Vietnam’s e-commerce export market has witnessed rapid growth, driven by increasing global demand, digital transformation, and supportive government initiatives. With a booming digital economy, a young population, and evolving infrastructure, Vietnam is poised to become a regional leader in cross-border e-commerce.

Vietnam’s E-commerce Export Situation in 2023

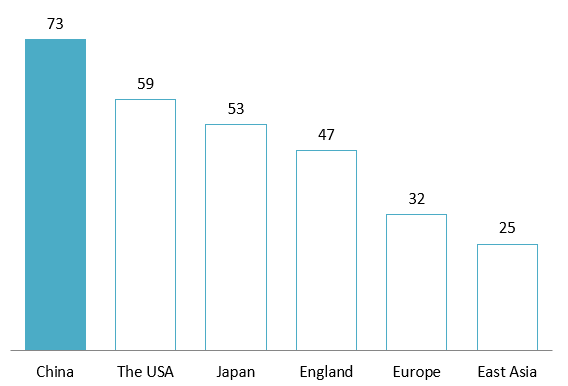

In 2023, Vietnam’s B2C e-commerce export value reached 3.4 billion USD and is projected to grow by 1.7 times, reaching 5.7 billion USD by 2028, with Micro, Small and Medium-sized Enterprises (MSMEs) contributed to 25% of this growth[1]. The top export destinations for MSMEs include China, the USA, and Japan, along with markets in England, Europe, and East Asia.

Potential E-commerce export markets according to a survey of 200 MSMEs in Vietnam in 2023

Unit: %

Source: Access Partnership

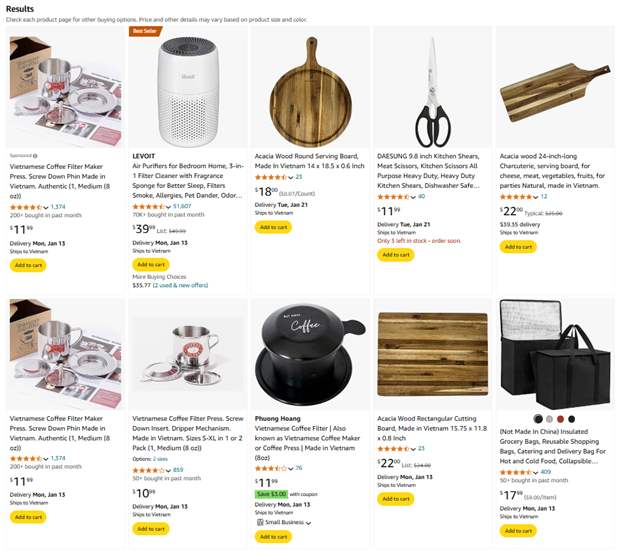

Amazon, Alibaba, Ebay, Taobao are the most popular e-commerce platform for global marketplaces in Vietnam. Just within 2023, the number of Vietnamese products sold on Amazon soared by 300% in the previous five years to reach 17 million products across many sectors, notably are home; kitchen; health and personal care; apparel and beauty[2].

Vietnamese products on Amazon market

Source: Amazon marketplace

In addition, there are several domestic e-commerce platforms, such as Shopee International, which allows users to sell products in countries like the Philippines, Singapore, Malaysia, Taiwan, and Thailand. By 2023, over 350,000 Vietnamese sellers were exporting globally through Shopee International, including more than 1,000 Vietnamese brands and approximately 15 million Vietnamese products[3]. Similarly, the TikTok Global Shop platform enables users to sell and ship goods to over 200 countries and territories worldwide[4].

With such rapidly developing e-commerce platforms, MSMEs are empowered to compete with larger retailers by showcasing their products on these e-commerce platforms. Compared to traditional sales methods, sellers can significantly reduce costs associated with renting physical stores, hiring staff, or extensive marketing campaigns. Instead, they can attract customer attention through their Unique Selling Points or by targeting potentially profitable niche markets.

Support and Policies from the Government

The Vietnamese government has actively recognized the growing importance of e-commerce in driving economic growth and enhancing global trade. To support the development of the e-commerce export market, the government has implemented various initiatives and policies aimed at fostering a conducive environment for digital trade.

Some government initiatives to support e-commerce export

| Decision | Issued date | Policy name | Terms on promoting e-commerce export |

| Decree No. 80/2021/NĐ-CP | 2021 | Enforcing law to support MSMEs | · Support up to 50% of the costs for participating in e-commerce development training programs

· Provide 50% cost support for maintaining accounts on both domestic and international e-commerce platforms |

| Decision No. 1445/QĐ-TTg | 2022 | Strategy for Import and Export of Goods by 2030 | · Develop and implement cross-border e-commerce application models

· Establish information systems to support e-commerce export activities · Enhance logistics services to promote the export of goods |

| Official Telegram No. 56/CĐ-TTg | 2024 | Strengthen management in the field of e-commerce and digital business | · Optimize customs clearance processes for import and export goods in e-commerce

· Support tax management for cross-border service provision in e-commerce. |

Source: B&Company Complication

Prospect and Challenges for Future Growth

By 2023, Vietnam’s digital economy accounts for 13 – 14% of total GDP and is expected to increase to 30% in 2030[5]. This growth is driven by the rapid development of the e-commerce as revenue in sector is projected to reach 14 billion USD and is expected to maintain an annual growth rate of 11% over the next five years (2024–2029), ultimately reaching 24 billion USD by 2029[6]. Coupled with the rapid development of Vietnam’s digital economy—recognized as the fastest-growing in Southeast Asia, achieving a 19% growth rate in 2023 and growing 3.5 times faster than GDP[7]— providing a solid foundation for the growth of e-commerce exports. Additionally, the demand for Vietnamese products, known for their high quality and reasonable prices, has surged in recent years in foreign markets, creating a significant demand surplus. This trend opens up numerous opportunities for Vietnamese MSME sellers to tap into international markets.

Despite its promising prospects, Vietnam’s e-commerce export market faces several challenges that are weighting this market down. Firstly, the lack in framework and policies is leading to confusion for businesses, complex customs procedures and varying tax requirements for cross-border e-commerce transactions create significant barriers, especially for MSMEs seeking to enter international markets. Secondly the shortage of high-quality labor forces poses a critical challenge, the Access Partnership survey also show that 95% of the MSMEs find the workforce lacking in advanced skills in areas such as cross-border trade management, digital marketing, e-commerce, IT, etc. This limits the ability of businesses to scale and compete in the global e-commerce space[8]. Finally, high logistics costs remain a substantial hurdle with 94% of respondents sharing the same issue. In 2024, the cost for logistics in Vietnam is 16-17% of GDP, comparing to other countries such as Japan with 11%, Singapore 8%, Malaysia 13%, etc[9].

Conclusion

Vietnam’s e-commerce export market holds immense potential, fueled by rapid digital transformation, and the growing integration of Vietnamese businesses into the global digital economy. The rise of both domestic and international e-commerce platforms has opened doors for MSMEs to expand globally, reducing traditional trade costs and enabling them to compete with larger retailers. By continuing to invest in infrastructure, training, and technology, Vietnam can fully unlock the potential of its e-commerce export market, driving sustainable growth for years to come.

[1]The Vietnam Plus Newspaper (2024). Vietnam E-commerce Boom in 2024 <Access>

[2]Amazon Marketplace (2024). 2023 Vietnam’s SMEs Empowerment Report <Access>

[3] Vietnam Economic Times (2024). From Shopee to Global Online Export <Access>

[4]Media Step (2024). Tiktok Global Shipping <Access>

[5]The Ministry of Finance Electronic Information Portal (2024). E-Commerce is a Great Opportunities for MSMEs <Access>

[6] Statista (2024). Vietnam E-Commerce Revenue <Access>

[7] Ministry Of Construction Electronic Information Portal (2024). Digital Transformation is the Breakthrough Path for Vietnam <Access>

[8]Vietnam Economic Times (2023). Vietnam Facing Challenges on Lacking High-Skill Workers <Access>

[9] The Government Newspaper (2024). Reducing Logistics Cost to Increase Vietnam’s Competitive Strength <Access>

| B&Company, Inc.

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

Read other articles