09Apr2025

Latest News & Report / Vietnam Briefing

Comments: No Comments.

As the global energy transition accelerates, green hydrogen and green ammonia are emerging as pivotal solutions for achieving carbon neutrality. Vietnam, with its abundant renewable energy resources, is positioning itself as a key player in the green hydrogen and green ammonia industries.

The demand for Green Hydrogen and Green Ammonia development in Vietnam

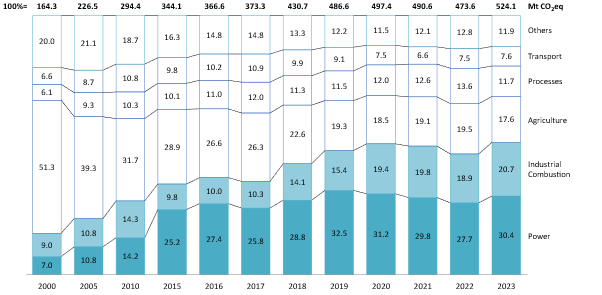

Vietnam’s current greenhouse gas (GHG) emissions pose significant threats to the country’s commitments to its Net-Zero targets by 2050. According to the Emissions Database for Global Atmospheric Research (EDGAR), Vietnam ranked 18th globally in GHG emissions with over 524 million tonnes of CO2eq in 2023, accounting for 1% of the global emission volume[1]. The power sector generated over 30% of the nation’s total emissions, with a CAGR of 12% from 2000 to 2023. The sector sees a heavy reliance on coal-fired thermal power[2], as reports from the International Energy Agency (IEA) highlight that coal was responsible for over 90% of its CO2 emissions in 2022 with a total emission volume of 127.3 million tonnes. With a plan to cut down emissions from the energy sector to only 101 million tonnes annually under the Net-Zero scenario[3], the country is under pressure to decarbonize the energy sector and to develop alternatives for traditional coal-fired plants.

Vietnam Greenhouse Gas emission by sector from 2000 to 2023

Unit: %

Source: B&Company Vietnam synthesis from EDGAR’s reports

The development of green hydrogen and green ammonia in Vietnam is emerging as a pivotal component of the country’s decarbonization efforts and transition to sustainable energy. Green hydrogen, produced through renewable energy, and green ammonia, synthesized via the Haber-Bosch process, are gaining traction as potential sustainable energy carriers to be used in the power industry and industrial combustion[4], the two leading sectors in terms of GHG emissions. These green alternatives also hold the potential to decarbonize hard-to-abate industries, such as cement, iron, and steel production[5]. With the current production of 500 thousand tonnes of grey hydrogen annually for these industries[6], transitioning to green hydrogen and green ammonia could cut the country’s greenhouse gas emissions by up to 6.5 million tonnes of CO2eq, further advancing its sustainability goals[7].

Current development status and growth potential of Green Hydrogen and Green Ammonia in Vietnam

Green hydrogen and green ammonia are primarily used in the chemical and manufacturing industries, with their role in the energy sector still in the experimental stage[8]. While this trend holds true in Vietnam, the country is currently undergoing significant developments in preparation for green hydrogen and ammonia production and application as part of its broader clean energy transition initiatives, driven by both domestic initiatives and global trends toward decarbonization.

Regarding green hydrogen, Vietnam is among the first 50 countries to announce its Hydrogen Energy Development Strategy in 2024 through Decision No. 165/QD-TTg signed in 2024[9]. Currently, 500 thousand tonnes of grey and brown hydrogen produced annually are used primarily in the oil refining (36%) and fertilizer manufacturing industries (64%), with only 0.5% allocated to other industries such as steel, food, and electronics[10].

Under Decision No. 165/QD-TTg, the production of green hydrogen from renewable sources and from carbon capture/utilization (CCS/CCUS) technologies will be prioritized, with a national output of between 100 and 500 thousand tonnes in 2030 and between 10 and 20 million tonnes in 2050. Future applications will focus on electricity generation (69%) and transportation (28%), marking a significant shift toward sustainable energy solutions. With strong domestic production and rising global demand, the exportation of green hydrogen is highly possible, with a total value expected to reach over 7.6 million tonnes in 2050.

Table 1: Vietnam’s demand for hydrogen in 2030 and 2050 in different scenarios

| 2030

Unit: thousand tonnes |

2050 – Baseline

Unit: thousand tonnes |

2050 – Growth

Unit: thousand tonnes |

||||

| Minimum | Maximum | Minimum | Maximum | Minimum | Maximum | |

| Domestic Consumption | 120 | 594 | 5,350 | 15,332 | 5,728 | 16,143 |

| Electricity Generation | 90 | 451 | 5,050 | 14,500 | 5,050 | 14,500 |

| Fertilizer Production | 6 | 28 | 190 | 381 | 338 | 677 |

| Steel Production | 3 | 12 | – | 150 | 178 | 533 |

| Cement Production | – | 33 | 61 | 122 | 111 | 222 |

| Oil Refining | 21 | 64 | 43 | 171 | 43 | 171 |

| Chemicals | – | 6 | 6 | 8 | 8 | 40 |

| Export | 10 | 448 | 100 | 4,431 | 171 | 7,628 |

| Aviation | – | 47 | – | 421 | – | 778 |

| Maritime Shipping | 10 | 401 | 100 | 4,010 | 171 | 6,850 |

| Total | 140 | 1,042 | 5,450 | 19,763 | 5,899 | 23,771 |

Source: Vietnam Energy Partnership Group

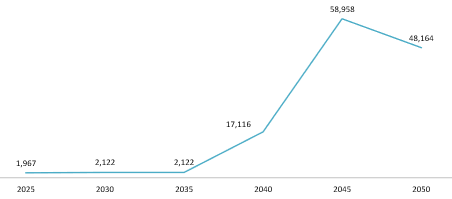

As for green ammonia, the current demand in Vietnam is concentrated in fertilizer manufacturing. However, under Decision No. 500/QD-TTg on the National Electricity Development Planning from 2021 to 2030, with a vision for 2050 signed in 2023, ammonia will play a crucial role as an alternative fuel for coal-fired power plants. In 2050, all coal-fired plants will fully make a transition to using biomass and ammonia, with a total capacity of 25,632 MW to 32,432 MW, accounting for 4.5% to 6.6% of the nation’s total energy capacity[11]. This shift will drive ammonia demand from 1.967 million tonnes in 2025 to 48.164 million tonnes in 2050, representing a CAGR of 14%.

Forecasted demand for ammonia in Vietnam from 2025 to 2050

Unit: thousand tonnes

Source: PVN

With a rising domestic demand and prospective export opportunities, Vietnam has attracted multiple green hydrogen and green ammonia manufacturing projects in Vietnam from both domestic and foreign investors.

– Tra Vinh Green Hydrogen Manufacturing Plant under The Green Solutions Group is Vietnam’s first hydrogen manufacturing plant, with construction commencing in 2023. The project, which is expected to be operational at the end of 2026, is capable of producing 575 tonnes of green ammonia daily using renewable energy such as wind and solar energy[12].

– In 2024, China Huadian Corp., a Chinese state-owned enterprise, is under discussion with the Vietnamese firm Minh Quang JSC about a $2.39 billion green hydrogen plant in the central province of Quang Tri. The project will have an annual output of 60,000 tonnes of green hydrogen using solar power[13].

– Vietnamese firm Phu My Group is also eyeing an 825 million USD complex project including a hydrogen production facility, a general port, and an industrial park in Binh Dinh. The project’s green hydrogen output is expected to be at 20,000 tonnes from 2026 to 2030 and increase to 160,000 tonnes between 2030 and 2035[14].

Government policies on the development of Green Hydrogen and Green Ammonia

The Vietnamese government has taken significant steps toward fostering the development of green hydrogen and green ammonia.

(1) The Politburo’s Resolution No. 55-NQ/TW on the orientations of Strategy for the National Energy Development by 2030, with a vision towards 2045 signed in 2020 highlighted the importance of renewable power sources in the energy transition roadmap of Vietnam. The share of renewable energy in total primary energy supply is to increase to between 15% and 20% in 2030, and between 25% and 30% in 2045[15].

(2) Decision No. 500/QD-TTg signed in 2023 and Decision No. 165/QD-TTg signed in 2024, foster the domestic demand for green hydrogen and green ammonia through applications in the electricity industry, transportation, and the manufacturing industry. Decision No. 165/QD-TTg also highlights the need for proper storage, transportation, and distribution of hydrogen, as well as export opportunities.

(3) Decree No. 58/2025/ND-CP elaborating the Law on Electricity pertaining to the Development of Renewable Energy Power and New Energy Power signed in 2025 shows the nation’s commitment to the development of sustainable energy sources. Under the Decree, electricity-producing projects using 100% green hydrogen, green ammonia, or their combination may enjoy sea area levy and land use fee exemptions for up to 3 years during the capital construction stage, with further reduction onwards. The projects also benefit from the long-term minimum contracted electricity output of 70% during the principal loan repayment period and up to 12 years, easing the initial operational phase of these power plants[16].

Opportunities and challenges

Vietnam’s green hydrogen and ammonia industries are on the cusp of significant expansion. The government has been showing significant support for the sector with new policies supporting the development of green hydrogen and green ammonia through shifting electricity sources, investment incentives, and building infrastructure for storage, transportation, and export. Vietnam’s long coastline presents renewable energy resources, particularly wind and solar power, which could be harnessed to produce low-cost hydrogen. For foreign investors, the sector provides ample investment opportunities as the country is expected to require up to 57.1 billion USD between 2021 and 2025 and 77.6 billion USD between 2026 and 2030 to develop its energy supply sources and distribution system[17].

However, the development of green hydrogen and green ammonia in Vietnam faces significant hurdles. Skepticism about the feasibility of green hydrogen remains as the production of renewable hydrogen is 2 to 12 times more costly than the traditional production using non-renewable sources[18]. Furthermore, Vietnam is still heavily reliant on foreign technology, which can hamper the domestic growth of the sector.

Conclusion

Vietnam is well-positioned to become a leader in green hydrogen and ammonia production, given its renewable energy capacity and strategic geographic location. While challenges remain, continued investments, policy support, and infrastructure development will drive the sector forward.

[1] EDGAR. GHG emissions of all world countries <Assess>

[2] EVN. Operational situation in first 6 months of 2024; objectives and tasks in July and remaining months of 2024 <Assess>

[3] EREA & DEA. Viet Nam Energy Outlook Report, Pathways to Net-Zero (2024) <Assess>

[4] PVN. Integrating Green Hydrogen and Green Ammonia into the Value Chain of Vietnam Oil and Gas Group’s Operations <Assess>

[5] EREA & DEA. Viet Nam Energy Outlook Report, Pathways to Net-Zero (2024) <Assess>

[6] Vietnam Energy. Report on the Implementation of the Hydrogen Energy Strategy in Vietnam <Assess>

[7] B&Company calculation from the production volume of hydrogen and the global average emissions intensity of hydrogen production in 2023 <Assess>

[8] Vietnam Energy. Report on the Implementation of the Hydrogen Energy Strategy in Vietnam <Assess>

[9] TVPL. Decision No. 165/QD-TTg on approving Vietnam’s Hydrogen Energy Development Strategy by 2030, with a vision to 2050 <Assess>

[10] PVN. Integrating Green Hydrogen and Green Ammonia into the Value Chain of Vietnam Oil and Gas Group’s Operations <Assess>

[11] Vietnam Government Portal. Decision No. 500/QD-TTg on approving the National Electricity Development Planning of 2021 – 2030 and vision for 2050 <Assess>

[12] The Green Solutions Group. Our projects – Tra Vinh Green Hydrogen Manufacturing Plant <Assess>

[13] The Investors. Chinese SOE Huadian plans $2.4 bln green hydrogen plant in Central Vietnam <Assess>

[14] The investors. Phu My Group plans 2,000 MW green hydrogen plant in central Vietnam <Assess>

[15] Vietnam Communist Party Document. Politburo’s Resolution No. 55-NQ/TW on the orientations of Strategy for the National Energy Development by 2030, with a vision towards 2045 <Assess>

[16] Vietnam Government Portal. Decree No. 58/2025/ND-CP elaborating the Law On Electricity pertaining to the Development of Renewable Energy Power and New Energy Power <Assess>

[17] Vietnam Government Portal. Decision No. 262/QD-TTg on approving the Plan to implement the National Power Development Planning for 2021 – 2030 period, with a vision toward 2050 <Assess>

[18] As of now, prices of traditional hydrogen produced in Vietnam costs between 1 USD and 2.5 USD per kg, while green hydrogen (produced from renewable energy sources) has a Levelized Cost of Hydrogen (LCOH) ranging from 5 USD to 12 USD per kg <Assess>

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |