The global smart lock industry has seen rapid growth in recent years, driven by increasing concerns over security, convenience, and technological advancement. Vietnam, a dynamic and fast-developing country in the region, is no exception to this trend. With its growing middle class, rapid urbanization, and tech-savvy consumer base, the demand for smart locks in Vietnam is expected to soar in the coming years.

Rising Trend of Smart Home in Vietnam

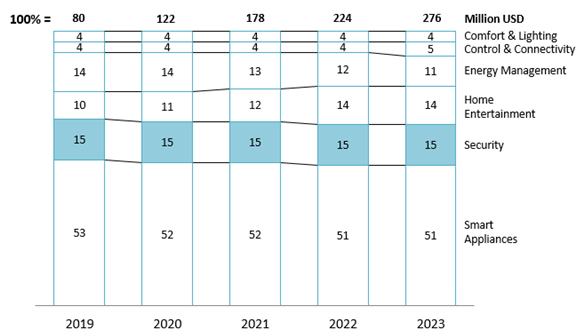

Vietnam is transitioning into a modern digital age, supported by economic growth and rising average incomes[1]. As a result, smart home market is developing significantly in Vietnam. Along with the government’s support and promotion efforts, by 2023, 48 out of 63 provinces and cities in Vietnam is implementing and developing smart city initiatives[2]. Consequently, the smart home is gaining traction, with smart household devices such as locks, kitchen appliances, refrigerators, curtains becoming increasingly popular due to their convenience[3]. In 2023, sales of smart home devices surged, reaching a revenue of $276 million, a 23% increase compared to 2022. Among these, security products accounted for 15% of the total revenue.

Smart home revenue in Vietnam by segment (2019 – 2023)

Source: Statista

The Rapid Growth of the Smart Lock Market

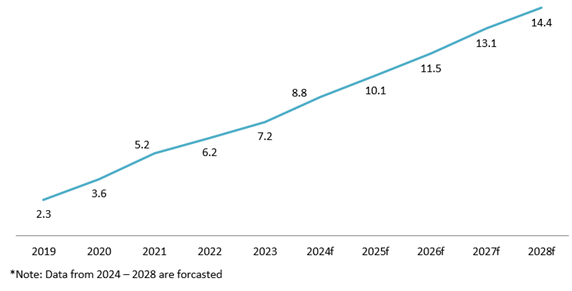

Rising concerns about home and office security, along with the growth of the real estate sector, are causing trends in smart locks. Additionally, the Vietnamese market is becoming more receptive to keyless entry systems, biometric access, and remote-control functionalities, aligning with global trends. As urban development accelerates and property owners seek enhanced security, the smart lock market is expected to continue its upward trajectory. In fact, Vietnam smart locks market revenue has risen from 2.3 million USD in 2019 to reached 7.2 million USD in 2023, marking an outstanding CAGR of around 28% per year. This trend is expected to continue for 5 years, from 2024-2028, with the market forecasted to grow at a CAGR of 8%

Smart lock revenue in Vietnam (2019 – 2028)

Unit: Million USD

Source: Statista

Smart locks in Vietnam have various type of fingerprint locks, numpad locks, facial recognition locks that can be equipped with advanced features such as fire alarms, anti-theft alerts. These convenient features make smart locks the most popular choice, especially in high-end apartments, condominiums, and office spaces[4].

Featuring Brands in Smart Locks Market

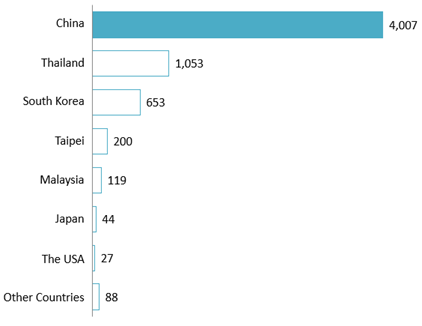

According to data from the International Trade Centre on Vietnam’s imports and exports in 2022, China was the leading supplier of locks for furniture (including smart locks), followed by products from Thailand, South Korea, and Taipei. However, domestic brands are increasingly competing by offering affordable smart lock solutions tailored to the Vietnamese market.

Import value of lock for furniture in Vietnam by country in 2022 (HS code 830130)

Unit: thousand USD

Source: International Trade Centre

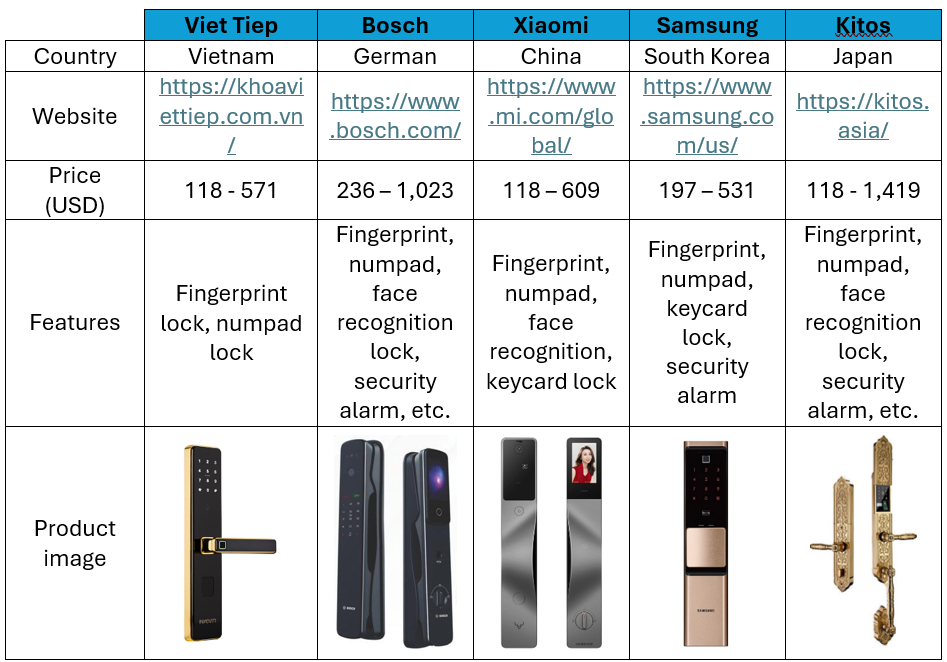

Global giants like Bosch, Xiaomi, and Samsung dominate the premium segment with smart locks that offer features such as remote access, biometric scanning, and integration with other smart home devices. Kitos from Japan also known for its high quality and attention to details, offering premium technology with reasonable price. On the other hand, Viet Tiep focus on providing cost-effective yet reliable products, aiming to reduce reliance on imports and promote growth and development in Vietnam’s manufacturing sector.

Some smart lock brands in Vietnam market

Source: B&Company Complication

Opportunities and Challenges for Foreign Brands in smart lock market

Vietnam presents many opportunities for foreign investors in the smart lock market, largely driven by rapid economic growth, urbanization, and rising demand for advanced security solutions.

However, the smart lock market is currently concentrated primarily in major cities such as Hanoi and Ho Chi Minh City. In contrast, suburban areas, particularly rural regions, remain largely unfamiliar with these products. As a result, many Vietnamese consumers are hesitant to adopt smart locks, citing concerns about security, reliability, and the complexity of installation. Moreover, the development of smart cities in Vietnam is still in its early stages and has not yet reached all provinces. As a result, smart home systems or smart doors have not garnered significant attention or demand across the country.

[1] 10 năm, thu nhập người Việt tăng 2,3 lần – Tuổi Trẻ Online

[2] 48 tỉnh, thành đang triển khai phát triển đô thị thông minh

[3] Sử dụng nội thất thông minh là xu hướng tất yếu

[4] Khóa cửa thông minh, xu hướng mới của người thành thị | Báo Dân trí

| B&Company, Inc.

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

Read other articles