24Nov2025

Latest News & Report / Vietnam Briefing

Comments: No Comments.

The market for pet care products and services in Vietnam has experienced strong growth in recent years. Along with the increase in the number of pet owners, more businesses have invested in this field, providing a variety of products from food and accessories to spa services and veterinary health care. Pets are gradually becoming considered family members, leading to an increasing need for care and pampering. This article will provide an overview of the Vietnamese pet market, prominent trends, introduce typical pet service store chains, and provide recommendations for foreign investors interested in this potential but also challenging field.

Overview of the pet products and services market in Vietnam

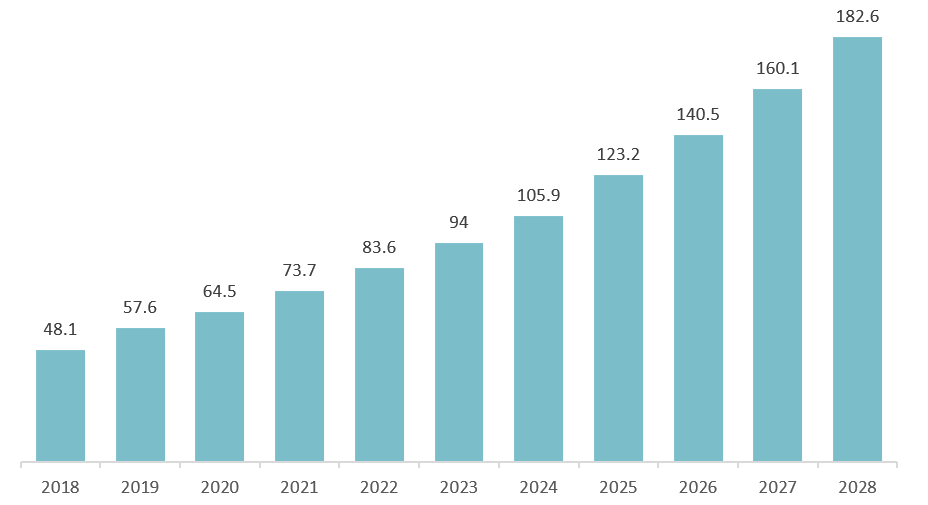

In Vietnam, the pet care products market has grown significantly thanks to increased income and more people raising pets. Pet care industry sales in Southeast Asia reached 4 billion USD, of which Vietnam accounted for 13%, or about 500 million USD[1]. The pet industry in Vietnam reached 94 million USD in 2023 and is forecast to grow to 182.6 million USD by 2028, with pet food accounting for around 85% of the total market. Veterinary services, accessories, spas, and pet hotels are also gaining in popularity. This upward trend reflects rising demand: there are currently more than 12 million pets (dogs and cats) in Vietnam, increasing by an average of 5% per year, and the number is expected to reach 16 million by 2027[2].

Pet market size in Vietnam, 2018–2028F

Unit: million USD

Source: Euromonitor, compiled and calculated by Kirin Capital

Notably, competition has also intensified as the industry’s concentration index (HHI) declined from 4,397 in 2017 to 3,176 in 2023, driven by the entry of many new brands. Several foreign brands have entered Vietnam, such as Catsan (Mars Inc.) in the cat litter segment and Merial (Boehringer Ingelheim) in pet healthcare. Comprehensive Japanese pet care centers such as Sasaki Animal Hospital and AEON Pet Shop have also expanded into Vietnam’s pet market.

The growth momentum of the pet market in Vietnam comes from a combination of factors. First of all, the proportion of households keeping at least one pet has increased from 67% in 2023 to about 74.5% in 2024, showing that pets are increasingly becoming a familiar part of family life[3]. In addition, the expansion of the middle class and higher disposable incomes have made pet owners pay more attention to the health, nutrition and quality of life of their pets. Along with the trend of “humanizing pets”, the market has witnessed a sharp increase in the segments of premium food, specialized nutrition and premium care products. At the same time, the booming e-commerce has created conditions for consumers to easily access a variety of pet products and services, promoting faster market growth[4].

Key market trends

From the overall market picture above, several key trends can be observed in Vietnam’s pet industry today:

– Humanization of pets and premium spending: More Vietnamese, especially young urban consumers, treat pets as family members and are willing to invest in the best products for them. Demand for premium cat food is rising rapidly across Southeast Asia, including Vietnam[5]. Spa, grooming, and pet hotel services are also booming in major cities to meet the needs of busy owners who want to provide the best care for their pets.

– Growing adoption of e-commerce and modern distribution channels: Vietnamese pet owners are gradually shifting their purchasing habits toward online channels. Currently, around 29% of pet owners have bought pet products online, and this figure continues to grow after the pandemic[6]. Pet supermarkets and pet-oriented convenience stores are also emerging, making products more accessible. For instance, pet product chains like Pet Mart have expanded their product presence from specialty stores to supermarkets.

– Intensifying competition with the entry of foreign brands: Vietnam is attracting international pet product manufacturers and retailers thanks to its high growth potential. Pet Lovers Centre, the largest pet retail chain in Southeast Asia, has already entered Vietnam, alongside the expansion of pet food brands from the US and Europe. Pet food imports from China to Vietnam have also surged (up nearly 500% from 2021 to 2024)[7], creating price competition that pushes domestic firms to improve product quality, while foreign companies are compelled to position themselves in the premium or differentiated segments.

– Increasing focus on pet health and professional veterinary services: Pet owners are paying more attention to their pets’ health. Veterinary hospitals, specialized clinics, and pet insurance are gaining interest. International-standard veterinary hospital chains such as PetCare, PetPro, and Sasaki Animal Hospital (Japan) are pioneering modern medical, surgical, and diagnostic services for pets[8].

Key pet service store chains in Vietnam

The market is currently led by domestic chains such as Pet Mart, PetCity, PetCare, and PetPro, which operate integrated models ranging from retail products and spa–grooming services to veterinary clinics and pet hotels. In addition, several international brands like Pet Lovers Centre (Singapore) and AEON Petemo (Japan) have also entered Vietnam, further energizing the market and intensifying competition in the mid- to high-end segments.

| No | Brand | Country | Establishment year in Vietnam | Short description | Website |

| 1 | Pet Mart | Vietnam | 2012 | No. 1 pet supermarket chain in Vietnam, ~35 stores nationwide (Hanoi, Ho Chi Minh City, Da Nang, Hai Phong), selling supplies, food and spa services, grooming, pet hotels. | https://www.petmart.vn/ |

| 2 | PetPro | Vietnam | 1998 | The first chain of veterinary hospitals and pet shops in Vietnam. After 25 years of development, PetPro has 6 hospitals and 6 pet shops in Ho Chi Minh City and Vung Tau, providing full services from examination and treatment, veterinary surgery to beauty, accommodation and sending pets abroad. | https://petpro.com.vn/ |

| 3 | GAIA Pet Care | Vietnam | 2010 | Japanese standard veterinary hospital clinic chain. Currently has 6 facilities in Hanoi and Thanh Hoa. Providing medical examination, surgery, spa and pet hotel services.. | https://www.gaia.vn/ |

| 4 | Pet Lovers Centre | Singapore | 2017 | The largest pet retail chain in Southeast Asia, famous for >15,000 diverse products and professional grooming services, operates under the model of a modern pet supermarket. Currently has a store in Ho Chi Minh City (District 7) and an online sales channel. | https://www.petloverscentre.com/ |

| 5 | AEON Petemo (Aeon Pet Shop) | Japan | 2019 | Pet store chain of AEON Group (Japan). Has 3 branches in Ho Chi Minh City. Sells food, accessories and grooming services. | https://www.aeon.com.vn/thuong-hieu-aeon/aeon-petemo-pet-store |

| 6 | Sasaki Animal Hospital | Japan | 2014 | Japanese standard veterinary hospital, located in District 7, Ho Chi Minh City. This facility provides medical examination and treatment services, surgery according to international standards and high-class spa grooming (directly performed by Japanese experts), ensuring comprehensive and safe pet care. | https://japananimalhospital.vn/ |

| 7 | PetCare | Vietnam | 2005 | A prestigious veterinary hospital system founded by Dr. Thanh Ngoc. Currently has 5 branches (4 in Ho Chi Minh City, 1 in Ba Ria-Vung Tau) with modern equipment, providing services from medical examination, surgery, testing to cosmetic surgery, accommodation for pets. | https://petcare.vn/ |

| 8 | Dog Paradise | Vietnam | 2009 | Long-standing dog and cat store system in Ho Chi Minh City, a pioneer in integrating purebred pet sales, accessories, food, on-site grooming, and dog and cat hotels. Currently has 4 stores in Ho Chi Minh City, serving both famous and trusted customers. | https://dogparadise.vn/ |

| 9 | Kimi Pet | Vietnam | 2010 | The leading chain of pet supermarkets & spa salons in Hanoi. Founded by a Grooming expert, now has 3 locations (2 in Hanoi, 1 in Ho Chi Minh City) with spa bathing, grooming, pet hotels and professional groomer training services. | https://kimipet.vn/ |

| 10 | Pet House | Vietnam | 2010 | Large combined store and breeding farm. Currently has 3 facilities in Hanoi and 1 in Ho Chi Minh City. Trading in pets, accessories, spa services and pet accommodation. | https://pethouse.com.vn/ |

B&Company’s synthesis

Implications for foreign investors

Opportunities: The number of pet owners is increasing rapidly (especially in urban areas) and awareness of pet health care is increasing, leading to a huge demand for high-quality care products and professional services. The market still has a lot of room for growth due to many segments that have not been fully exploited – for example, organic food, smart pet supplies, insurance, and professional training. Investors also have opportunities for international franchise models (grooming chain models, veterinary hospitals importing foreign technology). In addition, new regulations on veterinary medicine, such as mandatory vaccination, create demand for vaccines, medical examination and treatment services, opening a market that can be explored[9].

Challenges: Despite the great potential, investors also face many challenges. Competition from cheap products (especially from China) is very strong, Vietnamese consumers are still quite price-sensitive, many people are willing to choose cheap products over imported high-end brands if the difference is large. Legally, investors may encounter barriers in import and quarantine procedures: imported pet food is currently subject to a tax of ~7% and must go through a strict registration and quality control process.[10]. In addition, local consumer culture requires products/services to be suitable (e.g., Vietnamese packaging, nutritional formulas suitable for small dog/cat breeds popular in Vietnam). Finally, investors should prepare for the problem of on-site veterinary and grooming human resources, as the source of highly skilled human resources in this field in Vietnam is limited, and additional training may be needed.

To take advantage of opportunities and minimize risks, foreign investors need to have a systematic market approach strategy.

– Cooperate with local partners – for example, joint ventures with reputable pet shop chains and veterinary clinics – to quickly understand Vietnamese tastes and build a distribution network. The franchise model is also gaining attention in the pet industry; investors can consider it to quickly expand scale, taking advantage of existing brands.

– Investing in market education is necessary: organizing Pet Day events, Pet Health Workshop in coordination with veterinary associations and pet-raising communities to raise awareness of quality products and scientific care. This is not only a marketing activity but also helps build trust of foreign brands with Vietnamese customers.

– Regarding the product portfolio, it is necessary to flexibly adjust – providing product lines with diverse prices (both popular and high-end segments) to reach many customer groups; at the same time, emphasizing unique advantages (such as organic ingredients, smart technology) that domestic products do not have.

– Taking advantage of digital channels: e-commerce and social networks are effective channels to reach young “servants”. An omni-channel strategy combining physical experience stores with online sales will meet the current trend of convenient shopping.

– It is necessary to strictly comply with local regulations on quarantine, product safety and trademark registration; this may be more favorable in the future when Vietnam plans to adjust standards towards closer to international standards.

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

[1] https://petfair-vietnam.com/vi/xu-huong-phat-trien-nganh-thu-cung-tai-viet-nam/

[2] https://kirincapital.vn/wp-content/uploads/2024/06/BAO-CAO-TRIEN-VONG-NGANH-CONG-NGHIEP-THU-CUNG-VIET-NAM.pdf

[3] https://tgmstatbox.com/topics/pet-care/vietnam/

[4] https://www.marketreportanalytics.com/reports/pet-food-market-in-vietnam-106582#summary

[9] https://congly.vn/quy-dinh-moi-ve-nuoi-cho-meo-va-trach-nhiem-boi-thuong-khi-can-nguoi-489034.html