Vietnam’s furniture industry has evolved into one of the country’s most vibrant economic sectors, driven by both strong domestic demand and impressive export performance. Over the years, the nation has become a key global hub for furniture production, leveraging its competitive manufacturing costs, skilled labor, and abundant natural resources. Today, Vietnam is recognized as one of the world’s largest furniture exporters, catering to major international markets. This article examines the current state of the furniture market in Vietnam, identifies the major industry players, and explores the growth potential along with the challenges the sector faces.

Current Situation of the Furniture Market in Vietnam

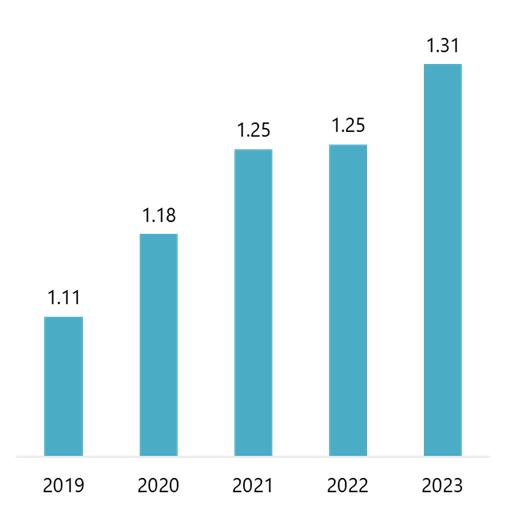

Over the past decade, Vietnam has achieved impressive growth in the global furniture supply chain, ranking as the sixth-largest furniture producer worldwide in 2023. According to data collected by Statista, the furniture market is forecasted to have a revenue of USD 1,354 million in 2024, with a projected annual growth rate of 2.70% (CARG 2024-2029). Of which, the largest segment is the living room furniture segement, which is expected to have a market volume of USD 462.9 million in 2024[1].

Revenue of the Furniture Market in Vietnam (2019 – 2023).

Unit: billion USD

Source: Statista

Regarding exports, Vietnam reached a milestone of USD 16 billion in furniture and wood products in 2023. Certain markets showed exceptional export growth: India (288%), Peru (111%), Turkey (90%), and Norway (52% in wood and wood products) compared to 2022. The export surge was particularly strong in late 2023 and early 2024, with January 2024 exports reaching USD 1.8 billion, underscoring Vietnam’s ability to supply high-quality, competitively priced furniture globally[2]. Exports are essential to Vietnam’s furniture industry, with the United States being the largest buyer, accounting for over 50% of total exports[3].

Vietnam has leveraged trade agreements such as the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and the EU-Vietnam Free Trade Agreement (EVFTA) to enhance its market access and competitive position. These agreements have reduced trade barriers, bolstering Vietnam’s reputation as a reliable supplier amid geopolitical uncertainties affecting other producers like China.

Regarding development factors, rapid urbanization, a growing middle class, and rising disposable incomes have increased demand for modern furniture, driven by home renovations and improvements in residential and commercial spaces. This demand spans household and commercial needs, with sectors like tourism and hospitality—including hotels, resorts, restaurants, and office buildings—requiring substantial furnishings. The market is segmented into residential, commercial, and custom-made furniture, with wooden items, such as chairs, tables, beds, and cabinets, dominating both domestic sales and exports. A significant trend within the sector is the shift toward eco-friendly and sustainable furniture, reflecting global preferences for environmentally responsible products. E-commerce growth has also transformed sales channels, as online shopping gains popularity, especially among younger, tech-savvy consumers, creating opportunities for local companies to serve the domestic market and strengthen their global presence.

Major Players in the Vietnam Furniture Industry

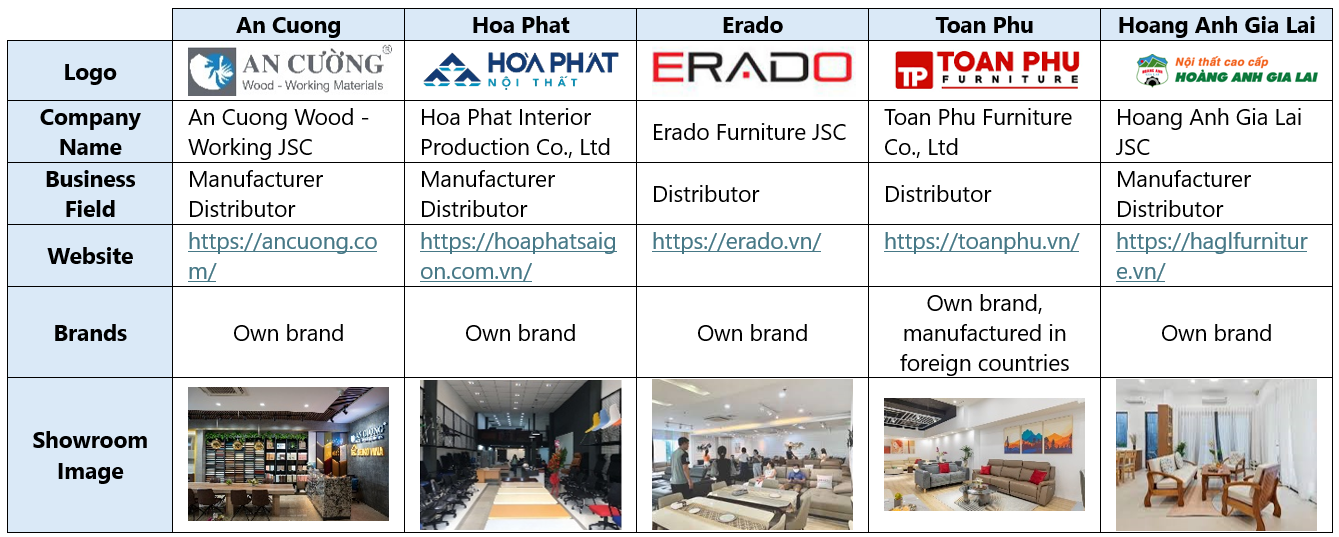

The furniture industry in Vietnam features a diverse range of companies, including large domestic manufacturers, joint ventures, and foreign enterprises. The table below shows some of the top furniture manufacturers/distributors in Vietnam

Source: B&Company’s synthesis

Global furniture giants like IKEA and Ashley Furniture have also played an influential role in Vietnam’s furniture market. These companies do not operate directly in the country but source extensively from Vietnamese suppliers. This collaboration has introduced advanced production standards and provided local manufacturers with valuable experience in meeting the demands of global buyers.

Potential Growth and Opportunities

The furniture market in Vietnam holds considerable potential for growth in the coming years. One of the key drivers is the growing export demand, particularly from markets such as the United States, the European Union, and Japan. The “China +1” strategy, where international buyers seek to reduce their dependence on Chinese manufacturing, has further positioned Vietnam as a preferred sourcing destination[4]. This shift presents a significant opportunity for the Vietnamese furniture industry to expand its global market share.

Urbanization and infrastructure development in Vietnam are also creating new opportunities for the furniture sector. With 38.1% of the population living in urban areas—a figured collected in 2023[5]—there is increasing demand for home furnishings. The hospitality industry, which is growing rapidly due to the country’s booming tourism sector, requires large quantities of commercial furniture for hotels, resorts, and restaurants. As new real estate developments emerge, both residential and commercial furniture sales are expected to increase steadily.

In recent years, the furniture market in Vietnam has seen vibrant activity, one of which is attracting foreign brands. In December 2023, NITORI – a renowned Japanese furniture brand – launched in Vietnam with its first showroom on the second floor of the SORA gardens SC shopping center in Thu Dau Mot City, Binh Duong Province. The showroom spans nearly 1,600 square meters, and NITORI Group also owns two factories in Vietnam[6].

Nitori showroom in Vietnam

Source: Tien Phong Online

Challenges Facing the Industry

Despite its potential, Vietnam’s furniture industry faces several challenges that could hinder its growth. One of the primary issues is the dependence on imported raw materials. Firstly, although Vietnam has access to natural wood resources, the industry still relies heavily on imported wood and metal components to meet production needs. Fluctuations in global raw material prices and supply chain disruptions pose significant risks to manufacturers, while compliance with strict international environmental regulations adds further complexity.

Secondly, labor shortages also present a challenge for the sector. Although Vietnam has a large labor force, competition from other industries, such as electronics and textile manufacturing, makes it difficult for furniture companies to retain skilled workers. Training and developing a qualified workforce will be essential for maintaining the industry’s growth momentum.

Finally, increasing competition from other regional producers, including Indonesia, Malaysia, and Thailand, is another obstacle for Vietnam’s furniture industry. As these countries ramp up their production capacities and compete for the same international markets, Vietnamese companies must continuously innovate and improve product quality to stay ahead.

Conclusion

Vietnam’s furniture market is in a strong position, with growing demand from both domestic and international markets. The industry has successfully capitalized on its cost advantages, skilled labor, and favorable trade agreements to become a leading global exporter. At the same time, rising urbanization and infrastructure development are driving local demand for both residential and commercial furniture. The presence of diverse players, including local companies and international brands, reflects the dynamic nature of the market.

[1] Statista (2024). Furniture – Vietnam. <Assess>

[2] CafeF (2024). Wooden and furniture exports exceed 1 billion USD in just one month. <Assess>

[3] VnEconomy (2024). Wood industry facing its “golden time” to regain glory. <Assess>

[4] VCCI (2022). Vietnam: New manufacturing center in the “China + 1” strategy. <Assess>

[5] GSO (2024). Press release on population, labor and employment status in the fourth quarter and the whole year of 2023. <Assess>

[6] Tien Phong Online (2024). Nitori officially opens its first showroom in Vietnam: Discovering high-quality Japanese furniture spaces. <Assess>

| B&Company, Inc.

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

Read other articles