25Jan2024

Industry Reviews / Latest News & Report

Comments: No Comments.

The insurance market in general, and life insurance in particular, in Vietnam has undergone a crisis in 2023. Not only facing the overall economic recession, but the insurance industry has also dealt with communication crises and a loss of customer trust. This has further intensified the significant impact on the entire sector. Nevertheless, the insurance industry has gradually overcome these challenges, restructuring to enhance service quality.

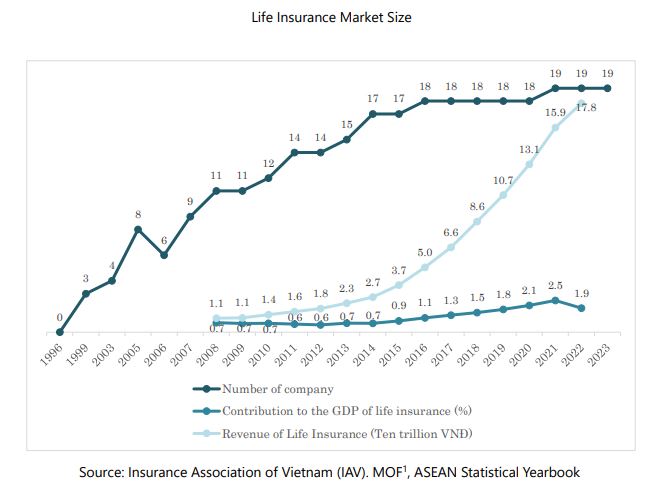

The Vietnamese life insurance market has been expanding steadily since its liberalization in 1999, even during the financial crisis. Previously, Bao Viet (https://www.baoviet.com.vn/insurance/ )dominated the market as the only insurer. The market expanded with the entry of foreign capital, with eight insurers in 2005, and as of May 2023, Vietnam has 19 life insurance companies

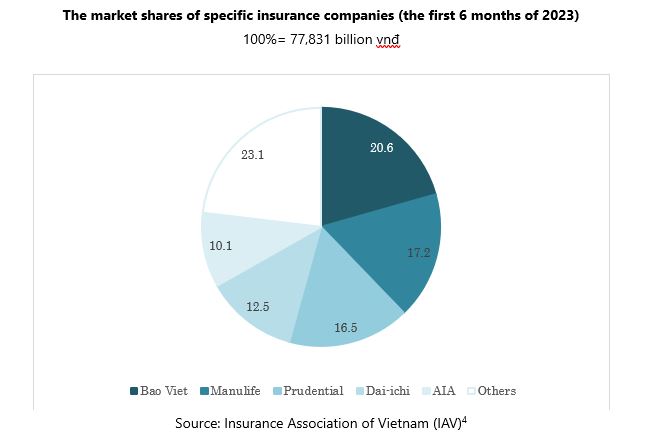

Examining the first 6 months of 2023, the number of new issued policies in the first 6 months of 2023 reached 1,028,402 contracts (main products), a decrease of 31.3% and the total insurance premium revenue for the entire market is estimated at 77.831 trillion VND, a decrease of 7.9% compared to the same period last year. The decline in the number of new policies and life insurance premium revenue across the entire market is a consequence of the distrust stemming from the recent crisis. Many customers have raised complaints due to incidents related to savings deposits and investments being transformed into insurance contracts or credit loans, and they have been coerced into purchasing life insurance through various tactics[3].

Bao Viet continues to maintain its leading market position in the life insurance sector with a market share of 20.1%. However, closely following are two entities with relatively close market shares, namely Manulife (17.2%) and Prudential (16.5%), next are Dai-ichi (12,5%) and AIA (10.1%). Following the top 5 are 14 companies, collectively sharing a total market share of 23.1%.

The year 2024 is still forecasted to be a challenging year for the overall economy and particularly for the insurance industry. However, it also presents an opportunity for life insurance companies to develop both in depth and breadth, enhancing their competitive capabilities to survive in the market. This is the market’s process that helps foster a healthy and efficient market development[5]. At present, the population of Vietnam is rapidly aging, leading to a need for insurance packages that are suitable for the elderly. This group has the demand and awareness of insurance, but currently, it is challenging for them to participate[6]. Insurance companies should offer specialized products and broaden the underwriting process for customers with conditions such as diabetes, high cholesterol, high blood pressure, etc. Additionally, special insurance packages should be extended to address the needs of individuals with disabilities or mental health issues. Currently, individuals with pre-existing conditions find it challenging to access insurance packages due to the high level of risk associated with them. According to insurance regulations, these applications are often rejected by insurance companies.

This article has been published in the column “Read Vietnamese trends” of ASEAN Economic News. Please see below for more information

|

B&Company, Inc. The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

Read other articles

[/vc_column_text][/vc_column][/vc_row]

- All

- E-Commerce

- Economic

- Environment

- Exhibition

- Food & Beverage

- Healthcare

- Investment

- Logistics & Transportation

- Manufacturing

- Regulation

- Retail & Distribution

- Seminar

- Tourism & Hospitality

- White Book