2025年10月14日

最新ニュースとレポート / ベトナムブリーフィング

コメント: コメントはまだありません.

ベトナムの美容業界は、ファッション感度の高い若年層の増加とオンラインショッピングの急速な成長に牽引され、2025年に重要な局面を迎えます。スキンケア、メイクアップ、ウェルネスサービスへの支出は、国内外のブランドが顧客獲得を競い合う中で増加を続けています。市場は、クリーンビューティー、eコマースの台頭、外国投資への開放性の向上といった新たなトレンドの出現により、急速に変化しています。世界的なブランドや投資家にとって、ベトナムは東南アジアで最も刺激的な市場の一つであり、美容、テクノロジー、文化が融合する場所です。

2025年のベトナムの美容市場の展望

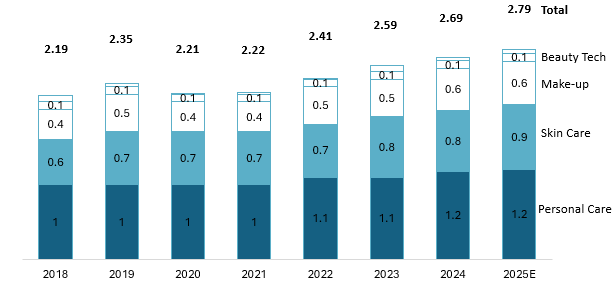

ベトナムの美容・パーソナルケア市場は、所得水準の向上、都市部の急速な発展、そして外見への関心が高まる消費者の増加に牽引され、2025年も引き続き力強い成長を続ける見込みです。市場規模は今年約27億4000万米ドルに達し、2029年まで年間約3兆3100億米ドルの成長を続けると予想されています。[1]すべてのカテゴリーの中で、トイレタリーやヘアケアなどのパーソナルケア製品が約12億米ドルという最大の部分を占めていますが、ベトナムの若者が肌の健康と見た目の美しさをより重視しているため、スキンケアと化粧品が最も急速に成長しています。

2018年から2020年までのベトナムの美容・パーソナルケア市場の収益

ベトナムの美容市場は、人口動態と経済状況の影響を受けており、特に比較的若い人口と着実に上昇する所得水準が、セルフケアや身だしなみへの定期的な支出を促しています。ベトナムの平均年齢は約33.4歳です。 [2]20代から30代前半の消費者が大部分を占めており、美容支出において最も活発なグループです。Statista(2023年)によると、ベトナム人の60%以上がスキンケア製品を毎日使用しており、洗顔料(49%)、香水(41%)、日焼け止め(31%)、保湿剤(25%)が最も一般的です。この若い世代は、美容と身だしなみを贅沢品消費ではなく、ライフスタイルと自信の一部と考えています。同時に、ベトナムの一人当たりGDPは2024年に4,700米ドルを超えました。 [3]10年前と比べてほぼ倍増しています。パンデミック後の所得増加と健康・ウェルネスへの意識の高まりにより、消費者はニキビケア、アンチエイジング、日焼け止めなど、美容とケアの両方の機能を兼ね備えた製品を求めるようになりました。その結果、美容への支出は一時的なものから日常的なものへと変化し、今後数年間の市場成長の確固たる基盤を形成しています。

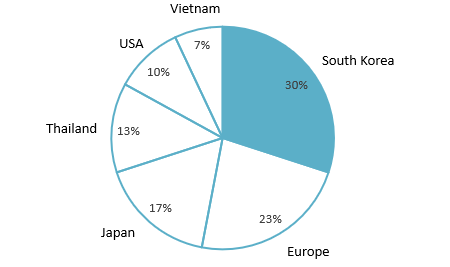

市場が拡大し、消費者がより洗練されるにつれ、ベトナムの美容業界において、国際的な企業が製品基準とブランド認知の形成を主導してきました。ベトナムの美容市場の明確な特徴の一つは、外国ブランドが市場を支配していることです。輸入品は化粧品売上高の90%以上を占めています。韓国ブランドが約30%でトップを占め、次いでヨーロッパブランド(23%)、日本ブランド(17%)、タイブランド(13%)、アメリカブランド(10%)となっています。[4]ベトナムのブランドは主に低価格帯をターゲットとしており、信頼と評判の構築に努めています。この優位性は、外国製品の方が品質、品揃え、ブランドイメージの面で優れているという確信に基づいています。ロレアル、バイヤスドルフ(ニベア)、アモーレパシフィック(雪花秀、ラネージュ)、LGハウスホールド&ヘルスケア(ザ・フェイスショップ、オウイ)といった大手企業や、資生堂、花王、ロート製薬といった日本ブランドは、ベトナムに現地支店や強力なパートナーシップを築いています。

ベトナムにおける外国化粧品ブランドの市場シェア 2024

2024~2025年の投資活動は安定しており、スキンケア、化粧品、パーソナルケア分野では、主要な外国ブランドの新規参入は報告されていません。ロレアル、ユニリーバ、資生堂、アモーレパシフィックなど、ベトナムに既に進出している国際企業の多くは、新規事業の立ち上げではなく、デジタルマーケティング、現地生産、小売提携を通じて事業拡大を続けています。直近で大型投資案件はないものの、このセクターは引き続き国内外の投資家から着実に関心を集めており、ベトナムの美容市場の長期的な潜在性に対する信頼を反映しています。

市場動向

ベトナムの美容市場の最近の傾向は、消費者の価値観の変化と新しい買い物方法を示しています。

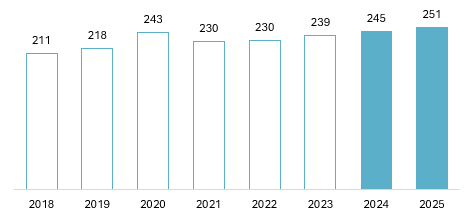

- ナチュラル&オーガニックビューティー:天然成分やハーブ成分を使った「クリーンビューティー」製品を選ぶ人が増えています。 スタティスタデータ 天然由来製品は現在、市場の約9~10%を占めており、年間約2.5%(2018~2025年)で着実に成長しています。消費者は有害な化学物質に対してより慎重になり、オーガニック、ヴィーガン、パラベンや硫酸塩フリーなどのラベルが付いた製品を好むようになっています。ベトナムの地元ブランドは、ココナッツオイル、緑茶、ターメリック、アロエベラなどのベトナム産天然成分を使用して、手頃な価格の天然スキンケア製品を製造しています。例えば、ベトナムのブランド 繭 ダクラク産のコーヒーとフンイエン産のウコンを製品に使用しています。より優しく環境に優しい美容へのシフトは、ミレニアル世代とZ世代の環境意識の高まりも後押ししています。

ベトナムのナチュラルビューティーおよびパーソナルケア市場の収益(2018~2025年)

単位: 百万米ドル

- 流通チャネル:小売流通は急速に変化しています。従来型の店舗は依然として最大のシェアを占めていますが、その優位性は縮小しています。ユーロモニター(2023年)によると[5]オフラインのシェアは2018年の92%から2023年には81%に減少する一方で、近代的な小売プラットフォームとオンラインプラットフォームが台頭しています。大手美容チェーンは急速に拡大しており、Hasakiは現在約170店舗、Guardianは130店舗以上を展開し、Watsonsは大都市で新規店舗のオープンを続けています。NutyやCocoluxなどの地元の化粧品店も規模を拡大しており、2024年から2025年にかけて活発な投資活動が見込まれています。[6] (ベトナムブリーフィング、2025年)。この変化は組織化された小売業の台頭を示しており、消費者はブランド製品へのアクセスが容易になり、市場全体の透明性が向上します。

- Eコマースの成長:Eコマースはベトナムの美容市場の主要な成長原動力となっています。美容は現在、ベトナムのオンラインショッピングで上位を占めるカテゴリーの一つです。オンライン美容売上高は2022年に47.61兆円、2023年には52.21兆円増加し、約37.7兆ルピー(約1兆4兆15億米ドル)に達します。[7]2023年までに、オンライン販売は美容製品総売上高の約19%を占め、2018年のわずか8%から増加しました。この急増は、ShopeeやLazadaなどのプラットフォーム、そしてデジタル決済と迅速な配達にますます慣れ親しんでいるベトナムの若いスマートフォンに精通した人口によって推進されています。

ベトナムの美容Eコマース収益成長

出典: Metric.vn

- デジタルコマースとライブストリーミング:eコマースの成長に加え、デジタルプラットフォームは美容ブランドと消費者のエンゲージメント方法にも変化をもたらしています。インフルエンサーやKOL(キング・オブ・リレーションズ)が主導するライブストリーミングショッピングは、リアルタイムの製品デモンストレーションや視聴者との直接的なインタラクションを可能にします。エスティ ローダー、ランコム、キールズ、雪花秀といったグローバルブランドは、新商品の発売や、割引、「1つ買うと1つ無料」キャンペーン、無料サンプルの提供などで若い世代の購買意欲を高めるために、ライブストリーミングを積極的に活用しています。こうしたエンターテインメントとショッピングの融合は、利便性とデジタル接続の両方を重視するベトナムのハイテク世代に合致しています。競争力を維持するために、ブランドはオンラインとオフラインの戦略を組み合わせ、eコマースプラットフォームのデータを活用して顧客行動を追跡し、新たなトレンドに迅速に対応する必要があります。

出典: KIEHL'S X LƯƠNG ĐỖ[1]

主な出演者

ベトナムの美容市場は、主に長年の経験を持つ大手国際企業が牽引しています。多くの企業は、1990年代から2000年代にかけて経済が開放された時期にベトナムに進出し、現地にオフィスや提携先を設立しました。彼らの強力な地位は、ニベアの人気やロレアル、エスティ ローダーの高級イメージといった有名ブランドと、マーケティングおよび流通への多額の投資によって支えられています。

ベトナムの美容企業の主要プレーヤー

| 会社 | 市場参入 | 国 | 簡単なプロフィール |

| ユニリーバ | 1995 | 英国 | ダヴ、ポンズ、サンシルクなどの人気パーソナルケアブランドで知られるこの世界的な消費財企業は、1995年にベトナムに進出し、現在では 保有 ~ 12% ベトナムの化粧品・パーソナルケア市場の |

| プロクター・アンド・ギャンブル | 1990年代半ば | アメリカ合衆国 | 世界最大の消費財メーカー(Olay、SK-II、パンテーン、ジレットなど)。1990年代半ばからベトナムで事業を展開し、ヘアケア製品とグルーミング製品を現地生産しています。 |

| ロレアル | 2007 | フランス | 化粧品、スキンケア、ラグジュアリーブランド(ロレアル パリ、メイベリン、ランコム)を擁するグローバルビューティーリーダー。2007年よりロレアル ベトナムLLCを通じてベトナムに進出。 |

| エスティ ローダー カンパニー | 2000年代初頭 | アメリカ合衆国 | エスティ ローダー、M.A.C.、クリニーク、ラ・メールなどのブランドを擁する、大手プレステージビューティーカンパニー。ベトナムの高級小売店や百貨店で販売されており、富裕層向けのスキンケアとメイクアップに重点を置いています。 |

| 資生堂 | 2010年代初頭 | 日 | スキンケアとフレグランス(資生堂、アネッサ、NARSなど)で知られる、老舗化粧品会社の一つ。ベトナムでは高級品セグメントをターゲットとし、販売代理店と資生堂ベトナム社を通じて事業を展開している。 |

出典: B&Company 編集

ベトナムの地元ブランドは、特にナチュラル・オーガニック分野で成長し始めていますが、グローバル企業と比較すると市場シェアはまだ小さいです。外資系企業は、強力な研究力、グローバルなリソース、そして先進的な製品開発力を活かし、イノベーションにおいて優位性を築いています。しかしながら、多くの大手企業が同じ分野で競合しているため、市場は非常に競争が激しくなっています。その結果、グローバルブランドはベトナム人の嗜好に合わせて戦略を常に調整していく必要があります。この競争は消費者に利益をもたらし、選択肢の拡大と継続的なイノベーションの促進につながります。

海外からの参入企業にとっての戦略的ポイント

2025年のベトナムの美容市場は魅力的である一方、競争が激化し、複雑化しています。中間層の増加、デジタル化の推進、そして高品質な国際製品への需要が、海外ブランドへの関心を高めています。しかし、成功するには、市場参入だけでは不十分です。現地の顧客の習慣、販売チャネル、そして期待にスマートに適応していくことが不可欠です。

- ローカリゼーションと消費者の洞察が決定的な要素です。

ベトナムの消費者、特にZ世代と若いプロフェッショナル層は、信頼性、製品の安全性、そして成分の透明性を重視しています。配合(軽いテクスチャー、熱帯気候への適合性)やコミュニケーションスタイル(ベトナム語のパッケージ、文化に合わせたマーケティング)をローカライズする外国ブランドは、顧客ロイヤルティを高める上で有利な立場にあります。急速に変化する嗜好に対応するには、ソーシャルプラットフォームや店舗データを通じた継続的なフィードバックループが不可欠です。

- デジタルファーストとオムニチャネル戦略が前提条件

美容Eコマースは年々拡大しており、投資家はデジタル事業を補完的なチャネルではなく、中核的なチャネルとして重視すべきです。Shopee、Lazada、TikTok Shopに認証済みの旗艦店を開設し、インフルエンサー主導のコンテンツを活用することは、今や市場の標準的な慣行となっています。しかしながら、美容チェーンとの提携やポップアップカウンターなど、厳選された実店舗の展開を維持することは、ブランドの正当性と消費者の信頼にとって依然として重要です。

- コラボレーションにより市場学習が加速

現地の販売代理店、小売業者、コンテンツ制作者との提携は、学習曲線を短縮するのに役立ちます。こうした提携は市場情報の提供、ライセンス取得の促進、ローカライズのスピード向上に繋がります。これらは、純粋な外資系企業が初期段階で得にくいメリットです。

成熟経済への試金石

ベトナムの美容業界は、量主導の輸入市場から、価値主導でデジタル統合されたエコシステムへと移行しつつあります。最も成功する投資家は、ブランドの伝統と革新性を、地域との関連性と事業運営の俊敏性と融合させる企業です。東南アジアで持続的な成長を目指すグローバル企業にとって、ベトナムは競争力の試金石であると同時に、長期的な事業拡大のための大きな可能性を秘めたプラットフォームでもあります。

*ご注意: 本記事の情報を引用される場合は、著作権の尊重のために、出典と記事のリンクを明記していただきますようお願いいたします。

| B&Company株式会社

2008年に設立され、ベトナムにおける日系初の本格的な市場調査サービス企業として、業界レポート、業界インタビュー、消費者調査、ビジネスマッチングなど幅広いサービスを提供してきました。また最近では90万社を超える在ベトナム企業のデータベースを整備し、企業のパートナー探索や市場分析に活用しています。 お気軽にお問い合わせください info@b-company.jp + (84) 28 3910 3913 |

[1] https://www.statista.com/outlook/cmo/beauty-personal-care/vietnam?srsltid=AfmBOoqfyi-OsC3fdXz_32kLYoOTYlWlmH0c4P4FPTQrrzXWIINzK_oQ

[2] ベトナムの人口(2025年) – Worldometer

[3] 一人当たりGDP(現在のUS$)–ベトナム | データ

[5] beauty_and_personal_care_in_vietnam.pdf – Google ドライブ

[7] https://fr.slideshare.net/slideshow/metric-th-trng-bn-l-trc-tuyn-vit-nam-2023-v-d-bo-2024/266002082