In today’s fast-paced world, consumers increasingly seek products that boost energy and enhance alertness, which has driven the expansion of the energy drink market. Both local and international brands are competing to meet the diverse needs of Vietnamese consumers. This article examines the current state of Vietnam’s energy drink market, identifies key players, explores emerging trends, and analyzes the opportunities and challenges the industry faces.

Vietnam’s Energy Drink Growth

Globally, the energy drink market is booming. According to Straits Research[1], the global market reached a value of USD 99 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 8.5%, reaching USD 206 billion by 2032. This growth is largely attributed to rising health awareness and increasing participation in fitness activities, which drive demand for energy drinks as they support post-workout recovery.

In Vietnam, the energy drink market is also expanding rapidly. A report from Astute Analytica[2] valued Vietnam’s market at USD 3.5 billion in 2023, with projections to reach USD 6.5 billion by 2032, representing a CAGR of 7.1%.

Key drivers include rapid urbanization, an increasingly young population, and rising disposable income. By 2023, Vietnam’s urbanization rate reached 38.1%, and the population aged 15–59 made up 62.2% of the total population, according to GSO. Additionally, average income increased by 6.9% in 2022-2023, further fueling consumption[3].

Key Market Trends Shaping Vietnam’s Energy Drink Market

1. Health-Conscious Consumption

Consumers are increasingly adopting healthier lifestyles, challenging traditional energy drinks that are often high in sugar and caffeine. Brands are responding by introducing low-calorie options, natural sweeteners, brain-boosting ingredients, and organic alternatives to cater to health-conscious consumers[4].

Examples of innovative offerings are Monster Energy Zero Sugar, Drink Izz Organic Energy Drink, and herbal energy drinks like Hong Ma, which feature ingredients such as goji berries and ginseng. This shift reflects the growing demand for beverages that provide functional benefits while aligning with healthier lifestyles.

Herbal energy drink is supplemented with Goji berry, Dan ginseng

Source: Hong Ma Herbal Energy Drink

2. Product Differentiation

Product differentiation is crucial in the highly competitive beverage market. To attract consumers, new products must offer unique flavors or address unmet needs. Brands that simply imitate market leaders may struggle to gain traction. For instance, although PepsiCo’s Sting Gold and Coca-Cola’s Samurai Gold benefit from strong distribution networks, they have not swayed consumers away from Red Bull, largely due to a lack of distinctive qualities[5].

Nowadays, energy drinks are no longer limited to traditional flavors such as lemon, orange or strawberry, but creative with tropical fruit flavors (mango, pineapple, passion fruit), herbal notes (ginger, lemongrass, mint), and even coffee or cola-infused energy drinks to create memorable and unique offerings for consumers[6].

3. Expanded Consumer Demographics

Energy drinks are most popular among men aged 18–34, with a smaller proportion of teenagers aged 12–17 also consuming them[7]. In Vietnam, this drink is no longer exclusively targeted at labor-intensive workers or truck drivers. With diverse flavors and ingredients, they have also appealed to office workers and gamers who need mental alertness and focus. In Vietnam, brands have started marketing to gamers over the past five to six years, helping them stay concentrated and perform better in extended gaming sessions.

In addition, energy drink brands frequently sponsor sports tournaments, collaborate with KOLs, KOCs, and launch engaging social media campaigns to attract younger demographics and drive engagement. A standout example is Red Bull, which became the official sponsor of Vietnam’s National Football Teams in February 2023[8]. This partnership highlights Red Bull’s strategy to associate its brand with sports and energy, resonating with both athletes and sports enthusiasts.

Red Bull is at the football championship matches to energize players and audiences

Source: Brands Vietnam

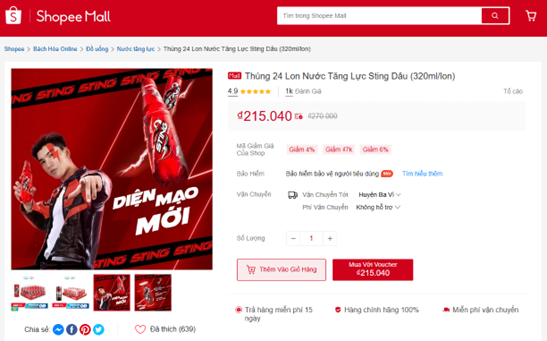

4. Diverse Online Distribution Channels

While traditional offline channels like grocery stores, supermarkets, and convenience stores remain significant, the rise of e-commerce and social media platforms such as Shopee, TikTok Shop has created new opportunities for energy drink sales. Brands that leverage these digital channels benefit from broader reach and enhanced consumer engagement.

Energy drinks on the official channel Shopee Mall

Source: Shopee Vietnam

Main Players in Vietnam’s Energy Drink Market

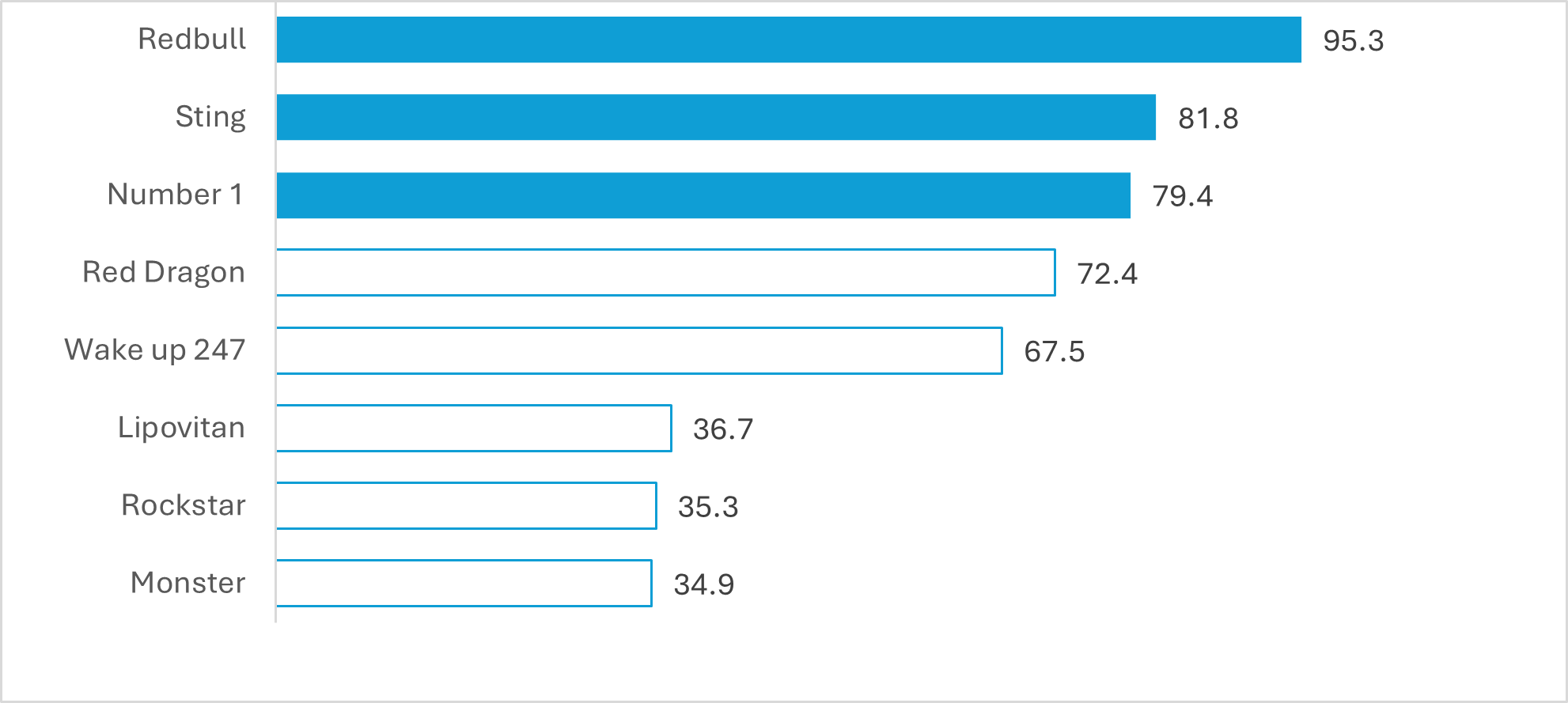

The Vietnamese energy drink market is competitive, with both international and local brands vying for market share – in which foreign brands are slightly more dominant. In a recent online survey conducted by InfoQ[9] at the end of 2023, involving 510 Vietnamese consumers, the results highlighted brand recognition within this sector:

Total awareness of energy drink brands (Dec, 2023)

Unit: %; N = 510

Source: InfoQ

According to the survey, Red Bull, Sting, and Number 1 emerged as the top three most recognized brands in Vietnam’s energy drink market. Notably, Red Bull continues to hold a strong influence as one of the first energy drink brands to enter and establish a foothold in Vietnam.

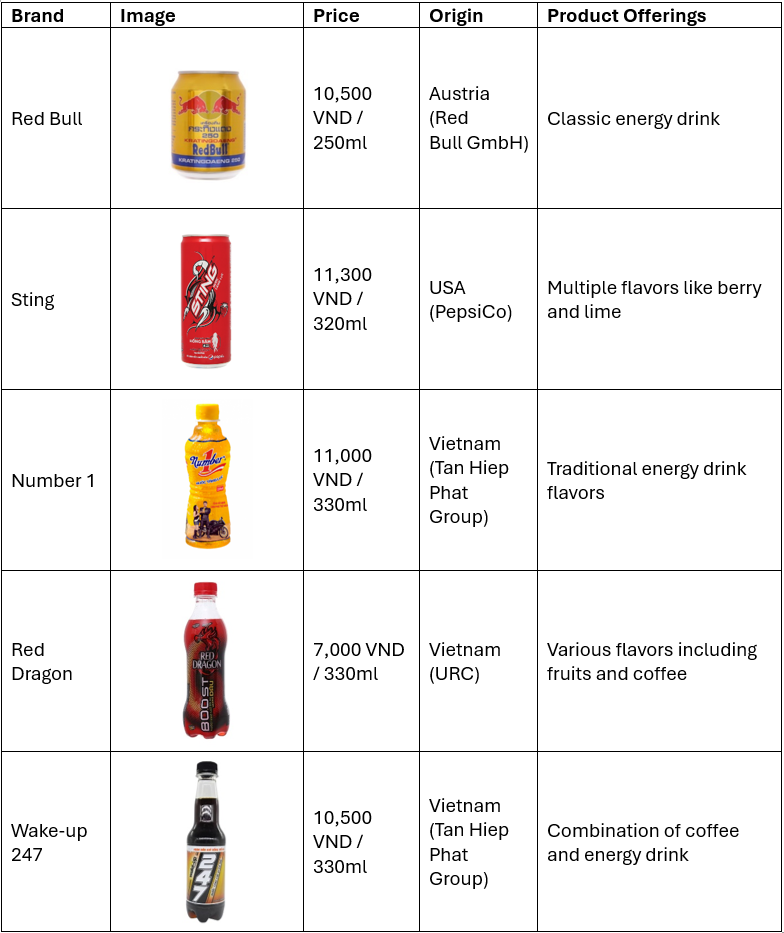

The table below provides more information about top 5 brands from the survey above:

Source: B&Comany’s synthesis

Energy drink prices in Vietnam typically range from 7,000 to 11,000 VND, with premium options like Monster priced around 25,500 VND / 355ml can. However, these higher-end products have lower brand recognition compared to more affordable alternatives.

Distribution channels have also evolved, with brands now actively leveraging e-commerce platforms and social networking sites alongside traditional outlets like grocery stores and supermarkets.

Opportunities

The Vietnamese energy drink market presents several growth opportunities for companies willing to adapt:

- – Rural Market Expansion: While urban areas show high consumption rates, rural markets are still largely untapped. With improvements in infrastructure and increasing income levels, these areas offer potential for growth as brands expand their reach.

- – Health-Oriented Products: Creating energy drinks with added health benefits, such as vitamins or natural ingredients, can attract health-conscious consumers and address concerns about sugar and caffeine content.

- – Strategic Partnerships: Collaborations with local distributors and retailers can strengthen brand visibility and accessibility, allowing energy drink companies to penetrate new segments more effectively.

- – Sustainability Initiatives: As eco-friendly practices gain popularity, energy drink brands that adopt sustainable packaging and production processes can appeal to environmentally conscious consumers, aligning with global sustainability trends.

Challenges

Despite the promising opportunities, the energy drink industry in Vietnam faces several challenges:

- – Intense Competition: The presence of numerous international and local brands heightens competition. Companies need continuous innovation and strong marketing efforts to differentiate themselves and retain market share.

- – Health Concerns: Increased awareness of the potential health risks of energy drinks, such as high caffeine and sugar levels, may lead to decreased demand or stricter regulatory policies.

- – Supply Chain Vulnerabilities: Global disruptions, including post-pandemics and geopolitical tensions, can impact supply chains, affecting production and distribution and ultimately impacting profitability.

Conclusion

Vietnam’s energy drink market is poised for continued growth, driven by favorable demographics and evolving consumer preferences. To capitalize on this growth, companies must innovate, adhere to regulatory requirements, and engage in strategic market partnerships. By staying in tune with consumer trends and addressing challenges proactively, energy drink brands can strengthen their position and secure long-term growth in Vietnam’s dynamic and expanding market.

[1] Straits Research (2024), Energy Drinks Market Size <Assess>

[2] Astute Analytica (2023), Vietnam Energy Drinks Market Size, Trends (2024-2032) <Assess>

[3] GSO Vietnam (2023), Population and employment labor in the 4th quarter and 2023 <Assess>

[4] Brands Vietnam (2024), Deep Dive #20: The Energy Drink Market <Assess>

[5] Brands Vietnam (2024), Deep Dive #20: The Energy Drink Market <Assess>

[6] Win R&D (2024), Discover the 9 latest energy drink trends of 2024 <Assess>

[7] Vinmec, What are the effects of energy drinks? <Assess>

[8] Brands Vietnam (2023), Red Bull and journey to increase brand love through football passion <Assess>

[9] InfoQ (2023), Survey on brand awareness, usage and purchasing habits of energy drinks among Vietnamese consumers <Assess>

| B&Company, Inc.

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

Read other articles