272월2025

최신 뉴스 및 보고서 / 베트남 브리핑

댓글: 댓글 없음.

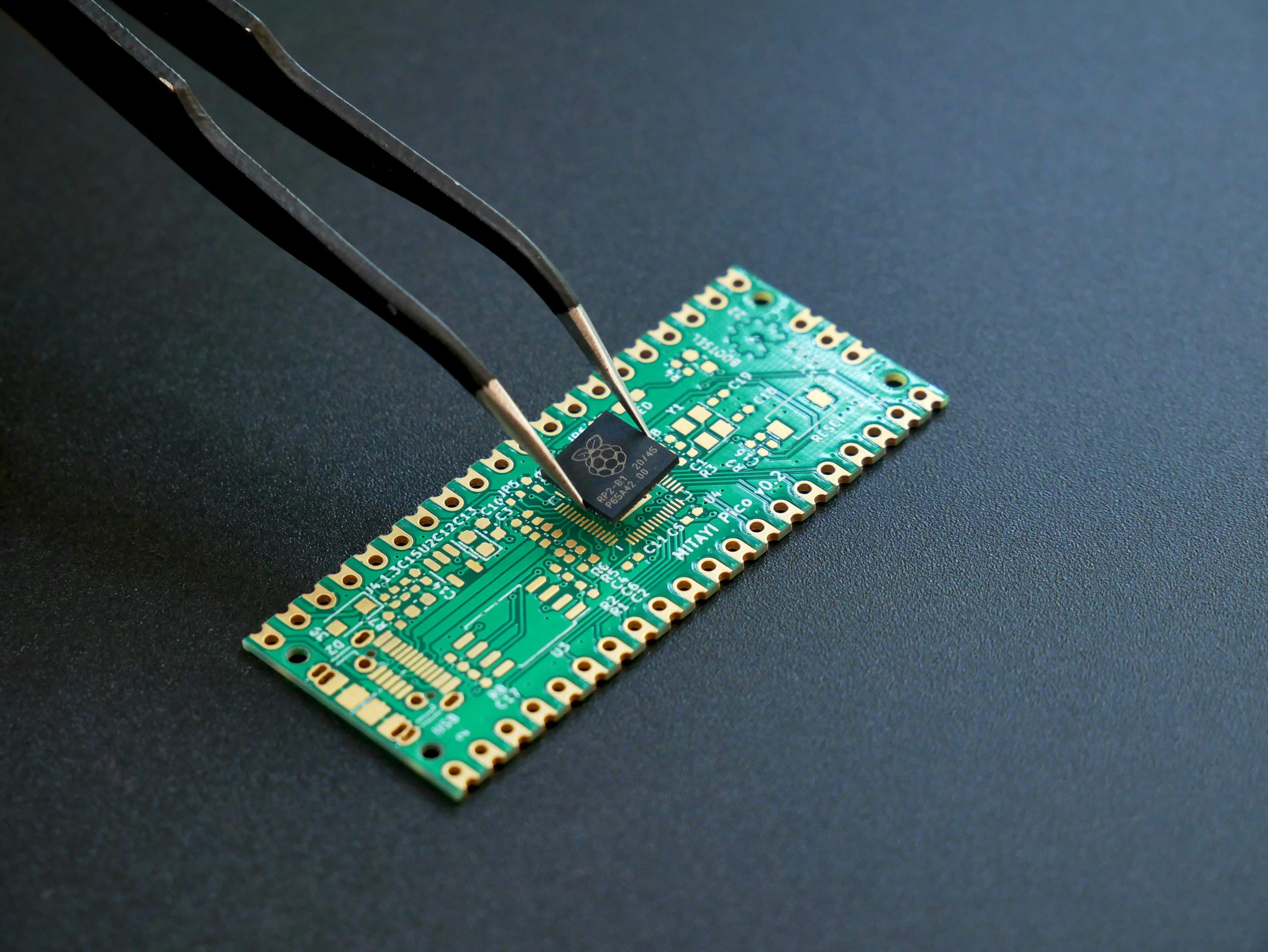

베트남의 반도체 산업은 정부 이니셔티브의 지원을 받아 성장 궤도에 있으며, 풍부한 자원과 방대한 노동력을 보유하고 있습니다. 아직 개발 초기 단계이기는 하지만, 이 산업은 점차 글로벌 공급망의 핵심 플레이어로 자리매김하고 있습니다.

베트남 반도체 산업 개요

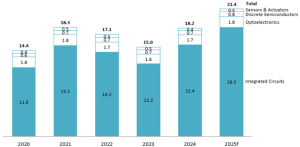

베트남의 반도체 산업은 강력한 성장 궤도에 있습니다. 반도체 시장은 2025년에 210억 달러의 수익에 도달할 것으로 예상되며, 2024년 대비 18% 증가했고 지난 5년 동안 인상적인 49% 성장을 기록했습니다. 이 시장은 2025년부터 2029년까지 10%의 CAGR로 계속 확장될 것으로 예상되며, 궁극적으로 2029년까지 총 가치는 310억 달러에 도달할 것입니다.[1].

베트남 반도체 산업의 수익

단위: 10억 달러

원천: 스타티스타

베트남은 반도체 공급망을 개발할 수 있는 상당한 기회를 가지고 있습니다. 정부는 반도체 사업을 촉진하기 위해 다양한 지원 정책을 도입했습니다. 가장 최신의 것은 2024년 9월의 결정 No. 1018/QĐ-TTg로, 베트남의 반도체 시장 개발을 가속화하는 것을 목표로 합니다. 이 전략적 로드맵은 2030년까지의 베트남의 반도체 개발 전략을 개략적으로 설명하며, 2050년까지 반도체 수익 1,000억 달러를 달성한다는 장기적 비전을 가지고 있습니다.[2]. 또한 베트남은 반도체의 핵심소재인 '희토류' 매장량에서도 세계 2위를 차지했다. 2024년 기준으로 베트남은 '희토류' 2,200만톤을 보유하고 있는 것으로 추산되며, 세계 총 희토류 매장량의 18% 이상을 차지한다.[3]

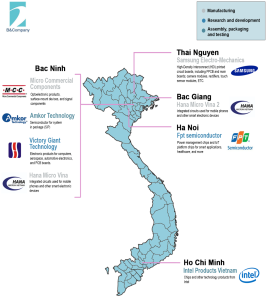

베트남, 반도체 공급망 참여

반도체 공급망은 설계/연구, 제조, 조립-테스트-패키징의 세 가지 주요 단계로 구성됩니다. 현재 베트남은 주로 설계/연구에 집중하고 있으며, 다른 두 단계에 대한 참여는 여전히 매우 제한적입니다.

설계 및 연구 단계에서 주요 제품은 칩셋입니다. FPT Semiconductor는 베트남에서 유일하게 스마트 애플리케이션, 헬스케어 등에 사용되는 전력 관리 및 IoT 플랫폼용 칩을 설계 및 개발하는 데 특화되어 있습니다. 이러한 설계는 생산 및 패키징을 위해 한국의 공장으로 이전됩니다.[4]. 이 회사는 또한 2024~2025년까지 전 세계적으로 2,500만 개의 칩을 공급한다는 목표를 설정했습니다.[5]. 한편, 중국 대표 Victory Giant Technology는 베트남에서 총 2억 600만 달러 규모의 인쇄 회로 기판 프로젝트에 대한 승인을 받았습니다. 이 회사는 2026년까지 공장 건설을 완료할 것으로 예상됩니다.[6].

반대로 제조 단계에서는 기업들이 회로 기판과 반도체 제품을 생산하는 데 집중하고 있으며 중국의 Micro Component와 한국의 Samsung, Hana Micro 등 국제 기업만 참여하고 있습니다. Samsung은 생산 확대에 20억 달러 이상을 지출한 후 더 이상의 투자 움직임을 보이지 않는 반면[7]하나마이크로, 2025년 말까지 총 투자액 10억 달러 이상으로 늘릴 전망[8]. 또한, 이 산업에 대한 정부의 상당한 지원을 바탕으로 Viettel은 2030년까지 베트남에 반도체 제조 공장 건설을 완료할 계획이며, 이는 이 단계에서 베트남 최초의 국내 기업이 될 것입니다.[9].

조립, 테스트 및 패키징 부문에서 전자 부품이 주요 제품이며, 미국의 Amkor Technology가 핵심 업체로, 시스템 인 패키지(SiP)용 반도체에 대한 연구에 집중하고 있습니다. 이 회사는 또한 2025년 10월까지 연간 420톤에서 연간 1,600톤으로 생산 용량을 확대할 계획이라고 발표했습니다.[10]. 반면 인텔은 엔터프라이즈급 반도체 제품과 관련된 연구에만 집중했고 2021년 말에 투자 활동을 중단했습니다. 그때까지 총 투자액은 10억 달러를 넘었습니다.[11].

베트남의 반도체 공급망 회사

출처: B&Company 편집

반도체 공급망에서 베트남의 과제

베트남은 반도체 공급망에 참여를 심화할 수 있는 상당한 기회가 있습니다. 그러나 베트남이 반도체 산업에 참여하기 위해서는 여전히 과제가 있습니다. 첫째, 고품질 인력 부족입니다. 2024년 베트남은 연간 약 150,000명의 엔지니어가 필요하지만, 현재 이 국가는 이 수요의 60%만 충족할 수 있습니다. 구체적으로, 반도체 부문만 해도 연간 5,000~10,000명의 엔지니어가 필요하지만, 공급은 이 요구 사항의 20% 미만을 충족합니다.[12]. 둘째, 복잡한 행정 규정 및 절차. 베트남의 수입, 수출 및 통관과 관련된 규정 및 행정 절차는 때때로 시간이 많이 걸리고 투명성이 부족할 수 있습니다. 이는 생산을 위해 원자재를 수입하려는 기업의 비용과 지연을 증가시킵니다. 마지막으로, 첨단 기술에 대한 제한된 접근성은 이 산업에서 베트남의 성장을 방해하는 가장 큰 장애물 중 하나입니다. 베트남 기업은 종종 높은 비용과 복잡한 법적 요구 사항으로 인해 최첨단 기술에 대한 접근성을 협상하는 데 어려움을 겪습니다. 또한, 새로운 기술 도입이 지연되면 글로벌 시장에서 베트남 기술 기업의 경쟁력에 영향을 미칩니다.

결론

베트남은 여전히 반도체 산업에서 고도로 숙련된 인력이 부족하고 규제 및 행정 절차가 지연되는 등 많은 어려움에 직면해 있지만, 강력한 정부 지원과 풍부한 광물 자원 덕분에 이 나라는 미래에 동남아시아의 핵심 반도체 허브 중 하나가 될 수 있는 위치에 있습니다.

[1] 스타티스타(2024). 베트남 반도체 시장입장>

[2] 베트남 정부 포털(2024). 2030년까지의 베트남 반도체 산업 개발 전략 및 2050년까지의 비전입장>

[3] 미국 지질 조사국(2025). 희토류 통계 및 정보입장>

[5] VnEconomy(2023). FPT, 2500만 개의 칩 공급 예정입장>

[6] The Investor (2024). 중국의 Victory Giant Technology가 2026년부터 베트남에서 2억 6천만 달러 규모의 공장을 운영할 예정입장>

[7] 정부 뉴스(2022). 삼성, 투자 9억 2천만 달러 늘린다입장>

[8] Doanh Nhan & Phap Luat (2024). Hana Micro가 투자금을 모금할 계획입장>

[9] CafeF(2025). Viettel, 2030년까지 반도체 공장 건설 계획입장>

[10] 베트남 무역 및 산업 리뷰(2025). Amkor Technology, 2025년까지 생산량을 3배로 늘림입장>

[11] VnExpress(2023). 인텔, 베트남에 추가 투자 계획 없음입장>

[12] VnExpress(2024). 베트남, 반도체 산업 고숙련 노동자 부족입장>

* 본 기사의 내용을 인용하고자 하시는 경우, 저작권을 존중하여 출처와 원 기사의 링크를 함께 명시해 주시기 바랍니다.

| 비앤컴퍼니

2008년부터 베트남에서 시장 조사를 전문으로 하는 최초의 일본 기업입니다. 업계 보고서, 업계 인터뷰, 소비자 설문 조사, 비즈니스 매칭을 포함한 광범위한 서비스를 제공합니다. 또한, 최근 베트남에서 900,000개 이상의 기업에 대한 데이터베이스를 개발하여 파트너를 검색하고 시장을 분석하는 데 사용할 수 있습니다. 문의사항이 있으시면 언제든지 문의해주세요. info@b-company.jp + (84) 28 3910 3913 |