28Feb2025

Highlight content / Highlight content vi / Industry Reviews / Latest News & Report

Comments: No Comments.

The Vietnamese automotive market in 2024 is witnessing a significant transformation, driven by an increasing shift toward electric and hybrid vehicles. This trend is fueled by consumer awareness of environmental sustainability, government policies aimed at reducing carbon emissions to achieve net zero by 2050[2], along with tax incentives and cost reductions for EVs.

Vietnam Auto Market Landscape in 2024

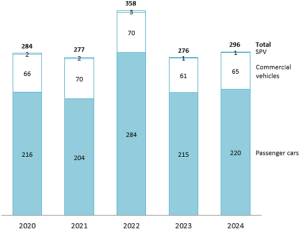

Vietnam’s automobile market experienced rapid growth in 2024, achieving total sales of around 296,000 cars, an approximately 7% increase compared to 2023. This growth is expected to continue, with the automotive market projected to grow at a CAGR of 2% from 2025 to 2030. Passenger cars continued to dominate the market, leading with approximately 220,000 units sold in 2024. A majority of these vehicles were purchased primarily in the southern and northern regions of Vietnam. Among them, SUVs were the most popular, accounting for 38% of total sales, followed by multi-purpose vehicles at 24% and sedans at 21%[3].

Vietnam’s automobile sales by types from 2020 to 2024

Unit: Thousand cars

Source: Vietnam Automobile Manufacturers’ Association (VAMA)[4]

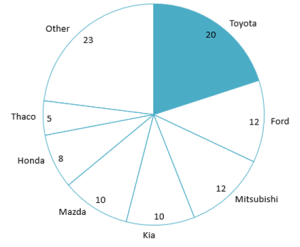

According to VAMA sales report, Toyota is the most purchased brand with sales reaching nearly 67,000 cars in 2024, accounting for 20% of total vehicle sales. Ford and Mitsubishi follow in popularity, each holding a 12% market share[5]. Japanese brands such as Toyota, Mitsubishi, and Mazda are highly favored by Vietnamese consumers due to their strong reputation for quality, durability, and affordability.

Vietnam’s automobile sales in 2024 by brands

Unit = %

Source: Vietnam Automobile Manufacturers’ Association (VAMA)

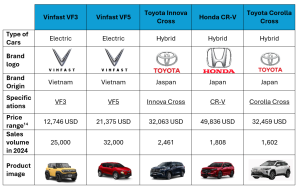

Rising Trend of Electric and Hybrid Vehicles

Vietnam’s EVs market has witnessed remarkable growth, with the market revenue estimated at approximately 3 billion USD in 2025 and projected to nearly double to 7 billion USD by 2030, growing at a CAGR of 18% during the forecast period (2025–2030)[6]. By the end of 2024, VinFast achieved total domestic sales of 87,000 units, representing a 150% increase compared to 2023 and making it the best-selling automotive brand in the Vietnamese market[7]. The VF5 and VF3 models have been the most popular, with sales of over 32,000 and 25,000 units, respectively[8]. This success was driven in part by agreements between VinFast and Xanh SM, an electric taxi operator, to supply EVs for their fleet.

In response to the growing demand, VinFast has announced plans to establish a new completely knocked down (CKD) factory in Ha Tinh, focusing on the production of VF3 and VF5 models. The factory, with a targeted maximum capacity of 300,000 EVs per year, is expected to commence operations in 2025[9]. Additionally, global giants from China, Japan, and Korea are also entering the market. For instance, Chinese automaker BYD launched its first 13 dealerships in Vietnam in July 2024 and aims to expand to about 100 dealerships by 2026[10].

Addition to the strong growth momentum of EVs, hybrid cars have also experienced significant development. In 2024, total sales of hybrid vehicles from brands under the VAMA reached 10,000 units, representing a surge of over 200% compared to 2023[11]. Toyota has emerged as the dominant player in Vietnam’s hybrid vehicle segment, delivering 1,682 hybrid vehicles in the first half of 2024 and capturing 48.8% of the hybrid market share during this period[12]. Models such as the Corolla Cross Hybrid and Innova Cross Hybrid have resonated strongly with Vietnamese consumers, offering a blend of reliability and enhanced fuel efficiency[13].

Key Players in the Market

Vietnam’s automotive market is seeing active participation from both domestic and international manufacturers, while the EVs market is dominated by Vinfast, Toyota dominated the hybrid cars.

Top-Selling EV and Hybrid models in Vietnam

Source: B&Company Compilation

Key Factors Driving Green Vehicles Purchase

In August 2024, a report from KPMG, based on insights from over 1,000 participants, highlighted a growing awareness of environmental sustainability among consumers. More than 85% of respondents expressed concerns about environmental and health impacts such as greenhouse gas emissions and noise pollution, emphasizing these factors as key drivers in their decision to purchase an electric vehicle. This increasing consciousness has led to a notable shift in consumer preferences, with 70% of respondents showing interest and willingness to purchase electric or hybrid vehicles. The trend is particularly strong among individuals aged 25 to 44, who not only have greater financial independence but also demonstrate a stronger tendency toward adopting new technologies[15].

Furthermore, the government implemented Decision 876/QĐ-TTg, which focuses on the green transition in the transportation sector[16]. This decision emphasizes expanding domestic EV production, supporting manufacturers like VinFast, and prioritizing the development of a nationwide EV charging network, particularly in urban areas and along key transportation routes. The decision also outlines an ambitious plan to achieve 100% electrification of all transportation by 2050, with charging stations accessible in every corner of the country.

Additionally, the government also introduced financial incentives such as tax reductions and registration fee exemptions to encourage a shift away from traditional internal combustion engine (ICE) vehicles, further supporting the growth of sustainable mobility in Vietnam.

Tax and cost incentives for EVs and hybrid cars in Vietnam

| EVs | |

| Special consumption tax | – 01/03/2022 – 28/02/2027: 1 – 3%

– From 01/03/2027: 4 – 11% |

| Registration fee[17] | – 01/03/2022 – 28/02/2025: 0%

– 01/03/2025 – 28/02/2027: 5 – 8% |

Source: Thu Vien Phap Luat

Challenges in the Adoption of Electric and Hybrid Vehicles

Despite the significant momentum in the adoption of electric and hybrid vehicles in Vietnam, one of the primary obstacles remains is the limited charging infrastructure. While major urban centers like Hanoi and Ho Chi Minh City are gradually improving access to charging stations, rural and remote areas are still underserved[18]. Currently, VinFast is the primary investor in building and expanding charging stations in the Vietnamese market, with approximately 150,000 charging portals spread across all 63 provinces. In contrast, other investors such as EV One, Charge+, Evercharge, etc. have only around 20 to 30 portals and mostly in big cities such as Hanoi and Ho Chi Minh[19]. VinFast’s extensive and widespread charging network makes it more challenging for other manufacturers to compete in the Vietnamese market.

While EVs receive strong government support, hybrid cars have not yet benefited from equivalent supportive measures. Hybrid vehicles are often priced similarly to, or even higher than, traditional ICE cars, with additional costs such as registration fees and maintenance expenses further adding to the financial burden. Therefore, the government should establish support funds or subsidy policies to encourage the adoption of this promising hybrid market. Having a clear roadmap for green vehicle adoption – similar to leading electric mobility countries like Norway by providing the countries with a strong initiative to support EVs, improving charging infrastructure, and slowly banning ICE car[20] – would raising confidence in both manufacturers and consumers. Thus, this could accelerate Vietnam’s transition into an EV-dominant auto market and position the country as a leader in Southeast Asia’s green transportation sector.

[1] The focus of this report will cover passenger cars, excluding motorcycle

[2] Tuoi Tre Online (2024). Vietnam is Committed to Achieving Net Zero by 2050 <Access>

[3] Vietnam Automobile Manufacturers’ Association (2024). VAMA Sales Report in 2024 <Access>

[4] Vietnam Automobile Manufacturers’ Association (VAMA) members: Daewoo Bus, Ford, Vinfast, Hino, Honda, Isuzu, Mekong Auto, Mercedes-Benz, Samco, Suzuki, Nissan, Thaco, Toyota, Veam, Vinamotor, Do Thanh, Mitsubishi. The sales volume only includes the public data from those brands.

[5] Vietnam Automobile Manufacturers’ Association (2024). VAMA Sales Report by Brand in 2024 <Access>

[6] Mordor Intelligence (2024). Vietnam’s EVs Market Size and Grow Trend <Access>

[7] The Investor (2025). VinFast Sets New Monthly EV Delivery Record in Vietnam <Access>

[8] The Investor (2025). VinFast is the Biggest Autos Seller in Vietnam <Access>

[9] Lao Dong Newspaper (2024). VinFast Electric Vehicle Factory Launches in Ha Tinh <Access>

[10] The Reuters (2024). BYD Sets Sights on Aggressive Expansion in Vietnam <Access>

[11] VnEconomy (2025). Top-Selling Hybrid Cars in Vietnam <Access>

[12] The CafeF (2024). Hybrid Cars Market in Vietnam in 2024 <Access>

[13] Giao Thong Newspaper (2024). Hybrid Cars Set High Record in Sales <Access>

[14] 1 USD = 25,263 VND

[15] KPMG (2024). Driven by Voltage: Navigating the EV Landscape <Access>

[16] Thu Vien Phap Luat (2022). Green Energy Transition Plan to Reduce Carbon Emissions in the Transportation Sector <Access>

[17] The registration fee may vary by province but will not exceed 15%

[18] VOV Giao Thong (2024). Lack of Charging Stations Makes Many Hesitant to Switch to EVs <Access>

[19] The CafeF (2024). Situation of Charging Station in Vietnam <Access>

[20] Norwegian Electric Car Association (2024). Norwegian EV Policy <Access>

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |