15Jun2021

Industry Reviews

Comments: No Comments.

Overview

Vietnam’s automotive industry takes on the challenge of domestic production

The size of Vietnam automobile market was once considered relatively small and overlooked by many Japanese manufacturers. There existed a strong opinion that the liberalization of trade among ASEAN countries would make the automotive industry become unnecessary in Vietnam. However, the demand for automobile in Vietnam has recently been on the rise. Could it be a potential driving factor for the growth of a manufacturing base?

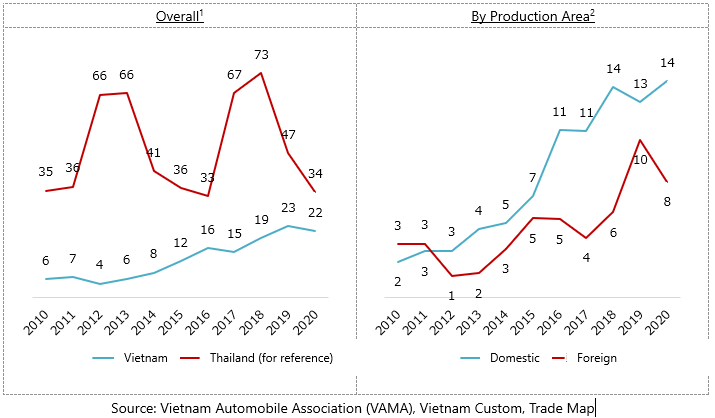

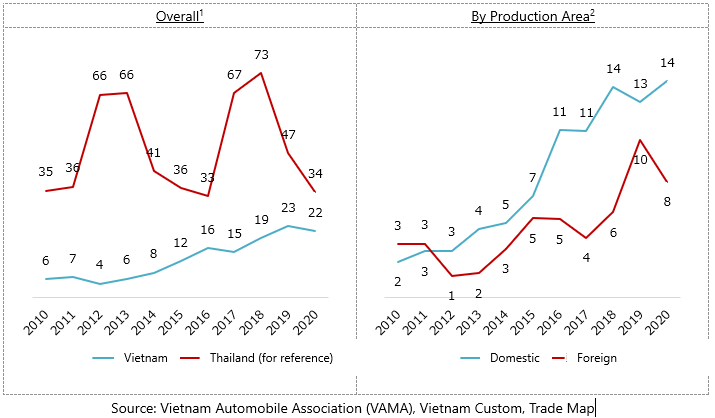

Japanese visitors to Vietnam are still impressed by the throngs of motorbikes. The car ownership rate in 2018 was 2.3 cars per 100 people, much lower than the rate in Thailand (20.4) or Japan, the US and Europe (over 50). One of the barriers was the tax and passenger car sales have remained stagnant, at less than 100,000 a year. However, in recent years, along with rising incomes, trade liberalization and lower tax rates have led to a rapidly expanding market, reaching 200,000 units in 2020, around half of passenger car sales volume of Thailand (more than 400,000, and if commercial vehicles are added, compared with around 800,000 in Thailand). At present, the two largest cities (Hanoi and Ho Chi Minh City) are leading the way, accounting for 45% of passenger car ownership, but it is likely to become more widespread throughout the country. In 2020, the year of the Covid-19 pandemic, sales in Thailand and Indonesia declined by around 20% and 50% respectively, while sales in Vietnam remained steady at around 8%. Specifically, April 2021 has seen a strong recovery, with an increase of 2.5 times in comparison with the same period of the previous year.

Passenger car sales in Vietnam (ten thousand units)

Source: Vietnam Automobile Association (VAMA), Vietnam Custom, Trade Map

Vietnam has also become a manufacturing hub in ASEAN, with Vinfast (a car manufacturer under Vietnam’s largest conglomerate Vingroup) starting its car production since 2019, launching 12 models, including the e34 EV due for market by the end of 2021. The production has been on track. However, the rate of domestic procurement of parts is only 10-20%, which results in higher cost than that of neighboring countries. The company has therefore set out a plan to increase its domestic procurement rate and increase its annual production from the current 250,000 units to 500,000 units by 2025. Other domestic players, such as Thaco and Thanh Cong Group, are also likely to follow suit, while Japanese and Korean manufacturers with large market share (Toyota, Hyundai, etc.) are likely to enhance their procurement in Vietnam as part of the ASEAN transition of labor.

On the other hand, the government and industry associations are planning to increase the domestic procurement rate to 40% and to export finished vehicles. The government has set targets of production of 1 million vehicles per year, sales of 900,000 vehicles per year, ownership of 5 vehicles per 100 people per year, more than 1,000 parts suppliers, and 5,000 km of highways, and is taking the opportunity of the transfer of manufacturing bases from China after the COVID-19 crisis to create an automobile society.

In 2018, the automotive industry accounted for 3% of GDP, which was surprisingly high compared to Germany 4%, China 5% and Thailand 12%. For example, with a production of 500,000 units/year and an average selling price of 400 million VND, it is already a large industry with a market size of about 209 trillion VND. Raising the domestic procurement rate and dropping the added value to the domestic market are the utmost priority. As for the base industry, the electronics industry has made a great leap forward and the parts and materials industry are also growing.

Only about three years ago, when Vingroup asked for cooperation to set up a car industry within a year, many Japanese manufacturers turned the offer down. They thought that Vingroup had been successful in retail and real estate, but would not in cars. As a result, Japanese companies have lost the opportunity to collaborate. The mindset of many Vietnamese entrepreneurs today is that “we can catch up with the developed countries if we take the right steps and don’t give up, because there is a big gap between us and them”.

Reference Materials:

- http://ncif.gov.vn/Pages/NewsDetail.aspx?newid=22020

- http://vama.org.vn/en/sales-report.html

- https://www.vietinbank.vn/investmentbanking/resources/reports/042019-CTS-BCnganhoto.pdf

- https://www.statista.com/topics/6485/automotive-industry-in-thailand/#dossierSummary

- https://vov.vn/en/market/growing-middle-class-drives-car-demand-in-vietnam-376821.vov

- https://www.marketresearchvietnam.com/insight/vietnams-passenger-vehicle-market-continues-to-grow

- https://asiaperspective.net/2020/05/28/vietnam-growing-automobile-industry-opportunities-investors/

- https://www.just-auto.com/news/vinfast-mulls-ipo-to-fund-rapid-expansion_id201274.aspx

- https://vietnamnet.vn/en/feature/the-last-chance-for-vietnam-s-automobile-industry-685065.html

- https://www.just-auto.com/news/vinfast-mulls-ipo-to-fund-rapid-expansion_id201274.aspx

- https://www.ceicdata.com/en/indicator/thailand/motor-vehicle-sales-passenger-cars

- https://www.ceicdata.com/en/indicator/thailand/motor-vehicle-sales-commercial-cars

- https://www.customs.gov.vn/

- https://www.gso.gov.vn/en/homepage/

- https://www.trademap.org/Index.aspx

- http://investvietnam.gov.vn/en/home.h.html

- http://www.ifeama.org/ifeamaspscp/

- https://e.vnexpress.net/news/business/companies/vinfast-to-complete-automobile-factory-ahead-of-schedule-3910145.html

[1] Data from the Vietnam Automobile Association (VAMA) does not include data from non-member companies

[2] The number of domestic cars is the total number of cars sold minus the number of imported cars.

B&Company

|

B&Company, Inc. The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

Read other articles

[/vc_column_text][/vc_column][/vc_row]

- All

- E-Commerce

- Economic

- Environment

- Food & Beverage

- Healthcare

- Human Resources

- Investment

- IT & Technology

- Logistics & Transportation

- Manufacturing

- Regulation

- Retail & Distribution

- Seminar

- Tourism & Hospitality

- White Book