08/01/2026

Tin tức & Báo cáo mới nhất / Vietnam Briefing

Bình luận: Không có bình luận.

Việt Nam là một trong những nước xuất khẩu dệt may hàng đầu thế giới, với tổng kim ngạch xuất khẩu đạt hơn 41,4 tỷ USD vào năm 2024, tăng gần 101 nghìn tỷ USD so với năm 2023.[1]Đằng sau sự thành công của các sản phẩm may mặc là thị trường vải, đóng vai trò nền tảng quan trọng cho sản xuất may mặc, cung cấp nguyên liệu đầu vào thiết yếu.

Tình hình sản xuất vải trong nước tại Việt Nam

Năm 2024, ngành dệt may Việt Nam có hơn 7.000 doanh nghiệp, nhưng chỉ có 18% sản xuất vải. Việt Nam vẫn chủ yếu tập trung vào các phân khúc giá trị gia tăng thấp như sản xuất cắt may (CMT) và sản xuất thiết bị gốc (OEM), nơi các doanh nghiệp chủ yếu hoạt động theo hình thức gia công cho các thương hiệu nước ngoài. Ngược lại, các giai đoạn giá trị cao hơn như sản xuất thương hiệu riêng (OBM) và sản xuất thiết kế riêng vẫn còn kém phát triển, chỉ có một số ít doanh nghiệp Việt Nam đầu tư vào xây dựng thương hiệu hoặc năng lực thiết kế riêng.

Hiện nay, Việt Nam sản xuất đa dạng các loại vải: từ vải dệt thoi và vải dệt kim truyền thống (dùng cho may mặc) đến các dòng sản phẩm mới như vải sinh thái từ sợi tự nhiên (sợi tre, sợi gai dầu, vải tơ sen, v.v.) và các loại vải kỹ thuật chuyên dụng. Trong giai đoạn 2021-2025, Tập đoàn Dệt may Việt Nam, một doanh nghiệp tiên phong trong ngành dệt may, đã công bố sản lượng vải sản xuất, bao gồm 170 triệu mét vuông vải dệt thoi, 35.000 tấn vải dệt kim và 10.000 tấn vải dệt gia dụng.[2].

Năm 2024, Việt Nam sản xuất khoảng 2,3 tỷ mét vải mỗi năm, nhưng chỉ đáp ứng được 251.300 tấn tổng nhu cầu. Tình trạng thiếu hụt nguồn cung vải trong nước xuất phát từ thực tế thị trường vải vẫn chưa thực sự hấp dẫn đối với các nhà sản xuất trong nước, do một số hạn chế chính.[3]:

– Chi phí đầu tư ban đầu rất cao. Đặc biệt là đối với các hệ thống xử lý nước thải đáp ứng các tiêu chuẩn môi trường. Đây là một thách thức lớn đối với khoảng 80% doanh nghiệp dệt may Việt Nam, vốn là các doanh nghiệp vừa và nhỏ, do đó bị hạn chế về năng lực tài chính và quản lý.

– Những hạn chế và thiếu hụt lao động lành nghề trong lĩnh vực thiết kế và in ấn vải. Điều này khiến vải Việt Nam thiếu tính cạnh tranh cần thiết trong phân khúc tầm trung và cao cấp.

– Không đạt được hiệu quả kinh tế theo quy mô: Điều này dẫn đến việc vải sản xuất tại Việt Nam đắt hơn đáng kể so với các nước sản xuất vải lớn trong khu vực và trên thế giới, như Trung Quốc và Ấn Độ.

Tuy nhiên, Việt Nam cũng có một số lợi thế trong lĩnh vực sản xuất vải, chẳng hạn như:[4]

– Thị trường tiêu thụ vải trong nước quy mô lớn: Ngành công nghiệp dệt may quy mô lớn của Việt Nam cần một lượng lớn nguyên vật liệu phụ trợ, đặc biệt là vải. Chiến lược của Chính phủ giai đoạn 2026-2030 đặt mục tiêu tỷ lệ nội địa hóa đạt 56-601 tấn/năm, thể hiện sự hỗ trợ mạnh mẽ cho việc phát triển sản xuất vải và nguyên vật liệu phụ trợ trong nước.

– Ưu điểm của một số loại vải có nguồn gốc tự nhiên: Các doanh nghiệp Việt Nam đã thành công trong việc sản xuất vải từ các nguyên liệu tự nhiên như lá dứa, tre, gai dầu để đáp ứng yêu cầu về nguồn cung ứng xanh và bền vững của các thương hiệu lớn như Nike và Adidas. Đặc biệt, lụa sen là một loại vải thủ công quý hiếm với chi phí rất cao, được sử dụng cho các sản phẩm cao cấp như khăn lụa sen.

– Nguồn nhân lực dồi dào và có tay nghề cao: Việt Nam có lực lượng lao động tương đối lớn trong ngành dệt may. Công nhân Việt Nam nổi tiếng với kỹ năng may vá tinh xảo, giúp đảm bảo chất lượng sản phẩm ổn định hơn so với một số nước khác trong khu vực như Indonesia, Bangladesh và Ấn Độ.

Meritorious artisan performs the process of taking lotus silk

Nguồn: TuoitreThudo

Tình hình xuất nhập khẩu ngành vải tại Việt Nam

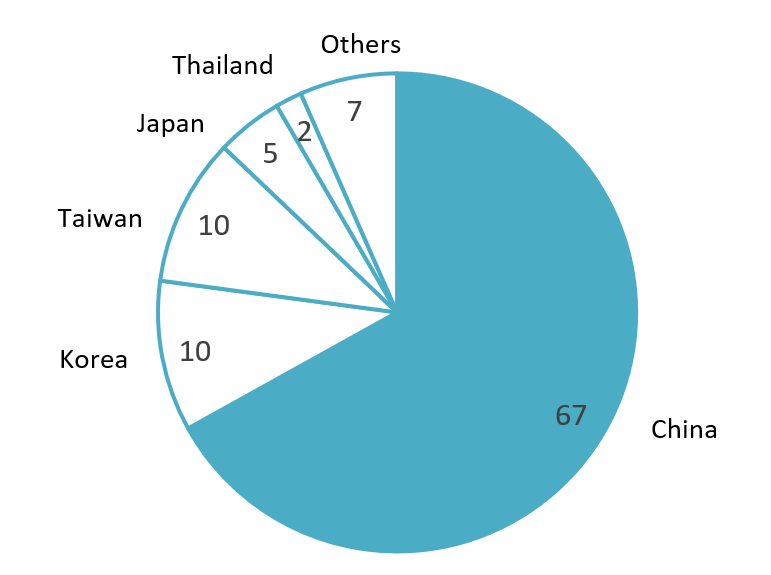

Về nhập khẩu vải, giá trị nhập khẩu năm 2024 đạt 14,9 tỷ USD, tăng 151 nghìn tỷ tấn so với năm 2023. Cụ thể, nhập khẩu vải từ Trung Quốc chiếm gần 671 nghìn tỷ tấn trong tổng lượng nhập khẩu vải, tiếp theo là Hàn Quốc (101 nghìn tỷ tấn) và Đài Loan (101 nghìn tỷ tấn). Nhập khẩu từ Nhật Bản và Thái Lan lần lượt chiếm khoảng 51 nghìn tỷ tấn và 21 nghìn tỷ tấn, đều giảm so với năm 2023.

Some major fabric import markets of Vietnam in 2024

100% = 14,9 tỷ USD

Nguồn: Báo cáo Xuất Nhập khẩu năm 2024

Mặt khác, xuất khẩu vải của Việt Nam vẫn còn khiêm tốn, chủ yếu bao gồm sản lượng được bán bởi một số ít các công ty dệt trong nước hoặc tái xuất theo hợp đồng gia công. Xuất khẩu vải năm 2024 ước tính chỉ đạt khoảng 2,7 tỷ USD; mặc dù tăng 121.300 tấn so với năm 2023, con số này vẫn rất nhỏ so với khối lượng vải nhập khẩu, cho thấy Việt Nam phần lớn vẫn đóng vai trò là một “xưởng may” phụ thuộc vào vải nhập khẩu.

Xu hướng thị trường chính

Trong những năm gần đây, một số xu hướng mới đã xuất hiện trên thị trường vải Việt Nam, bao gồm:

– Sự dịch chuyển trong chuỗi cung ứng và sự gia tăng đầu tư nước ngoài: Khi các nhà mua hàng toàn cầu tìm cách đa dạng hóa chuỗi cung ứng của họ khỏi Trung Quốc, Việt Nam đã trở thành điểm đến hấp dẫn đối với các nhà sản xuất vải nhằm tận dụng chi phí cạnh tranh, nguồn lao động dồi dào và các ưu đãi thuế quan theo các hiệp định thương mại tự do. Đặc biệt, vào năm 2024, Tập đoàn Toray (Nhật Bản) đã khánh thành nhà máy Top Textiles tại Nam Định – một dự án dệt và nhuộm công nghệ cao với vốn đầu tư 203 triệu USD. Giai đoạn 1 của nhà máy có công suất gấp bốn lần tổng công suất dệt và nhuộm trước đây của tỉnh.[5].

– Hướng tới các sản phẩm công nghệ cao, bền vững: Nhiều doanh nghiệp đang tập trung phát triển các dây chuyền sản xuất vải chuyên dụng và áp dụng các tiêu chuẩn sản xuất xanh. Các nhà máy nhuộm và dệt mới đang đầu tư vào công nghệ tiết kiệm nước, tái chế hóa chất trong quá trình nhuộm, và các hệ thống xử lý nước thải và khí thải hiện đại đạt tiêu chuẩn môi trường loại A (mức cao nhất tại Việt Nam).[6]Song song đó, ngành công nghiệp đang thử nghiệm và sử dụng các vật liệu sợi bền vững mới như gai dầu và tre để đáp ứng nhu cầu ngày càng tăng trên toàn cầu về thời trang bền vững.[7]Tuy nhiên, sản lượng vẫn còn nhỏ và trung bình. Nhà máy gai dầu An Phước sản xuất 1.700 tấn sợi gai dầu và 1.400 tấn sợi hỗn hợp gai dầu-bông mỗi năm.[8]

– Nhu cầu ngày càng tăng đối với các chứng nhận về truy xuất nguồn gốc và tính bền vững: Các thương hiệu toàn cầu ngày càng yêu cầu khả năng truy xuất nguồn gốc rõ ràng đối với sợi và vải, cùng với các hệ thống chứng nhận như OEKO-TEX, GRS, BCI và ISO liên quan đến hiệu suất môi trường và an toàn hóa chất. Xu hướng này buộc các nhà sản xuất vải tại Việt Nam phải số hóa quản lý chuỗi cung ứng, triển khai hệ thống quản lý chất lượng, ghi chép dữ liệu theo lô đối với sợi và vải, và đầu tư vào việc đạt được các chứng nhận quốc tế. Các công ty đáp ứng được các yêu cầu về truy xuất nguồn gốc và chứng nhận này sẽ có lợi thế đáng kể trong việc thu hút đơn đặt hàng, đặc biệt là từ thị trường Nhật Bản và EU.[9].

Highly durable fiber is produced from hemp with advanced, modern technology

Nguồn: Kinh tế VN

Các nhà sản xuất vải chủ chốt trên thị trường Việt Nam

Ngành sản xuất vải của Việt Nam đang được dẫn dắt bởi một số doanh nghiệp lâu đời, tiêu biểu. Bên cạnh đó, một số nhà sản xuất nước ngoài cũng đã gia nhập thị trường Việt Nam trong những năm gần đây.

| KHÔNG | Tên công ty | Quốc gia | Trụ sở chính | Năm thành lập | Mô tả ngắn | Trang web |

| 1 | Tập đoàn Dệt may Việt Nam (Vinatex) | Việt Nam | Hà Nội | 1995 | Sở hữu 4 nhà máy dệt vải (dệt vải: ~170 triệu m²/năm; dệt kim: ~25.000 tấn/năm) và 12 nhà máy sản xuất sợi (1 triệu cọc sợi/năm) tại Hà Nội, Nam Định, Thừa Thiên Huế và Thành phố Hồ Chí Minh. | https://vinatex.com.vn/ |

| 2 | Tổng công ty cổ phần Phong Phú | Việt Nam | Hồ Chí Minh | 1964 | 3 nhà máy tích hợp (sợi – dệt – nhuộm – may – khăn), công suất khoảng 23 triệu mét vải/năm, sản xuất sợi, vải denim, khăn tắm, vải gia dụng và các mặt hàng thời trang xuất khẩu. | http://phongphucorp.com |

| 3 | Công ty Cổ phần Thanh Công (TCM) | Việt Nam | Hồ Chí Minh | 1976 | Công suất sản xuất khoảng 10 triệu mét vải dệt thoi/năm và khoảng 8.400 tấn vải dệt kim/năm, xuất khẩu vải dệt thoi/dệt kim và hàng may mặc sang Mỹ, Nhật Bản, Hàn Quốc, EU, v.v. | https://www.thanhcong.com.vn/ |

| 4 | Công ty Cổ phần Việt Thắng | Việt Nam | Hồ Chí Minh | 1962 | Năng lực sản xuất khoảng 40 triệu mét vải/năm, bao gồm sợi, vải thô, vải thành phẩm và một số sản phẩm may mặc cho thị trường trong nước và xuất khẩu. | https://vietthang.com.vn/ |

| 5 | Công ty TNHH Dệt kim Đồng Xuân (Doximex) | Việt Nam | Hà Nội | 1959 | Doanh nghiệp nhà nước, sở hữu khu phức hợp kéo sợi-dệt kim-hoàn thiện-may mặc tại Hưng Yên, công suất khoảng 15-20 triệu sản phẩm/năm, cung cấp vải dệt kim và quần áo cho khách hàng trong nước và đặc biệt là Nhật Bản. | https://doximex.vn/ |

| 6 | Công ty Hualon Việt Nam | Malaysia và Đài Loan | Đồng Nai | 1993 | Vận hành một khu phức hợp kéo sợi-dệt-nhuộm-hoàn thiện quy mô lớn tại Đồng Nai, cung cấp vải dệt kim tổng hợp và vải thô cho xuất khẩu và khách hàng trong nước. | http://www.hualonvn.com.vn |

| 7 | Tập đoàn Dệt may Texhong | Hồng Kông | Bình Dương | 2006 | Công ty hiện đang vận hành 5 nhà máy sản xuất sợi tại Đồng Nai và các nhà máy sản xuất sợi/dệt may khác tại Quảng Ninh, với công suất khoảng 82.500 tấn vải/năm. | https://www.texhong-vietnam.com/ |

| 8 | Công ty TNHH Dệt may Tường Long | Việt Nam | Bình Dương | 2000 | Sở hữu nhà máy dệt – nhuộm – hoàn thiện tại Bình Dương được trang bị máy móc hiện đại của châu Âu và Nhật Bản, công suất khoảng 15 triệu mét vải denim/năm. | https://tuonglong.com/en/ |

| 9 | Công ty Cổ phần Dệt may Bao Minh | Việt Nam | Nam Định | 2018 | Đầu tư vào một nhà máy dệt khép kín tại Nam Định, tập trung vào sản xuất vải may áo sơ mi và vải nhuộm sợi chất lượng cao cho thị trường xuất khẩu và nội địa. | https://www.baominhtextile.com/ |

| 10 | Hàng dệt may hàng đầu | Nhật Bản | Hồ Chí Minh | 2024 | Nhà máy nhuộm dệt công nghệ cao của Tập đoàn Toray Nhật Bản và Pacific Textiles tại Nam Định, tổng vốn đầu tư hơn 203 triệu USD; giai đoạn 1 đã hoàn thành với công suất 96 triệu mét vải/năm. | https://www.toray.com/ |

Nguồn: Tổng hợp của B&Company

Ngành công nghiệp dệt may Việt Nam đang được định hình bởi sự kết hợp giữa các doanh nghiệp trong nước lâu đời và các nhà đầu tư FDI quy mô lớn từ Trung Quốc/Hồng Kông, Malaysia/Đài Loan và Nhật Bản. Các công ty Việt Nam chủ yếu tập trung tại các cụm công nghiệp dệt may truyền thống như Hà Nội, Nam Định, Thành phố Hồ Chí Minh và Bình Dương. Bên cạnh những doanh nghiệp dệt may lâu đời này, trong những năm gần đây, một số nhà sản xuất trong và ngoài nước như Bảo Minh và Top Textiles đã đầu tư và mở rộng sản xuất vải tại Việt Nam. Các nhà máy này thường được xây dựng mới trên quy mô lớn, trang bị công nghệ dệt – nhuộm – hoàn thiện hiện đại, tự động hóa cao và hướng đến sản xuất vải bền vững.

Đánh giá tiềm năng tìm nguồn cung ứng vải của Việt Nam

Việt Nam có tiềm năng lớn để trở thành trung tâm cung ứng vải dệt quan trọng trong khu vực, tận dụng vị thế xuất khẩu hàng may mặc hàng đầu thế giới và nhu cầu vải dệt lớn, ổn định. Thị trường nội địa sẵn có, kết nối tốt với chuỗi cung ứng toàn cầu và các hiệp định thương mại tự do thế hệ mới (CPTPP, EVFTA, RCEP, v.v.) đều khuyến khích việc sử dụng vải dệt sản xuất trong nước. Mục tiêu của Chính phủ về tỷ lệ nội địa hóa 56-601 tấn/năm trong giai đoạn 2026-2030, cùng với chi phí lao động cạnh tranh và môi trường đầu tư ổn định, cũng đang thu hút lượng lớn FDI, bao gồm cả các nhà đầu tư Nhật Bản với công nghệ dệt may tiên tiến, tạo ra nhiều cơ hội hợp tác.

Tuy nhiên, ngành dệt nhuộm vẫn là một “nút thắt cổ chai”, đặc biệt là trong khâu xử lý môi trường, đòi hỏi vốn đầu tư lớn, công nghệ tiên tiến và thời gian hoàn vốn dài, dẫn đến chậm trễ dự án. Sự đa dạng về vải trong nước vẫn còn hạn chế, thiếu hụt các loại vải chức năng và vải thời trang cao cấp, nên một phần nhu cầu được đáp ứng bằng nhập khẩu. Ngành công nghiệp này cũng phải đối mặt với sự cạnh tranh gay gắt từ các nhà sản xuất lớn như Trung Quốc, Ấn Độ và Bangladesh, buộc các doanh nghiệp Việt Nam phải liên tục nâng cấp công nghệ, cải thiện chất lượng và chuyển sang các phân khúc giá trị gia tăng cao hơn.

Đối với các doanh nghiệp quan tâm đến việc nhập khẩu vải từ Việt Nam, cần xem xét các khuyến nghị sau:

– Trước tiên, hãy tập trung vào các loại vải mà Việt Nam có thế mạnh rõ rệt, chẳng hạn như vải dệt/vải đan cơ bản, vải denim, vải may áo sơ mi và vải nhuộm sợi. Đây là những phân khúc có năng lực sản xuất tương đối ổn định và rủi ro nguồn cung thấp hơn. Hơn nữa, Việt Nam cũng có lợi thế trong một số loại vải tự nhiên mới như vải sợi gai dầu, vải sợi tre, lụa sen và lụa dâu tằm.

– Thứ hai, xây dựng quan hệ đối tác lâu dài với một số nhà máy chủ chốt (như Bao Minh, các công ty thành viên Vinatex, Top Textiles, v.v.), vượt ra ngoài các giao dịch đơn lẻ hướng tới mô hình “đối tác cung ứng” thực sự: chia sẻ kế hoạch đặt hàng trung và dài hạn, cùng phát triển các kiểu vải, thống nhất các tiêu chuẩn chất lượng và quy trình kiểm soát. Điều này sẽ giúp các nhà cung cấp tự tin đầu tư vào công nghệ và mở rộng năng lực sản xuất dành riêng cho các đơn đặt hàng của bạn.

– Thứ ba, ưu tiên các nhà cung cấp có năng lực tuân thủ môi trường mạnh mẽ và các chứng nhận bền vững được công nhận (OEKO-TEX, GRS, ISO, v.v.), đồng thời chủ động tận dụng các hiệp định thương mại tự do (CPTPP, EVFTA, RCEP) để thiết kế chuỗi cung ứng đáp ứng các quy tắc về nguồn gốc xuất xứ. Điều này không chỉ tối ưu hóa thuế quan đối với các sản phẩm may mặc mà còn củng cố hình ảnh “nguồn cung xanh” của bạn với khách hàng cuối cùng.

* Lưu ý: Nếu bạn muốn trích dẫn thông tin trong bài viết này, vui lòng ghi rõ nguồn và kèm theo link bài viết để đảm bảo tôn trọng bản quyền.

| B&Company, Inc.

Công ty nghiên cứu thị trường của Nhật Bản đầu tiên tại Việt Nam từ năm 2008. Chúng tôi cung cấp đa dạng những dịch vụ bao gồm báo cáo ngành, phỏng vấn ngành, khảo sát người tiêu dùng, kết nối kinh doanh. Ngoài ra, chúng tôi đã phát triển cơ sở dữ liệu của hơn 900,000 công ty tại Việt Nam, có thể được sử dụng để tìm kiếm đối tác kinh doanh và phân tích thị trường. Xin vui lòng liên hệ với chúng tôi nếu bạn có bất kỳ thắc mắc hay nhu cầu nào. info@b-company.jp + (84) 28 3910 3913 |

[1] Báo cáo Xuất nhập khẩu Việt Nam năm 2024 <Access>

[2] Vinatex. 30 năm hành trình: Vinatex – từ hạt giống chiến lược đến trụ cột của ngành dệt may Việt NamTruy cập>

[3] Cập nhật ngành dệt may – Mở rộng khâu sản xuất thượng nguồn nhằm hỗ trợ lợi nhuận cao hơn <Access>

[4] VietnamPlus. Ngành dệt may Việt Nam đối mặt với những khó khăn và cơ hội đan xen.Truy cập>

[5] Nam Định chính thức đưa nhà máy dệt nhuộm công nghệ cao vào hoạt động. <Access>

[6] Phát triển ngành công nghiệp dệt may xanh để thoát khỏi bẫy gia công ngoài. <Access>

[7] Gai dầu – Vải gai dầu là gì? Một loại vật liệu bền vững có thể dễ dàng phát triển tại Việt Nam. <Access>

[8] Vải dệt hữu cơ sản xuất tại Việt Nam, ngày 23/12/2024.Truy cập>

[9] Hệ thống chứng nhận dệt may là gì? Nó có ý nghĩa gì? <Access>