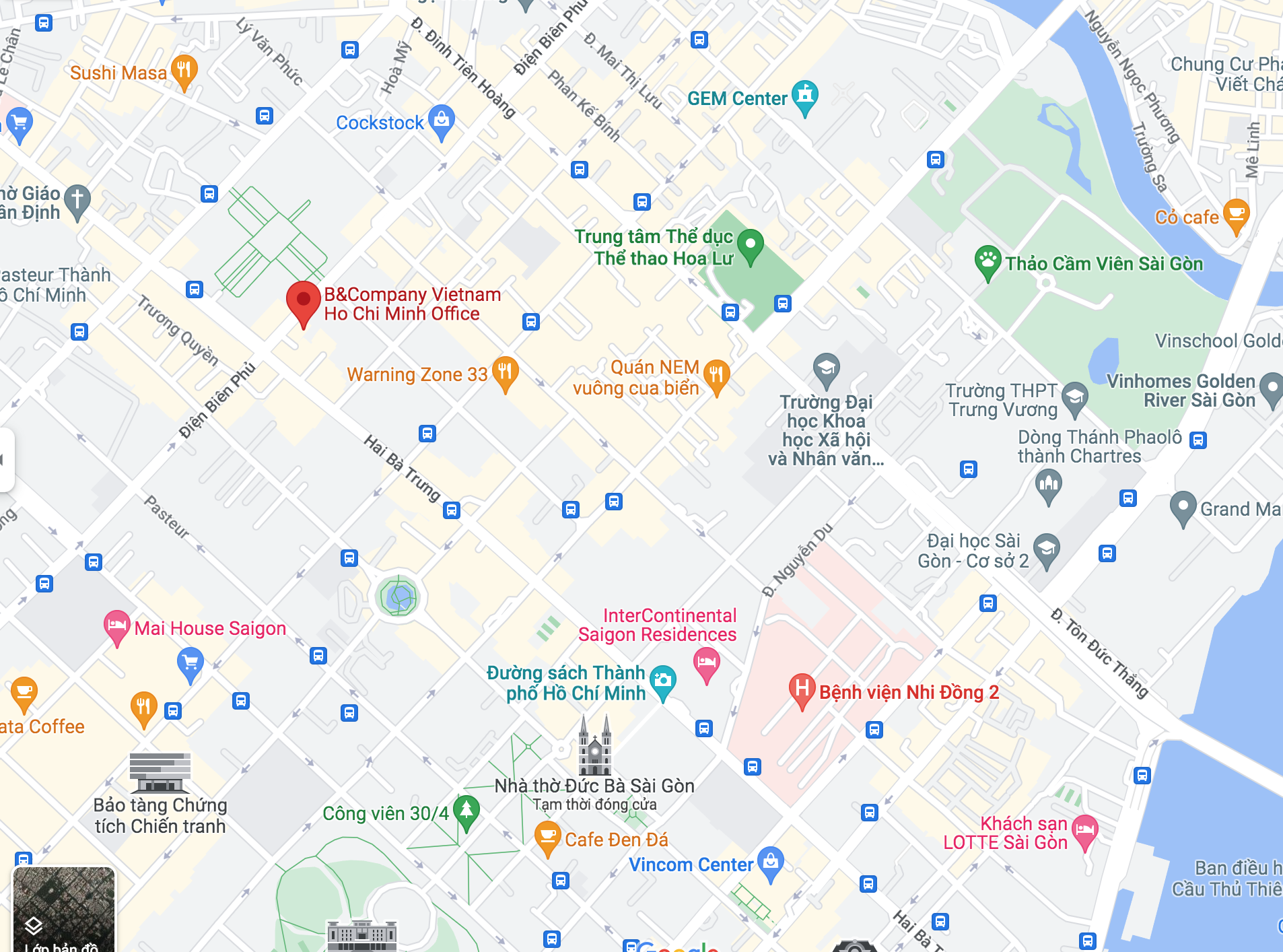

Notice of B&Company Ho Chi Minh Office Relocation

Please be kindly advised that our Ho Chi Minh Office has been moved to a new location from February 13, 2023.

Read More

Vietnam: Hanoi & Ho Chi Minh

(84) 24 3978 5165