03Dec2024

Industry Reviews / Latest News & Report

Comments: No Comments.

Current Situation of the Vietnamese Beauty and Personal Care Market

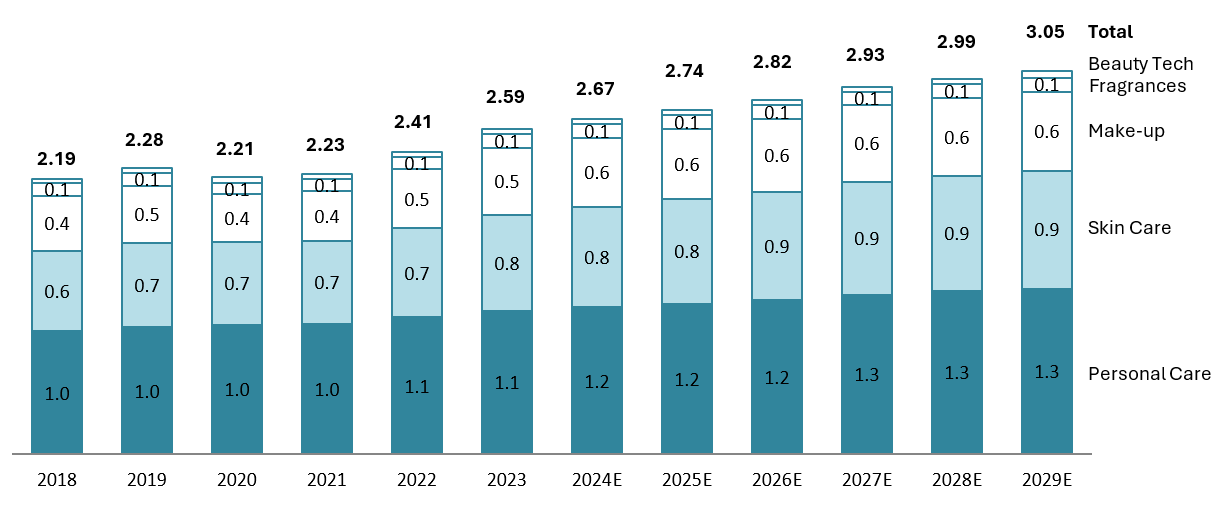

Vietnam’s beauty and personal care market[1] has witnessed remarkable growth in recent years. As of 2024, it is projected to be valued at approximately 2.67 billion USD, with an expected compound annual growth rate (CAGR) of around 2.7% from 2024 to 2029. The market includes a diverse range of products, including skincare, makeup, fragrances, personal care and beauty tech. The largest segment within the market is personal care, which is anticipated to reach a market volume of 1.17 billion USD in 2024. Skincare products come in second, possibly largely driven by the increasing awareness of skincare among Vietnamese consumers, particularly within younger demographics.

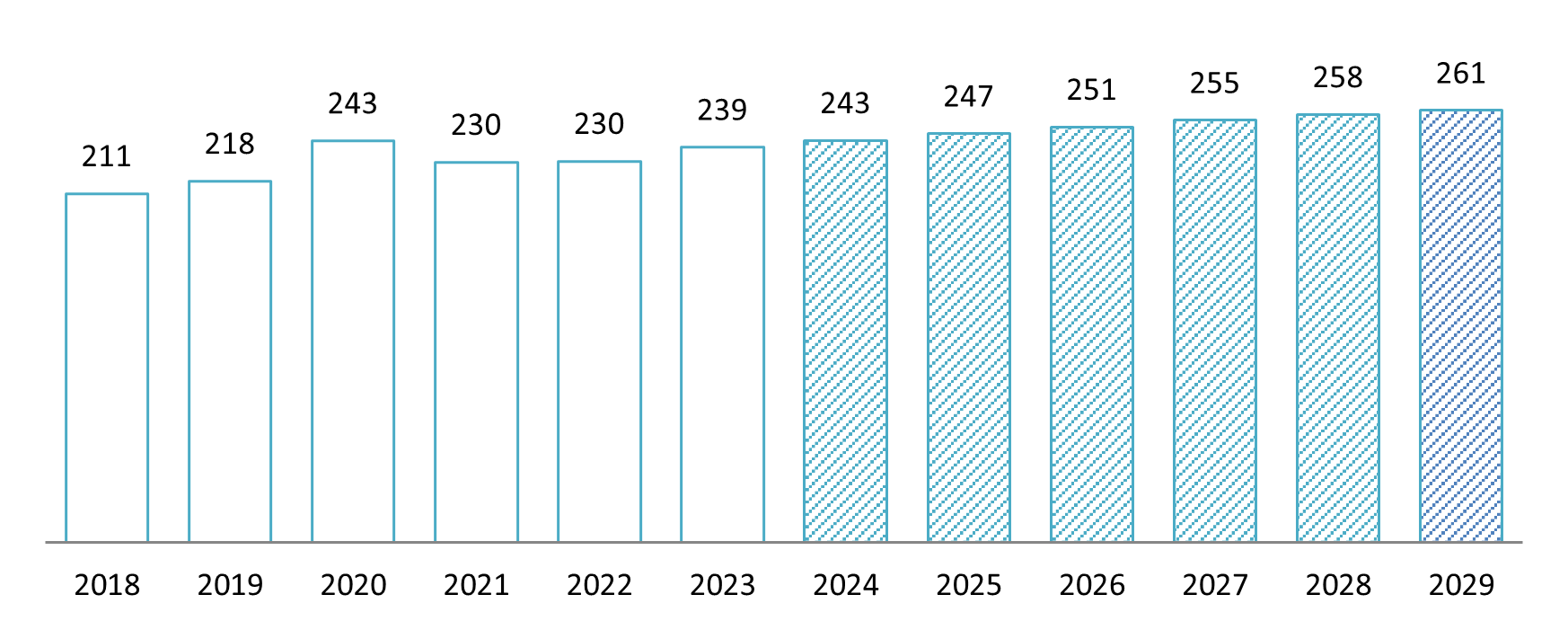

Revenue of the beauty and personal care market in Vietnam from 2018 to 2029

Unit: billion USD

Source: Statista Market Insights

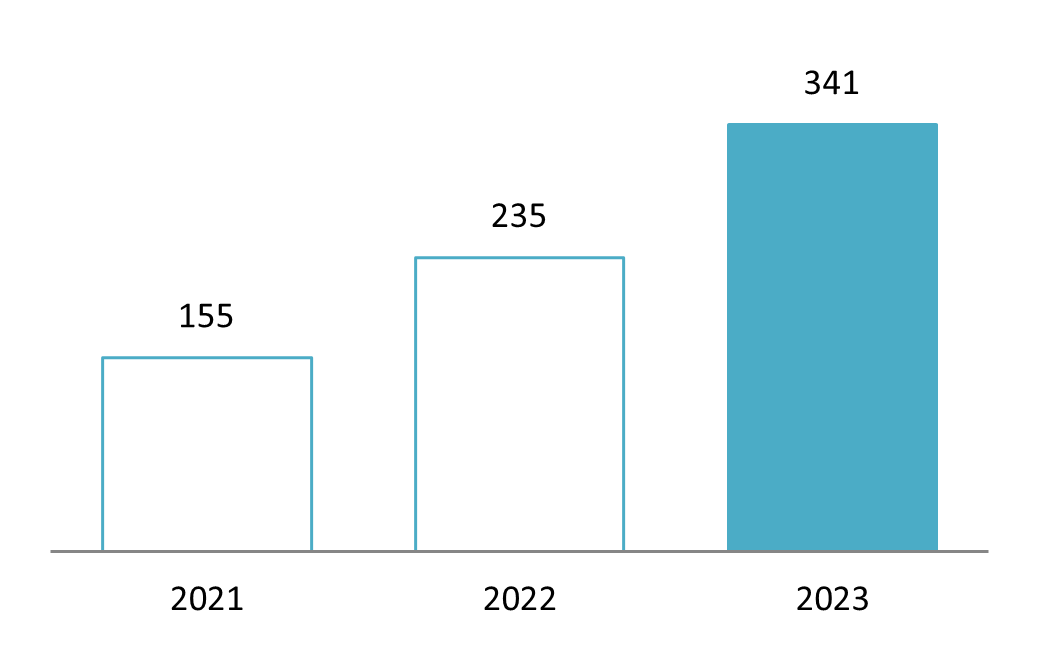

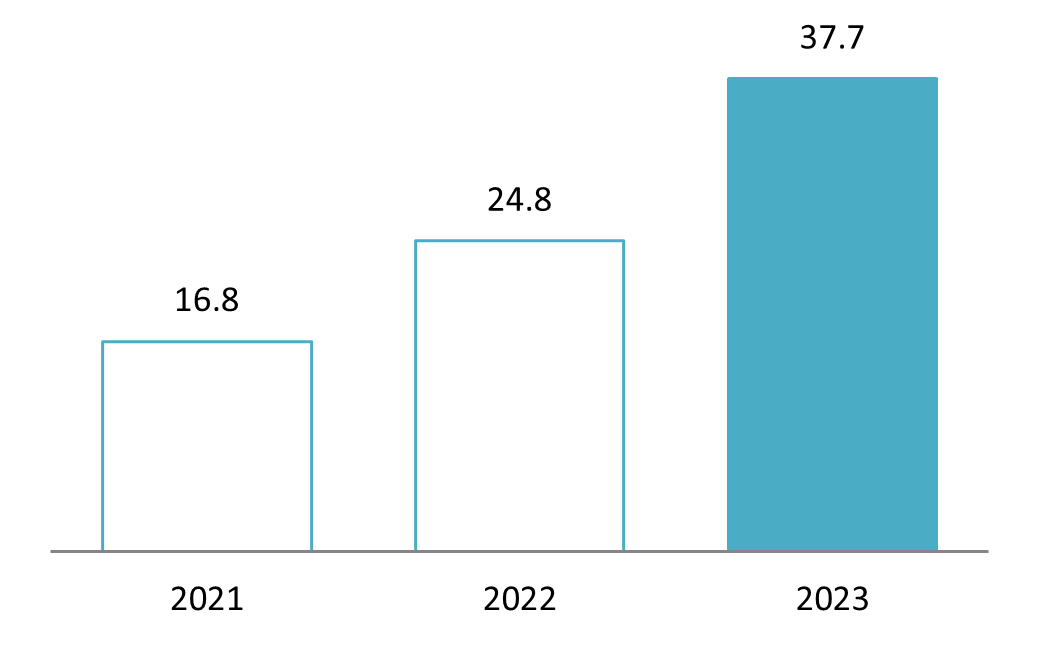

The significant growth of the beauty and personal care sector is also evident when looking at the online channels. According to statistics retrieved from five major e-commerce (EC) platforms in Vietnam – Shopee, Lazada, Tiki, TikTok Shop, and Sendo – the industry’s revenue surged by 47.6% in 2022 compared to 2021. In 2023, this growth accelerated, reaching an impressive 52.2% and totaling 37.7 trillion VND (~1.5 billion USD). Additionally, the volume of products sold in this category has also seen a significant increase over the years, hitting 341 million products in 2023. It is recorded that there are currently about 137,000 shops selling beauty and personal care products on 5 EC platforms.

Top 5 EC platforms

| Number of products sold on 5 EC platforms 2021 – 2023

unit: million items |

Revenue on 5 EC platforms 2021 – 2023 unit: trillion VND |

Source: Metric.vn

Key Players and The Participation of Japanese Brands

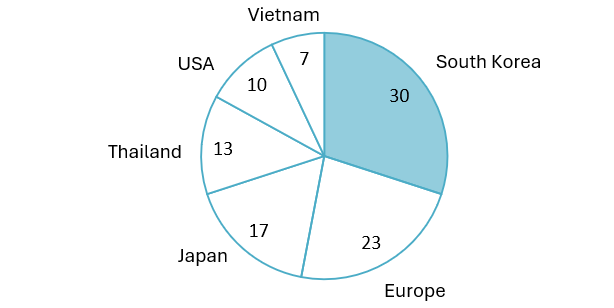

While local producers still hold a modest share, foreign brands make up about 90% of the beauty and personal care market in Vietnam. Particularly, Korean brands have the highest share at 30%, followed by brands from Europe (23%), Japan (17%), Thailand (13%), and the U.S. (10%).

Beauty and Personal Care Brands Market Share in Vietnam 2019

Source: International Trade Administration

Foreign players’ dominance in the market is mainly due to the Vietnamese’s preference for imported cosmetics/beauty products. In 2022, Vietnam imported 600 million USD in beauty products, becoming the 24th largest importer of beauty products worldwide[2]. Vietnamese consumers perceive foreign brands as having established reputations, higher quality and a wider variety of products that can cater to individual needs. Especially, South Korea is renowned for its skincare and makeup regime. Korean idols and influencers add fuel to self-care trends in Vietnam through social media, campaigns, advertisements, and beauty blogs[3].

In terms of Japanese brands, they have established a robust presence in Vietnam, offering a diverse array of products that include skincare, makeup, hair care, and body care. These brands span a wide range of price segments, from premium labels like SK-II to more affordable options like Senka, effectively catering to various customer demographics. In addition to exporting products from Japan, several Japanese cosmetics corporations, such as Kao, Rohto, and Shiseido, have set up manufacturing operations in Vietnam. This local production enables them to better serve the market and enhance their distribution capabilities, further solidifying their position in the competitive landscape. Japanese retail chains have actively entered the Vietnamese market, with Matsumoto Kiyoshi opening its first store in 2020. This marked its entry into the beauty and personal care sector, where it now competes with other retailers such as Guardian, Watsons, and Hasaki. Since then, the brand has expanded to a total of 10 outlets in major shopping malls across Ho Chi Minh City and Hanoi.

Notable Market Trends

The rising popularity of natural and organic products and the involvement of Vietnamese local brands

Vietnam’s beauty and personal care market is witnessing a notable increase in demand for natural products as consumers increasingly favor organic and eco-friendly options that are both safe for their skin and sustainable. This trend is likely influenced by rising skin issues such as allergies, sensitivities, and premature aging, leading many to believe that natural products are a superior alternative to traditional ones. Moreover, consumers, particularly Millennials and Generation Z, are now placing significant emphasis on the environment; they no longer prioritize beauty products with ‘miraculous’ claims but instead set new standards for transparency, authenticity, environmental responsibility, and the ethical values of brands. The growth of the middle class in Vietnam is also contributing to the rising demand for natural and organic beauty care solutions[4]. According to data from Statista, the natural segment acquires about 9 – 10% of the whole beauty and personal care market and has experienced a CAGR of approximately 2.5% from 2018 to 2023, with revenue reaching around 239 million USD in 2023.

Revenue of natural beauty and personal care market in Vietnam from 2018 – 2029

(Unit: million USD)

Source: Statista Market Insights[5]

While foreign brands bring established reputations and innovative approaches to grasp this trend, local brands are also thriving because of their deep understanding of the market and consumer needs, coupled with Vietnam’s natural resource advantages. Vietnamese cosmetics companies are reported to increasingly investing in modern production lines and sourcing high-quality raw materials[6]. Their insights into the needs of Vietnamese consumers allow them to create products tailored to local preferences, offering safe, natural, and effective solutions. Many local brands specialize in offering products formulated with locally sourced plant-origin ingredients, for example:

- – Cocoon uses ingredients like Dak Lak Province coffee and Hung Yen Province turmeric in its product lines

- – Co Mem Homelab features key ingredients such as silkworm, pennywort, and Lai Chau Province ginseng in its skincare products

- – Thorakao (established in 1957) offers nearly 100 products for skincare, haircare, and body care, utilizing various plants such as betel leaves, chives, ginger, and lemongrass

Influence of KOLs and social networks

The impact of key opinion leaders (KOLs) and social media on Vietnam’s beauty and personal care industry is growing significantly. Social media platforms such as Facebook, Instagram, and TikTok provide KOLs with the ability to engage with millions of consumers, presenting a valuable opportunity for brands to boost their visibility. Consumers are increasingly relying on KOLs’ opinions and reviews when making purchases, as these genuine interactions enhance their confidence in the recommended products.

Recently, many brands have partnered with EC platforms and celebrities, KOLs and KOCs to organize livestream sales events lasting several hours, attracting millions of views, with cosmetics being one of the prominent categories. These live streams are not only frequently featured and prioritized in visibility but are also directly supported by the platforms with discount codes worth billions of VND. Investing in livestream events has become a common strategy for EC platforms over the past year to draw users to their sites and create new purchasing incentives, leveraging the price sensitivity of Vietnamese customers, who tend to consider the best-value-for-money sales channel, as well as the popularity and credibility of celebrities, KOLs, and KOCs[7].

Images from a livestream sales event of Diep Le – a beauty KOL

Source: Diep Le’s fanpage

Key Considerations For Foreign Brands Aiming To Enter The Vietnamese Beauty And Personal Care Market

While the Vietnamese beauty and personal care market offers significant demand potential, foreign brands – especially Japanese ones – should be mindful of some key considerations when entering this market.

Firstly, thorough market research is essential to understand local beauty standards, consumer preferences, and purchasing behaviors. Vietnamese consumers prioritize natural ingredients, skincare efficacy, and product safety, yet they are also influenced by global trends. Staying informed about emerging demands for organic and eco-friendly products, as well as popular beauty philosophies like K-beauty and J-beauty, is crucial for long-term success.

Secondly, brands should leverage the growing popularity of e-commerce by partnering with local online platforms to extend their reach. Additionally, establishing relationships with local retailers and beauty chains, which are some of the popular sales channels, can enhance product visibility and accessibility in physical stores.

Thirdly, analyzing the pricing strategies of both local and international competitors is vital for effectively positioning new products. While some consumers prioritize brand authenticity and associate it with quality, a growing segment of young, budget-conscious buyers seeks affordable options[8]. Therefore, offering a range of pricing tiers—from premium to budget-friendly—is essential to cater to diverse consumer segments.

Lastly, collaborating with local KOLs and beauty influencers can help build brand awareness and credibility. Utilizing popular social media platforms like Facebook, Instagram, and TikTok for targeted marketing campaigns is essential for engaging effectively with consumers. However, it is recommended that brands carefully select KOLs whose values, audience, and reputation align with their own to avoid potential risks while ensuring compliance with local advertising regulations to maintain authenticity and trust.

[1] This article focuses on consumer goods for beauty and personal care. It includes various categories, such as makeup, skincare, personal care, fragrances and beauty tech, with the following definitions:

- – Makeup: face, lip, eye makeup products and nails

- – Skincare: skincare products face and body

- – Personal care: shower & bath, hair care, oral care, deodorants, shaving, and other personal care products

- – Fragrances: perfume and Eau de Toilette and any fragrances that cover normal body odor

- – Beauty tech: digital tools and devices that aim to enhance beauty-related experiences, improve skincare routines, and provide personalized beauty solutions (e.g., facial cleansing device)

- – Exclusions: Beauty services, such as hairdressers, professional products; and products that primarily serve medical purposes are excluded from this article

[2] OEC (2022). Beauty Products in Vietnam. <Access>

[3] Vietnam Briefing (2022). Vietnam’s Emerging Cosmetics Industry: Strong Potential for Growing Market. <Access>

[4] VnEconomy (2024). Vietnamese cosmetics take the lead in green opportunities. <Access>

[5] Total from the revenue of natural products of makeup, skincare and personal care segments

[6] VnEconomy (2024). Vietnamese cosmetics – Chinese cosmetics: The battle for market share. <Access>

[7] Znews (2024). Livestreams “warrior” to close millions of orders on 11/11 sale. <Access>

[8] Vietnam Briefing (2022). Vietnam’s Emerging Cosmetics Industry: Strong Potential for Growing Market. <Access>

| B&Company, Inc.

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

Read other articles

- All

- Agriculture

- Apparel

- B& Company

- Economic

- Education & Training

- Equipment & Appliances

- Exhibition

- Food & Beverage

- Industrial Park

- Investment

- IT & Technology

- Manufacturing

- Seminar