In recent years, the lighting industry has undergone a remarkable transformation, driven by advancements in technology and an increasing demand for energy efficiency. Among the innovations reshaping the sector, smart lighting stands out, offering not only enhanced functionality but also substantial energy savings. Vietnam, with its rapidly expanding economy and urbanization, presents a burgeoning market for smart lighting solutions.

Smart Lightning Market Overview

Vietnam’s lighting market has experienced robust growth over the past decade, fueled by urbanization, industrialization, and rising income levels. According to market research organization IMARC Group, Vietnam’s LED lighting market reached 647.6 million USD in 2022, and is expected to increase to 982.8 million USD in 2028, representing a rapid growth rate (CAGR) of 7% in the period of 2023-2028[1].

Smart lighting, characterized by its remote capabilities, adjustable brightness, and integration with other smart home systems, is gaining traction in Vietnam. The trend is primarily driven by the country’s rapid urban development and growing awareness of energy efficiency. According to the Ministry of Construction, as of September 2023, Vietnam has had 902 urban areas, including 2 special-class urban areas. The urbanization rate nationwide is estimated at over 42.6%[2] in 2022, an increase compared to 39.3% in 2020 and 30.3% in 2010[3]. In major cities like Ho Chi Minh City and Hanoi, the adoption of smart technologies, including smart lighting, is becoming increasingly common as part of broader smart city investment. According to information from the Vietnam – Asia Smart City Conference 2023 held in Hanoi, Vietnam has had 48/63 provinces and cities in the process of implementing smart city projects[4]. Some prominent smart cities in Vietnam as of current includes: Phu My Hung (HCMC; 750ha), Ecopark (Hanoi; 500ha), Vinhomes Ocean Park (Hanoi; 420ha).

Phu My Hung smart city in Ho Chi Minh City (Source)

Applications of smart lightning in Vietnam and key players

The Vietnamese smart lighting market is becoming increasingly competitive, with several key players establishing a presence. Domestic companies such as Dien Quang, Rang Dong, prominent in the traditional lighting sector, are gradually expanding into smart lighting. These companies leverage their extensive distribution networks and local market knowledge to capture a share of the growing demand. In addition, smaller companies and start-ups have also joined in the smart lightning industry, Acis, a start-up company have come up with the smart lighting system S3[5].

International players are also making significant strides in the market. Companies like Philips Lighting, Osram, and GE Lighting have introduced smart lighting solutions tailored to the Vietnamese market. Their presence underscores the attractiveness and potential of the market. Philips Lighting, for instance, has been particularly active in promoting its connected lighting solutions in Vietnam, aiming to integrate them into smart city projects[6].

Philips Lighting has introduced a new range of smart lighting solutions for streets, factories, offices, and residential areas. Notably, the CityTouch Connect App, a smart streetlight management solution, has been developed based on cloud computing and IoT technology. This essential software allows for the control and automated programming of public lighting systems.

| Pilot application of LED street lights and CityTouch lighting management from Philips Lightning platform at Hung Vuong – Le Loi intersection (Source) | S3 smart lightning project – ACIS (Source) |

Japanese companies’ participation in the Vietnamese market

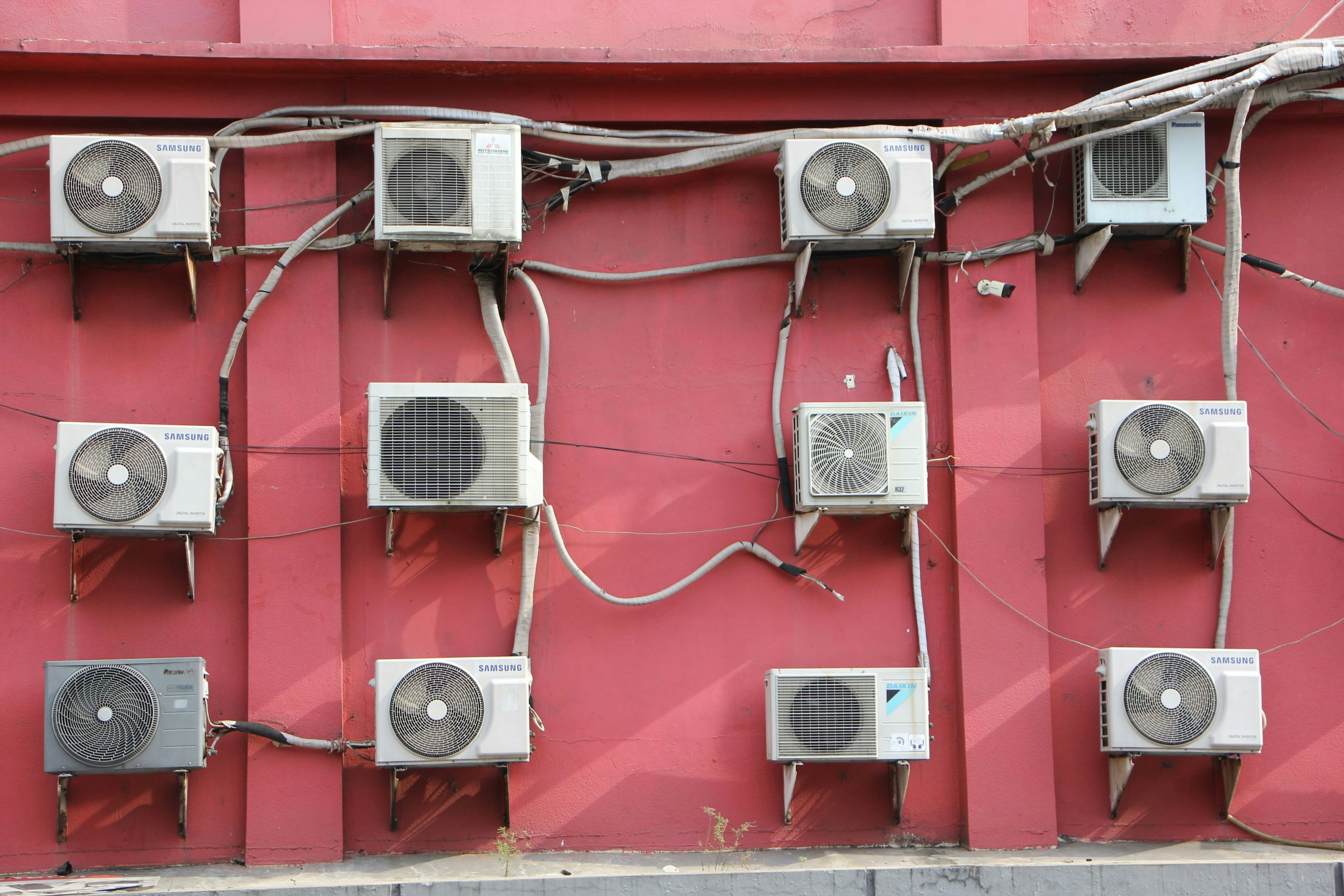

Japanese companies are well-positioned to capitalize on the Vietnamese smart lighting market due to their technological expertise and innovative solutions. Japan is renowned for its advanced technology and innovation in lighting solutions. Companies like Panasonic, Toshiba, and Sharp have developed state-of-the-art smart lighting systems that offer energy efficiency, connectivity, and enhanced user control. These technologies can meet the growing demand for smart lighting in Vietnam’s urban centers, where energy efficiency and automation are increasingly valued.

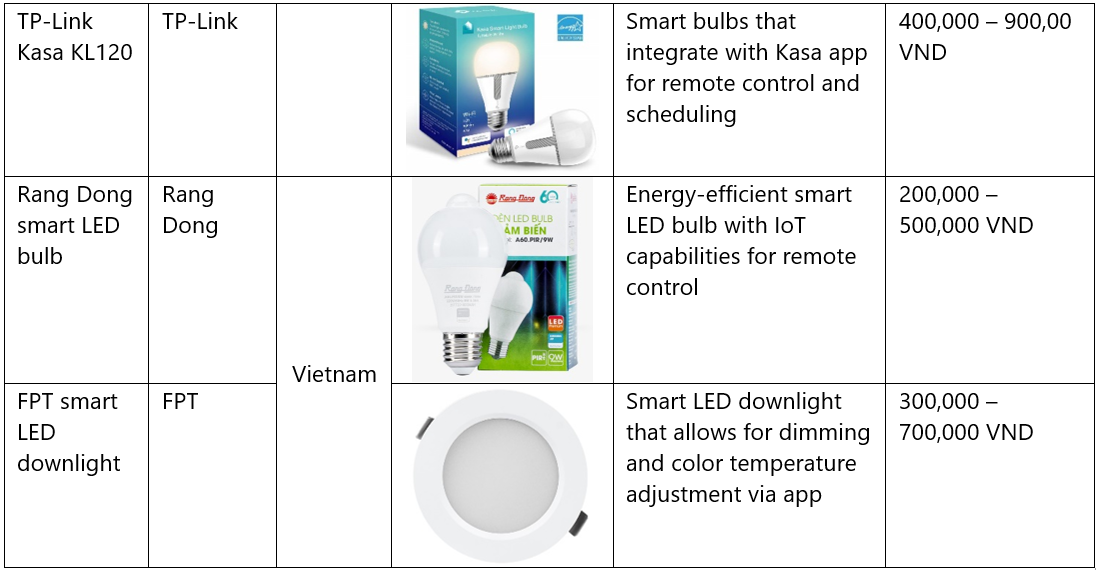

This table shows a quick comparison of smart lightning products from Japan, Vietnam and China to show the difference in origins and price range of these products

Source: B&Company’s synthesis

Compared to Vietnamese products, Japanese smart lighting generally stands out in terms of quality and reliability, thanks to advanced manufacturing technology. However, Vietnamese products tend to be more competitively priced. In terms of product variety, Japanese brands offer more options, including smarter features and modern designs. In contrast, products from other countries, such as China, are usually very affordable but often face issues with quality and durability.

Opportunities for Japanese companies

With the ongoing urbanization in Vietnam, alongside the rising living standards, there is an increasing demand for smart products, including high-quality smart lighting. The smart lighting market in Vietnam is projected to continue to grow, creating many opportunities for Japanese companies to enter the high-quality product segment.

In addition, Vietnam is investing heavily in smart city initiatives, particularly in big cities such as Hanoi, HCMC and Danang. Japanese companies can participate in these projects by providing smart lighting solutions that contribute to energy savings, improved public safety, and enhanced urban aesthetics. Collaborations with local governments and infrastructure developers could open up significant opportunities for Japanese companies.

As Vietnam seeks to improve its energy efficiency and reduce carbon emissions, there is a growing emphasis on sustainable solutions. Japanese companies with expertise in energy-efficient lighting technologies, such as LED and OLED, can play a crucial role in helping Vietnam achieve its sustainability goals. By offering energy-saving products and solutions, Japanese firms can differentiate themselves in the market.

Challenges for Japanese companies

Japanese companies looking to enter the Vietnamese market face several challenges. Firstly, the smart lighting market is becoming increasingly competitive, with both domestic and international players vying for market share. To stand out in this landscape, Japanese firms must differentiate their products through innovation, quality, and exceptional customer service. Secondly, compliance with local regulations and standards related to product quality, safety, and environmental impact is essential for successful integration. Building strong relationships with local authorities and thoroughly understanding the regulatory framework will be crucial for effective market entry.

Conclusion

In conclusion, the smart lighting market in Vietnam presents a promising opportunity for Japanese companies, thanks to the country’s rapid urbanization, increasing focus on energy efficiency, and growing adoption of smart technologies. By leveraging their technological expertise, participating in smart city projects, and addressing sustainability concerns, Japanese firms can establish a strong presence in the Vietnamese market.

[1] IMARC Group (2024). Vietnam LED lighting market report by product type <Assess>

[2] VietnamPlus (2024). Vietnam still has a lot of room for green city development. <Assess>

[3] GSO (2021). The impact of urbanization on the rich-poor gap in Vietnam <Assess>

[4] Government News (2023). 48 provinces and cities are implementing smart urban development <Assess>

[5] ACIS (2024). Smart street light system S3 <Assess>

[6] VnExpress (2017). Binh Duong pilots CityTouch smart street light management <Asses>

| B&Company, Inc.

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

Read other articles