30Oct2025

Latest News & Report / Vietnam Briefing

Comments: No Comments.

Vietnam’s laundry market is expanding steadily across both product and service segments, supported by urbanization, rising hygiene awareness, and gradual market formalization. Laundry care products continue to dominate household spending, while commercial and industrial services are gaining momentum through technological and operational upgrades. Growing consumer interest in convenience, sustainability, and standardized service quality presents emerging opportunities for structured business models and foreign participation. With an open regulatory environment and evolving consumer preferences, Vietnam’s laundry sector offers potential for long-term investment and strategic market entry.

Market Overview

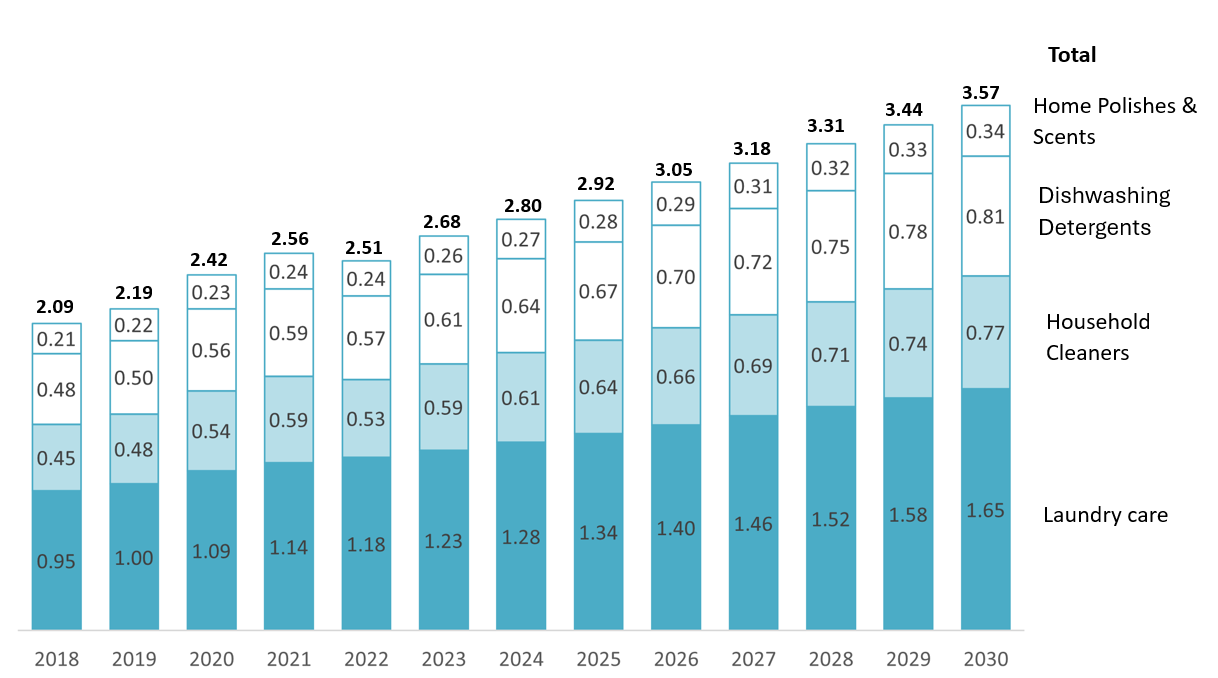

Vietnam’s laundry market is growing fast across both products and services. In 2025, the laundry care segment (including detergents and fabric softeners) reached about $1.34 billion, the largest part of Vietnam’s $2.92 billion home care market. It’s projected that the market will experience an annual growth rate of 4.18% (CAGR 2025-2030).

Vietnam Home Care Market Revenue by Segment (2018–2030)

Unit: USD Billion

Source: Statista Market Insights[1]

Alongside the growth in consumer products, the laundry services segment has also developed rapidly. The commercial laundry services market (including laundromats and hotel or industrial laundry) was valued at around $205 million in 2022, growing at roughly 6% per year—a pace notably higher than the Asian regional average of 3.6% [2]. At that time, Vietnam had over 15,000 laundry shops nationwide, with nearly 60% established between 2020 and 2022, reflecting a rapid expansion phase. About 96% of these outlets were small, family-run businesses, showing that the sector remained highly fragmented and largely informal. Even so, the strong pace of new openings indicates rising demand, and with continued urbanization and lifestyle changes[3], the market is expected to sustain steady growth in the coming years.

Growth Driver

Vietnam’s laundry market is undergoing a steady transformation driven by changing consumer behavior and broader socioeconomic factors. Four key trends are shaping its current development.

Eco-friendly and sustainable products are gradually gaining attention as environmental awareness among consumers increases[4]. Urban households are showing interest in biodegradable detergents, natural ingredients, and recyclable packaging. Global brands such as Unilever and P&G have introduced concentrated liquid detergents, including products like OMO Matic Comfort and Ariel Power Gel Concentrate. While concentration primarily aims to improve resource efficiency and reduce packaging volume, these initiatives may also align with broader sustainability efforts, such as promoting biodegradable formulations and recyclable materials in the Vietnamese market.

Urbanization and lifestyle acceleration [5] are reshaping how consumers approach laundry care in Vietnam. As more people move to cities and working hours become longer, convenience and time-saving features are increasingly valued. This shift is reflected in the growing preference for ready-to-use liquid detergents, compact packaging, and quick-wash formats, as well as a gradual increase in demand for professional laundry services among urban households with limited space and time.

The rising young consumer segment—with a large share of Vietnam’s population under 35 [6]—also plays a role in reshaping market behavior. Younger consumers tend to be more digitally engaged and receptive to new product formats such as laundry pods and concentrated liquids. Moreover, their strong presence on online shopping platforms and increasing reliance on e-commerce channels are contributing to the gradual digitalization of the laundry care market.

Finally, heightened hygiene awareness following recent health crises (COVID-19) continues to influence consumer preferences. Many households place greater emphasis on hygiene and safety, leading to sustained demand for antibacterial and disinfectant products.

Key Trends Shaping the Market

Vietnam’s laundry service industry is gradually transitioning from small, informal operations toward more structured and modern business models. Two key trends stand out in this transformation – the rise of personal laundry services and the expansion of industrial laundry operations – each showing distinct directions in business structure, investment, and service innovation

Personal Laundry Services

Personal laundry services in Vietnam are evolving in response to changing urban lifestyles and growing demand for convenience. In recent years, self-service laundromats and franchise-based chains have started to emerge in large cities such as Hanoi and Ho Chi Minh City. These models offer standardized pricing, predictable quality, and faster turnaround times, appealing especially to younger, urban consumers with limited time and space. The entry of foreign brands such as Wash Friends (Korea) and Mr Jeff (Spain) reflects rising international interest in Vietnam’s consumer service sector. Their presence suggests that investors see opportunities in introducing scalable, franchise-style concepts to a market still dominated by household-run laundries

Industrial Laundry Services

The industrial segment is also gaining momentum as demand rises from hotels, hospitals, and manufacturing facilities. Operators such as EcoWash are gradually shifting from manual to semi-automated systems to more efficient, technology-based operations. Modern industrial laundry increasingly emphasizes energy and water savings, hygiene control, and service reliability[7], reflecting growing client expectations. Partnerships with foreign equipment suppliers and technical consultants[8] have begun to influence operational standards, particularly in large-scale facilities in Ho Chi Minh City and nearby industrial zones. Although the segment remains relatively small, its focus on compliance, sustainability, and process optimization indicates potential for future consolidation and professional growth.

Vietnam’s laundry service market is progressing toward greater formalization, efficiency, and investment attractiveness. The emergence of standardized business models, gradual technology adoption, and early signs of foreign participation all point to a sector moving beyond fragmentation toward structured, scalable, and customer-focused development.

Competitive Landscape

Personal Laundry Services

Vietnam’s personal laundry services sector is gradually modernizing as structured business models expand in urban areas. International brands such as Wash Friends and Mr Jeff have introduced standardized service formats that emphasize convenience, hygiene, and consistent quality. Although they operate under different models—self-service and franchise-based, respectively—both reflect the broader shift from informal, family-run laundries to organized, brand-led operations. Their presence signals rising investor interest in scalable, urban-oriented service concepts and may contribute to shaping operational standards, customer expectations, and future franchise development in Vietnam’s laundry market.

Some active companies in Vietnam’s personal laundry services segment

| Company | Year of Market Entry | Main Cities | Number of Outlets (2024) | Service Type | Description |

| Wash Friends (Korea) | 2019 | Hanoi, Ho Chi Minh City | >80 stores | Self-service laundromat model | Operates coin-operated laundromats equipped with modern washing and drying machines. Stores focus on convenience, hygiene, and standardized service quality for urban consumers with limited space and time. |

| Mr Jeff (Spain) | 2019 | Ho Chi Minh City | >16 stores | Franchise-based laundry service | Runs a network of franchise-operated outlets offering drop-off and delivery laundry services through a unified brand and digital management system. The model aims to improve customer convenience and operational consistency. |

Source: B&Company’s compilation

Industrial Laundry Services

Vietnam’s industrial laundry sector is expanding steadily alongside the growth of the hospitality, healthcare, and manufacturing industries. Service providers are modernizing operations through improved hygiene management, energy-efficient systems, and professional service processes. Although the market remains small and data on market share is limited, available evidence suggests a gradual shift toward technology adoption and environmental sustainability. Increasing engagement from foreign suppliers and technical partners is also contributing to equipment modernization and higher operational standards across the industry.

Some active companies in Vietnam’s industrial laundry services segment

| Company | Year of Establishment | Main Service Area | Country of Origin | Service Type | Description |

| TMC Vietnam | 2015 | Ho Chi Minh City | Vietnam | Industrial & Commercial Laundry | Operates coin-operated laundromats equipped with modern washing and drying machines. Stores focus on convenience, hygiene, and standardized service quality for urban consumers with limited space and time. |

| EcoWash HCMC | 2018 | Ho Chi Minh City | Vietnam | Industrial Laundry (Eco-Focused) | Runs a network of franchise-operated outlets offering drop-off and delivery laundry services through a unified brand and digital management system. The model aims to improve customer convenience and operational consistency. |

| Mr. Clean | 2016 | Ho Chi Minh City | Vietnam | Industrial Laundry & Sanitization | Specializes in industrial washing and disinfection services for the hospitality and healthcare sectors. |

Source: B&Company’s compilation

Regulatory Environment

Vietnam’s regulatory environment for the laundry sector remains favorable, with clear investment procedures, standardized product regulations, and growing policy support for sustainable business practices.

– Law on Investment (2020) and Law on Enterprises (2020) permit up to 100% foreign ownership in most manufacturing and trading activities. Investors are required to obtain both an Investment Registration Certificate (IRC) and an Enterprise Registration Certificate (ERC) from the provincial Department of Planning and Investment. Small-scale laundromats, often household-run, register at the district level under simplified procedures.

– Law on Chemicals (2007) and Decree 113/2017/NĐ-CP regulate the production, import, and sale of detergents and fabric-care products. All products must carry Vietnamese-language labels indicating composition, usage, and safety information. Imported goods must comply with the relevant Vietnamese Technical Regulations (QCVN) before being distributed in the market.

– Recent policies, including Decree 19/2025/NĐ-CP, have simplified investment procedures and promoted eco-friendly manufacturing under the National Green Growth Strategy (2021–2030).

Key Implications for Investors

Vietnam’s laundry market offers promising long-term opportunities across both product and service segments, supported by steady consumer demand, urbanization, and an open regulatory environment. However, successful entry requires careful localization, operational efficiency, and adaptation to evolving consumer behavior.

In the laundry care product segment, growth is driven by shifting consumer preferences toward liquid, concentrated, and environmentally friendly formulations. Investors may find potential in positioning brands that balance international product quality with localized pricing and fragrance preferences suited to Vietnamese households. Collaboration with local distributors or retail networks remains essential to reach both modern trade channels and traditional markets, which still account for a large share of nationwide sales. Partnerships with local manufacturers can also support cost efficiency and compliance with Vietnam’s chemical and labeling regulations.

In the laundry services segment, ongoing market fragmentation presents opportunities for structured, scalable models such as self-service laundromats, franchise chains, and industrial laundry operations. The sector’s modernization creates potential for foreign investors to introduce technology-based solutions, including water- and energy-efficient systems, hygiene monitoring tools, and digital management platforms. Industrial partnerships may be particularly attractive in urban and industrial zones, where demand from hotels, hospitals, and factories is rising.

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

[1] https://www.statista.com/outlook/cmo/home-laundry-care/vietnam

[2] https://en.sggp.org.vn/laundromat-market-growing-in-vietnam-post104793.html

[3] https://vietnam.opendevelopmentmekong.net/topics/urbanization-in-vietnam/

[4] https://en.nhandan.vn/vietnam-works-towards-sustainable-production-and-consumption-post140664.html

[5] https://vietnam.opendevelopmentmekong.net/topics/urbanization-in-vietnam/

[6] https://www.worldometers.info/demographics/vietnam-demographics/

[7] https://ecowash.net.vn/en/class-and-prestige-laundry-service-for-hotel-industry-from-ecowash-hcmc