Vietnam has emerged as one of the world’s leading agricultural producers, with the sector playing a significant role in bolstering the country’s economy through exports. In recent years, Vietnam has consistently achieved a substantial agricultural trade surplus, largely driven by exports of key commodities such as coffee, rice, fruit and vegetables. This surplus not only reflects Vietnam’s agricultural strength but also underscores the importance of the industry as a contributor to foreign currency reserves.

Overview of Agricultural Export and Import Value

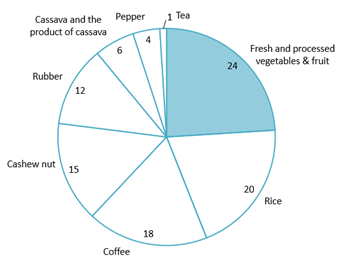

In 2023, Vietnam successfully ranked among the top 15 global agricultural exporters and secured the 2nd position within Southeast Asia[1]. Export revenue for agriculture reached around USD 24 billion (an increase of 25% compared with 2022), accounting for 6.3% of Vietnam’s total export volume. China, the United States, and Japan consistently remain the top three importers of Vietnamese agricultural products, accounting for 22.1%, 20.7%, and 7.6% of total export turnover, respectively[2]. Fruit and vegetables account the most for total export value with 24%, followed by rice with 20%, 18% for coffee and other products take up 37% of agricultural total export.

Vietnam’s agricultural total export by products in 2023

100%= 24 billion USD

Source: General Statistics of Vietnam

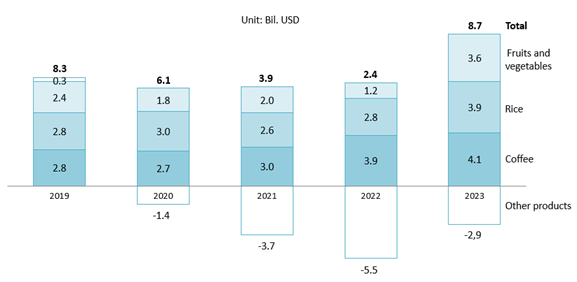

Relating to trade surplus (value of export minus import), Vietnam witnessed a total of 8.7 Bil. USD in 2023 (an increase of 260% compared with 2022)[3]. The main contributors to trade surplus in Vietnam include coffee (4.1 Bil USD), rice (3.9 Bil USD), fruit and vegetables (3.6 Bil USD).

Vietnam Agricultural Trade Surplus by Products in 2023

Source: General Statistics Office of Vietnam

Vietnam’s trade surplus, while strong, primarily consists of low-value, minimally processed goods. In terms of export value of pepper, cashew, coffee, and rice, Vietnam is among the top countries, but in terms of export prices is very low. In 2021, roughly 60% of exports remain in raw or semi-processed form[4]. This structure limits potential gains, as fully processed goods yield higher returns. Moving towards value-added exports, such as roasted coffee or processed nuts, could increase economic benefits and enhance the trade surplus’s impact. Moreover, while Vietnam’s agricultural exports in the leading position in the world, by 2024, nearly 80% of exported products are under the brand name of foreign companies due to a lack of logo and brand recognition.

Opportunities and Challenges for Vietnam’s agriculture segment

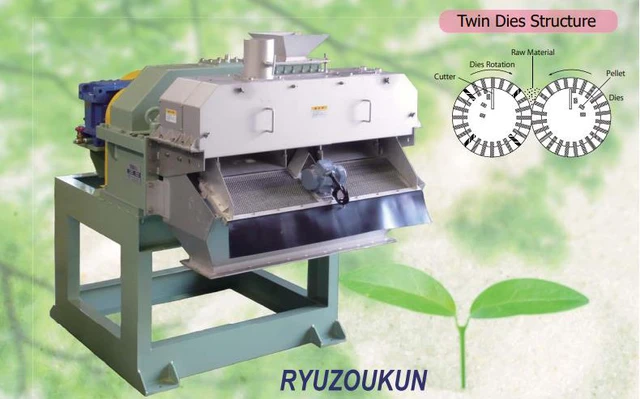

Vietnam’s tropical climate and fertile lands make it a prime exporter of rice, coffee, vegetables, and other products. Additionally, the government is actively promoting sustainable practices and mechanization through policies like Decree No. 858/QĐ-TTg in 2022. The policy aims to increase productivity, reduce manual labor, and boost farmer profitability, with a target of achieving 70% mechanization in agriculture by 2030 and an annual productivity growth of 10%[5]. This presents opportunities for foreign companies to invest in supplying agricultural machinery and improving yields to keep Vietnam competitive globally. However, financial and technical barriers prevent small-scale farmers from accessing these technologies, requiring collaborative efforts, including public-private partnerships, to bridge this gap and ensure equitable growth.

Besides, Vietnam remains a global leader in agricultural exports but continues to rely heavily on raw, unprocessed products, such as in 2023, the export of unprocessed coffee beans is accounted for over 90% of total coffee exports[6]. Developing value-added processing capabilities is essential to tap into global demand for high-quality, finished products like roasted coffee and packaged fruits. This creates significant opportunities for investors in agro-processing technology and facilities. However, achieving this transformation requires substantial capital, skilled labor, and adherence to strict quality standards in export markets, posing a challenge for businesses entering or expanding in this sector.

Additionally, Inadequate cold storage and transportation systems result in post-harvest losses of up to 20-25% in the first two quarters of 2024, contributing to a total of 2% loss in total GDP[7]. This presents a clear opportunity for developing modern cold chain infrastructure, including refrigerated storage and transport, to preserve product quality and meet the stringent requirements of high-value markets such as the EU and Japan. Investment in this sector can significantly reduce losses and enhance export competitiveness. However, implementing cold chain systems demands large-scale investments, improved logistics networks, and lower operational costs, challenges that require careful planning and collaboration among stakeholders.

Conclusion

Vietnam’s agricultural sector plays a vital role in the national economy, generating a consistent trade surplus through key exports like coffee, rice, fruit and vegetables. However, to fully capitalize on this potential, the country must address key challenges related to mechanization, value-added processing, and cold chain logistics. Strategic investments, government support, and public-private partnerships will be essential for overcoming these barriers and transforming Vietnam’s agricultural sector into a sustainable and globally competitive industry.

[1] Vietnam Information, Communication and Technology (2023). Vietnam’s Agricultural Export Followed Economic Growth <Assess>

[2] Center for WTO and International Trade – VCCI (2023). Most Imported Countries of Vietnam’s Agricultural Products <Assess>

[3] General Statistics Office of Vietnam (2023). Statistical Yearbook of Vietnam <Assess>

[4] Vietnam Institute of Strategy and Policy for Industry and Trade (2021). Export of Key Agricultural Products of Vietnam <Assess>

[5] Prime Minister (2022). Strategy for Developing Agricultural Mechanization until 2030 <Assess>

[6] United States Department of Agricultural (2024) Vietnam Coffee Annual Report <Assess>

[7]Vietnam Agricultural (2024). Agricultural Losses after Harvest <Assess>

| B&Company, Inc.

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

Read other articles