07Feb2025

Latest News & Report / Vietnam Briefing

Comments: No Comments.

Vietnam’s construction industry has become a cornerstone of its economic transformation, reflecting the country’s rapid urbanization and industrialization. As one of the fastest-growing sectors in Southeast Asia, it has attracted both domestic and international attention for its potential to shape the nation’s future.

Overview of Vietnam’s Construction Industry

Vietnam’s construction industry has been one of the key drivers of the nation’s economic growth and urbanization over the past decade. In 2024, the industry recorded a growth rate of about 8% surpassing the annual target of 6.4% to 7.3%[1]. With the highest growth rate since 2020, the construction industry is estimated to contribute around 28.2 billion USD to the nation’s total GDP, which is equivalent to 6%. The Ministry of Construction (MOC) also highlighted many achievements of the sector, such as exceeding the targeted urbanization rate and meeting the targeted wastewater collection and treatment rate along with the national average housing area per capita[2].

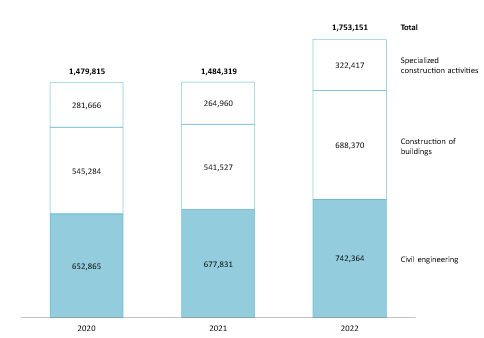

According to B&Company’s Enterprise Database, in 2022, the industry had a total of 104,732 companies in operation, recording a total net revenue of 1,753,151 billion VND, or nearly 70 billion USD. The industry is segmented into three major areas, which are:

– Construction of buildings (VSIC Code 41) focuses on residential construction and non-residential infrastructures, driven by the rising demand for affordable housing, particularly in urban areas such as Hanoi and Ho Chi Minh City as well as the national industrialization process. The industry had a net revenue of 680,775 billion VND in 2022[3].

– Civil engineering (VSIC Code 42) led the construction industry with a net revenue in 2022 of 735,674 billion VND[4]. The sector’s activities encompass infrastructure development, including transportation networks, energy facilities, and water management systems.

– Specialized construction activities (VSIC Code 43), which includes commercial spaces, industrial facilities, and retail complexes, posted a net revenue of 322,417 billion VND in 2022[5].

Net revenue of Vietnam’s construction industry, from 2020 to 2022 (Unit: Billion VND)

Source: B&Company’s Enterprise Database

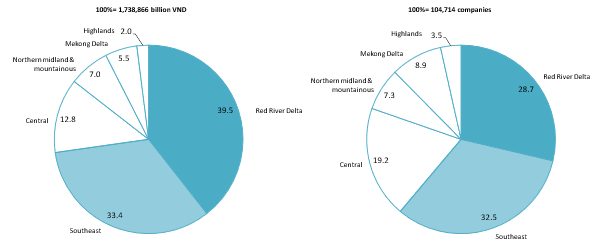

Vietnam’s construction industry is concentrated in the Red River Delta and Southeast, each on average accounting for 36% of net revenue and 30% of companies in 2022. The Central region ranked third, contributing 13% of net revenue and 19% of the industry’s participants. The Highlands had the smallest share, with 3,619 companies generating just 2% of the industry’s revenue.

Structure of Vietnam’s construction industry by region in 2022 (Unit: %)

Source: B&Company’s Enterprise Database

The sector is mainly dominated by Vietnamese companies, both with notable names in the building construction sub-sector such as Hoa Binh Construction Group JSC, Conteccons Construction JSC, and Viet Nam Construction and Import – Export JSC. In 2022, Hoa Binh Construction Group JSC recorded the highest net revenue of the sector with over 14,000 billion VND. Zeit Ca Vietnam Co., Ltd was the sole representative of FDI enterprises among the top earners of the sector.

Table 1: Top 10 companies in Vietnam’s construction industry by net revenue in 2022

| No. | Company Name | VSIC Code | City/Province | Country | Net Revenue (Billion VND) |

| 1 | Hoa Binh Construction Group JSC | 41020 | HCMC | Vietnam | 14,064 |

| 2 | Ricons Construction Investment JSC | 41010 | HCMC | Vietnam | 11,290 |

| 3 | Newtecons Investment Construction JSC | 41020 | HCMC | Vietnam | 11,148 |

| 4 | Conteccons Construction JSC | 41010 | HCMC | Vietnam | 10,775 |

| 5 | Central Construction JSC | 41010 | HCMC | Vietnam | 9,014 |

| 6 | Viet Nam Construction and Import – Export JSC | 42990 | Ha Noi | Vietnam | 7,531 |

| 7 | Zeit Ca Vietnam Co., Ltd | 42990 | Hai Phong | S. Korea | 7,146 |

| 8 | Trung Nam Construction and Engineering Corporation | 42120 | Lam Dong | Vietnam | 6,884 |

| 9 | PC1 Group JSC | 42210 | Ha Noi | Vietnam | 6,263 |

| 10 | Unicons Investment Construction Co., Ltd. | 41010 | HCMC | Vietnam | 5,771 |

Source: B&Company’s Enterprise Database

Foreign direct investment in Vietnam’s Construction industry

The construction industry experienced a decline in inward investment following the global pandemic but has shown signs of recovery since 2023. The pandemic significantly reduced new FDI projects, with numbers dropping from 139 in 2019 to 36 in 2022, and their total value decreased from $994 million to $353 million[6]. However, 2023 saw a 13% increase in registered capital, highlighting renewed growth potential[7]. By mid-2024, the sector recorded 1,837 active FDI projects, representing 4.5% of Vietnam’s total FDI projects and a registered capital of approximately $11 billion, or 2.3% of the nation’s total FDI value[8].

Table 2: New licensed FDI projects in Vietnam’s construction industry, from 2017 to 2023

| Year | Quantity (Unit: projects) | Value (Unit: Million USD) |

| 2017 | 128 | 1,260 |

| 2018 | 118 | 659 |

| 2019 | 139 | 994 |

| 2020 | 79 | 619 |

| 2021 | 28 | 465 |

| 2022 | 36 | 311 |

| 2023 | 40 | 353 |

Source: Statistical Yearbook of Vietnam, B&Company synthesis

FDI remains concentrated in the Red River Delta and the Southeast, Vietnam’s key economic hubs. In 2022, 621 foreign companies in the construction sector generated a combined net revenue of 96,570 billion VND, with the Red River Delta contributing over half of the two indicators. The Southeast accounted for 44% of total net revenue and 43% of the companies. Japan led foreign investment with 90 firms active in the sector, including prominent names such as TTCL Vietnam Corporation Limited (building construction), Kinden Vietnam Co., Ltd. (civil engineering), and Phan Vu Investment Corporation (specialized construction activities). FDI firms from Japan have had many notable projects in recent years with innovative designs, such as the Bac Ninh High-Technological municipal waste-to-energy plant built by TTCL Vietnam Corporation in 2023[9] or the modern office building Taisei Square Hanoi, the first LEED certified Grade A office building in West Hanoi, by Taisei Corporation in 2024.

Taisei Square Hanoi, the first LEED certified Grade A office building in West Hanoi

Source: Taisei Square Hanoi

Government policies

The government has aimed to maintain the current growth rate of the construction industry to fuel Vietnam’s urbanization and industrialization. In 2024, the government passed Decision No. 179/QD-TTg approving the construction industry development strategy to 2030, orientation to 2045[10]. The Decision highlighted many key targets for the sector in urban development and construction management, as well as aiming to tackle key social challenges such as housing shortages and wastewater treatment with the support of the sector.

Table 3: Notable objectives under the construction industry development strategy to 2030, orientation to 2045 in Decision No. 179/QD-TTg

| No. | Sector | Specific objectives | |

| By 2025 | By 2030 | ||

| 1 | Construction planning and architecture | Formulation of architectural management regulations in urban areas | 80% of urban and rural residential areas having architectural management regulations |

| 2 | Urban development | – Urbanization rate: 45%

– Urban construction land proportion: 1.5-1.9% – Urban areas: 950-1,000 |

– Urbanization rate: 50%

– Urban construction land proportion: 1.9-2.3% – Urban areas: 1,000-1,200 |

| 3 | Urban technical infrastructure | – Collection rate of urban wastewater: 70%

– Coverage of the urban rainwater drainage system: 70% |

Collection rate of urban wastewater: 80%

– Coverage of the urban rainwater drainage system: 80% |

| 4 | Housing | – Average living area per capita: 27 m2/person | – Average living area per capita: 30 m2/person |

| 5 | Construction management | – Construction production value: 8-10%

– Labor productivity growth rate: 8%/year |

– Construction production value: 8-10%

– Labor productivity growth rate: 10%/year |

Source: TVPL, B&Company synthesis

Conclusion

Vietnam’s construction industry presents a dynamic and competitive market, shaped by its diverse segments and a mix of domestic and international players. While challenges persist, the industry’s robust growth prospects, coupled with government support and private sector innovation, ensure that it will remain a key pillar of Vietnam’s economic transformation.

[1] The Government Electronic Newspaper. The construction sector’s growth is the highest since 2020 <Assess>

[2] MOC. Report on the 2024 Year-End Review and Directions and Tasks for 2025 of the Construction Sector <Assess>

[3] Enterpise Database. Company & Industry Report 2022

[4] Enterpise Database. Company & Industry Report 2022

[5] Enterpise Database. Company & Industry Report 2022

[6] GSO. Statistical Yearbook of Vietnam in 2019 <Assess>

[7] GSO. Statistical Yearbook of Vietnam in 2023 <Assess>

[8] FIA. The situation of foreign investment attraction in Vietnam in the first half of 2024 <Assess>

[9] TTCL Vietnam. Project experiences – Bio & Renewable Energy <Assess>

[10] TVPL. Decision No. 179/QD-TTg on approval for the construction industry development strategy to 2030, orientation to 2045 <Assess>

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |