Vietnam Textile and Apparel Association (Vitas) and the Ministry of Industry and Trade, exports have been estimated at 40.3 billion USD in 2023, accounting for approximately 12.52% of total exports and are forecast to reach US$44 billion by the end of 2024, highlighting the significant growth potential of this important sector.

Export value of Vietnam textiles and garments from 2019 – 2024F

Source: VITAS

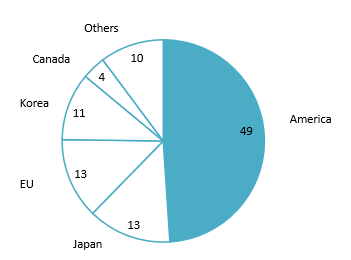

According to Tradeinmex, Vietnam is the third largest clothing exporter in the world in 2023, after China and Bangladesh. Clothes made in Vietnam are sold to over 180 countries and territories. Vietnam exports the majority of its textiles and garments to the United States, accounting for nearly 50%, followed by Japan at approximately 13%, and the EU. These markets highlight Vietnam’s strong presence in the global textile trade. The high demand from these regions underscores the competitiveness and quality of Vietnam’s textile and garment industry.

Main export market of Vietnam textiles and garments in 2023

100%= 40.3 billion USD

Source: Statista

Advantages and challenges of Vietnam textiles and garments manufacturing

Advantages

The most valued advantage of Vietnam’s textile and garment industry lies in its flexibility and agility. Vietnam has the capacity to design and manufacture a wide range of clothing styles, from basic to high-end apparel, catering to diverse customer demands. Unlike Bangladesh, which primarily focuses on basic clothing such as T-shirts and jeans, Vietnam excels in producing high-value garments, including jackets, sportswear, swimwear, and tailored suits, requiring advanced craftsmanship and technical expertise.

The second advantage is speed to market. Vietnam is highly rated in this criterion due to its extensive port system. Additionally, participation in numerous free trade agreements (FTAs) has facilitated Vietnam’s textile and garment exports to various markets. One of the key beneficiaries of these agreements is the textile and garment sector under the CPTPP (Comprehensive and Progressive Agreement for Trans-Pacific Partnership). This is a leading export industry that has seen strong growth of over 50%.

According to Mr. Vu Duc Giang, Chairman of the Vietnam Textile and Apparel Association (VITAS), in the first 8 months of 2024, textile and garment exports reached approximately USD 32 billion globally, with the CPTPP markets accounting for about 16%. Since the CPTPP took effect, Vietnam’s textile and garment exports to Mexico have grown significantly. In the first 7 months of 2024, exports to Mexico hit a record high of USD 119.06 million, a 119.58% increase compared to USD 54.22 million in the first 7 months of 2018 (before the CPTPP took effect), and a 71.38% increase from USD 69.47 million in the first 7 months of 2019 (the first year of CPTPP implementation). Vietnam’s industry also benefits from FTAs such as the EVFTA (EU-Vietnam Free Trade Agreement) and RCEP (Regional Comprehensive Economic Partnership).

Challenges

Vietnam’s textile and garment industry previously leveraged its low-cost labor and high-skilled workers, enabling the production of intricate items requiring advanced sewing techniques. This advantage attracted numerous CMT (cut, make, trim) orders over the past 20 years, with Vinatex achieving significant success. However, other countries like Bangladesh, Indonesia, India, and AGOA nations have now emerged with better sourcing costs, indicating that this advantage is unsustainable in the long term.

Vietnam faces challenges in textile exports due to limited adoption of green production practices, with many enterprises failing to meet international environmental and social standards, leading to restricted market access and lost opportunities. Vietnam’s textile industry has already lost some orders to Bangladesh, a country that has rapidly embraced green supply chain practices. Bangladesh has proactively managed and invested in green infrastructure, as of August 2024, Bangladesh boasts approximately 230 LEED-certified factories, 40% of which have achieved LEED Platinum, the highest standard for green production established by the U.S. Green Building Council. Furthermore, an additional 500 textile factories in Bangladesh are awaiting LEED certification evaluations. In contrast, only 10% of Vietnam’s LEED-certified projects belong to the textile sector, highlighting the country’s speed in adopting industry-wide sustainable practices.

Conclusion

Vietnam’s textile and garment industry has established itself as a critical player in the global supply chain, supported by its strategic location, skilled workforce, and strong presence of leading international brands. The industry’s flexibility, speed to market, and access to numerous free trade agreements have further strengthened its export capabilities. The sector faces significant challenges, particularly in adopting sustainable and green production practices, which are increasingly demanded by global markets. Therefore, the Vietnamese government has been actively promoting and supporting the green transition in the textile and garment industry to align with international sustainability standards.

| B&Company, Inc.

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

Read other articles