221월2025

업계 리뷰 / 최신 뉴스 및 보고서

댓글: 댓글 없음.

베트남 의료기기 시장 전반 상황

베트남은 인구 고령화가 진행되고 시민과 정부 모두의 의료비 지출이 증가하면서 의료기기 투자에 유망하고 역동적인 시장을 제공합니다.

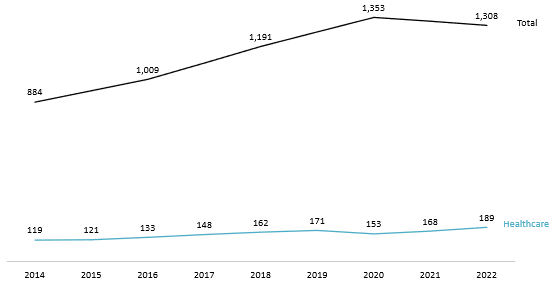

베트남 국민들은 고령화되고 있으며, 노인 인구 비율은 2019년 11.9%에서 2023년 13.9%로 증가했습니다.[1] 2050년까지 전체 인구의 4분의 1을 차지할 것으로 예상됩니다.[2]. 인구 구조 조정은 보다 나은 의료 시스템의 필요성을 의미합니다.[3]. 이 노인 집단은 가장 큰 수요와 지출 잠재력을 가지고 있지만, 의료 서비스에 대한 증가하는 수요는 일반 대중 사이에서 공유됩니다. 특히, 2020년부터 2022년까지 1인당 연간 총 지출은 전국적으로 3.3%, 도시 지역에서 13.5% 감소했습니다. [4]그러나 의료비 지출은 153달러에서 189달러로 거의 25% 증가했습니다.

연간 총 지출 및 h건강케어 이자형베트남의 1인당 지출분 2014-2022

단위: USD

원천: WHO 글로벌 건강 지출 데이터베이스, 지오(GSO), B&Company의 합성

베트남 정부는 국내 수요를 충족하기 위해 2021년부터 2025년까지 중기 투자 자본으로 약 10억 달러를 의료 부문에 배정하여 대중의 일반 의료 서비스를 지원하고 개선하기 위한 인프라, 시설 및 장비를 개발할 계획입니다.[5]. 이러한 동인으로 인해 베트남 의료 장비 시장은 곧 상당한 성장을 기대합니다. 이 시장은 2023년 말 16억 7천만 달러로 추산되며 아시아 태평양 지역에서 8번째로 큰 시장이 되었습니다.[6]2026년 말까지 21억 달러에 도달할 것으로 예상됩니다.[7]CAGR은 8%입니다.

그러나 베트남의 의료 기기 공급은 증가하는 수요를 충족하기 위해 많은 어려움에 직면해 있습니다. 보건부(MoH)는 2022년에 중앙 병원의 90%에서 의약품과 의료 기기가 부족했으며, 특히 응급 치료, 중환자 치료, 심장학 및 수술 장비가 부족했다고 보고했습니다.[8]. 국내 공급이 부족한 것은 이러한 부족의 한 가지 특징입니다. 국내에서 제조되는 제품은 주로 기본적이고 일반적인 범주에 속하지만 첨단 의료 제품은 부족합니다.[9] 베트남 기업의 기술 수준이 낮아서[10] 그리고 적당한 하이테크 내부 투자[11]. 이로 인해 국가는 해외 수입에 크게 의존하게 되었고, 이는 총 공급량의 최대 90%를 차지합니다.[12]. 정부의 복잡한 규제로 인해 부족 현상이 더욱 심화되고 있다[13]제조업체는 유통 전에 인프라 및 의료 기기 관리국(IMDA)에 제품을 등록해야 합니다.[14]. 그러나 승인 프로세스는 비효율적이며 2024년에 11,300건의 신청 중 약 3,000건이 읽히지 않고 승인되지 않은 상태로 남아 있습니다.[15]국내 및 해외 공급이 심각하게 중단되었습니다.

베트남 의료기기 시장점유율

베트남의 의료 기기 국내 생산은 외국인 투자 기업이 주도하고 있습니다. B&Company 기업 데이터베이스에 따르면, 2022년에 가장 큰 의료 기기 제조 기업 10곳은 모두 외국인 직접 투자(FDI) 기업이었고, 산업 수익의 약 75%를 차지했습니다. 일본 기업은 베트남에 적극적으로 투자했으며, 베트남의 제조업체를 선도하고 있습니다(표 1 참조). 한편, 국내 기업은 수입 제품 및 FDI 기업과 경쟁하는 데 상당한 어려움에 직면해 있습니다. MoH는 현지 공급업체가 주로 소규모 및 초소규모 기업이라고 강조했습니다.[16], R&D 투자 및 첨단 생산 능력 제한[17]. 수입 제품이 자국의 보조금 혜택을 받는 반면 국내 생산자는 원자재에 대한 높은 수입세로 인해 비용에 더 큰 압박을 받기 때문에 기본 의료 기기 부문의 경쟁은 치열합니다.[18]. 긴 승인 절차는 현지 기업이 시장에 대응하는 데 더 오랜 시간이 걸리기 때문에 현지 기업의 발전을 방해합니다.[19].

표 1: 상위 의료 기기 제조 회사이것들 2022년에

| 아니요. | 회사 이름 | 투자의 출처 | 시/도 |

| 1 | 소노바 오퍼레이션 센터 베트남 주식회사 | 스위스 | 빈즈엉 |

| 2 | 테루모 BCT 베트남 주식회사 | 일본 | 동나이 |

| 3 | 테루모 베트남 주식회사 | 일본 | 하노이 |

| 4 | 호야렌즈베트남(주) | 일본 | 빈즈엉 |

| 5 | 오므론 헬스케어 제조 베트남 유한회사 | 일본 | 빈즈엉 |

| 6 | B.브라운 베트남 주식회사 | 말레이시아 | 하노이 |

| 7 | 아사히 인텍 하노이 주식회사 | 일본 | 하노이 |

| 8 | 마쓰야 R&D(베트남) 주식회사 | 일본 | 동나이 |

| 9 | 마니 하노이 주식회사 | 일본 | 타이 응우옌 |

| 10 | 니키소 베트남 주식회사 | 일본 | 호치민시 |

원천: 엔터프라이즈 데이터베이스, B&Company의 합성

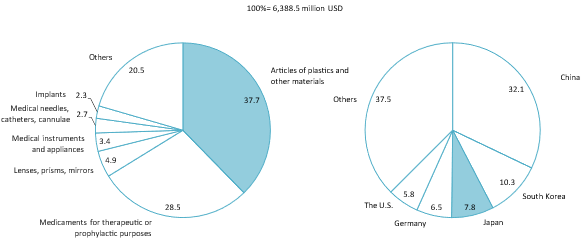

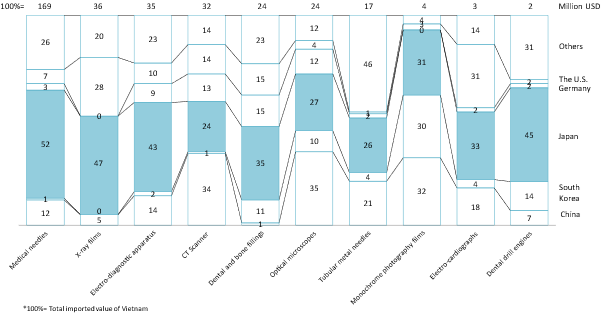

베트남의 의료기기 수입구조를 살펴보면, 베트남은 주로 중국, 한국, 일본, 독일, 미국 등에서 수입을 하고 있다.[20]2023년 전체 수입 가치의 거의 2/3를 차지하는 플라스틱 의료 기기와 치료 또는 예방 목적의 의약품이 주요 수입 제품입니다.[21]일본은 의료용 바늘, 첨단 의료 기계, 치과용 제품 등 첨단 의료 기기를 베트남에 공급하는 주요 국가였으며, 다른 중요한 의료 상품에도 상당한 기여를 했습니다.

Vietnam’s import of medical devices by product category and country of origin in 2023 (단위 : %)

출처: 무역지도, B&Company's Synthesis

Top medical device imported from Japan, compared with the total import to Vietnam in the same categories (2023년, 단위: %)

출처: 무역지도, B&Company's Synthesis

베트남 의료기기 부문 투자의 기회와 과제

베트남의 끊임없이 변화하는 의료기기 시장은 일본 기업에 수출이나 현지 제조 투자를 통해 확장 기회를 제공합니다.

수출에 관하여일본은 첨단 의료 기기의 주요 공급업체로, 여러 부문에서 시장 점유율을 지배하고 있습니다. 일본 장비는 일부 중앙 공공 및 전문 병원에서 광범위하게 활용되고 있으며, 이는 베트남에서 일본 의료 기기에 대한 높은 평가를 반영합니다.[22] [23]. 베트남과 일본은 2008년 경제 동반자 협정(VJEPA)에 가입해 일본 제품에 0%~25%의 우대 관세율을 적용하면서 의료 기기 수입도 호조세를 보이고 있다.[24].

직접 투자 측면에서, 정부는 외국인 투자를 유치하고 의료 기기의 국내 생산을 장려하기 위한 유리한 조건을 추진해 왔습니다. 최근 호치민시는 2030년까지 운영될 제약 산업 개발 프로젝트를 발표했으며, 2045년 비전을 가지고 있습니다. 이 이니셔티브는 제약 및 의료 기기 제조를 위한 전문 산업 클러스터를 구축하고 공급망을 강화하여 외국인 투자를 유치하는 것을 목표로 합니다.[25]. MoH는 또한 현지에서 제조된 의료 기기의 보다 나은 상용화를 위한 정책 및 프레임워크를 개발하고 공공 병원의 입찰 규정을 완화함으로써 국내 생산을 장려합니다. [26].

Handover of medical equipment from the Japanese Government to 4 central hospitals

출처: Vietnamplus

베트남의 의료기기 제조산업은 성장 잠재력이 큰 반면, 일본 공급업체가 주목하고 대비해야 할 과제도 있습니다.

첫째로, 정부는 안전을 보장하기 위해 의료 기기의 공급 및 유통 인증에 대한 엄격한 규정을 부과합니다. 회사는 분류에 따라 IMDA 또는 지방 보건부에 제품을 등록해야 합니다.[27]. 어떤 경우에는 2~3년까지 걸리기도 합니다.[28] 유효한 문서를 얻기 위해.

둘째로수입의 경우 의료기기를 수입하기 위해서는 수입허가증 또는 시장허가증이 필요한데, 이는 베트남 내 법인만이 취득할 수 있다.[29]따라서 일본 기업은 베트남에 대표 사무소를 설립하거나 베트남 파트너를 통해 제품을 유통해야 합니다.

마지막으로, 이 부문에 투자하는 것은 본질적인 장벽을 제시합니다. 제조 공장을 설립하려면 적절한 생산 라인을 구축하기 위해 상당한 선불 자본이 필요합니다. 게다가 회사는 제품을 시장에 출시하기 전에 R&D, 생산에 추가로 투자하고 시장 승인을 받아야 합니다.[30]일본 제조업체가 베트남에서의 사업 확장을 고려할 때, 국내 시장 전망의 이점을 최대한 활용하기 위해서는 이러한 복잡성을 인식해야 합니다.

[1] https://www.gso.gov.vn/du-lieu-va-so-lieu-thong-ke/2023/12/thong-cao-bao-chi-ve-tinh-hinh-dan-so-lao-dong-viec-lam-quy-iv-va-nam-2023/

[2] https://vietnam.unfpa.org/en/topics/ageing-6

[3] https://vietnam.unfpa.org/sites/default/files/pub-pdf/final_vie_factsheet-final_for_printing.pdf

[4] https://www.gso.gov.vn/wp-content/uploads/2024/06/NG-TONG-CUC-2023-Final.pdf

[5] https://thuvienphapluat.vn/van-ban/Dau-tu/Nghi-quyet-29-2021-QH15-Ke-hoach-dau-tu-cong-trung-han-giai-doan-2021-2025-484264.aspx

[6] https://baotintuc.vn/kinh-te/thi-truong-thiet-bi-y-te-viet-nam-thu-hut-nhieu-nha-dau-tu-nuoc-ngoai-20240801155034120.htm

[7] https://www.trade.gov/country-commercial-guides/vietnam-healthcare

[8] https://thuvienphapluat.vn/van-ban/The-thao-Y-te/Bao-cao-1528-BC-BYT-2022-thuc-trang-tinh-hinh-cung-ung-su-dung-thuoc-tai-co-so-kham-chua-benh-540779.aspx

[9] https://baodauthau.vn/thiet-bi-y-te-trong-nuoc-can-tiep-suc-post160380.html

[10] https://moh.gov.vn/documents/20182/212437/628Du-thao-To-trinh%20TTCP%2012.7.20.doc/2b1998aa-18c5-46be-a236-789a99a5f525

[11] https://baodautu.vn/von-fdi-dau-tu-vao-linh-vuc-duoc-pham-y-te-viet-nam-con-thap-d194453.html

[12] https://baodautu.vn/90-thiet-bi-y-te-o-viet-nam-deu-phai-nhap-khau-d112438.html

[13] https://laodong.vn/y-te/thieu-thuoc-trang-thiet-bi-y-te-van-dien-ra-cuc-bo-tai-mot-so-dia-phuong-1290233.ldo

[14] https://www.trade.gov/market-intelligence/vietnam-medical-device-registration

[15] https://vietnamfinance.vn/cap-phep-thiet-bi-y-te-hang-nghin-ho-so-ton-dong-dn-lo-lang-mat-co-hoi-d118634.html

[16] 베트남 기업 데이터베이스에 따르면, 2022년에 베트남 내 중소기업은 96%(307개 기업 중 295개)를 차지했습니다.

[17] https://moh.gov.vn/documents/20182/212437/628Du-thao-To-trinh%20TTCP%2012.7.20.doc/2b1998aa-18c5-46be-a236-789a99a5f525

[18] https://thanhnien.vn/thiet-bi-y-te-san-xuat-trong-nuoc-canh-tranh-khoc-liet-voi-hang-nhap-khau-185240816184151713.htm

[19] https://thanhnien.vn/thiet-bi-y-te-san-xuat-trong-nuoc-canh-tranh-khoc-liet-voi-hang-nhap-khau-185240816184151713.htm

[20] https://www.marketresearch.com/China-Research-and-Intelligence-Co-Ltd-v3627/Vietnam-Medical-Devices-Research-37608100/

[21] 두 제품 유형의 총 수입 가치는 각각 24억 달러와 18억 달러로, 2023년 베트남의 의료 기기 총 수입 가치는 64억 달러입니다(Trade Map의 데이터를 기반으로 계산).

[22] https://www.vn.emb-japan.go.jp/itpr_ja/20240531_KHospital_vn.html

[23] https://www.vietnamplus.vn/ban-giao-thiet-bi-y-te-cua-chinh-phu-nhat-ban-cho-4-benh-vien-tw-post857798.vnp

[24] https://thuvienphapluat.vn/phap-luat/ho-tro-phap-luat/nhap-khau-thiet-bi-y-te-thi-ap-dung-thue-gia-tri-gia-tang-nhu-the-nao-nhap-khau-thiet-bi-y-te-phai–127355-39509.html

[25] https://moh.gov.vn/vi_VN/hoat-dong-cua-dia-phuong/-/asset_publisher/gHbla8vOQDuS/content/tphcm-khuyen-khich-doanh-nghiep-san-xuat-thuoc-va-trang-thiet-bi-y-te-trong-nuoc

[26] https://baochinhphu.vn/phat-trien-cong-nghiep-trang-thiet-bi-y-te-san-xuat-trong-nuoc-102276530.htm

[27] https://thuvienphapluat.vn/van-ban/The-thao-Y-te/Nghi-dinh-98-2021-ND-CP-quan-ly-trang-thiet-bi-y-te-493940.aspx?anchor=dieu_48

[28] https://thanhnien.vn/thiet-bi-y-te-san-xuat-trong-nuoc-canh-tranh-khoc-liet-voi-hang-nhap-khau-185240816184151713.htm

[29] https://www.trade.gov/market-intelligence/vietnam-medical-device-registration

[30] https://khoahocphothong.vn/san-xuat-thiet-bi-y-te-viet-nam-cong-nghe-cao-van-gap-kho-256686.html

* 본 기사의 내용을 인용하고자 하시는 경우, 저작권을 존중하여 출처와 원 기사의 링크를 함께 명시해 주시기 바랍니다.

| 비앤컴퍼니

2008년부터 베트남에서 시장 조사를 전문으로 하는 최초의 일본 기업입니다. 업계 보고서, 업계 인터뷰, 소비자 설문 조사, 비즈니스 매칭을 포함한 광범위한 서비스를 제공합니다. 또한, 최근 베트남에서 900,000개 이상의 기업에 대한 데이터베이스를 개발하여 파트너를 검색하고 시장을 분석하는 데 사용할 수 있습니다. 문의사항이 있으시면 언제든지 문의해주세요. info@b-company.jp + (84) 28 3910 3913 |