221월2025

최신 뉴스 및 보고서 / 베트남 브리핑

댓글: 댓글 없음.

베트남의 소매 부동산 시장은 경제 성장과 소비자 행동의 변화에 힘입어 계속해서 빠르게 진화하고 있습니다. 2024년에 이 부문은 팬데믹 이후 회복, 전자 상거래 확장, 도시화 증가로 인해 기회와 과제에 직면했습니다. 2025년 현재, 경험적 소매 공간과 지속 가능한 개발에 대한 수요가 성장을 주도할 것으로 예상되며, 이해관계자들에게 과제와 기회가 뒤섞인 모습을 보일 것입니다.

2024년 베트남 소매 부동산 상황

소매용 부동산은 주로 하노이, 호치민시와 같은 대도시에 집중되어 있으며, 이곳의 주요 기업들의 상당한 투자는 활발한 경제 활동과 소비자 지출과 일치합니다.

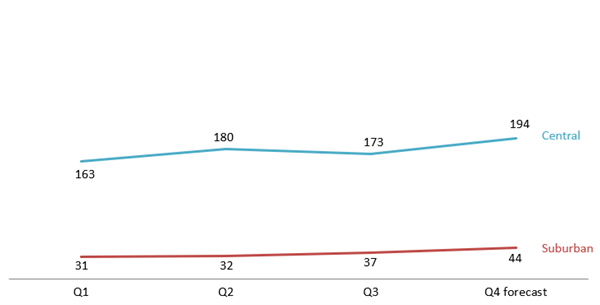

2024년 하노이 중심 지역의 임대료는 평균 178달러/m²/월로 2023년 대비 13% 증가했습니다. 교외 지역도 비슷한 추세를 보였으며, 임대료는 평균 36달러/m²/월로 역시 전년 대비 13% 증가했습니다. 이러한 급증은 이 지역의 토지 가용성이 감소한 데 기인하며, 중심 지역의 공실률은 2%, 교외 지역의 공실률은 12%로 떨어졌습니다.[1].

2024 rental prices in Suburban and Central Areas of Hanoi

단위: USD/m2/월

원천: CBRE 베트남

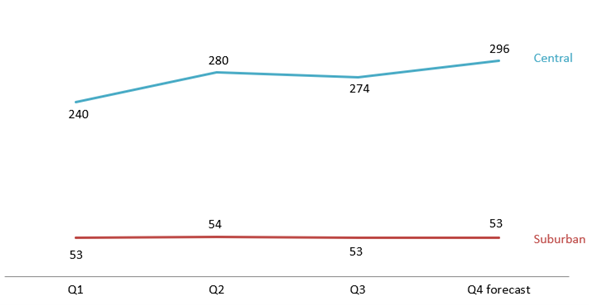

또한 호치민시 중심 지역의 평균 임대 가격은 약 273 USD/m²/월로, 연중 상당한 변동이 있었으며 최대 23%의 차이를 보였습니다. 반면 교외 임대 가격은 2023년 대비 10% 상승하여 53 USD/m²/월에 도달했으며, 연중 비교적 안정을 유지했습니다.[2].

2024 rental prices in Suburban and Central areas of Ho Chi Minh City

단위: USD/m2/월

원천: CBRE 베트남

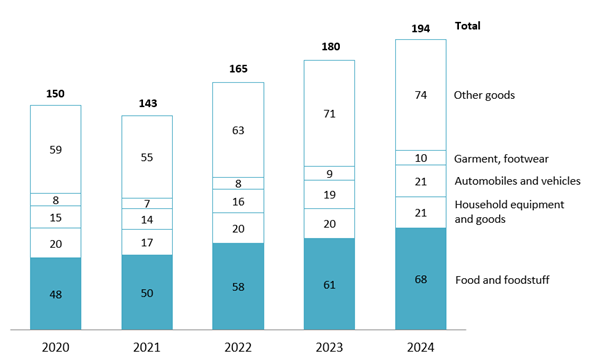

또한 2024년 소매 부동산의 급증은 소매 시장 성장에 의해 뒷받침되며, 2024년 소매 매출은 약 1억 9,400만 달러에 도달하여 전년 대비 8% 증가를 나타냅니다.[3]. 한편, 전자상거래는 소매 부문을 빠르게 변화시키고 있으며, 연간 20%의 놀라운 성장률을 달성하고 있습니다. Tiki, Shopee, TikTok Shop, Lazada와 같은 플랫폼이 시장을 선도하며 소비자 지출의 상당 부분을 차지하고 있습니다.[4].

Total retail sales in Vietnam by commodity group from 2020 – 2024

단위: 10억 달러

원천: 베트남 통계청

2024년은 또한 여러 대규모 쇼핑 센터가 개장하는 해이며, 대부분의 투자자는 베트남에서 온다. 이러한 새로운 쇼핑몰은 소매 부동산 부문의 성장을 더욱 촉진하여 새로운 브랜드가 시장에 진입하고 임대 공간의 잉여 가용성으로 운영을 확장할 수 있는 기회를 제공한다.

2024년 하노이와 호치민시에 새로 오픈하는 쇼핑몰 몇 개

| 지역 | 쇼핑몰 | 주요 투자자 | 국가 | 임대 지역

(천m2) |

출시일 |

| 하노이 | 링크 파크 시티 | 페르다나 파크시티 그룹 | 말레이시아 | 11 | 1월 |

| 다이아몬드 플라자 | 오리엔트 인베스트먼트&

개발 |

Vietnam | 14 | 구월 | |

| 호치민시 | 파크 몰 | VATHA JSC 및 Song Da Company | Vietnam | 35 | 구월 |

| 센트럴 프리미엄 몰 | 꾸옥 꾸옹 지아 라이 주식회사 | Vietnam | 30 | 12월 | |

| 빈컴 메가몰 그랜드 파크 | 빈그룹 | Vietnam | 48 | 칠월 |

출처: B&Company 편집

2025년 베트남 소매 부동산 시장 전망

소매 공간을 포함하는 상업용 부동산 부문은 2025년부터 2029년까지 2%의 CAGR을 달성할 것으로 예상되며, 이는 추정 시장 규모에 도달할 것입니다.[5] 2029년까지 5500억 달러[6]CBRE의 리테일 부동산 보고서에 따르면, 이 부문의 임대 가격은 향후 몇 년 동안 계속 증가할 것으로 예상되지만, 증가율은 2024년에 비해 안정될 것입니다. 게다가 F&B(식음료), 패션 및 화장품, 라이프스타일과 같은 산업은 2024년에 눈에 띄는 확장을 보였습니다. 이러한 추세는 향후 몇 년 동안 지속될 것으로 예측됩니다.

이러한 확장은 몇 가지 주요 요인에 의해 뒷받침됩니다. 첫째, 인프라에 대한 상당한 투자와 더불어 급속한 도시화가 연결성과 접근성을 향상시키고 있습니다. 하노이와 호치민시와 같은 주요 도시는 교통망이 상당히 개선되어 소비자가 리테일 센터에 쉽게 접근할 수 있게 되었습니다.[7]. 결의안 06-NQ/TW에 따라 정부는 2025년 말까지 최소 45%, 2030년까지 50% 이상의 도시화를 달성하는 목표를 설정했습니다.[8]. 둘째, 통합 쇼핑, 식사 및 엔터테인먼트 경험을 제공하는 현대식 소매 형식으로 소비자 행동이 눈에 띄게 바뀌고 있습니다. 2023년까지 베트남에는 약 2,300만 가구의 중산층이 있어 특히 프리미엄 상품 및 서비스에 대한 강력한 소비자 수요가 발생했습니다.[9]. 마지막으로, 2024년 토지법, 주택법, 부동산 사업법의 개정 및 시행으로 부동산 거래의 투명성과 전문성이 크게 향상되었습니다. 이러한 법적 강화로 인해 시장이 더욱 안정적이고 외국인 투자자에게 매력적으로 되었으며, 베트남의 소매 부동산 부문에 대한 신뢰가 더욱 높아졌습니다.[10].

또한 2025년에는 하노이와 흥옌과 같은 시장에서 새로운 소매 부동산 공급이 크게 유입될 것으로 예상됩니다. 새로 건설된 쇼핑 센터의 대부분은 교외 지역에 집중될 것이며, 이 지역의 이용 가능한 토지는 풍부하고 중심 도시 시장에 비해 경쟁이 덜 치열할 것입니다.

2025년 계획 중인 쇼핑몰

| 지역 | 쇼핑몰 | 주요 투자자 | 국가 | 임대 지역

(천m2) |

예상 출시 |

| 하이즈엉 | 이온몰 | 투안 키엣 무역 및 서비스 JSC | Vietnam | 30 | 2025 |

| 흥옌 | 빈컴 메가몰 오션시티 | 빈그룹 | Vietnam | 70 | 2025 |

| 하노이 | 티엔보 플라자 | 프로프린트 회사

그리고 TID JSC |

Vietnam | 50 | 2025 |

| 하노이 | 비나코넥스 다이아몬드 | 비나코넥스 인베스트 | Vietnam | 13 | 2025 |

출처: B&Company 편집

결론

베트남의 소매 부동산 시장은 혁신적이고 지속 가능한 소매 공간에 대한 소비자 수요 증가로 인해 2025년 성장할 수 있는 좋은 위치에 있습니다. 이 부문의 잠재력을 최대한 발휘하고 주요 글로벌 투자자를 유치하기 위해서는 전략적 투자, 지원 정책, 개선된 관리 품질이 이 산업의 지속 가능한 발전을 보장하는 데 필수적입니다.

[1] CBRE 베트남(2024). 2024년 3분기 하노이 수치입장>

[2] CBRE 베트남(2024). 호치민시 2024년 3분기 수치입장>

[3] VietnamPlus(2025). 2024년 총 상품 소매 매출 및 소비자 서비스 수익입장>

[4] 베트남 투자 리뷰(2025). 2024년 베트남의 전자상거래 시장입장>

[5] 상업용 부동산 매매 또는 임대의 총 거래 가치.

[6]Statista(2024). 2024년 베트남 상업용 부동산 시장입장>

[7] Savills Vietnam(2024). 2024년 베트남 부동산 시장 보고서입장>

[8] 투 비엔 파프 루앗(2024). 결의안 No. 06-NQ/TW: 2030년까지 베트남 도시 지역의 계획, 건설, 관리 및 지속 가능한 개발입장>

[9] Business and Integration Magazine(2025). 베트남 리테일 부동산의 기회와 전망입장>

[10] 투비엔팝루앗(2024). 토지법, 주택법, 부동산 사업법입장>

* 본 기사의 내용을 인용하고자 하시는 경우, 저작권을 존중하여 출처와 원 기사의 링크를 함께 명시해 주시기 바랍니다.

| 비앤컴퍼니

2008년부터 베트남에서 시장 조사를 전문으로 하는 최초의 일본 기업입니다. 업계 보고서, 업계 인터뷰, 소비자 설문 조사, 비즈니스 매칭을 포함한 광범위한 서비스를 제공합니다. 또한, 최근 베트남에서 900,000개 이상의 기업에 대한 데이터베이스를 개발하여 파트너를 검색하고 시장을 분석하는 데 사용할 수 있습니다. 문의사항이 있으시면 언제든지 문의해주세요. info@b-company.jp + (84) 28 3910 3913 |