17Jun2025

Latest News & Report / Vietnam Briefing

Comments: No Comments.

VSIP Hai Phong Industrial Parks[1]

Context

During the process of expanding investment into Vietnam, many foreign companies—including Japanese firms—often encounter difficulties in finding factories that meet their needs. Common challenges include:

– Lack of complete and up-to-date information about industrial parks (IPs): accepted business sectors, occupancy rates, available factory sizes, rental prices, support policies, etc.

– Difficulty in finding small-sized factories (e.g., under 500m²), especially within IPs that have well-developed infrastructure and complete legal status.

– Uncertainty about which regions to prioritize, depending on factors such as the manufacturing sector, logistics convenience, labor recruitment, or domestic market expansion potential.

– Language and administrative barriers: Many IPs do not have dedicated English/Japanese-speaking staff; investment licensing procedures (ERC, IRC), environmental requirements, and fire safety approvals can be complex and time-consuming.

To minimize these issues, companies should clearly define their needs and prepare relevant information/criteria in advance before searching for information or contacting industrial parks.

Criteria for selecting industrial parks:

1. Factory size and type

Newly entering companies in Vietnam often tend to adopt a cautious approach by renting small-sized factories, typically around 300–500 m². However, for ready-built factories within IPs, the minimum available size is often 1,000 m² or more, especially in parks with abundant land. Therefore, companies seeking smaller spaces may consider looking for factories outside of IPs.

However, this option may pose certain risks in terms of legal compliance (e.g., land use planning), infrastructure reliability (electricity, water), and inconsistent enforcement of regulations related to the environment and fire safety, compared to those inside IPs. In such cases, working with a real estate agent can help companies save time and avoid potential issues.

Additionally, companies should explore the market and seek advice from local partners in Vietnam to thoroughly assess their overall needs and make informed decisions regarding investment options, including factory size.

2. Geographic location and infrastructure connectivity

Before selecting an industrial park, companies should narrow down potential geographic areas (regions, provinces, cities) based on their priorities such as logistics, labor recruitment, or market access. Export-oriented businesses often prioritize locations near seaports, airports, and expressways—such as Hai Phong, Binh Duong, and Long An. Meanwhile, businesses focused on local labor recruitment and domestic market consumption may prefer IPs near major urban centers like Hanoi, Ho Chi Minh City, or Da Nang.

If the company already has partners in Vietnam or has identified a raw material source, it may also prioritize locations nearby or with convenient transportation to that area. For instance, a wood-processing company might choose to locate its factory in Bac Kan or Yen Bai—key regions for timber harvesting and supply in Vietnam.

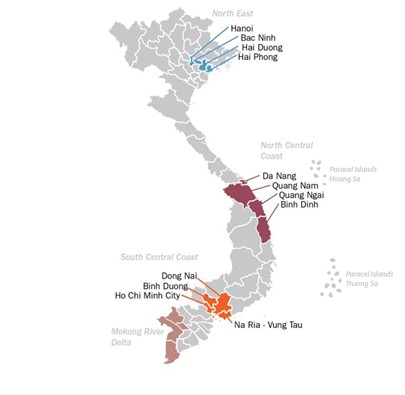

Vietnam Key Economic Regions[2]

3. Investment costs and legal considerations

Costs:

Ready-built factories within IPs typically have rental prices ranging from USD 3.2 to 6.5/m²/month, often including basic fire protection systems. Monthly fees may be lower when paid quarterly or annually. In addition, companies should confirm other associated costs such as management, security, sanitation, and infrastructure maintenance. Infrastructure management fees can range from USD 0.4 to 1/m²/year, depending on the IP’s service standards. Some IPs bundle these fees into the monthly rent, while others charge them separately on a quarterly or yearly basis.

Legal requirements:

Besides service fees, companies should prepare for legal and administrative costs for procedures like ERC (Enterprise Registration Certificate), IRC (Investment Registration Certificate), environmental assessments, and fire safety approvals. Many IPs provide support for ERC and IRC procedures free of charge. For environmental and fire safety assessments, companies are usually required to submit documents such as HS codes of products, ingredient lists, waste types, and factory layout diagrams. These help the IP evaluate acceptance feasibility and estimate costs for proceeding with government procedures.

Investment incentives:

Incentives significantly impact long-term investment costs. Companies should thoroughly research incentive policies offered by each locality and industrial park, which may include:

– Corporate income tax incentives (exemptions or reductions for a certain number of years)

– Land lease incentives

These policies often depend on the location (e.g., socio-economically disadvantaged or specially disadvantaged areas) and whether the business falls under the list of prioritized investment sectors as defined by Vietnamese law.

Contacting IPs can be time-consuming due to language barriers or unclear public information (e.g., outdated occupancy rates, and incorrect contact points). Companies are advised to prepare all necessary information about their products and factory needs in advance to provide to the IPs upon request.

Suggested Vietnam Industrial Parks by Industry

As of 2024, the whole country has 418 IPs, of which 298 are operational.[3] Depending on each IP’s planning strategy and development orientation, different types of investment fields are accepted. Below are some recommended IPs suitable for specific industries:

1. Mechanical and manufacturing industry

| IP Name | Province/City | Key Features |

| Thang Long II | Hung Yen (North) | A model Japanese-style IP, home to many Japanese companies in precision mechanics, auto parts, and electronics. |

| VSIP Hai Phong | Hai Phong (North) | Strategically located near Lach Huyen seaport, suitable for large-scale production.

Equipped with synchronized infrastructure and one-stop services, attracting investment from Japan and South Korea. |

| Hoa Khanh | Da Nang (Central) | Suitable for electronics and machinery manufacturing; convenient access to technical labor from nearby universities such as the University of Science and Technology, and the University of Technical Education. |

| Long Duc | Dong Nai (South) | Concentration of Japanese companies in mechanics, mold-making, and industrial equipment. |

| Duc Hoa 3 | Long An (South) | A new industrial park supporting various industries including mechanics, textiles, chemicals, pharmaceuticals, and cosmetics; conveniently located near airports and seaports. |

2. Chemicals, additives, specialized raw materials

| IP Name | Province/City | Key Features |

| DEEP C Hai Phong | Hai Phong (North) | Includes a dedicated petrochemical zone; international-standard wastewater treatment; located near Lach Huyen deep-sea port; suitable for complex chemical projects. |

| Nam Cau Kien | Hai Phong (North) | An eco-industrial park model allows controlled chemical manufacturing. |

| Dung Quất | Quang Ngai (Central) | Near Dung Quat oil refinery, suitable for petrochemical and heavy chemical industries. |

| Phu My 3 | Ba Ria – Vung Tau (South) | Located near Cai Mep deep-sea port; supports heavy chemical industries with advanced waste treatment systems. |

3. Agriculture

| IP Name | Province/City | Key Features |

| Dong Van IV | Ha Nam (North) | Hosts many Japanese firms investing in food processing and agricultural materials. |

| VSIP Nghe An | Nghe An (Central) | Offers low rental rates; ideal for agricultural product processing in the North Central region. |

| Tan Duc | Long An (South) | Located near raw material areas, suitable for processing exported fruits and vegetables. |

| Sa Dec | Dong Thap (South) | Near key agricultural production zones in the Mekong Delta; it hosts rice, fruit, and seafood processing plants. |

How B&Company Supports Investors in Vietnam Industrial Parks

With over 15 years of experience, B&Company supports foreign investors in navigating Vietnam’s IP landscape through:

– IP Matching & Evaluation: Tailored list of suitable IPs based on sector, location, size, and incentives. Comparative analysis of rental prices, legal risks, and government support.

– Liaison & Site Visit Coordination: Acting on behalf of clients to communicate with IP developers, submit documents, and schedule site inspections. Interpretation and negotiation support are available.

– Legal & Expert Advisory Network: Step-by-step guidance for ERC, IRC, environmental and fire approvals. We connect clients with trusted legal, certification, and industrial real estate partners.

[1] VSIP Hai Phong Industrial Park’s website <Access>

[2] Nam Dinh Vu Industrial Park’s website <Access>

[3] Ministry of Industry and Trade “Promoting Sustainable Development of Industrial Parks in Vietnam” <Access>

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |