27Feb2025

Latest News & Report / Vietnam Briefing

Comments: No Comments.

Vietnam’s semiconductor industry is on a growth trajectory, supported by government initiatives, rich in resources and a vast amount of labor forces. While still in the early stages of development, the industry is gradually establishing itself as a key player in the global supply chain.

Overview of Semiconductor Industry in Vietnam

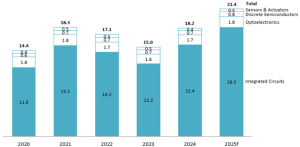

Vietnam’s semiconductor industry is on a strong growth trajectory. The semiconductor market is projected to reach a revenue of 21 billion USD in 2025, marking an 18% increase from 2024 and an impressive 49% growth over the past five years. The market is expected to continue expanding at a CAGR of 10% from 2025 to 2029, ultimately reaching a total value of 31 billion USD by 2029[1].

Revenue of semiconductor industry in Vietnam

Unit: Billion USD

Source: Statista

Vietnam has significant opportunities to develop semiconductor supply chain. The government has introduced various support policies to facilitate semiconductor businesses. The latest is Decision No. 1018/QĐ-TTg in September 2024, aimed at accelerating the development of Vietnam’s semiconductor market. This strategic roadmap outlines Vietnam’s Semiconductor Development Strategy through 2030, with a long-term vision of achieving 100 billion USD in semiconductor revenue by 2050[2]. In addition, Vietnam ranked second in the world in “rare earth” reserves, the key material for semiconductor. As of 2024, Vietnam estimated to have 22 million tons of “rare earth”, accounting for more than 18% of the world ‘s total[3]

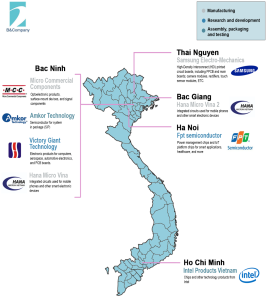

Vietnam participation in semiconductor supply chain

The semiconductor supply chain consists of three main stages: design/research, manufacturing, and assembly – testing – packaging. Currently, Vietnam primarily focuses on design/research, while their involvement in the other 2 stages remains very limited.

In the design and research stage, the main products are chipsets. FPT Semiconductor is the only representative from Vietnam, specializing in designing and developing chips for power management and IoT platforms used in smart applications, healthcare, and more. These designs are then transferred to factories in Korea for production and packaging[4]. The company has also set a goal of delivering 25 million chips globally by 2024–2025[5]. Meanwhile, China’s representative, Victory Giant Technology, received approval for a printed circuit board project in Vietnam, with a total investment of 206 million USD. The company is expected to complete construction of its factory by 2026[6].

Conversely, at the manufacturing stage, companies are focus on producing circuit boards and semiconductor products with only international corporations are involved, including Micro Component from China, as well as Samsung and Hana Micro from South Korea. While Samsung has shown no further investment movement after spending over 2 billion USD on expanding its production[7], Hana Micro is expected to increase its total investment to more than 1 billion USD by the end of 2025[8]. Furthermore, with significant government support in this industry, Viettel has planned to complete the construction of a semiconductor manufacturing plant in Vietnam by 2030, marking the first domestic player from Vietnam in this stage[9].

In the assembly, testing, and packaging segment, electronics components are the primary products, with Amkor Technology from the U.S as a key player, focusing its research on semiconductors for System-in-Package (SiP). The company has also announced plans to expand its production capacity from 420 tons per year to 1,600 tons per year by October 2025[10]. Intel, on the other hand, has focused solely on research related to enterprise-level semiconductor products and halted its investment activities at the end of 2021. By that time, its total investment had reached over 1 billion USD[11].

Semiconductor supply chain companies in Vietnam

Source: B&Company Compilation

Challenges for Vietnam in semiconductors supply chain

Vietnam has significant opportunities to deepen its participation in the semiconductor supply chain. However, challenges remain for Vietnam’s participation in the semiconductor industry. Firstly, the shortage of high-quality human resources. In 2024, Vietnam requires approximately 150,000 engineers per year, yet the country can currently meet only 60% of this demand. Specifically, the semiconductor sector alone needs 5,000-10,000 engineers annually, but the supply meets less than 20% of this requirement[12]. Secondly, complex administrative regulations and procedures. Vietnam’s regulations and administrative procedures related to imports, exports, and customs clearance can sometimes be time consuming and lack transparency. This increases costs and delays for businesses seeking to import raw materials for production. Finally, limited access to advanced technology is one of the biggest obstacles hindering Vietnam’s growth in this industry. Vietnamese companies often struggle to negotiate access to cutting-edge technology due to high costs and complex legal requirements. Additionally, delays in adopting new technologies will affect the competitiveness of Vietnamese tech enterprises in the global market.

Conclusion

While Vietnam still faces many challenges, such as a shortage of highly skilled workers in the semiconductor industry and delays in regulatory and administrative procedures, strong government support and abundant mineral resources have positioned the country to become one of Southeast Asia’s key semiconductor hubs in the future.

[1] Statista (2024). Semiconductor Market in Vietnam <Access>

[2] Vietnam Government Portal (2024). Vietnam’s Development Strategy for Semiconductor Industry to 2030 and Vision to 2050 <Access>

[3] U.S. Geological Survey (2025). Rare Earths Statistics and Information <Access>

[4] FPT (2024). Semiconductor <Access>

[5] VnEconomy (2023). FPT Expected to Deliver 25 million Chips <Access>

[6] The Investor (2024). China’s Victory Giant Technology to Run 260 million USD Plant in Vietnam from 2026 <Access>

[7] The Government News (2022). Samsung Increase Their Investment by 920 million USD <Access>

[8] Doanh Nhan & Phap Luat (2024). Hana Micro Planning to Raise Their Investment <Access>

[9] CafeF (2025). Viettel Planning to Build a Semiconductor Factory by 2030 <Access>

[10] Vietnam Trade and Industry Review (2025). Amkor Technology Triple Its Production by 2025 <Access>

[11] VnExpress (2023). Intel not Planning to Further Investment in Vietnam <Access>

[12] VnExpress (2024). Vietnam Falls Short in High-Skill Worker in Semiconductor Industry <Access>

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |